Late Fees for Rent: How Much to Charge, State Limits, and Daily Penalty Rule

Managing rental properties demands clear financial guidelines to ensure a stable income stream. For landlords and property managers, understanding the nuances of late fees for rent is crucial for maintaining cash flow and tenant compliance.

This guide covers how to legally charge late fees, the limits set by state laws, and best practices for implementation.

Key takeaways

- Most states cap typical late fees for rent between 5% and 10% of the monthly rent.

- Grace periods, typically five days, must pass before a late fee can be applied.

- Lease agreements must clearly outline late fee policies to be legally enforceable.

- Landlords must comply with state-specific laws for late rent fee limits, as excessive or improperly applied fees can lead to disputes.

- Online rent collection platforms can automate and streamline rent collection and the application of late fees.

What are late fees, and why are they charged?

Late fees for rent are charges applied when a tenant fails to pay their rent by the due date stated in the lease agreement. You can charge late fees to your tenants for untimely payments, encouraging tenants to meet their financial obligations on time.

Charging late fees also helps you recover administrative costs associated with late payments, such as additional banking fees or time spent on follow-up communication.

Is it legal to charge late fees on rent?

Yes, it’s legal to charge late fees for rent in most jurisdictions across the United States. However, the legality and specific rules depend heavily on state and local laws. Landlords must always ensure that late fee policies comply with these regulations to avoid legal penalties.

Courts generally uphold late fees as enforceable if they’re reasonable and specified in the lease agreement. Fees that are deemed excessive or punitive by a court may be invalidated. Therefore, understanding the legal framework in your specific state is paramount before implementing any late fee policy.

Understanding grace periods and when fees apply

A grace period is a specified number of days after the rent due date during which a tenant can still pay their rent without incurring a late fee. This period provides a buffer for tenants, accounting for potential payment delays or minor oversight.

Grace periods commonly range from 0 to 30 days, although a 5-day grace period is quite typical across many states. Landlords can only apply a rent late fee once this grace period has fully elapsed.

For example, if rent is due on the 1st of the month with a 5-day grace period, the earliest a late fee can be charged is on the 6th. This clarity helps prevent misunderstandings and disputes between you and your tenants.

Types of late rent payment fees and how to calculate

There are various late fee structures you can choose from—flat fees, percentage-based fees, and daily penalties—as long as it’s within a range that states consider reasonable.

As per World Population Reviews, late fees should generally be capped at 5% of the total rent if late by three days, and can rise to a maximum of 10% if late by ten days or more.

That being said, there are different types of late fees you can charge your tenants.

Flat fee

A flat fee for late rent is when you charge a fixed dollar amount regardless of the rent amount.

For example, if the lease specifies a flat fee of $75 for any late payment, and the rent is $1,500, due on the 1st with a 5-day grace period, the tenant would owe $1,575 if they pay on the 7th.

Percentage fees

A percentage fee is calculated as a specific percentage of the monthly rent. For instance, a 5% late fee on $1,000 rent would be $50.

Daily penalty fees

A daily penalty fee mean an additional charge is added for each day the rent remains unpaid after a certain period.

For example, Oregon caps daily penalties at 6% of the permitted late fee per rental period. If the initial late fee is 5% of a $1,000 rent ($50), the daily penalty would be 6% of $50, which is $3. If the rent is 10 days late beyond the grace period, the total daily penalty would be $30 ($3 x 10 days), in addition to the initial $50 late fee. The total late fees rent would be $80.

An average late fee can vary, but generally, courts are likely to invalidate fees exceeding approximately 10% of the monthly rent.

Make sure you charge a standard and reasonable late fee for rent that covers actual damages rather than being punitive.

State limits on late fees: State-by-state comparison

Some states impose strict caps on the maximum amount a landlord can charge, while others require fees to be "reasonable." Consult your specific state and local regulations to ensure compliance.

For example, California doesn’t set a maximum late fee but mandates that fees must be reasonable, which is typically interpreted as around 5% of the rent. In contrast, New York caps late fees at the lesser of 5% of the monthly rent or $50.

State-by-state late rent fee and grace period rules

Handling states without maximum late fees

Some states, such as Georgia, don’t impose a statutory maximum for a fee for late rent. In these jurisdictions, the primary legal criterion is "reasonableness." This means that while there's no specific dollar or percentage cap, courts will evaluate whether the late fee charged is fair and proportionate to the landlord's actual damages resulting from the late payment.

Charging an unreasonably high late fee, even in a state without a cap, can lead to legal challenges and the fee being invalidated. Courts typically consider late fees to be a form of "liquidated damages," meaning they must be a genuine pre-estimate of the losses incurred due to the late payment, not a punitive measure.

Landlords should aim for a late fee that aligns with common industry practices, such as the typical 5% of the monthly rent. This approach helps demonstrate that the fee is a legitimate estimate of costs, like administrative overhead, rather than an attempt to penalize the tenant.

Drafting lease clauses for late fee enforcement

A lease contract offers transparency for both the landlord and tenant, and it holds up in court should any disagreements occur. To ensure that any late fee is legally enforceable, it must be clearly outlined in the lease agreement.

Additionally, the lease clause concerning late fees should clearly define the following elements:

- Specific amount or the formula used to calculate the late fee

- Type of late fees—whether it’s a fixed amount, a percentage of the rent, or a daily charge

- Due date for rent payments

- Duration of the grace period

- Exact day after which the late fee will be imposed

For example, the clause could state, "Rent is due on the 1st of each month. A grace period of 5 days is allowed. If rent is not received by the 6th day of the month, a late fee of $X will be charged."

Make sure your lease also specifies if any additional daily penalties apply and how they will be calculated, provided that state law allows it.

Tenant communication: Late fee notices and legal steps

To manage late fees, maintain clear and consistent communication with your tenants. Once a grace period has passed, inform tenants about the late fees. This is typically done using a past due rent notice, which should clearly itemize the outstanding rent, the late fee amount, and the new total balance due.

If the rent still remains unpaid after notices, you can take further legal steps like issuing a notice to pay rent or quit. This notice informs the tenant that they must either pay the overdue rent (plus fees) or vacate the property within a specific timeframe.

If a tenant moves out with unpaid rent, landlords must understand the legal avenues for recovery. Here’s a guide to help navigate how to collect unpaid rent after a tenant moves out.

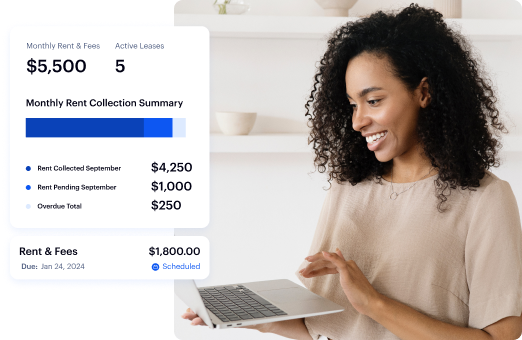

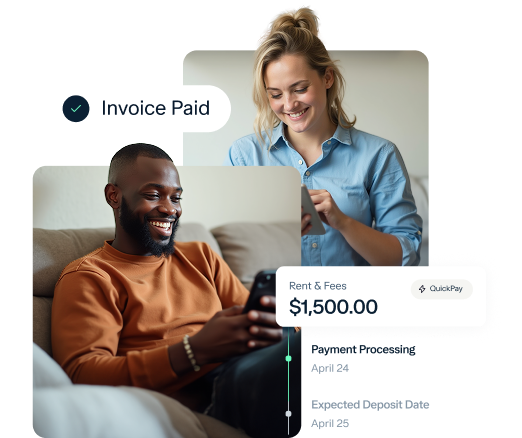

Manage and collect late fees with Baselane

The easiest way to manage and collect late fees is by using an online rent collection platform. Baselane is one of the best ways to collect rent online and automate late fees (daily and flat rate), rent invoices, and payment reminders.

Tenants have a dedicated dashboard to schedule one-time or recurring payments, view upcoming rent payments, payment progress, and past invoices. You can also allow tenants to pay rent with a credit card and enable credit reporting to help boost their credit score when they pay rent on time.

Depending on your state's laws, you can also offer partial rent payment options to tenants. This helps you maintain cash flow by accepting a certain amount out of the total rent and continuing to charge late fees on the remaining balance.

And, above all, you get utmost clarity and control throughout the entire rent collection lifecycle. Set up your account today with Baselane!

FAQs

What is a typical late fee for rent?

A typical late fee for rent often ranges from 5% to 10% of the monthly rent amount. Many states, or courts in states without specific caps, consider a 5% fee to be reasonable.

How much is late fee for rent generally capped at by states?

State laws widely vary, but many states cap the late fee for rent at 5% or 10% of the monthly rent. Some states, like New York, set a specific dollar amount or a percentage, whichever is less.

Is it legal to charge late fees on rent if not specified in the lease?

No, it is generally not legal to charge late fees on rent if they are not clearly specified in a written lease agreement. The lease must detail the fee amount, grace period, and conditions for application.

Can landlords charge a rent late fee per day?

Yes, some states permit landlords to charge a rent late fee per day for each day the rent remains unpaid after the grace period. However, these daily penalties are typically capped and must comply with state laws.

How do rent late payment fees affect tenant relationships?

Clear communication about rent late payment fees from the start, along with a reasonable grace period, can minimize negative impacts on tenant relationships. Transparency and fairness are key to avoiding disputes.