If you’re running your rental property business as a sole proprietorship, you’re likely trying to manage all your income and expenses with personal bank accounts. We know that keeping personal and business finances separated can feel like a major complication when you’re already juggling tenant management, repairs, and sourcing new deals.

However, operating your rental business without a separate bank account for your rental property can make tax season a chaotic, headache-inducing scramble, put your personal assets at risk, and prevent you from scaling your portfolio.

As real estate experts, we’re here to show you that setting up a dedicated business account—even as a sole proprietor—isn’t nearly as complicated as it seems. This guide will walk you through the essential steps, documents, and features you need to secure your finances and focus on growing your rental income.

Key takeaways

- Having a dedicated sole proprietorship bank account for your rental business is critical to prevent commingling funds, simplify bookkeeping, and prepare for tax season.

- Most states require landlords to hold tenant security deposits in a separate, non-operational account (escrow), making a dedicated business bank account essential for legal compliance.

- As a sole proprietor, setting up your account is straightforward, generally requiring only your government-issued ID and your Social Security Number (SSN) as your tax ID.

- Choose a banking partner like Baselane that offers unlimited virtual accounts (to track multiple properties and security deposits), integrated bookkeeping (for auto-tagging expenses by Schedule E category), and a high APY to maximize your passive income

Why sole proprietors need a separate bank account

Whether you own one unit or four, treating your rental activity like a separate business is a crucial step toward building generational wealth and achieving financial freedom. Even though a sole proprietorship doesn’t offer the same liability protection as a Limited Liability Company (LLC), a separate bank account is still vital for two primary reasons.

Financial clarity and tax simplification

As a landlord, you need tools that save you time, not create more work. When you commingle, or mix, your rental income and expenses with your personal checking account, tracking becomes nearly impossible.

A dedicated bank account simplifies your accounting and saves you countless hours of manual data entry by doing the following:

- Prevents commingling: A separate business account creates a clear separation of your rental income and expenses from your personal finances. This is essential for accurate tracking and proper tax reporting.

- Reduces tax preparation time: All your rental-related transactions are contained in one place, making it easier to identify and capture legitimate landlord tax deductions (like mortgage interest, property taxes, and repair costs) that you might otherwise miss. This organized record keeping gives you a clear view of your property’s performance before you hand it off to your accountant.

- Prepares for audits: Clear, separated records are your first line of defense if the Internal Revenue Service (IRS) ever audits your rental activity, demonstrating you treat it as a legitimate business.

Compliance and professionalism

Having a dedicated account doesn’t just make your life easier; it also establishes trust with your tenants and can be a legal requirement for security deposits in some states.

- Security deposit compliance: Most states require landlords to hold tenant security deposits in a separate, non-operational account, often referred to as an escrow account, to prevent commingling. Some states mandate that this account be interest-bearing. A business banking platform built for real estate, like Baselane, allows you to easily open unlimited, compliant virtual accounts for security deposits for free.

- Improves credibility: Using a business account demonstrates professionalism to vendors, lenders, and tenants. Lenders, in particular, prefer to see clear, organized financials when you apply for future financing, which can lead to better loan terms as you scale your portfolio.

How to set up your sole proprietorship business bank account

The good news is that opening an account as a sole proprietor is typically the simplest and quickest path to business banking. Since you are the business, you usually only need your personal identification and business information.

Step 1: Gather your documents

- Personal identification: A government-issued photo ID, such as a driver's license or passport.

- Your tax ID: For a sole proprietorship, you will typically use your Social Security Number (SSN). You generally won't need an Employer Identification Number (EIN) unless you have employees or choose to register for one.

- Business/rental documentation: While a sole proprietorship is easy to form, banks may still require property ownership documentation (like a deed or property management agreement) or a signed lease agreement to prove the account's purpose.

- Contact information: Your mailing address, phone number, and email.

Step 2: Choose a landlord-focused bank

Don't settle for your personal bank, as some of the key features or services might be missing, such as separate business accounts for different purposes. You need a bank that is purpose-built for real estate investors and offers key features like no monthly fees, high-yield savings, and built-in property management tools.

Look for features that directly support real estate activities, such as:

- Unlimited sub-accounts: This helps you create sub-accounts for dedicated expenses such as maintenance reserve or utilities payments—all under one main account.

- Automated bookkeeping: Look for a platform that makes bookkeeping automatic through auto-categorization, Schedule E reporting, and custom categories.

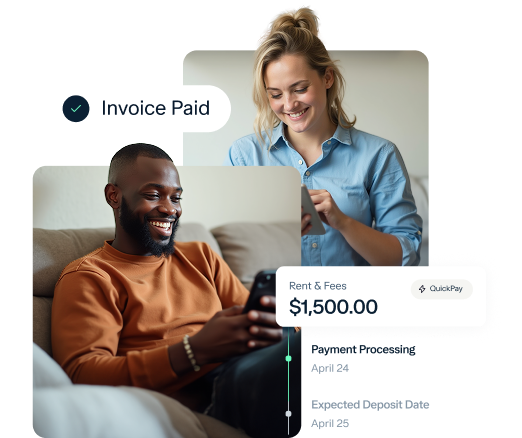

- Integrated rent collection: Collecting rent directly into the same platform where you bank automates transaction tagging and provides a complete, real-time picture of your cash flow.

Step 3: Apply for your account

Whether you choose a local bank or a specialized online banking platform like Baselane, the application process for a sole proprietorship is fast. But with online platforms, you can often apply and get approved in a matter of minutes.

To open an account with Baselane follow these four basic steps:

- Sign up for an account using your email address.

- Choose the type of entity you are opening the account for (in this case, an individual/sole proprietor)

- Provide your personal details, including your first and last name, DOB, and physical address

- Add your business information, including your industry and Social Security Number (SSN) (optional, Employer Identification Number (EIN)).

Once you open your account, you can start adding funds or create sub-accounts for specific purposes, such as one for security deposits.

Step 4: Fund and start managing your property

Once approved, you'll need to fund your new account and set up your rental financial workflows.

Deposit an initial amount to cover upcoming expenses and set a dedicated flow for future rental income. For example, in Baselane, you can set up recurring payments from a specific account to be sent out on a particular day every month or week. Automating expenses helps you stay on top of your payment timeline while ensuring a clear record of money flowing in and out.

Best practices for ongoing financial management and growth

Setting up your account is just the beginning. The goal is to build an efficient, scalable system that puts you in control of your finances.

Create an account per property

Use virtual accounts to separate the financial performance of each individual property within your main business account. This allows you to track profitability "per door" and make smarter investment decisions.

Use sub accounts for security deposits

Many states require landlords to place tenant security deposits in dedicated accounts, sometimes interest-bearing escrow accounts. Having separate accounts or clearly designated sub-accounts ensures these funds are kept segregated from operating capital. This practice also helps in accurately generating Schedule E reports and other tax documentation, as all income and expenses are correctly attributed.

How Baselane helps you keep bank accounts organized

As a real estate investor operating as a sole proprietor. The onus is on you to manage your finances in a way that avoids any financial liability.

That’s why you need a reliable and modern banking solution on your side that takes the manual work out of your hands and improves accuracy and transparency in your financial workflows.

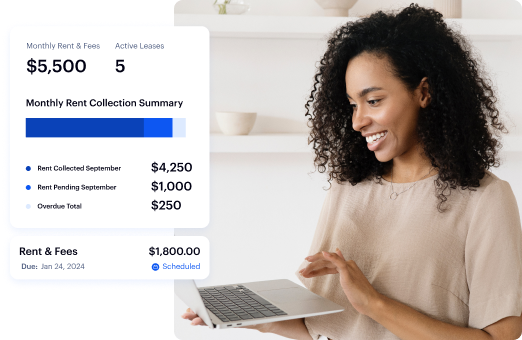

Baselane is the financial partner built to deliver that efficiency. Our all-in-one platform helps you organize your rental finances, move away from manually reconciling spreadsheets, and get real-time insights into your cash flow.

- Automated bookkeeping: Every transaction, whether from rent collection or a maintenance payment with a virtual card, is automatically categorized by property and the correct Schedule E category.

- Unlimited virtual accounts: Open as many checking or high-yield savings sub-accounts as you need—one for each property, a general operating account, and separate, compliant accounts for every security deposit—all with no monthly fees.

- High-yield on savings account: Grow your passive income by earning a [v="apyvalue"] APY² on all your cash balances, including reserves and security deposits.

Open your bank account with Baselane and move from being an active manager to a strategic investor.

FAQs

What is a sole proprietorship bank account for landlords?

A sole proprietorship bank account for landlords is a dedicated bank account used exclusively for rental property income and expenses. It helps separate personal and business finances, simplifying bookkeeping and tax preparation for landlords operating as sole proprietors. This separation is crucial for financial clarity and audit readiness.

How do I set up a sole proprietorship bank account online?

To set up a sole proprietorship bank account online, you typically need to visit the website of a financial institution that offers online onboarding. You will need to provide digital copies of your government ID, SSN or EIN, and any required business documentation. Platforms like Baselane allow you to set up accounts specifically designed for landlords entirely online.

Is an EIN required for a sole proprietorship bank account?

While a Social Security Number (SSN) is generally sufficient for a sole proprietorship, an Employer Identification Number (EIN) is highly recommended. An EIN helps separate your business tax identity from your personal SSN, enhancing privacy and potentially simplifying future business transitions. Some banks may also prefer or require an EIN for business accounts.