Taxes are complicated enough, and mixing income and expenses for all your properties in one bank account makes it impossible to keep everything straight. And if you end up underpaying taxes because your financial records aren’t in order, you could get hit with a hefty 20% penalty from the IRS.

Using a dedicated business bank account for landlords helps you avoid paying more than you have to. But choosing the right business bank account for rentals is more than just picking a place to stash your rental income and reserves. It's about finding a partner that helps you keep finances organized, generate reports, and simplify taxes.

This guide covers what to look for in a landlord-friendly business bank account, compares traditional banks with fintech options, and shares the 6 best business bank accounts for landlords.

Key takeaways

- Landlords need a dedicated business bank account to avoid tax mistakes, simplify bookkeeping, and maintain audit-ready financial separation.

- The best business bank accounts for landlords offer tools beyond basic checking—like automated rent collection, property-level sub-accounts, and built-in bookkeeping.

- Fintech banking platforms often outperform traditional banks as they offer multiple bank accounts, higher APY, lower fees, and built-in accounting and rent collection tools.

- Baselane stands out as the most landlord-focused option, combining banking and bookkeeping under one login.

Key features to look for in a business bank account

Managing rental properties means handling everything from fund transfers to bookkeeping, so your bank account needs to work just as hard as you do. Here's how to pick a bank account that works for you:

- No or low minimum balance requirements: Keeps operating costs low across multiple properties.

- Unlimited sub-accounts or virtual accounts: Separate income/expenses for each property or unit.

- Flexible payment options: Whether you’re paying a contractor or moving funds into reserves, fast, reliable access to your money is essential. Look for banks that offer free or low-cost ACH transfers, mobile check deposits, and no ATM fees.

- Smooth integrations: Connects with accounting tools, rent collection tools, bookkeeping systems, and property management workflows

- Built-in expense tracking and accounting: Helps get your bookkeeping done in real-time instead of months later when taxes are due.

- High APY: Generate passive income by keeping funds deposited in high-interest earning bank account.

- Multi-user access: Allows bookkeepers, property managers, or partners to collaborate safely.

Top 6 business bank accounts for landlords

Baselane

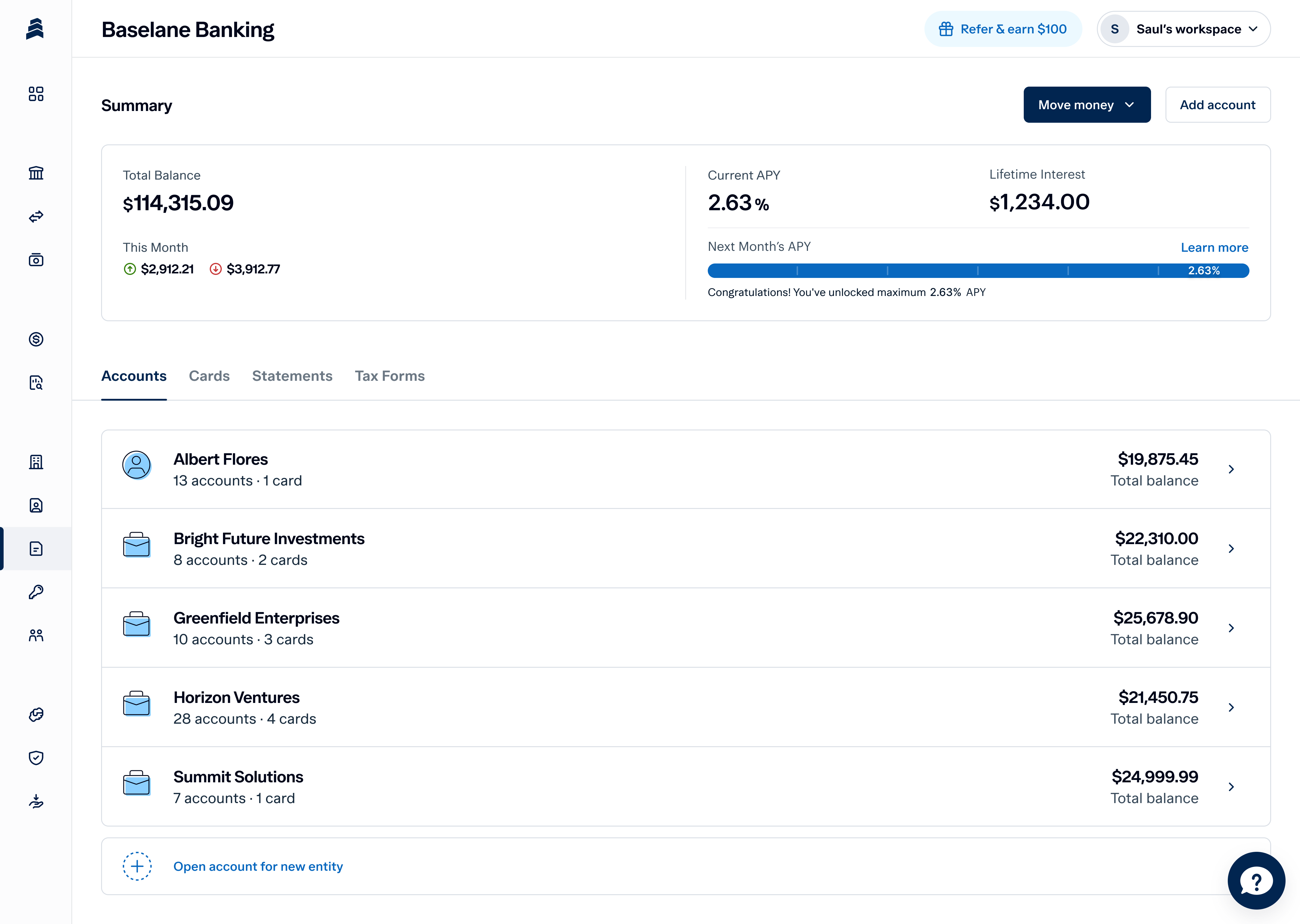

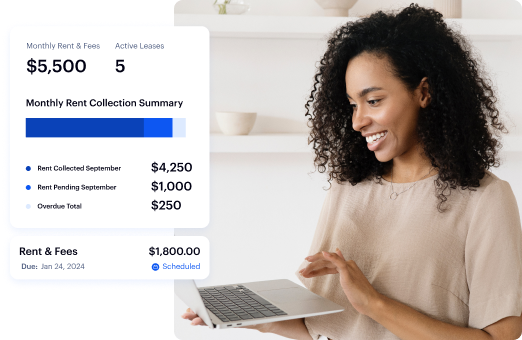

Baselane is a banking and financial platform built specifically for real estate investors and landlords. It helps you organize funds, manage cash flow, and get visibility into your finances.

What makes Baselane the best banking solution for landlords is that it not only offers an unlimited property-specific business account but also integrated bookkeeping, so your banking and accounting lives under one login. It’s one of the most efficient ways to maintain clear books for tax season and focus on growing your rental business rather than worry about cash flow management.

Baselane key banking features

- Property-specific accounts: Open unlimited checking and high-yield savings accounts per property to organize your funds.

- Auto-transfer funds: Schedule transfers to internal or external accounts to eliminate the headache of late or missed payments.

- Savings accounts with high APY: No monthly fees and up to [v="apyvalue"] APY² on deposits.

- Debit cards: Control and manage your rental property expenses with custom spend limits and share with your vendors, contractors, or property managers.

- No minimum balance requirements: Whether your checking or savings account balance is $50 or $50,000, you avoid monthly maintenance fees and earn interest on savings deposits.

- Integrated bookkeeping: Auto-tag every transaction by property and the correct Schedule E tax category.

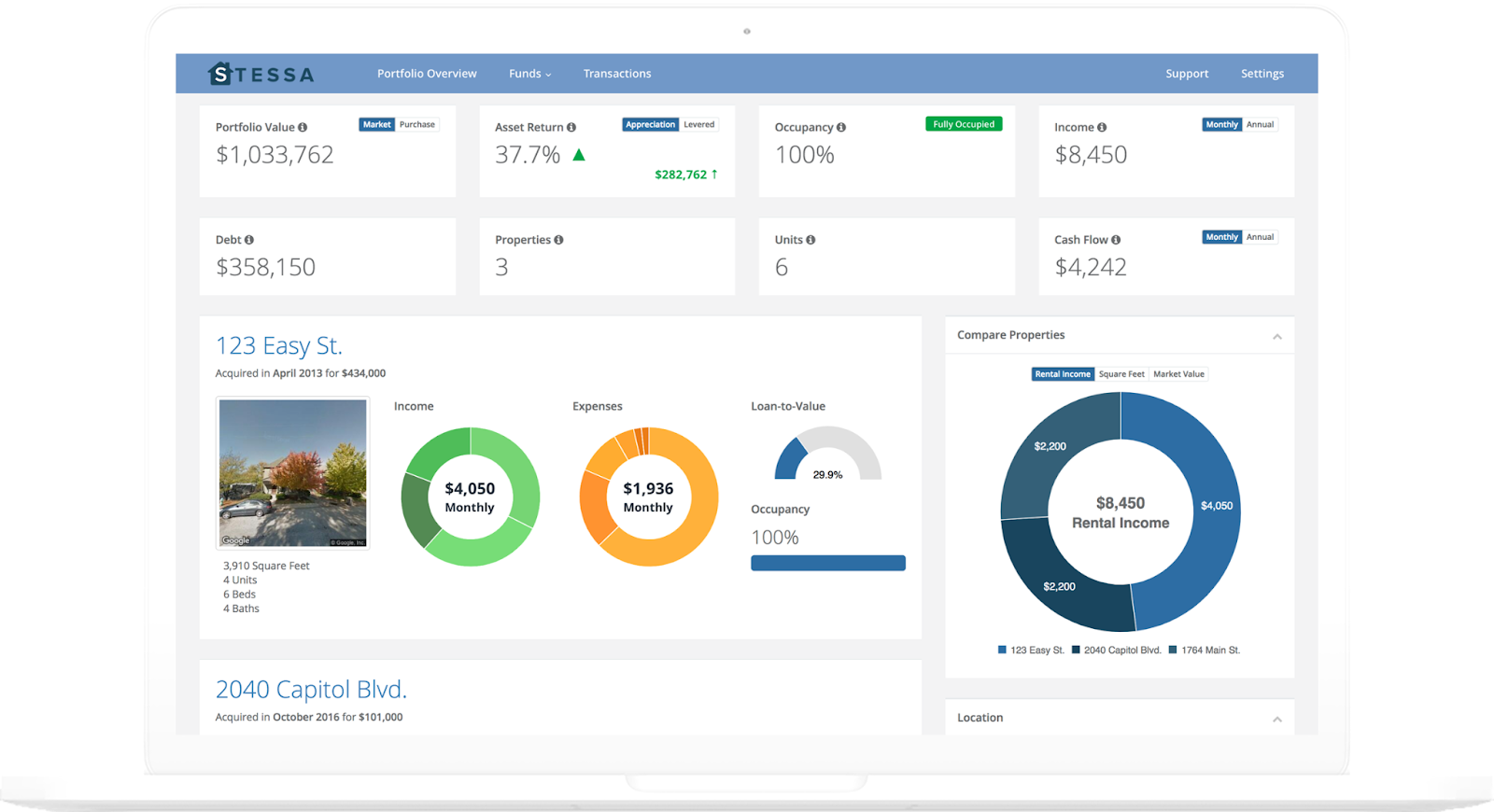

Stessa

Stessa offers property-level bank accounts with competitive APY, which makes it a good option for landlords managing a small to mid-size portfolio. It also offers built-in accounting to keep track of rental cash flow and maintain clear books. Stessa offers a free plan, and its paid plans start from $12/mo and go up to $28/mo.

Stessa key banking features

- High-yield business checking with tiered APY only at the premium plan costing $28/mo.

- Property-level subaccounts so each rental can have a dedicated account

- Visa debit card (physical and virtual) with cash-back rewards and mobile check deposit.

- Automated transaction categorization and real-time portfolio dashboards.

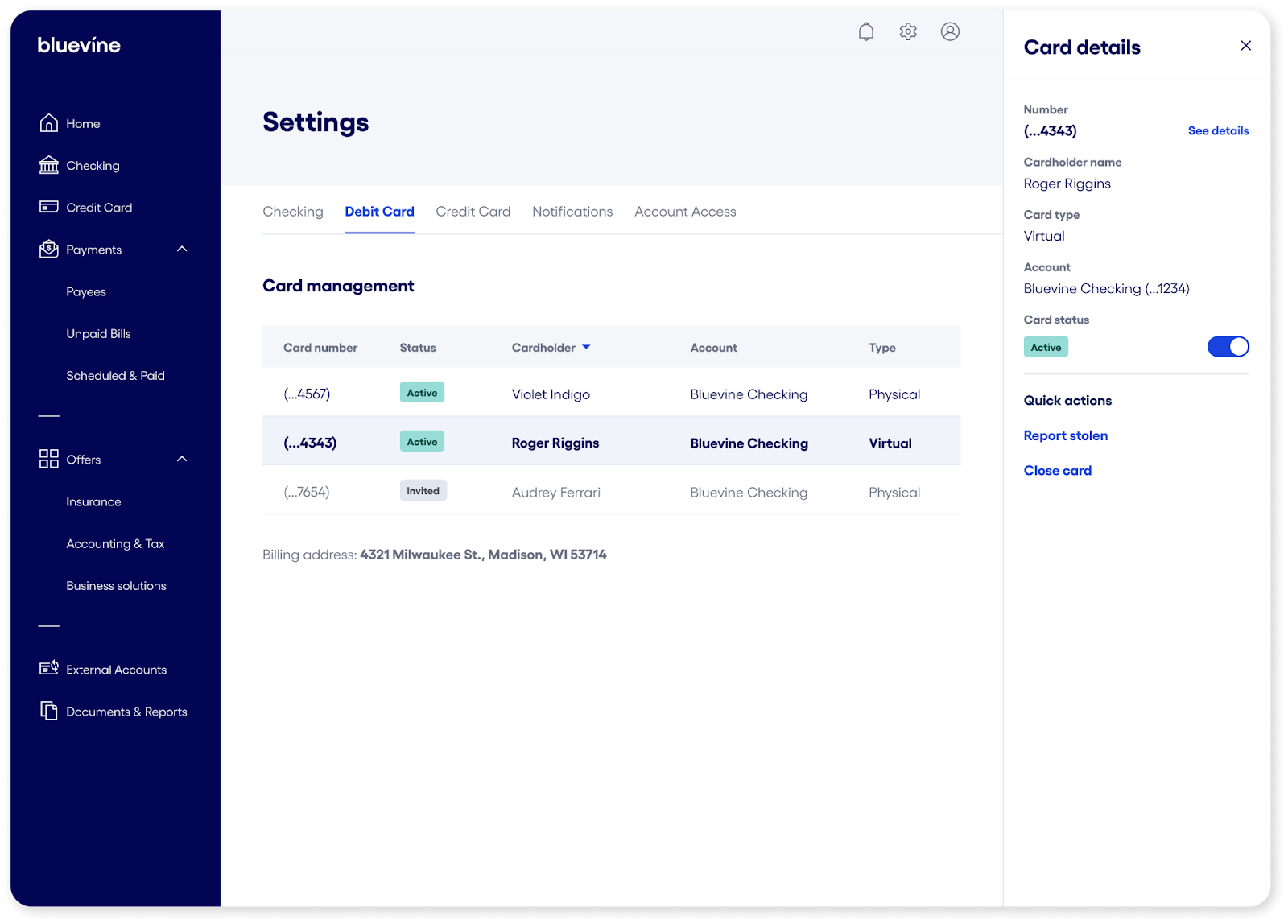

Bluevine

While not specifically built for real estate, Bluevine offers features that can help you manage a small rental portfolio. Its business checking accounts are free of any monthly fees or minimum balance maintenance, giving you flexibility with your funds.

Bluevine key banking feature

- Debit cards for each sub-account with spend limits to manage projects and control team spend

- Built-in bill pay, AP automation, and invoice management with recurring payments.

- Integrates with QuickBooks and other accounting tools.

- Easily deposit checks online through its mobile banking

Wells Fargo

Wells Fargo is a traditional brick-and-mortar bank that offers business checking and savings accounts for small to midsize businesses. You can use these accounts to manage your portfolio, but you’ll need to invest in accounting software to maintain clear books.

Wells Fargo key banking features

- Online and mobile banking with bill pay, alerts, and ACH/wire transfers.

- Link merchant services and credit products under one business banking relationship.

- Debit cards with basic controls and monitoring tools.

- Fraud monitoring tools and overdraft options tailored to each business’s needs.

Chase

Chase Bank offers bank accounts with built-in invoicing, card acceptance, and strong digital tools–a good choice for landlords who are looking to grow their portfolio.

Chase key banking features

- Tiered business checking accounts with varying transaction and cash-deposit limits.

- Strong online and mobile banking, including Zelle, wires, ACH, and integrated bill pay.

- Built-in tools for accepting card payments via Chase Payment Solutions tied to the business account.

- Multiple user access with controls plus fraud protection.

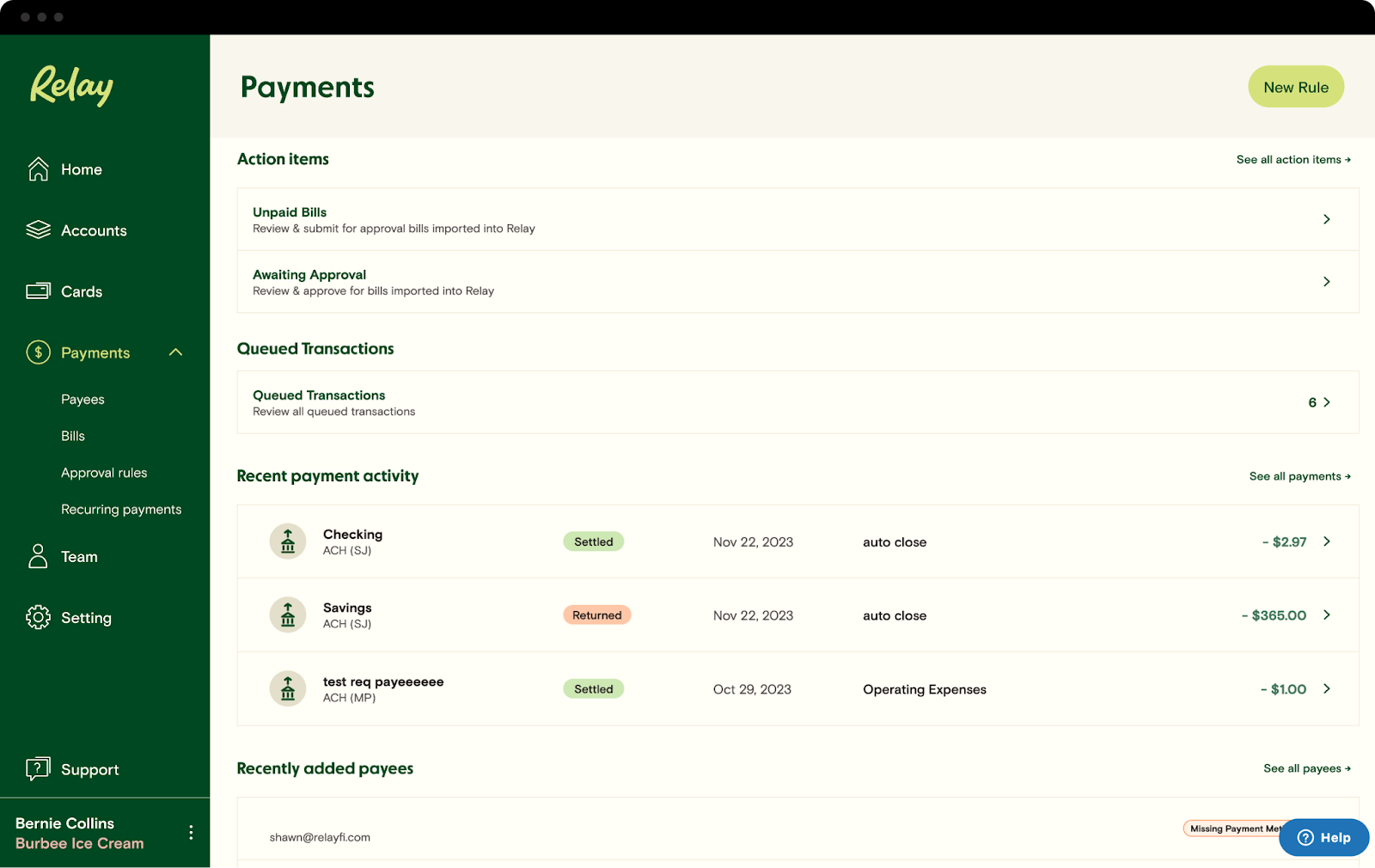

Relay

Relay is a business banking platform designed for small businesses to help them manage their cash flow. While it’s not built for landlords, its generous number of checking accounts and profit-first focus make it a good choice for landlords using that portfolio growth strategy.

Relay key banking features

- Integrates with QuickBooks, Xero, Gusto, and other payment processors.

- Up to 20 free checking accounts and multiple savings accounts under one login

- Automated transfer rules to allocate funds across accounts

- Physical and virtual debit cards for teams, with role-based permissions and multi-user access controls.

Business bank account for landlord comparison table

Mistakes to avoid when choosing a business bank account

Here are some common mistakes to watch out for when selecting a business banking for landlords:

- Choosing a generic account over a real-estate focused one. Standard small business accounts often lack landlord-specific tools like built-in rent collection or property-level accounting. This forces you into manual processes or "patchwork" solutions.

- Overlooking hidden banking fees. Beyond monthly fees, scrutinize charges for everyday transactions like ACH transfers, wire transfers, ATM withdrawals, and having multiple accounts. These costs can quickly reduce your profit margin, especially with multiple properties.

- Ignoring integration with essential accounting tools. A bank account that doesn't sync with your accounting software (like QuickBooks) or property management systems will lead to wasted hours on manual data entry and reconciliation. Better still, look for platforms with built-in bookkeeping to keep your banking and accounting under one login.

How to open a business bank account with Baselane

Here’s a quick walkthrough to open and fund your checking account with Baselane.

Step 1: Sign up for a Baselane account

First, sign up for Baselane banking account with your name, email, and password, then verify your email if prompted.

Step 2: Start your banking application

- In the dashboard, go to the “Baselane Banking” tab.

- Click “Add Account.” You will see options to open an account as a Sole Proprietor (individual) or as a Business entity (LLC, corporation, or partnership).

- Select the correct entity type.

Step 3: Enter business and personal information

Add identifying details based on the entity you select. For an LLC, have your Employer Identification Number (EIN) and your LLC’s formation documents ready.

NOTE: If your business is international but you’re opening a U.S. LLC account, our partner bank, Thread Bank, may require additional proof of organization or incorporation in the foreign jurisdiction as part of business verification.

Step 4: Submit the application

After you review your details, apply. We’ll run identity and business checks and verify the authenticity of documents submitted.

Step 5: Set up checking and savings accounts

Once your application is approved, you get one primary business checking account. You can add multiple sub-accounts within the main account or open additional accounts. For example, an account for maintenance reserve, mortgage payment, or security deposits.

Step 6: Add funds to your account

Deposit funds using ACH transfers, checks, wire transfers, or debit/credit cards. There is no required initial deposit amount, which is helpful if you are ramping up a new property or entity gradually.

Get started with Baselane banking

The best real estate business bank account for landlords depends on the features you’re looking for, your budget, and the property type. But, Baselane is built for landlords, whether you manage two units or 20+, helping you keep your finances in check—from initial deposit to when you’re ramping up finances across your properties.

Plus, you’ll head into tax season with confidence, knowing everything is already categorized, tracked, and ready to go with our automated bookkeeping. Open your business account with Baselane today!

FAQs

Do I need a business bank account for rental income?

Not always legally required — but usually necessary.

- Owned by an LLC/corporation: Yes. You must use a separate business account or you risk losing liability protection (“piercing the corporate veil”).

- Owned personally: Not mandatory, but strongly recommended. Separate accounts simplify taxes, bookkeeping, and audits.

Do landlords need a business bank account?

Yes, the landlord should open a business bank account to keep rental funds separate from personal ones. A dedicated business bank account is legally required when you operate under an LLC. Consider having multiple bank accounts to keep property/unit finances separate and organized.

What are the fees associated with a real estate bank account?

A traditional bank account comes with different types of fees–account maintenance, overdraft fees, transaction fees, and minimum balance fees. When choosing a bank for rental properties or an Airbnb business, prioritize a digital banking solution that often offers no monthly fee or balance requirements.

Which banks offer online and mobile banking features?

Mobile banking is standard for most banks, including large ones like Wells Fargo and Chase, which offer dedicated mobile apps. But digital, and investors like Baselane, provide a full range of online banking services, giving you all the digital banking benefits at no extra cost.

Which bank supports multiple accounts or sub-accounts?

Setting up multiple bank accounts for rental income makes tracking easy. Baselane offers unlimited property-specific checking and savings accounts to keep funds separate. You can use these accounts for keeping landlord security deposits, HOA reserve funds, or maintenance expenses.

What real estate financing options does a bank offer?

The best banks for real estate investors offer lending options that fit your business needs and size. Large banks like Wells Fargo and Chase provide DSCR loans, credit lines, and financing. Also, check if the bank can handle transactions related to Roth IRA real estate investing.

Can a landlord open a business bank account if they rent out a room in their house?

Yes, a landlord should open a business bank account, even for a single rental room. It's not legally required, but it helps keep personal and rental money separate and makes tracking income easier, especially if you plan to expand. Furthermore, separate accounts can also help with security depot management.

.jpg)

.jpg)