Choosing the right business structure is a pivotal decision for any real estate investor. Your entity choice impacts liability, taxation, administrative burden, and growth potential.

In this guide, we’ll share the advantages and disadvantages of starting a sole proprietorship for a real estate investor. Evaluating the pros and cons will help you decide whether forming a sole proprietorship is the right choice for your real estate business.

Key takeaways

- Sole proprietorships offer ease of setup, low costs, and full control, making them attractive for new investors.

- A primary concern for sole proprietors is unlimited personal liability, which exposes personal assets to business risks.

- Tax filings for sole proprietorships are simpler, with income reported on Schedule E, though self-employment taxes apply.

- Scaling a real estate portfolio can be challenging as a sole proprietor due to difficulties in raising capital and establishing business credit.

- Many real estate investors initially start as sole proprietors but transition to LLCs as their portfolios expand for better protection.

What is a sole proprietorship in real estate?

A sole proprietorship is a business structure where an individual directly owns and operates it. As an investor, it means you are personally responsible for all aspects of your rental properties. There is no legal distinction between you and your business.

This structure is often the default if you begin investing in real estate without formally registering another entity. Your rental income and expenses are reported directly on your personal tax return. Many real estate investors, especially those starting out, operate under this model.

Sole proprietorship advantages for real estate investors

Operating as a sole proprietor offers several compelling benefits for real estate investors.

Ease and affordability of setup

One of the most significant advantages of a sole proprietorship is its inherent simplicity. There are no complex formation documents or extensive ongoing filings required to establish this business structure. You can often begin operating without any formal registration beyond necessary local licenses.

This ease translates into low setup costs, typically ranging from $50 to $500, with minimal regulatory burdens. For small-scale investors, this reduced initial investment frees up capital for property acquisitions. The straightforward nature makes it an accessible entry point into real estate investing.

Full control and flexible operations

As a sole proprietor, you retain complete control over all business decisions. This means you have full autonomy in managing your properties, choosing tenants, and making financial choices. You do not need to consult partners or adhere to corporate governance rules.

This level of decision-making freedom allows for quick adjustments to market conditions or personal investment strategies. The structure provides unparalleled flexibility, enabling you to operate your real estate business exactly how you envision it. This direct control can be a significant motivator for independent investors.

Tax simplicity and benefits

Tax filings are generally simpler for sole proprietorships compared to other business structures. Your rental income and expenses are reported directly on your personal tax return using Schedule E. This eliminates the need for a separate business tax return.

You can also deduct eligible expenses, such as mortgage interest, property repairs, and depreciation, which can reduce your taxable income. While simplified, it is crucial to accurately track all income and expenditures for precise reporting. This straightforward tax process is a key sole proprietorship advantage.

Minimal paperwork

Beyond initial business permits or licenses, sole proprietorships typically involve very little ongoing administrative paperwork. You avoid the regular filing requirements often associated with corporations or LLCs, such as annual reports or board meeting minutes. This reduction in bureaucratic tasks allows you to focus more directly on managing your properties and investments. The minimal compliance burden saves you valuable time and resources.

Sole proprietorship disadvantages

Despite the simplicity, sole proprietorships carry significant risks and limitations, especially as your real estate portfolio grows. Some of the most common ones are mentioned below.

Unlimited personal liability risks

The most critical sole proprietorship disadvantage is unlimited personal liability. There is no legal distinction between your personal assets and your business liabilities. This means if your real estate business incurs debts or faces lawsuits, your personal assets—such as your home, savings, and other investments—are at risk.

For real estate investors, this exposure is particularly significant due to potential tenant lawsuits, property damage claims, or contractual disputes. Without the protection of a separate legal entity, your personal wealth remains vulnerable.

Difficulty raising capital and limited credit options

Sole proprietorships often face challenges when trying to raise capital for expansion. Lenders and investors may perceive this structure as riskier because there's no separate business entity with its own credit history. This can make it difficult to secure favorable loan terms or attract external investment.

Building separate business credit is nearly impossible, as all debts are tied to your personal credit. This limitation can hinder your ability to finance new property acquisitions or significant renovations. As a result, growth often relies solely on personal funds or financing, which restricts scalability.

Scalability issues for growing portfolios

As your real estate portfolio expands, managing it as a sole proprietorship becomes increasingly complex and risky. The lack of asset protection and difficulty in securing business-specific financing can impede significant growth. Handling multiple properties under one personal umbrella can also overwhelm administrative capacity.

Transitioning to a more formal structure like an LLC often becomes necessary to manage larger portfolios more efficiently and securely. The inherent limitations of a sole proprietorship can create significant roadblocks for ambitious investors seeking to scale their operations.

Higher personal tax burdens

While tax filings are simpler, sole proprietors often face a concentration of tax burdens on their personal income. You are responsible for self-employment tax, which amounts to 15.3% on active income, covering Social Security and Medicare (rentastic.io). This can significantly impact your net earnings.

Unlike corporations, sole proprietors cannot elect to be taxed as an S-Corp to reduce self-employment taxes on distributions. This direct impact on personal income makes careful tax planning essential for managing your overall financial health. The cumulative effect of these taxes can be a substantial burden on a sole proprietorship.

Business lifespan and transition challenges

A sole proprietorship is intrinsically tied to its owner, meaning the business technically ceases to exist if the owner retires, becomes incapacitated, or passes away. This lack of continuity can complicate succession planning for your real estate assets. Transferring properties and ongoing operations becomes a complex personal estate matter rather than a business transition.

This structure also lacks the inherent ease of transferring ownership stakes that partnerships or corporations offer. Without careful planning, the future of your real estate investments could face significant disruption. This intrinsic limitation is another critical consideration among the disadvantages of a sole proprietorship.

Should you transition from sole proprietorship to LLC?

Many real estate investors start as sole proprietors due to the simplicity of the process. However, as your portfolio expands or risk exposure increases, transitioning to a Limited Liability Company (LLC) often becomes a strategic necessity.

LLCs provide a legal shield, separating your personal assets from business liabilities. This protection is invaluable against potential lawsuits from tenants, property damage claims, or business debts. An LLC also presents a more professional image, which can be advantageous when seeking financing or partnerships.

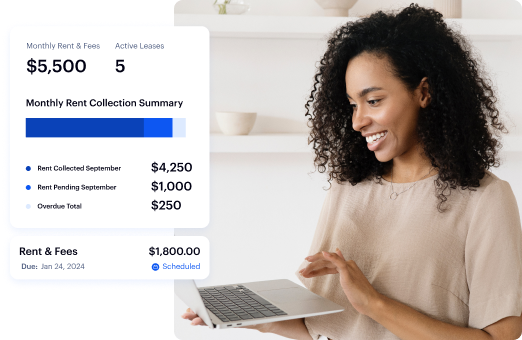

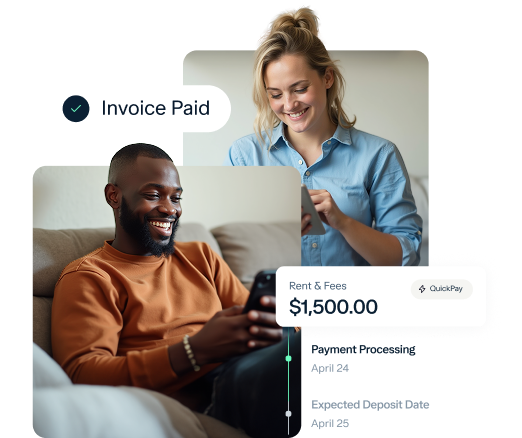

When considering a transition, you will need to open an LLC business account to maintain proper separation of funds. Many financial institutions offer options like a business bank account for an LLC with no minimum balance. Baselane provides comprehensive banking solutions that can support your new LLC structure. You can also explore options for the best free business bank account for an LLC to minimize overhead costs for your growing business.

Sole proprietorship vs. LLC: A side-by-side comparison

This table provides a clear overview of the sole proprietorship advantages and disadvantages compared to an LLC. Understanding these differences helps you make an informed choice that aligns with your investment goals and risk tolerance.

Bottom line

The simplicity and low cost of a sole proprietorship are undeniably attractive for new investors. However, the critical issue of unlimited personal liability and challenges in scaling a portfolio can create significant concerns.

As your real estate portfolio grows, the limitations of capital raising and scalability become more apparent. Thus, it is vital to weigh your options and think about other business models, such as forming an LLC or a partnership.

Whichever business model you choose, Baselane helps you integrate your finances across properties and give back time. Our platform simplifies banking, rent collection, and bookkeeping, whether you operate as a sole proprietor or transition to an LLC. Explore how Baselane can streamline your rental property finances and support your investment growth. Open an acount today!

FAQs

What are the main sole proprietorship advantages for real estate investors?

The primary advantages of sole proprietorship include its ease and low cost of setup, full control over business decisions, and simplified tax filing on Schedule E. This structure is ideal for new investors seeking a straightforward entry into real estate.

What are the key sole proprietorship disadvantages for real estate investors?

The most significant disadvantages of sole proprietorship involve unlimited personal liability, which exposes personal assets to business debts and lawsuits. Other drawbacks include difficulty raising capital and challenges in scaling a growing real estate portfolio.

When should a real estate investor consider moving from a sole proprietorship to an LLC?

Real estate investors should consider transitioning from a sole proprietorship to an LLC when their portfolio expands, or when increased liability risks become a concern. An LLC offers critical personal asset protection and can simplify scaling operations.

Is it necessary for a sole proprietor to have a separate bank account for rental properties?

Yes, even as a sole proprietor, it is highly recommended to have a separate bank account for your rental property business. This practice helps maintain clear financial records, simplifies tax preparation, and provides better insight into your property's performance.

.jpg)