Managing rental properties comes with a lot of moving parts—from finding tenants and handling maintenance to keeping the books in order.

The big question is whether to hire a property manager or take matters into your hands. This guide breaks down what property managers charge, why fees vary, and how dedicated software can help you run your properties efficiently—so you can make the choice that’s right for your portfolio and your peace of mind.

Key takeaways

- Property management costs vary—but usually hover around 10% of rent. Fees can increase with larger portfolios, multifamily properties, or complex urban markets.

- Percentage-based fees align manager incentives with revenue, while flat fees are predictable but may limit proactive property management.

- Setup, leasing, maintenance, inspections, vacancies, and evictions can significantly increase total costs if not carefully reviewed.

- Deciding between a manager and self-managing depends on your portfolio and capacity. Small, local portfolios can be self-managed with systems; large or remote portfolios often benefit from professional management.

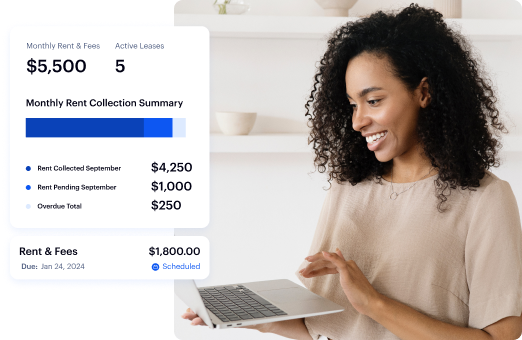

- Software can make self-management easier and more profitable. Baselane automate rent collection, bookkeeping, tenant onboarding, and expense tracking, while giving you shared access for hybrid setups with property managers.

Factors that affect property management costs and fees

Property management fees vary widely depending on several key factors. The type, size, and condition of your property all play a role, as do location, neighborhood, and local market conditions.

For example, a well-maintained suburban single-family home typically costs less to manage than an older multifamily property in a highly regulated urban area.

Other cost drivers include:

- Property type & size: Multi-unit or larger properties require more oversight.

- Location & neighborhood: High-rent cities or desirable neighborhoods often have higher fees.

- Property condition: New or renovated properties usually cost less to manage.

- Services offered: Full-service management is more expensive than selective or hourly options.

- Local market & competition: Fees fluctuate based on manager availability and rental demand.

Understanding these factors helps you anticipate costs and choose the best service for your portfolio.

Common fee structures that property managers use

Percentage of rent

This is the most common fee structure where property managers charge a fixed percentage of the monthly rental income, typically between 8% and 12%.

If you collect a monthly rent of $1,500 and you both agree on a 10% fee, you’d pay your property manager $150 each month. If you have a vacant property with no rent coming in, some property managers may still charge a fee. Vacant properties require just as much work (and sometimes more).

Flat property management fee

A flat-fee structure is based on factors like the property’s type and size as regardless of your rental income.

For example, they might charge $100 per month for a single-family home, but more for a larger property with multiple units.

At first glance, this model might seem attractive. However, property managers may not be as inspired to maximize the earning potential of your property’s rental income with a fixed fee.

Flat fee vs percentage property management charges

When hiring a property manager, it’s important to understand the difference between rent due and rent collected:

- Rent collected means you pay the manager only when they collect rent from your tenants.

- Rent due means that if the tenant doesn’t pay, you still owe the manager their fee.

Rent collected is typically the better financial option, so review the wording in your contract that explains how property managers get paid to ensure it reflects the right choice for your investment and aligns with vacation rental income tax requirements.

9 additional fees that property managers charge

Fees charged by property managers cover a wide range of property management services, from bookkeeping setup to tenant management and maintenance oversight. While each company structures fees differently, most include the following major cost categories:

Contract setup fee

Some mid-term rental property management companies charge a setup fee at the start of your working relationship. The average property manager fee for this is typically between $300 to $500 and goes toward setting up your accounting ledger for bookkeeping, assisting with necessary business or tax licenses, and any initial property inspections.

Repairs and maintenance fee

Property management companies will often (but not always) charge a 5-15% markup on all maintenance costs for the property. So, for example, if a plumbing problem costs $500, it will be forwarded to you at $550 with a 10% markup.

Some property management companies have trusted vendors or in-house teams. These teams usually offer preferred pricing, ensuring repair costs are lower than what an individual might get. Some property management companies have a property maintenance services list with trusted vendors or in-house teams. These teams usually offer preferred pricing, ensuring repair costs are lower than what an individual might get.

Inspection fees

Some property managers include regular inspections as part of their costs, while others will expect you to foot the bill. You’ll receive inspection reports alerting you to any general wear and tear or property damage tenants may need you to address. Either way, regular inspections can save you money in the long run.

Tenant placement or leasing fees

Leasing fees cover marketing, showings, tenant background checks, preparing the lease, selecting tenants, and onboarding them. These fees often equal half a month to a full month’s rent.

For instance, if your property rents for $1,800 and your manager charges a 75% leasing fee, you’ll pay $1,350 upfront when a new tenant moves in. This fee is one of the biggest expenses landlords belittle. The cost may be worth it if you’re not sure how to write a lease agreement.

Lease renewal fee

Even if a tenant stays, most managers charge for renewing the lease—usually $100 to $300 or a small percentage of the monthly rent. It’s not a huge expense, but adds across multiple units.

Eviction handling fees

If an eviction becomes necessary, managers often charge administrative and court-processing fees. These typically run a few hundred dollars and do not include legal costs, which vary by jurisdiction.

Another layer of complexity arises if the eviction involves squatters. This makes the eviction process more complicated and often costlier for you.

Vacancy fee

Managing a vacant property requires more attention because of unexpected leaks or security concerns. Regular weekly visits to the property are needed to minimize risks at $50 – $100 per month.

Some firms charge an upfront fee equal to a month’s rent if you engage them while the property is vacant.

Late payment fees

You should consider charging a late fee if you don’t receive rent on time. Property managers may ask for a percentage of late rent payments (typically 25% to 50%) since they’ll be securing the rent payments. Using property management payment solutions can help automate late fees and ensure timely rent collection.

Early termination fee

If you end your contract with the property management company earlier than agreed, you might incur an early termination fee. This fee varies but could range from a month’s worth of lost income for the company to more severe penalties for breach of contract.

Should you hire a property manager or use software instead?

Professional property managers can save you time, reduce headaches, and bring expertise, but they come at a cost—often 10% of rent plus additional fees. On the other hand, self-management can help maximize cash flow and ensure high-quality tenants, but it requires systems, discipline, and time.

Here’s how to think about it.

When hiring a property manager makes sense

Property managers provide an entire team working for you. One key benefit is you get a full-time revenue and operations management team. The team monitor rates, inquire tenant inquiries, run maintenance checks, and track payments daily. Unless you have countless hours to dedicate, a PM often pays for itself in stress saved and revenue preserved.

You should consider hiring a property manager if:

- You own more than a few units, especially 10+ properties.

- You live out of state or far from your properties.

- You have a low tolerance for problem-solving or stress, and handling tenant issues, emergencies, and complaints would be burdensome.

- You lack confidence, experience, or a reliable mentor to guide you through leasing, maintenance, and financial decisions.

- You want a professional team monitoring your revenue, occupancy, and operations daily.

In short, property managers are ideal if your time is limited, your portfolio is large, or you want a hands-off experience with professionals handling every aspect.

Tips for finding a property manager/management company

Here are some ideas to help you find a reliable and trustworthy property management company:

- Tap into your network: Ask fellow real estate investors and landlords which property management company they prefer. Be specific about your needs (e.g., single-family homes or vacation rentals).

- Check with local real estate professionals: If you're an out-of-town investor, ask local real estate agents or inspectors for recommendations. A local property manager is a huge asset for maintenance contacts and market insights.

- Browse online and verify credentials: Search legitimate sources like the National Association of Residential Property Managers (NARPM), Yelp, Google, and the Better Business Bureau. Make sure the company holds the appropriate licenses and is accredited by associations like the NARPM.

- Review contracts carefully: Check the management contract for hidden fees, notice periods, and service terms.

- Evaluate their services and technology: Confirm the company offers all the services you need—from tenant screening and maintenance to rent collection and evictions. Choose a company that uses modern digital tools for easy communication.

- Meet face-to-face: Schedule a meeting (in-person or virtual) to see if the property manager's style and responsiveness align with yours.

- Ask about their tenant screening process: This is crucial for securing quality tenants, minimizing issues, and protecting your property's value.

When self-managing can work

Self-management is not only possible but can be highly profitable—especially if you have a few local properties and are willing to run them like a business.

Many experienced investors recommend learning the ropes yourself first to understand the nuances of leasing, maintenance, and tenant management.

Self-management works best if you:

- Own a small number of local properties (typically under five units).

- Are organized, disciplined, and willing to implement systems for tenant communications, maintenance, and bookkeeping.

- Can handle tenant inquiries and emergencies without letting it impact your day job or lifestyle.

- Want to keep more cash flow while ensuring high-quality tenants.

How property management software makes self-management easier

Property management software automates the majority of your tasks, especially when you self-manage a handful of your properties. From screening and onboarding tenants to keeping track of rent payments, this software is a good option to take off manual work from your plate.

Baselane is among the best property management software that handles the financial side of your properties under one login.

With Baselane, you can:

- Automate flexible rent payments, charge late fees, and keep tracking rental income and invoices

- Screen and onboard tenants

- Automate bookkeeping and accounting

- Pay bills, manage expenses, and more with built-in banking

- Track cash flow and generate financial reports

See how Baselane can help you save time and money. Sign up for a free account.

FAQs

What do property managers typically charge?

Most long-term rental (LTR) property managers charge 8–12% of monthly rent, depending on property type, location, and services included. Short-term rental (STR) managers usually charge 25–40% of rental revenue because they handle higher turnover, cleaning, guest communication, and 24/7 support.

What is the minimum property management fee?

Many managers have a minimum monthly fee ranging from $100–$200, especially for smaller properties or low-rent units. This ensures basic operational costs are covered.

What does a property manager charge for?

Property managers typically charge for a combination of:

- Monthly management of rent collection, tenant communication, and maintenance coordination

- Tenant placement and lease onboarding

- Inspections and reporting

- Handling evictions or late payments

Additional fees may include setup, lease renewal, and vacancy monitoring.

Why do STR fees cost more than LTR fees?

Short-term rentals require more hands-on management—frequent tenant turnover and check-ins, cleaning and maintenance between guests, 24/7 guest communication and support, and dynamic pricing and revenue management. All this labor and operational complexity drives the higher percentage fees.

How much is a property leasing fee?

Leasing or tenant placement fees typically range from 50–100% of one month’s rent. This covers marketing, showings, tenant screening, lease preparation, and onboarding.

What is a setup fee?

A setup fee is a one-time onboarding charge, usually around $300–$500, covering accounting and bookkeeping setup, initial inspections, and assistance with licenses or registration. Some companies may include this in the first month’s management fee.

What is included in monthly management?

Monthly management fees usually cover:

- Rent collection and accounting

- Tenant communication and issue resolution

- Maintenance coordination and vendor management

- Property inspections and reporting

Are flat property management fees better than percentage-based fees?

Flat fees (around $100/month) are predictable and work well for smaller, low-rent properties. Percentage-based fees (typically 8–12% of rent) scale with income, allowing managers to boost occupancy and revenue. The best choice depends on property size, type, and local market conditions.

.jpg)