If you're tracking security deposits in the same account you use to pay your mortgage or buy groceries, you're exposed.

Mismanaging these funds is not just an accounting headache; it's a major regulatory risk. This is particularly true if your rental units are in one of the states that explicitly mandate holding these deposits in an escrow account on your tenant’s behalf.

To make matters more complicated, many states further require these accounts to be interest-bearing. Juggling these varied and complex compliance needs can feel overwhelming, but that's where we come in.

We will walk you through the essential steps on how to open a proper security deposit account to legally separate your assets and turn this compliance burden into an effortless, structured part of your rental business.

Key takeaways

- An escrow account for security deposits is a separate, non-operational account managed by a third party.

- 22 out of 50 states require landlords to hold security deposits in an escrow or trust account, while many jurisdictions also mandate these accounts to be interest-bearing.

- Even without a legal mandate, you should always keep deposits in a separate account to avoid commingling funds and steer clear of legal risks.

- Keep tenants informed about where you hold their funds and share all required information upfront to maintain compliance.

- Landlords can set up a free security deposit account with Baselane in three easy steps: open a high-yield online savings account, set up virtual accounts, and collect security deposits.

What is an escrow account?

An escrow account is simply a separate, non-operational account where you hold a tenant's security deposit. This account is kept separate from your other business funds (like your checking or operating account) to ensure the money is only used for its intended purpose: covering damages, unpaid rent, or security deposit fees at the end of a lease.

While the money is held, it is essentially managed by a neutral third party—the bank or financial institution—acting as a custodian until the lease ends.

Why a dedicated security deposit account is your best asset

You might be asking, "Do I really need a separate account?" Even if your state doesn't technically mandate a third-party escrow bank account, using a dedicated account is one of the smartest, most practical steps you can take to manage your risk and save time later.

Here’s why an escrow account is non-negotiable for keeping security deposits.

- Prevents commingling and protects assets: Mixing your personal or business operational funds with tenant security deposits (known as commingling) exposes your personal assets to liability in a legal dispute. A separate account draws a clear line, protecting your savings and investments.

- Ensures regulatory compliance: Many states explicitly require deposits to be held in a separate account—often an interest-bearing one. Using a dedicated account ensures you meet these requirements and avoid penalties.

- Simplifies bookkeeping and tax prep: Imagine sifting through a year's worth of transactions in a shared account just to find the original deposit amount or track accrued interest. A dedicated account simplifies this process for accounting, makes security deposit deductions easier, and streamlines tax preparation.

Escrow account requirements by state

How each state defines an escrow account varies, along with the rules for collecting and reimbursing a refundable security deposit.

Here’s a brief overview of security deposit laws for escrow accounts in all 50 states:

How interest is calculated, who gets it, and when required

Interest-related rules are set at the state and often municipal level, making interest requirements highly dependent on your property's location.

Here is a breakdown of how interest requirements generally work on security deposits:

When interest is required

The requirement to hold security deposits in an interest-bearing account and pay out that interest is not universal—it is mandated by specific states and cities. The requirement may kick in based on the deposit amount (e.g., in Ohio, interest is mandated on deposits over 1 month’s rent) or the duration the deposit is held.

How security deposit interest is calculated

The calculation is typically based on the simple interest formula: Interest=Principal×Rate×Time

- Principal: The initial security deposit amount collected from the tenant.

- Rate: The annual interest rate, which is usually set by state law (e.g., a fixed percentage like 5%) or tied to a market rate (like the U.S. Treasury yield or local passbook savings rates).

- Time: The duration the deposit is held, usually measured in years.

If a tenant provides a $1,000 security deposit at an annual interest rate of 1% for a one-year lease, the interest owed is calculated as: $1,000 × 0.01 × 1 = $10.

3. Who gets the interest and when it's paid

Tenant is legally entitled to any accrued interest on the security deposit. However, local laws dictate the precise terms. In Florida, for example, landlords must pay 75% of the earned interest or a fixed 5% per year on interest-bearing accounts.

Payment schedules also vary by location. Connecticut and Pennsylvania require that interest be paid or credited toward rent annually, while Maryland mandates that interest be paid to the tenant upon move-out.

What to disclose about escrow accounts

The most critical step after opening your dedicated security deposit account is ensuring your tenants know about it. State laws have strict requirements for disclosing where and how security deposits are held, and failing to comply—even on a minor detail—can result in hefty financial penalties.

Key information you need to disclose

Here is the essential information you need to provide your tenants to meet state-specific tenant escrow account disclosure requirements:

- Bank name and location. Many states, including Florida and New York, legally require you to provide the bank name and address where the deposit is stored. Florida specifically mandates that this disclosure be given within 30 days of receiving the deposit.

- Account type and interest. States like New Jersey and Connecticut demand that you inform tenants if the account earns interest and outline precisely how that interest will be distributed. New Jersey also requires that you pay out interest to the tenant annually.

- Deposit amount and terms. Clearly state the exact amount deposited and the precise conditions under which deductions (e.g., for property damages or unpaid rent) may occur, as outlined in your lease agreement.

- Written notice timeline. Send written notice at the time of lease signing or within 30 days of receiving the deposit. For instance, Massachusetts requires written notice of deposit details within 30 days.

- Security deposit returns: Landlords must send a security deposit return letter detailing the amount and timing of returns within the state-mandated notice period (e.g., 14 days in South Dakota and 30 days in Georgia). If any of the deposit is withheld, these details must be provided to the tenant.

Tips to follow to maintain full compliance

Once you know what to disclose, focus on how to deliver that information, document the interaction, and maintain your records.

- Include disclosures directly in the lease. Adding a dedicated "Security Deposit" clause in your lease agreement is the simplest way to ensure tenants receive all required information (deposit amount, bank details, interest handling) upfront in a legally binding document.

- Provide a separate, signed receipt. List the deposit amount, bank details, and account type on a security deposit receipt. In New York, for example, you need to provide a signed receipt confirming where the deposit is held.

- Use simple, direct language. Avoid all unnecessary legal jargon. Instead of overly complicated phrasing, simply state: “Your deposit is in a separate escrow account at [Bank Name] for security deposits only".

- Always notify tenants of account changes. If you switch banks, sell the property, or transfer ownership, you must notify tenants in writing. Some states require this updated disclosure within 30 days of the change.

- Maintain clear records. Always keep copies of all lease agreements, receipts, and written notices. Consider asking tenants to sign an acknowledgment or sending a confirmation email for documentation.

How to set up an escrow account for security deposits

Here’s a step-by-step guide to opening your escrow account:

Step 1: Check state and local laws

Your first and most important step is legal due diligence. The specific requirements for security deposits are defined by your property's jurisdiction.

- Is an escrow account required? Determine whether landlords in your area are legally required to hold deposits in an escrow account.

- Interest mandates: Research if the account must be interest-bearing, and how any interest earned should be handled or distributed.

- Disclosure obligations: Identify all rules for informing tenants about the bank details and the location of the deposit.

Pennsylvania mandates the use of an escrow account if deposits exceed $100, along with providing tenants with written notice of the bank and deposit location. Conversely, California does not require landlords to use an escrow account. Oklahoma requires deposits to be held in an escrow account with a federally insured, in-state banking institution.

Step 2: Choose a bank or financial institution

Select a bank that meets your state's criteria for landlord escrow accounts. For example, some states like Delaware require a federally insured financial institution. Look for an account with no monthly fees, easy access, and clear record-keeping. Choosing an institution that helps you avoid bank fees is essential to maximizing your returns

Understanding how to avoid bank fees can help you choose the right institution and prevent unnecessary costs when managing tenant rent and security deposits.

Step 3: Provide required documentation

When opening the account, be prepared with the paperwork to verify your identity and your business entity.

- Government-issued ID and your EIN if the deposit is held under a business entity like an LLC.

- Deed or property management agreement.

- Lease agreement as proof that the account will be used for tenant security deposits

Step 4: Fund the escrow account

Once the account is approved and opened, deposit the tenant’s security deposit as soon as you collect the funds. Ensure the funds are held completely separate from your personal or operational rent payment accounts and accurately track which deposits belong to each tenant to ensure organized records.

Step 5: Notify tenants about the escrow account

A lot of states require you to disclose escrow account holdings to your tenants. Follow these tips to comply.

- Inform tenants in writing about the bank name and location holding.

- Disclose interest details (if applicable), including how and when it will be disbursed to them.

- State the conditions for deposit return and deductions, based on the lease agreement.

💡 Pro tip: Include these details in the lease agreement and provide a written security deposit receipt to ensure compliance.

Additional steps: How to monitor, close, or transfer the escrow account

Your responsibility doesn't end after funding. You must continuously monitor the account and adhere to all timelines to avoid costly penalties.

- Pay interest: If required, pay the security deposit interest rate to tenants annually or upon lease termination. Maryland mandates interest on deposits over $50 after six months. Pennsylvania requires annual interest on deposits over $100 held for over two years, less a 1% fee.

- Return deposits on time: Follow state-mandated timelines for refunding full or partial deposits after lease termination. California requires a return within 21 days. New York mandates return within 14 days. Florida requires written notice within 30 days if deductions apply

💡 Pro Tip: Set calendar reminders for security deposit return deadlines to avoid legal penalties.

If you sell the property or change financial institutions, make the transfer process transparent and well-documented.

- Notify tenants: Inform tenants about any change in the escrow account holder in writing.

- Transfer documentation: Transfer funds and proper documentation to the new landlord or management company.

- Close properly: Close the account only after all security deposits have been returned to tenants.

Penalties for non-compliance

Mismanaging security deposits is one of the quickest ways to expose yourself to severe financial and legal risk. Each state has different consequences for landlords who fail to follow the rules, but the penalties consistently outweigh any benefit of non-compliance.

Here's a look at what non-compliance with security deposit and escrow rules could cost your business:

Case in point: In 2022, the New York Attorney General found SGW Properties improperly withheld about $296,000 of security deposits from 129 tenants. SGW failed to return deposits within the legal timeframe, did not provide required itemized lists, and failed to keep deposits segregated in an escrow account. As a result, SGW had to comply with penalties and return all withheld deposits. This is just one example of mishandling security deposits and the consequences it can lead to.

To stay compliant, ensure you follow the state regulations and stay transparent with tenants.

How to use Baselane to manage security deposits

As you've seen, the consequences for mismanaging security deposits—from forfeiting the deposit in Delaware to owing up to three times the amount in Maryland—are severe. The solution to mitigating this risk is clear: separate your funds and maintain flawless records.

While Baselane does not currently offer state-registered escrow accounts, we provide the ideal financial solution to receive, track, and manage your security deposits for states where an escrow account is not mandated. For states requiring a local, registered escrow account, Baselane helps you manage the funds and keep a clear trail of deposits without using external accounting software.

Here’s how to set up your banking workflow within Baselane:

Step 1: Open your Baselane banking account

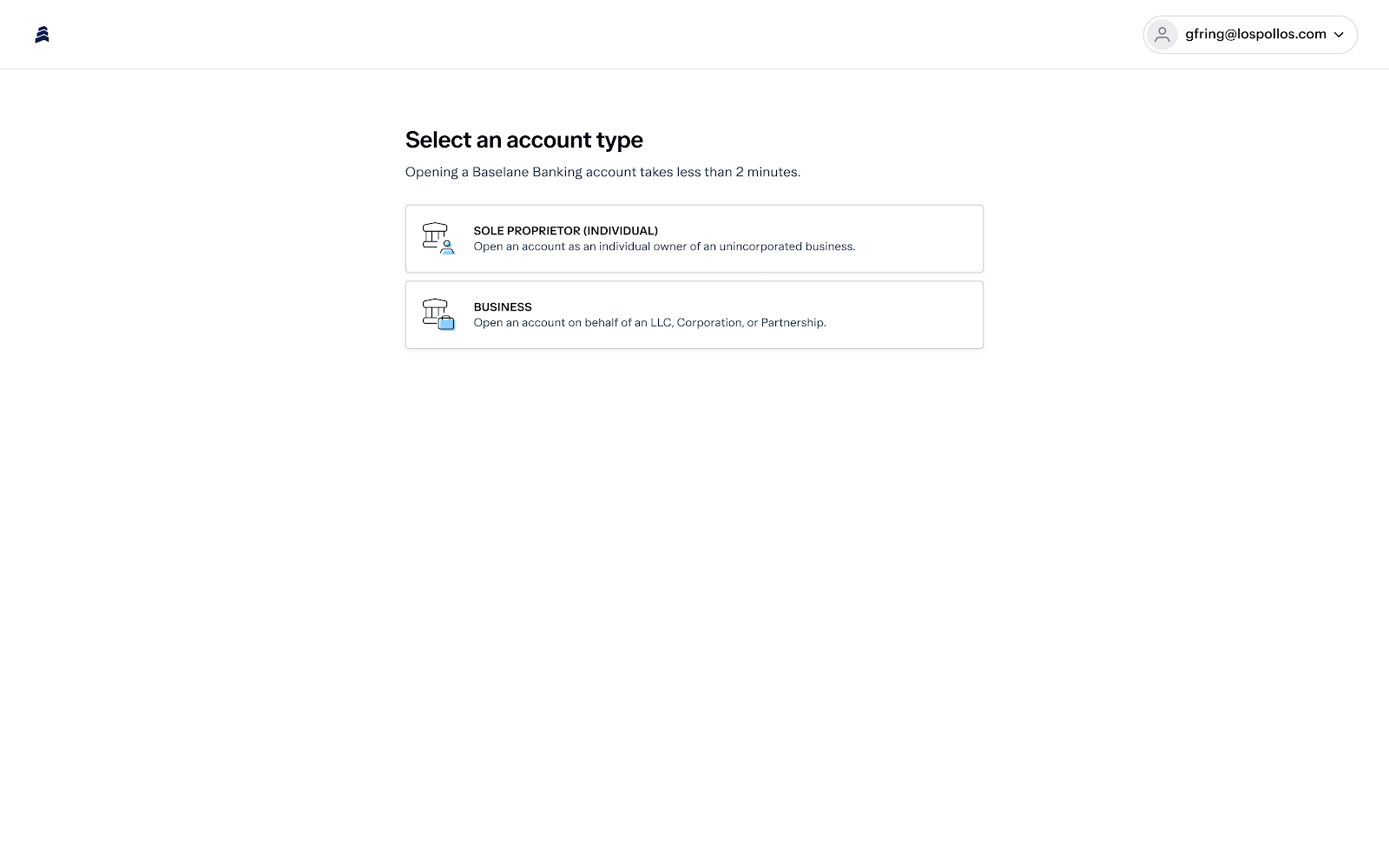

- Sign up: Create a free account using your email address.

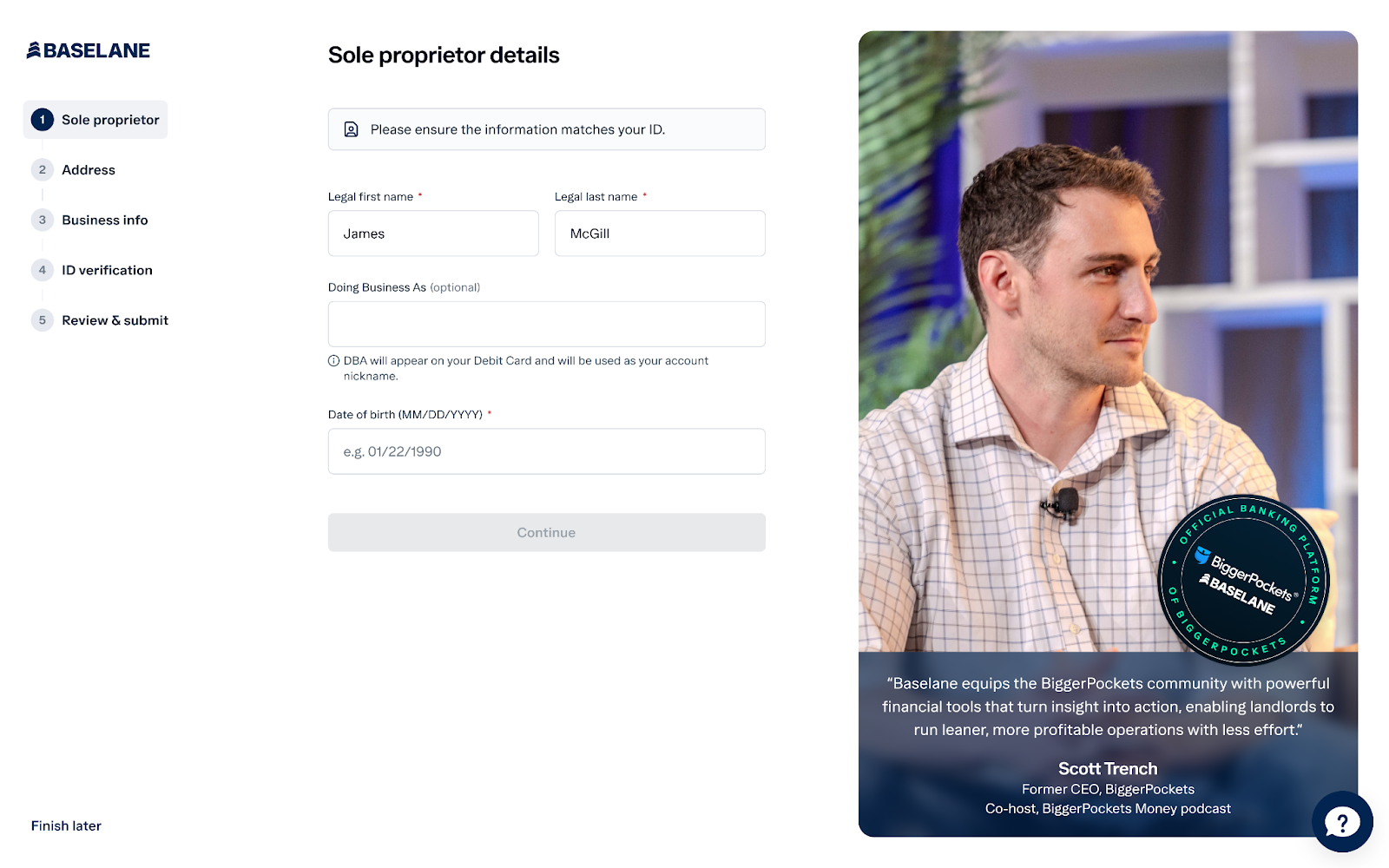

- Select entity type: Select entity type: Sole proprietor or Limited Liability Company (LLC).

- Provide details: You’ll be asked to provide documents for identity verification purposes. For a business bank account for landlords, you must be officially registered in the U.S. and provide additional details like your federal Employer Identification Number (EIN).

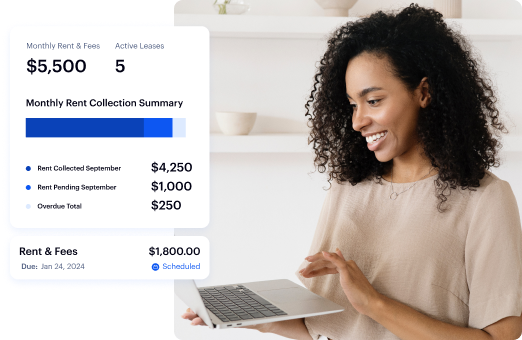

Step 2. Create property-specific accounts

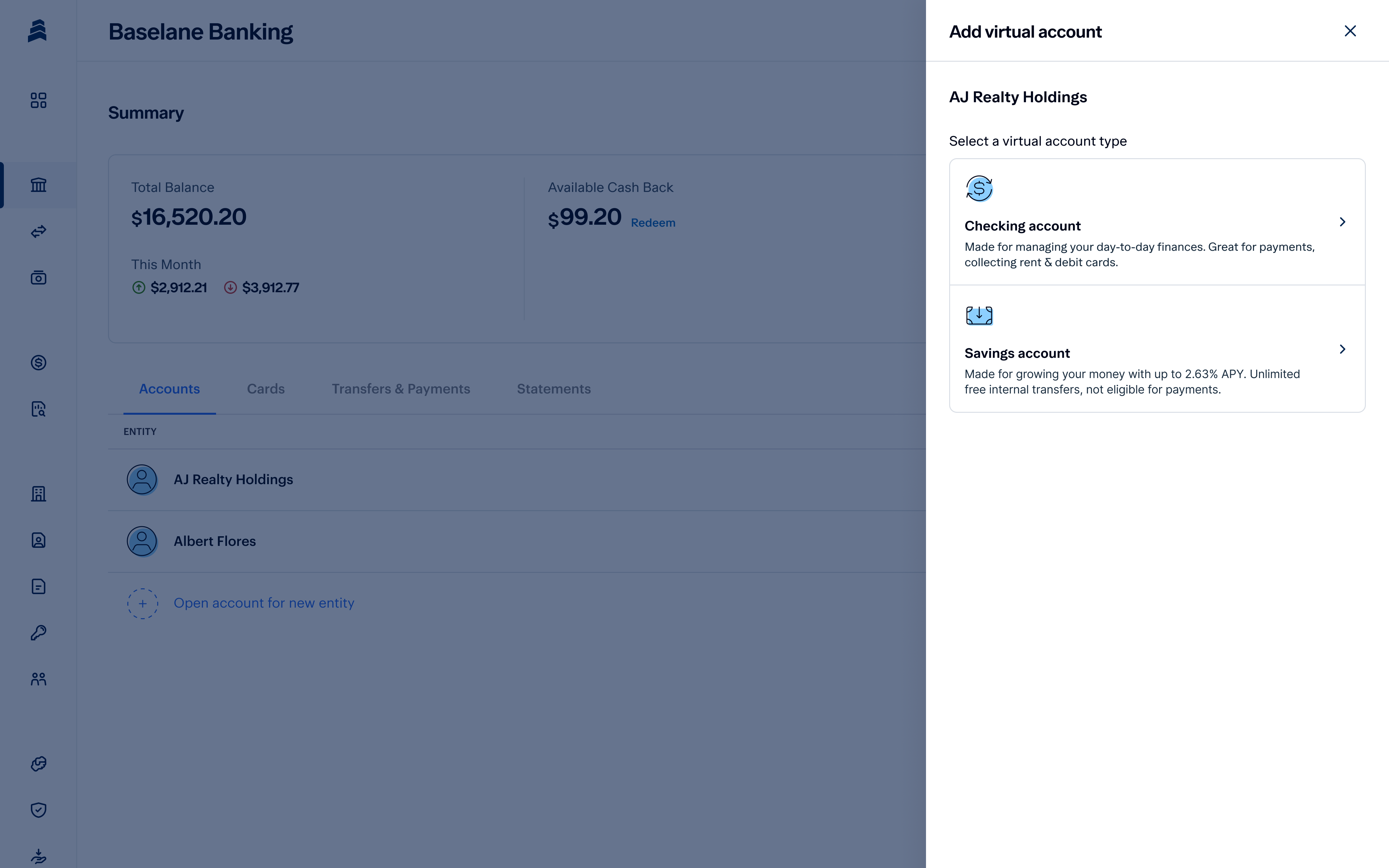

Once your application is approved, you can start creating checking or savings accounts specifically for your security deposits. You can create unlimited accounts per property.

Depending on state regulations, you can hold security deposits in a non-interest-bearing (Checking) or interest-bearing (Savings) account. Savings accounts earn up to [v="apyvalue"] APY² interest on deposits.

There’s no limit on the number of security deposit accounts you can have, and there are no account fees or minimum balance requirements.

Pro tip: Before you open a bank account, we recommend adding your property details first under the Property tab, as this will auto-tag all transactions in that account to a specific property/unit, making the account setup and bookkeeping faster and easier.

Step 3: Collect security deposits

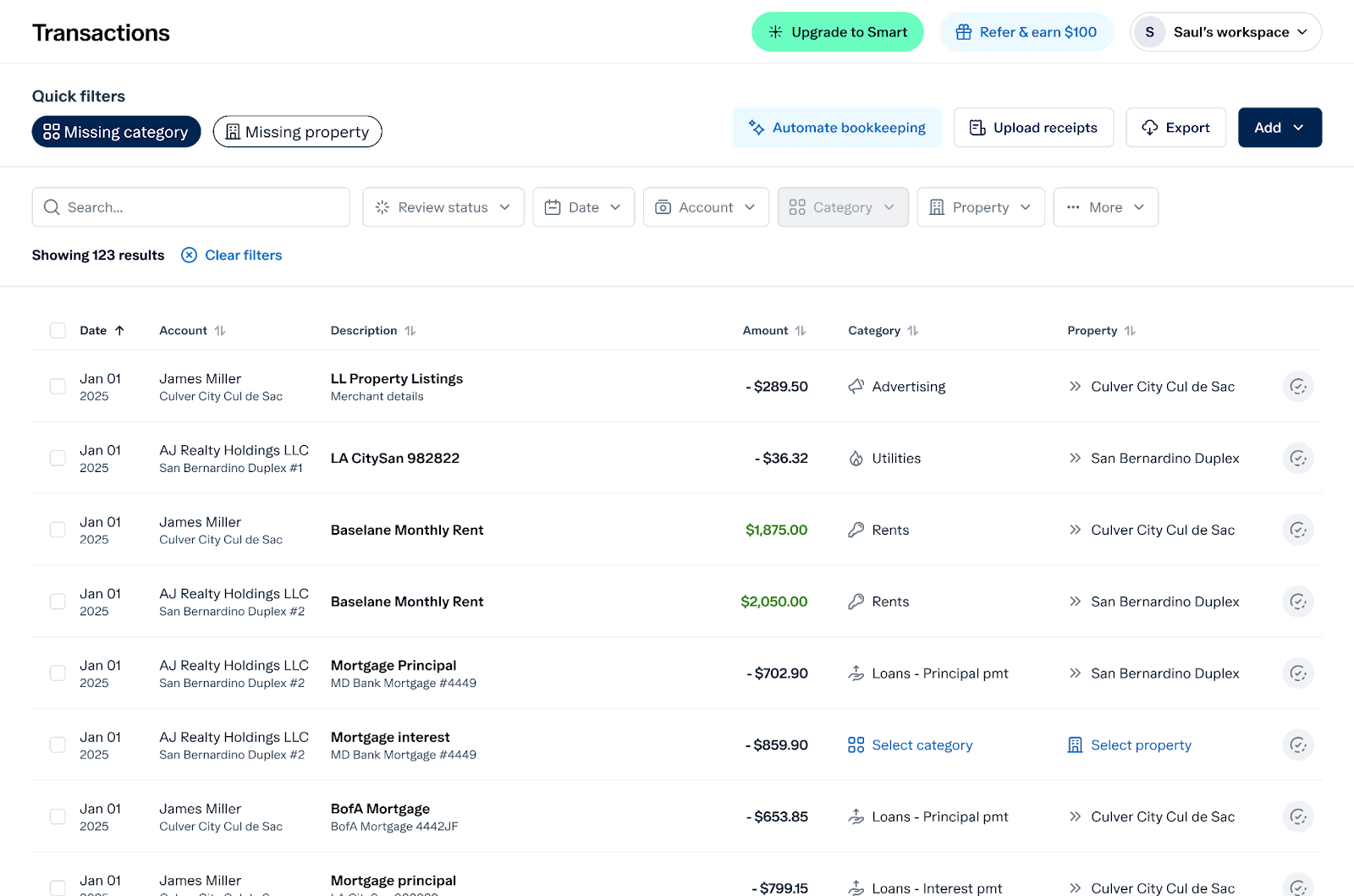

Send tenants a secure link to pay a security deposit within your Baselane security deposit account. Tenants can pay via bank transfers (ACH payments), mobile check deposits, credit/debit cards, or wire transfers. Your deposit will automatically be deposited into the selected account—ideally, a security deposit account for the property.

All transactions are auto-tagged to the specific property or unit, eliminating manual work and ensuring effortless tax reporting.

NOTE: If you are in a state that requires you to hold security deposits in an escrow account, you can still open a checking or savings account to receive security deposits from tenants and transfer it to a state-registered bank while keeping a clear trail of deposits without using any external accounting software.

Ready to get started? Open a security deposit account today.

FAQs

What is an escrow account for renters?

A landlord's escrow account for a tenant's security deposit is a bank account that holds the deposit in a neutral and separate location, legally segregated from the landlord's personal or operating business funds. This account ensures the funds remain available to cover damages or are returned to the tenant when they move out.

Where to open an escrow account for the security deposit?

The best bank for your escrow or security deposit account is one that meets your state's specific requirements (e.g., federally insured, in-state location) and offers features that help you manage compliance effortlessly. Look for institutions that offer special trust or escrow accounts and clear record-keeping. For managing the flow of deposits and generating compliance records, a platform like Baselane offers virtual accounts to logically separate deposits per property.

What are the escrow requirements for rental properties?

Escrow requirements vary significantly by state and even municipality. Key requirements include: whether deposits must be held in a segregated account (which is often mandatory even if true escrow is not); the maximum deposit amount allowed (e.g., 1.5 months' rent in Michigan); whether the account must be interest-bearing (e.g., New York, Chicago); and specific timelines for disclosing the bank's location to the tenant.

What is an escrow account for rent?

Rent escrow is a legal process, typically court-ordered, that allows a tenant to pay rent to a neutral third-party account (usually the court) instead of directly to the landlord when the landlord fails to make necessary, serious repairs. This process ensures rent is still collected while a habitability dispute is resolved, protecting landlords from tenants withholding rent entirely.

How to open an escrow account for a landlord?

To open a security deposit escrow account, select a federally insured financial institution and open a dedicated, non-operational account to deposit the funds immediately. You are often required to notify the tenant in writing of the bank's name and address, along with how any interest will be handled.

.jpg)