Getting new tenants is a pressure-packed time for landlords. There are dozens of things that need to be done within a tight timeline. And failing to get everything done on time, or making a mistake during the handover, can mean the loss of a tenant or risking penalties from mortgage lenders, insurance companies, and more. If this feels overwhelming, we’re here to help. Get organized and make the next tenant turnover a smooth transition with this must-have landlord checklist for new or potential tenants.

1. Get the Finances Organized

Whether renting out a property for the first time or bringing in a new tenant to replace an outgoing one, starting a new lease is the perfect time to get the rental property’s finances in order.

In addition to some very necessary tasks (like making sure compliance with the renters insurance policy), this is the time when the property will demand most of the landlord’s attention. Hence, it’s a good idea to include the business side of things at the same time.

While the landlord is turning over their unit, they can do these things to whip their finances into shape and should certainly get their books in order.

Here are a few ways to make bookkeeping a little easier.

Get the Books in Order

It’s important to keep track of the rental income and expenses for many reasons, the most important of which are the landlord’s income taxes and property taxes. If it’s been a while since the owner has gone over their receipts, now is a good time.

If managing a rental property’s finances is challenging, the landlord should consider switching to bookkeeping software for landlords. Baselane offers free bookkeeping software to landlords that help categorize expenses and reconcile accounts automatically. Not only is it easier to use than spreadsheets, but it provides incredibly useful rental property analytics as well.

Using the best bank account for landlords

Depending on how the property owner does their banking, the landlord might not get the best deal. If they’re using the same bank account for personal and rental property finances, now is the time to get everything separated.

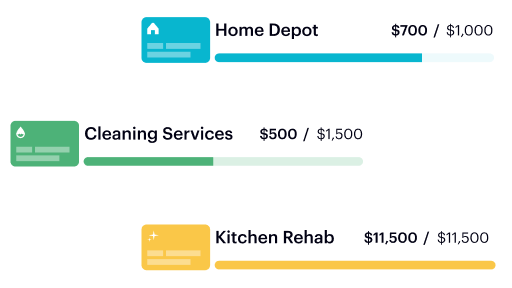

Baselane offers free landlord banking services with really useful features for landlords that the average bank probably doesn’t offer, like sub-accounts that can help them stay organized and virtual cards to control and manage their spending.

Check-in on mortgages and loans

After more than a decade of record-low rates, the cost of mortgages and loans is rising. The landlord should use this opportunity to make sure they’re still getting the best deal on their mortgage and lines of credit and consider refinancing if it makes sense to do so.

Look over the insurance policy

As time goes on, insurance needs to change. Landlords should take this time to review the insurance policy to make sure that they still have the coverage that they need, and are getting the best price.

The policy may also set out stipulations for taking on a new renter, like what insurance they need to carry.

2. Advertise the Property

The first step in finding a new tenant is advertising the property for rent. Landlords will need to:

Look up comparable listings and set the rent

Setting the rent appropriately is one of the most important steps in advertising a rental unit. If the rent is too high, the unit will attract fewer showings, and take longer to find a tenant. If the rent is too low, the landlord could miss out on potential revenue.

A landlord’s best method for determining the rent is looking up comparable units for rent in the same area. Units that are taken off the market quickly may be priced too low; units that have been listed for a long time are probably priced too high.

Ready the unit for showing

Prospective tenants will want to see the unit before deciding whether to submit an application. To the extent possible, the unit should be clean and tidy and available for showings on the day the listing goes up. Landlords should:

- Give notice to the outgoing tenant that they will be showing the unit and remind the tenant of their obligations to cooperate under the terms of their lease and the law.

- Ask the outgoing tenant to keep the unit clean and ready for showings.

- Hire a professional photographer to take good quality pictures of the unit to be used in advertising.

Advertise the unit for rent

Property owners will want to advertise the unit or room for rent as soon as possible after it becomes available. Potential advertising vehicles include:

- Apartment listing websites like apartments.com

- Free classified websites like Craigslist and Facebook Marketplace

- Print classifieds in local newspapers

- The Multiple Listings Service (MLS)

Prepare the application form

Landlords should be prepared to give prospective tenants the information they need to apply at the time of the showing. Application forms should ask for all the necessary information to vet the applicant, including personal information, financial information, and consent to background and credit checks.

Show the unit

Especially if the landlord will be sharing the property with the tenant (e.g., if they’re renting out a basement apartment), they will want to be personally involved in showing the unit so they can meet applicants personally and look for any potential red flags that might not show up on an application.

3. Complete the Rental Application Process

The first part of the landlord’s move-in checklist for new tenants is completing the rental application. Steps to doing this include:

- Receiving the applicant’s completed application

- Ensuring the applicant has submitted complete information and not left anything out

- Performing a credit check for each applicant

- Reviewing the credit check information on the applicant’s current and past addresses, as well as employment details

- Obtaining the applicant’s FICO Score

For context, a FICO score is a number between 300 and 850 that represents their overall creditworthiness.

A score over 630 is considered “fair,” over 690 is “good,” and over 720 is “excellent.” It’s worth noting that there’s little difference between the makeup of a “good” credit score and an “excellent” one.

Tenant Screening – Review details on the applicant’s loans and lines of credit, including credit limits and payment history.

The report will also include any red flags to be aware of, like past bankruptcies, wage garnishments, and legal issues.

Tenant Screening – Perform a criminal and eviction record search for each applicant

A criminal record search or background check reveals whether the applicant has had any trouble with the law, including illegal activities, and helps to verify their identity. An eviction record search reveals any eviction history.

Be aware that while the Fair Housing Act doesn’t prohibit landlords from discriminating based on a criminal record, blanket policies against renting to people with a criminal history could be interpreted as discrimination against a protected class.

Check references for each applicant

Landlords can call their applicants’ references personally or hire a property manager on their behalf. Be on the lookout for signs of a phony reference, and be prepared to ask the reference for a reference of their own if things don’t seem quite right.

Contact the preferred applicant for a final screening call

When the property owner decides to accept an application, contact the applicant and have one last discussion before offering a lease. This is the last opportunity to explain the rules, let them ask questions, and surface any final reasons that they might not want to accept their application.

4. Execute the Lease

Until the signed lease is in hand, along with the new tenant’s deposit, the landlord doesn’t have a new tenant.

After the tenant’s application is approved, the landlord needs to take steps to make sure all the appropriate paperwork is signed.

Draft the lease and legally reviewed

The lease, or rental agreement, is a legal document that governs the relationship between the landlord and the tenant. Each state has its own rules about what must, may, and can’t be included in the lease.

Working with a legal professional to write a lease agreement that conforms to all local laws and protects the landlord’s interests in case of problems.

Have the applicant(s) sign the lease and all related documents

Once the application has been approved, have the applicant(s) sign the lease as well as any related documents that are required.

This can be done in person or online. The property owner may wish to set a deadline for the completed lease to be returned to allow enough time to select another applicant if the first one falls through. It’s generally not necessary to use a notary for a lease term of 1-year or less.

Execute the lease

Once the applicant has signed all the documents, it’s the landlord’s turn to countersign. Doing so makes the agreement official and binding. In some circumstances, the owner may also be required to record the lease with their county recorder’s office.

Give a copy of the fully executed lease to the tenant

When all signatures are in place, make a copy and give it to the tenant.

Save the details of the lease using rental property management software

Rental property management software, like Baselane, can help keep track of rental property finances. Entering the details of the lease in Baselane allows landlords to keep track of deposits, one-time fees, rent payments, and late fees.

Save copies of the lease

Scan the completed lease and keep a digital copy on file. The original lease should be kept in a place where it will be safe from harm, such as a safety deposit box or fireproof filing cabinet at the rental home or the office.

Collect rent, deposits, and fees

Landlords may need to collect money for some or all of the following before the tenant moves in:

- The first month’s rent

- A deposit for last month’s rent

- A security deposit

- One-time fees (e.g., move-in fees)

- Save the deposit(s) in the appropriate bank accounts

Many states and municipalities require deposits to be held in separate, interest-bearing bank accounts.

Using Baselane for landlord banking allows landlords to open the appropriate account with a single click and earn high-yield interest on the balance. Check local laws to ensure compliance.

Provide receipts for the deposits received if required

Some states require landlords to provide the tenant with a receipt for any deposits received that shows the name of the bank where the deposit is held and the rate of interest paid on the funds being held.

5. Prepare the Property

Preparing the property for the new tenant to move in can take significant effort and coordination, especially if the landlord has an existing tenant who will be moving out around the same time.

Make arrangements for an outgoing tenant's move-out

As early as possible, after the outgoing tenant gives their notice, make specific arrangements for them to move out. This is also a good time to ensure that the outgoing tenant has paid their rent on time.

Confirm the date and time they will be vacating the unit so they can schedule everything that will need to be done before the new tenant moves in.

Perform an inspection with an outgoing tenant

If the landlord hasn’t already inspected the unit in the process of listing it for rent, they should perform a thorough inspection before the outgoing tenant moves out.

Make a note of everything that needs to be done before the new tenant moves in and confirm which jobs will be the outgoing tenant’s responsibility and which will be the landlord’s. Additionally, the landlord’s checklist should include:

- Inspecting walls, ceilings, doors, and windows for any damage that needs to be repaired

- Inspecting walls for paint that requires touching up

- Inspecting flooring for normal wear and damage

- Inspecting cabinets and countertops in the kitchen and bathrooms

- Ensuring kitchen appliances are in good working order

- Ensuring plumbing fixtures are in good working order and checking for leaks

- Ensuring heating and cooling equipment is in good working order

- Inspecting unfinished areas of the home for signs of moisture, mold, and pests

- Ensuring the property’s safety certifications are up to date

Depending on where the property is located, the landlord may be required to have a third-party inspection and obtain a certificate of compliance before the unit can legally be occupied.

Local laws may also require regular inspections of electrical, plumbing, and gas systems by a certified contractor.

Arrange work to be done as a result of the inspection

After performing the inspection, make arrangements as soon as possible for any work that needs to be done.

Some jobs, like repairing fixtures and appliances, can be done while the outgoing tenant is still occupying the unit. Others, like replacing flooring and painting, are best done after they’ve moved out while the unit is vacant.

When rental units turn over, service providers are busiest around the first of the month, so make arrangements as early as possible.

Perform a final inspection with the outgoing tenant and collect keys

When the outgoing tenant has finished moving out, meet with them at the property to perform a final inspection for wear and tear or damage and collect their keys.

The landlord should also make note of anything that’s changed since the last inspection of the property and make arrangements for any final repairs to be completed as soon as possible.

Perform final cleaning, painting, and repairs

After the outgoing tenant has left, ensure all necessary work is done before the new tenant moves in. Typical jobs to complete include:

- Dispose of items left behind by the outgoing tenant following local laws

- Touch up paint as required

- Thoroughly clean the kitchen and bathrooms

- Shampoo carpets

- Wash hard floors

- Change air filters

- Test smoke/carbon monoxide detectors and change batteries

- Address any maintenance issues

- Change the locks

Even if the outgoing tenant has returned all their keys to the landlord, changing the locks before starting a new tenancy is an important safety and security practice.

Record all expenses in rental property management software

The landlord must record all the expenses they incur while turning over the unit for a few reasons.

First, having good visibility of the actual cost of turning over the unit provides the property owner with valuable information that the landlord can use to inform decision-making the next time they need to onboard a new tenant.

Second, the money the property owner can spend on readying a rental property for a new tenant to move in is tax-deductible. Keeping detailed records of their expenses as they happen is the best way to ensure maximizing deductions at tax time.

Landlords and property owners can record their expenses manually or take the start of a new tenancy as an opportunity to start using rental management software.

Baselane, for example, offers free bookkeeping software for landlords that tracks expenses and automatically reconciles accounts so they always have an updated picture of the rental property finances with much less manual work.

6. Onboarding the New Tenant

Once the lease is signed and the landlord has received the deposit, it’s time for the new tenant to move into their new home. Moving is a stressful time, and it’s common for tenants to be overwhelmed.

Landlords should start the relationship on the right foot and ensure all needs are met by guiding them through the move-in process.

Provide new tenants with a checklist of everything required of them

Don’t assume that tenants have any idea what they’re doing! Provide them with a detailed move-in checklist of everything they must do before moving in.

Their move-in checklist might include:

- Pay the first month’s rent, deposits, and fees (specify the amount, due date, and rent payment method).

- Set up utility accounts for electric, water, and gas (provide the name and phone numbers of providers)

- Purchase renter’s insurance and give a copy of the insurance binder to the landlord (be sure to reiterate insurance requirements as set out in the lease)

- Reserve an elevator for moving and provide contact information for the building manager who schedules moves, if applicable.

- Register for the tenant portal in the property management software (provide detailed instructions).

Clear conditions

Even if the lease is signed and the landlord has received the deposit, the landlord and the tenant may still be required to clear the conditions of the lease before the tenant moves in.

For example, the tenant may be required to show proof of insurance, and the landlord may be required to replace an aging kitchen appliance.

Make move-in arrangements

This is especially important when the landlord is coordinating with an outgoing tenant.

Landlords should find out the move-in date and time that their new tenant wants to move in and ensure the unit will be ready. If required, contact the building’s management to notify them that the new tenant will be moving in.

Schedule a property tour on move-in day

On the day the new tenant takes possession of the unit, the first order of business should be to meet in person at the property to tour it together.

During the tour, ensure:

- Reiteration of any rules that pertain to the tenancy

- Give the tenant an opportunity to inspect for damage and make note of any concerns.

- Ensure the tenant understands how to operate the home’s systems (e.g., thermostat, garage door opener, washing machine, etc.)

- Confirm the tenant has registered for the tenant portal and understands how to use it to pay rent and contact the landlord.

- Ensure the tenant understands when they should contact the property owner and when they should contact building management (if applicable)

- Allow the tenant to ask any questions they may have

- Take pictures to record the pre-move-in condition of the property.

- Provide the tenant with keys and have them sign for receipt.

7. Plan for the future

Once the new tenant has moved in and is enjoying their new home, take some time to plan for the future and ensure organization.

Schedule time for a personal check-in with the tenant

Make plans to check in with the tenant after they’ve been in the unit for a few weeks. Take the opportunity to build rapport and uncover any issues that could lead to bigger problems later on.

Note important dates in the calendar

The start of a new tenancy agreement starts the clock on a number of future events. Take stock of important dates and prepare for them ahead of time. Be sure to note:

- Dates of scheduled maintenance requests (e.g., changing air filters)

- Dates to conduct routine inspections and safety certifications (e.g., smoke detector inspection) – Start with quarterly inspections and adjust as needed.

- Deadlines to submit any required applications (e.g., application to increase the rent, where applicable)

- The earliest date that the landlord can give the tenant a notice of rent increase, according to local laws

- The earliest date that the renter can give the landlord notice to end their tenancy agreement, according to local laws

- Dates for handling any special requests from tenants (e.g., requests for additional parking spaces, installation of a new appliance)

- Deadlines for disability accommodation requests

FAQs about New Tenant Checklist

If a tenant doesn’t pay the rent, the landlord can evict them – but it’s not always an easy process. In most cases, the property owner needs to file a petition in court, argue their case, win a judgment, and hire a bailiff or sheriff to carry out the eviction. The process can easily take months, which is why it’s important to carefully screen applicants before making an offer to lease.

A lease is a legal contract, in which the tenant has agreed to pay rent and use the premises for a specified period of time. In most cases, the tenant can’t break the lease, but local and state laws may provide the tenant with relief in some extenuating circumstances. If the tenant wants out, the landlord can also agree to end the tenancy early if they wish.

Landlords in all states have the right to refuse pets and set restrictions on what pets are or aren’t allowed. However, landlords also have a responsibility to make exceptions for people with special needs who rely on service animals like guide dogs and seizure response dogs. If the landlord wishes to prohibit pets, be sure to include the appropriate clause(s) in the lease and proactively enforce a pet policy if the landlords find the tenants in violation.