Keeping tabs on rental property finances isn’t always straightforward. With income, expenses, and maintenance costs constantly in motion, it’s easy to lose track of your cash flow, especially if you’re still relying on spreadsheets. That’s where cash flow management software can make a real difference. It brings clarity to your finances by helping you monitor income and expenses in real time, so you can make informed decisions with confidence.

This guide will explore what this software is, why it's critical, must-have features, how to choose the best option, and more, helping you master your landlord cash flow.

Financing is a critical step in building your real estate investment portfolio, especially when it comes to single-family rentals. Understanding your loan options is key to making smart decisions and maximizing your returns. This guide explores the different types of [rental property loans], their requirements, and how to choose the best fit for your investment goals.

Key takeaways

- Single-family rental (SFR) loans differ significantly from primary home mortgages, with higher requirements.

- Multiple loan types exist, including Conventional, DSCR, Portfolio, and Private Money loans, each with unique pros and cons.

- Qualification for SFR loans typically requires strong credit, substantial down payments, cash reserves, and proof of rental income.

- Interest rates for SFR loans are generally higher than those for owner-occupied homes.

How single-family rental loans differ from primary residence mortgages

Securing financing for a rental property is not the same as getting a mortgage for your primary home. Lenders view investment properties as higher risk, which impacts loan terms. You will generally face stricter requirements and higher costs.

Investment property loans require higher down payments, often ranging from 15% to 25% or more. This compares to much lower minimums sometimes available for owner-occupied homes. Interest rates for SFR loans are also typically higher, often starting at 6.5% or more and potentially being 0.5% to 0.75% higher than rates for primary residences.

Lenders also place more emphasis on your cash reserves, commonly requiring enough to cover at least 6 months of loan payments. Your debt-to-income (DTI) ratio, typically needing to be below 36%, and proof of rental income or history are also key factors.

Types of single-family rental loans

Navigating the landscape of rental property financing options is crucial for investors. There isn't a one-size-fits-all answer for the type of loan for investment property. Each loan type serves different purposes and caters to various investor profiles and property types.

Here's a look at common financing options available for single-family rentals:

Conventional loans

Conventional loans for investment properties are similar to those for primary homes but come with stricter terms. They typically require higher down payments and stronger borrower financials. These are common for investors buying turnkey properties with solid personal financial profiles. To learn more, see our guide on how to get a loan for a rental property.

DSCR loans

Debt-Service Coverage Ratio (DSCR) loans are asset-based loans where qualification relies on the property's cash flow. Lenders assess the property's ability to cover the mortgage payments rather than the borrower's income and DTI. These are popular for investors who may not meet traditional income requirements but are purchasing a property with strong rental potential.

Portfolio loans

Portfolio loans are offered by lenders who keep loans in-house instead of selling them on the secondary market. They allow investors to finance multiple properties under a single loan or finance multiple properties within a portfolio. These loans offer flexibility but may have shorter terms and different rate structures than conventional loans. These can be considered a type of commercial loan for rental property.

Private money & hard money loans

These are short-term loans typically used for property acquisition or rehabilitation, often by experienced investors. They are asset-based, focusing primarily on the property's value and potential, not the borrower's credit or income. While they offer speed and flexibility, they come with significantly higher interest rates and fees compared to traditional financing.

Blanket loans

Similar to portfolio loans, blanket loans cover multiple properties under one mortgage. A key feature is a "release clause," allowing you to sell one property and have it removed from the blanket loan without triggering a due-on-sale clause for the remaining properties. This provides flexibility for investors managing multiple assets.

Government-backed loans

While primarily for owner-occupied homes, certain government-backed loans like FHA and VA loans have specific use cases for investors. You can potentially use an FHA or VA loan for a rental property if you intend to live in one unit of a multi-unit property or occupy the home as your primary residence for at least 12 months initially.

This is an important point to consider if exploring an FHA loan for investment property. Note that SBA loans, like the SBA 7(a), are typically for business real estate and have specific SBA 7a loan requirements, different from residential investment property financing, though you can explore how an SBA loan for real estate might fit other parts of your business.

Alternative financing methods

Beyond traditional mortgages, investors can explore other ways to finance rentals. Using a Home Equity Line of Credit (HELOC) from another property is one option, though LTV requirements for investment properties are lower (70-80%) than for primary homes (85-90%).

Seller financing, where the seller acts as the bank, and using funds from 401k/IRA rollovers (with specific rules) are also possibilities for rental property financing.

Here is a comparison table outlining the key features of different single-family rental loan types:

Baselane also offers competitive rental property loans designed with investors in mind. These loans focus on the property's performance and your investor experience, offering streamlined documentation and competitive terms. You can explore Baselane's offerings as part of your search for the right financing partner.

Single family rental loan requirements

Lenders have specific criteria for approving single-family rental loans. Meeting these requirements is crucial for getting approved and securing favorable terms. Understanding these upfront helps you prepare your finances and documentation.

Your credit score is a primary factor; most SFR loans require a minimum score typically between 660 and 680+, with higher scores leading to better terms. As noted, a significant down payment, usually 15-25% or more, is expected.

Lenders also scrutinize your cash reserves, often requiring enough liquid funds to cover 6 months of property expenses like mortgage payments, taxes, and insurance. Your Debt-to-Income (DTI) ratio, which compares your monthly debt payments to your gross monthly income, is typically required to be below 36%.

Lenders will also require proof of your income and any existing rental history to assess your ability to manage the property and loan. The property itself must meet eligibility criteria, often needing to be in good, turn-key condition, especially for conventional financing.

Understanding single-family rental loan interest rates and costs

Investment property loans typically come with higher interest rates than primary residence mortgages. This is due to the perceived higher risk involved with financing non-owner-occupied properties. Understanding these costs is vital for calculating potential profitability.

Interest rates for SFR loans generally start at 6.5% or higher, and can be 0.5% to 0.75% higher than rates for primary homes. Factors influencing your specific rate include your credit score, down payment amount, loan type, loan term, and the lender.

Beyond the interest rate, you'll also face other costs like origination fees, appraisal fees, title insurance, and potentially points, which are fees paid to the lender to reduce the interest rate. You can find current rates for rental property online, but remember these are estimates, and your actual rate will depend on your specific situation.

Choosing the right SFR loan for your investment strategy

Your investment goals significantly influence which loan type is best for you. Different loans are better suited for financing a single property versus building a large portfolio. Consider whether you are acquiring a new property or refinancing an existing one.

If you're financing a single property for long-term hold, a Conventional or DSCR loan might be suitable. DSCR loans can be particularly attractive if you prefer qualification based on property cash flow over personal income. For investors planning extensive renovations, private money or hard money loans are often used in a BRRRR strategy (Buy, Rehab, Rent, Refinance) to quickly acquire and fix properties before refinancing into longer-term debt.

Building a portfolio of properties might lead you to Portfolio or Blanket loans, which simplify financing multiple assets under one loan structure. If you're financing short-term rental financing or Airbnb loans, some lenders offer specific products tailored to the unique income characteristics of these properties.

Finding a single-family rental lender

The type of lender you choose can also impact your financing options and experience. Different lenders specialize in various types of investment property loans. You can explore traditional lenders like banks and credit unions, which often offer conventional loans. Mortgage brokers can help you compare offers from multiple traditional lenders.

Alternative and private lenders specialize in DSCR, private money, and hard money loans, often catering to investors with specific needs or timelines. Portfolio lenders are typically commercial banks or private firms that keep loans in-house and are better equipped to handle multiple properties or unique financing structures.

Researching lenders based on the type of loan you need and your investment strategy is key. For instance, exploring investment property loans in Florida would involve looking for lenders active in that specific market.

Navigating your SFR financing options with Baselane

Financing single-family rental properties requires careful consideration of various loan types and their requirements. From conventional mortgages to asset-based DSCR loans and portfolio financing, understanding your options is the first step. Always compare interest rates, fees, and qualification criteria across different lenders.

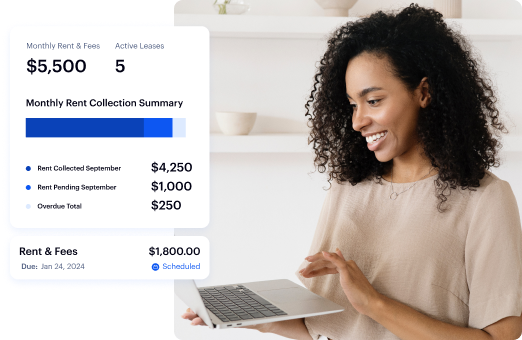

Choosing the right loan aligns your financing with your investment strategy, whether you're buying your first rental or expanding a large portfolio. As you manage your rental property finances, tools that streamline banking, bookkeeping, and rent collection can be invaluable. Consider how a platform like Baselane can help simplify managing the financial aspects of your rental properties once financed. Sign up for free today.

FAQs

What is a single-family rental loan?

A single-family rental loan is a type of mortgage used to finance the purchase or refinance of a property intended for rental income, not as the owner's primary residence. These loans have specific requirements that differ from owner-occupied mortgages.

How is an SFR loan different from a regular mortgage?

SFR loans typically require higher down payments (15- 25 %+), higher interest rates (often 0.5-0.75% higher), stricter credit score requirements, and require significant cash reserves compared to primary residence mortgages.

What credit score do I need for an SFR loan?

Most lenders require a minimum credit score between 660 and 680 or higher to qualify for a single-family rental loan. A higher score generally leads to more favorable loan terms.

Can I use an FHA or VA loan for a rental property?

FHA and VA loans are primarily for owner-occupied properties. You can potentially use them for a rental property if you meet the owner-occupancy requirement, typically living in the property (or one unit of a multi-unit property) as your primary residence for at least 12 months initially.

Are interest rates higher for home equity on investment properties?

Yes, interest rates for home equity loans and HELOCs on investment properties are generally higher than those for primary residences. They may be 0.5% to 0.75% higher than current market rates.