According to a recent study conducted by PYMNTS Intelligence, roughly 50% of renters prefer paying their rent online. Rent collection apps can make this process easier, faster, and more reliable.

The best tenant management apps to collect rent offer multiple payment options, have easy-to-use interfaces, and keep both tenants and landlords updated on where property management payments stand.

Choosing the right online tool or app to collect rent payments is essential to the future success of your real estate business. Here are some of the best apps to make rent collection easier and faster.

Key takeaways

- The majority of renters (roughly 50%) prefer paying rent online, making digital collection essential for your real estate business.

- Choose platforms that are free for you and offer low-cost or free Automated Clearing House (ACH) transfers for tenants to maximize your cash flow.

- The best platforms combine core functions like rent collection, banking, and automated bookkeeping to streamline your financial management and eliminate the need for multiple, disconnected tools.

Key features to look for in rent collection platforms

81% of tenants prefer the option to pay rent online which makes it the most convenient and best way to collect rent payments. While there are many ways, you can streamline online rent payment by picking the best rent collection software.

Here are a few key features to look for when exploring your options:

- Payment options: Choose a platform that offers multiple payment options and consider working with a service that supports split rent payments, allowing your tenants to break their monthly rent into weekly or biweekly installments.

- Automation: Your rent collection platform should let you set up automated reminders for upcoming rent payments and give your tenants the ability to schedule recurring payments at a minimum.

- Payment processing times: Consider how long each platform takes to transfer money to your account. Baselane deposits payments in 2-5 days, so you’re not left wondering when you’ll see an increase in your bank balance.

- No partial payments: Blocking partial payments for overdue rent should be a standard feature. This will help avoid delays if you’re in the middle of the eviction process.

- Security: Your rent payment collection app should encrypt payment data and account information for both you and your tenants.

- Cost: Choose an app that keeps tenant-paid fees to a minimum and is free for you to set up and use. Try to keep tenant transaction fees below 3% for debit or credit cards and ACH bank transfers.

- Built-in bookkeeping: to help replace manual data entry with automatic income and expense tracking for Schedule E tax reports.

Keep all your rent payments organized with our rent ledger template to track payments, overdue balances, and tenant histories effortlessly.

Top 12 apps for collecting rent with ease

Before we dive into the pros and cons of landlord rent collection software, here’s a quick overview of the top rent collection apps.

- Baselane: Best for flexible rent collection for landlords with integrated banking and bookkeeping for free.

- Apartments.com: Best for basic rent collection needs if you’re already using it for rental listings.

- Rentec Direct: Best for larger portfolios that need advanced features and can afford monthly and scaled unit-based pricing.

- PayRent: Best for those who prioritize premium features like credit reporting despite having higher tenant transaction fees.

- Buildium: Best for landlords with 50+ units or property managers who can offset high monthly fees and setup costs for faster processing.

- TenantCloud: Best for landlords who need customizable payment options and can accommodate longer payment processing times (up to seven days).

- Zillow Rental Manager: Best for small or DIY landlords who need basic rent collection paired with property listings and tenant screening.

- Avail: Best for landlords who want property listing and automated rent collection together.

- TurboTenant: Best for experienced landlords who can maximize the value of its additional property management features and don't need integrated banking.

- RentRedi: Best for landlords with tenants who primarily pay rent in cash.

- ClearNow: Best for landlords with one or two properties whose tenants are content with ACH as the only payment method.

- Innago: Best for landlords who want a free platform and are comfortable passing all transaction fees (including a $2 ACH fee) to the tenant.

1. Baselane

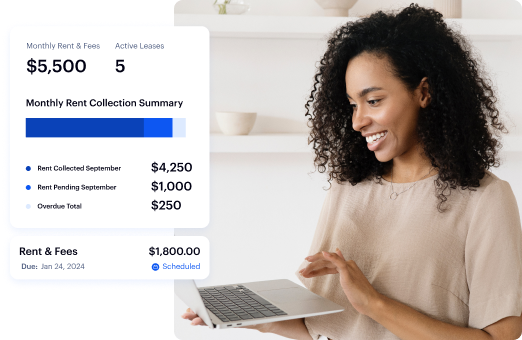

Baselane is a banking and bookkeeping platform offering free rent collection that simplifies managing your rental payments. You can collect rent via ACH, debit/credit, or wire transfer into your Baselane banking or an external account.

Since you can open multiple accounts, rent payments for each property or unit are organized instantly upon deposit. Plus, all transactions are automatically tagged to the correct property and Schedule E category, making bookkeeping effortless.

Key features

- Automated rent collection: Schedule rent invoices, collect security deposits, one-time fees, and recurring fees, and send automatic reminders to reduce late payments.

- Tenant auto-pay: Allow tenants to schedule recurring payments so that you can get rid of rent chase and get rent payments on time.

- Security deposit accounts: Open a dedicated security deposit account to collect funds or transfer to a state-based institute while keeping track of them in your books.

- Credit boost: Offer tenants to report timely rent payments to the credit bureau and help them boost their credit.

- Rent reports: Tap into your property rent performance through the rent roll, rent ledger, and cash flow statements.

Pros and cons

Pricing

Baselane Core gives you access to a full range of features for free. Baselane Smart, which costs $20/mo, gives you access to fast rent deposits, an auto-tag assistant, and the option to share access with your CPA, property manager, or vendors.

Baselane has completely streamlined how I manage my rental portfolio. Rent collection is automatic, expenses are tracked in real time, and I get clear financial insights without juggling multiple spreadsheets or bank accounts. It’s intuitive, landlord-focused, and saves me hours each month, plus my tenants love how easy it is to pay. Highly recommend to any landlord who wants to simplify their rental business and improve cash flow. ~ Alex Spino

Apartments.com

Apartments.com is a listing management platform that also offers rent collection tools. You can collect rent from one or multiple tenants, but it doesn’t go beyond the basic toolkit.

Key feature

- Supports multiple payment options like credit card, bank transfer, Apple Pay, and Google Pay with automatic email reminders.

- Create 360-degree tours of your property to show to tenants virtually.

Pricing

The core Rental Manager platform is free for landlords. However, premium features like listing promotion or tenant screening services incur additional, variable costs.

Pros and cons

3. Rentec Direct

Rentec Direct is a property management software that offers online rent collection alongside tenant screening, electronic leases, and property management accounting.

Key features

- Supports online rent payments via ACH, credit/debit cards, or cash

- Rental listing syndication

- Owner and tenant portal for communication and payment tracking

Pricing

There’s no free plan. Rentec Direct Pro starts at $45/mo for 1 unit, and you can try it for free with a 14-day free trial.

Pros and cons

4. PayRent

PayRent is an automated rent payment collection platform focused entirely on online rent collection with tools for monitoring payments and enforcing rent collection. It supports bank transfers, ACH, and debit/credit payments.

Key features

- Rent collection and credit reporting

- RentDefense tool for payment protection

- Block partial payments

Pricing

PayRent offers two paid plans, and a starting plan costs $24/mo, giving you access to manage up to 30 units with $3 per additional unit. There is no free plan, only a 7-day trial.

Pros and cons

5. Buildium

Buildium is a rental property management platform with built-in rent collection features. It helps you manage properties, collect rent, screen tenants, and get rent reports in an instant. One downside is that you’ll need to pay a $99 setup fee for each bank account that receives rent payments. These high fees can add up real quick, making Buildium an expensive option for small portfolios.

Key features

- Collects credit, debit, and ACH rent payments with automated reminders.

- Offers a range of accounting and financial reports suitable for larger operations.

- Provides a portal and tools to manage communication with your tenants.

Pricing

Buildium does not offer a free plan, only a 14-day free trial. Pricing starts at $62/mo for the Essential plan and increases based on the number of units managed.

Pros and cons

6. TenantCloud

TenantCloud is a property management platform known for its customizable payment options and tenant-friendly interface. It's best suited for landlords with multiple properties who need flexibility but can afford longer payment processing times.

Key features

- Automated rent reminders, autopay, and automatic late fees.

- Built-in accounting, with real-time reports and transaction activity.

- Tenant portal for rent payment tracking and reminders.

Pros and cons

Pricing

Starts at $16.50/mo for unlimited properties. There’s no free plan offered.

7. Zillow Rental Manager

Zillow Rental Manager is a free tool built into the Zillow Rentals Network, specializing in listing properties and basic rent collection. It’s an accessible option for DIY landlords, STR investors, and property managers. It offers core features including listing, advertising, tenant screening, and rent collection.

Key features

- Automated payment reminders and late fee charges

- Offers ACH and card payment options with automatic reminders.

- Tracks payments in a central dashboard

Pricing

Zillow Rental Manager is free for property listings. Premium pricing of $39.99 gives you listings more exposure and benefits for up to 90 days.

Pros and cons

8. Avail

Avail is a property management software that helps you list your properties, create state-specific leases, and collect rent.

Key features

- Create payment lists for rent payments, fees, and deposits from one or multiple renters

- CreditBoost to report on-time payments to credit bureaus

- Expedited payment processing (on their paid plan)

Pricing

Avail offers a free plan, and its paid plan starts at $9 per uni/mo.

Pros and cons

9. TurboTenant

TurboTenant is a property management software that includes online rent collection alongside marketing and tenant screening tools. It's a good choice for landlords who need a complete front-end management solution and are willing to pay for premium features.

Key features

- Free online rent collection for landlords (ACH, credit/debit card; convenience fees for ACH/credit).

- Automated payment tracking and receipts with payment logs.

- Automated rent reminders and late fee notifications to tenants.

Pricing

TurboTenant offers a free plan. Its paid plan, which includes essential features like multiple bank accounts and faster payouts, starts at $12.42/mo.

Pros and cons

10. RentRedi

RentRedi is a rent management software that is especially useful for landlords whose tenants prefer cash payments, as it integrates with a network of retail locations.

Key features (related to rent collection)

- Accepts cash (via retail network), credit card, debit, and ACH payments.

- Tenants can set up autopay and receive payment reminders in-app.

- Automated or manual late fees, with the ability to accept/block partial payments.

Pricing

RentRedi offers no free plan. Its premium plan starts at a fairly low price of $5/mo.

Pros and cons

11. ClearNow

ClearNow is a purpose-built app for collecting house rent payments online that fast-tracks rental income management with direct deposit and income/expense tracking tailored for landlords and property managers.

Key features

- ACH payment network

- Payments are deposited in three days

- Rent payments reported to Experian

Pricing

ClearNow fees are based on your debit day and are only charged when you attempt to debit a tenant. Monthly debits: $14.95/month for one debit. Semimonthly debits: $4/debit. Biweekly debits: $4/debit.

Pros and cons

12. Innago

Innago is a property management platform that lets tenants set up automatic payments and sends them payment reminders when rent is due.

The platform helps you set up automated late fee reminders and gives you control over how you bill tenants for rent and other fees. You can also track payments offline, so you know who still owes you and who has paid you on time. Innago makes tenants cover the fees for additional services, including rent payments.

Key features

- Supports ACH, debit/credit payments

- Short hold times on payments received

- Exportable rent reports

Pricing

Innago is free for landlords and passes any fees to the tenant. Tenants pay $2 for ACH payments and 2.99% for credit/debit card payments.

Pros and cons

Best free rent collection apps comparison table

Automate rent collection with Baselane

With the right landlord rent collection software, you can automate rent payments, send timely reminders, and maintain consistent cash flow through scheduled tenant payments.

While each app is unique in its offering, the right one depends on your portfolio size, the features you need, and the fees you’re comfortable paying.

Innago, for example, is a good app to use if you’re just starting out, while TenantCloud or TurboTenant are good options if you want rent collection, tenant screening, and accounting in one.

Baselane shines above all because it centralizes your banking, bookkeeping, and rent collection under one login. Instead of switching between apps, you collect rent, track the payments, and organize your books without any hassle. This saves you time so that you can spend your weekend playing with your family.

FAQs

What is the best method to collect rent?

The best way to collect rent from your tenants is the way that works for them. Baselane’s rent collection platform makes it easy to collect rent from multiple properties, fast, and affordable. Your tenants can choose between ACH, credit card, or debit card payments.

What is the best rental collection app for landlords?

The best rent collection software for landlords depends on what your needs are now and how they’ll change. Choose an app that’s free to use and offers tons of features that can grow with your business, like Baselane. Through Baselane’s rent collection platform, you can e-sign leases and automatically collect fees, create separate accounts for security deposits, auto-tag transactions for tax reporting, screen tenants, and access other premium features for complete control over your rental finances without monthly fees.

How does online rent collection work?

Every rent collection app is different, but it should be easy to set up and use. With Baselane, the setup is quick and simple – it only takes a few minutes.

- Enter your rental’s address, rent amount, fees, lease terms, timing of payments, and your tenant’s information.

- Invite your tenant through the platform.

- Your tenants make one-time or automatic monthly payments through the app.

- You get paid in 2-5 days.

Our online rent collection app aims to save you time and take the stress out of getting paid.

What's the fastest ACH rent payment app?

The fastest ACH payouts are often offered through premium features or paid plans, such as those that deliver funds in one (Avail FastPay) or two days (Buildium). Apps like Baselane offer fast payments, typically in two to five days, with QuickPay.

Can landlords block partial rent payments?

Yes, many dedicated rent collection platforms allow you to block partial rent payments. This is a crucial feature that gives you control, especially for avoiding potential delays if you enter the eviction process.

Do rent collection apps report rent payments to credit bureaus?

Yes, several apps offer this feature. Platforms like Baselane, PayRent, Avail, and ClearNow can report on-time rent payments to one or more credit bureaus, which is a valuable benefit for your tenants seeking to build credit.

Are apps like Zelle, Venmo, or PayPal safe for rent payments?

No, these peer-to-peer (P2P) apps are not recommended for rent payments. They are designed for personal use, not business transactions, which can create legal risks, compromise your accounting, and may result in the platform freezing your account. Dedicated rent collection software is the safer, compliant choice.