Managing rental properties comes with its share of challenges, especially when it comes to rent collection. Traditional methods like paper checks can lead to delays, lost payments, and significant administrative burden for landlords and rental managers.

You are constantly looking for ways to streamline operations, reduce costs, and ensure a steady cash flow for your real estate business. Fortunately, Automated Clearing House (ACH) payments offer a powerful, modern solution to these common pain points, providing a more efficient, secure, and predictable approach to managing your rental income.

These ACH benefits make rent collection smoother and more reliable for landlords.

Key takeaways

- ACH payments offer significant cost savings compared to credit card processing fees, often costing pennies per transaction.

- They provide enhanced security through Nacha operating rules, including data encryption and fraud detection mechanisms.

- Automated ACH transactions dramatically improve efficiency, saving landlords valuable time on manual rent collection and bookkeeping.

- Predictable electronic transfers lead to more consistent cash flow and improved financial predictability for your rental portfolio.

- ACH is highly convenient for both landlords and tenants, with easy setup and widespread accessibility among bank account holders.

- Electronic trails from ACH payments simplify reconciliation and ensure accurate record-keeping for tax purposes.

What are ACH payments?

ACH payments are electronic money transfers processed through the ACH Network, a vast, secure network that connects all U.S. financial institutions. This network facilitates a wide array of financial transactions, including direct deposits, bill payments, and, increasingly, rent collection.

For landlords and rental managers, ACH payments simplify the process of receiving rent directly from a tenant's bank account to your own. The tenant authorizes the landlord or property management software to "pull" funds from their account on a specific date. This push-and-pull system eliminates the need for physical checks and manual deposits.

The process typically involves the landlord initiating a debit request through an ACH payment processor or a property management platform. This request is then sent to the ACH Network, which communicates with both the tenant's bank (the originating financial institution) and the landlord's bank (the receiving financial institution).

Funds are debited from the tenant's account and credited to the landlord's account within a few business days, providing a reliable and trackable transaction.

Benefits of ACH payments for landlords & real estate investors

From reducing costs to boosting security, the benefits of ACH payments can help you take back time, gain clarity and control, and grow your passive income. Let’s take a closer look at the top ACH payment benefits that solve common landlord headaches.

Significant cost savings on transaction fees

One of the most compelling benefits of ACH payments for landlords is their cost-effectiveness. Compared to other electronic payment methods, ACH transactions typically incur significantly lower fees. For example, ACH payments often cost mere pennies per transaction.

In stark contrast, credit card payments can range from 1.5% to 3.5% of the transaction value, plus a per-transaction fee. This difference can add up to substantial savings for landlords, especially when collecting multiple rent payments each month.

ACH payments are significantly cheaper than credit card payments, often costing pennies per transaction compared to 1.5% to 3.5% for credit cards.

These savings directly impact your bottom line, allowing you to retain more of your rental income. For a landlord managing several properties, avoiding high credit card processing fees can translate into hundreds or even thousands of dollars saved annually.

Enhanced security and reduced fraud risk

Security is a paramount concern for any financial transaction, and ACH payments offer robust safeguards designed to protect both landlords and tenants. The ACH Network operates under strict rules set by Nacha, a non-profit organization that governs the electronic movement of money. These rules include comprehensive data encryption and fraud detection mechanisms.

These security protocols significantly reduce the risk of fraud associated with traditional payment methods like paper checks, which can be lost, stolen, or altered. Using ACH for rent collection provides an electronic audit trail, making it easier to track transactions and resolve any disputes that may arise.

Nacha’s ACH Security Framework highlights that ACH payments offer robust security through operating rules, including data encryption and fraud detection mechanisms, reducing risk compared to checks.

By adopting ACH, you enhance the overall financial security of your rental operations, protecting your income and your tenants' sensitive information. This peace of mind allows you to focus more on managing your properties and less on worrying about payment security.

Improved efficiency and time management

Manual rent collection, whether by check or cash, is a time-consuming endeavor involving physical deposits, record updates, and chasing late payments.

ACH payments automate much of this process, leading to significant improvements in efficiency and time management for landlords. With automated rent collection, you can set up recurring debits, eliminating the need to manually collect or deposit checks.

This automation frees up valuable hours you can dedicate to other critical aspects of your rental business, such as property maintenance, tenant relations, or portfolio growth. Landlords adopting online payment systems frequently report a notable reduction in time spent on manual rent collection. Leveraging property management rent collection software can further amplify these time savings.

Integrating ACH with your property management or banking solution means rent payments are automatically recorded and categorized. This streamlines bookkeeping and reduces the likelihood of human error, making your financial management smoother and more accurate.

Like any other operation, landlords are running a business—and the benefits of ACH payments for businesses apply just as much here, helping reduce overhead and admin time.

More consistent cash flow and financial predictability

For landlords, consistent cash flow is the lifeblood of a sustainable rental business. ACH payments provide unparalleled predictability by ensuring that rent is debited and credited on schedule each month. This regularity significantly reduces instances of late payments, which can disrupt your financial planning.

The predictable nature of electronic transfers helps you forecast your income more accurately, making it easier to manage expenses, plan for capital improvements, and optimize your investment strategy.

Implementing ACH for rent can lead to more consistent cash flow due to predictable electronic transfers, reducing late payments and administrative overhead. This stability is particularly beneficial for managing mortgages, property taxes, and other recurring costs.

Some platforms even support same-day transfers. The benefits of Same Day ACH include quicker access to funds and fewer cash flow delays—without the steep cost of wire transfers.

With a clearer picture of incoming funds, you can make more informed decisions about your property investments and overall financial health. This leads to a more stable and less stressful financial management experience.

Greater convenience for both landlords and tenants

Convenience is a significant factor in tenant satisfaction and compliance, and ACH payments excel in this regard for both parties. Tenants appreciate the ease of setting up automated, recurring rent payments directly from their bank accounts. This eliminates the need to remember due dates, write checks, or visit a post office.

Over 95% of Americans have a bank account, making ACH a widely accessible payment method for tenants. Landlords benefit from not having to physically collect or deposit checks, reducing trips to the bank and associated logistical hassles.

Offering Flexible Rent Collection options, like allowing tenants to pay via ACH, significantly enhances their experience.

Some systems even allow for split rent payments app functionality through ACH, adding another layer of convenience for tenants with roommates. This mutual convenience fosters a better landlord-tenant relationship and encourages on-time payments.

Simplified reconciliation and accurate record-keeping

Effective financial management in real estate hinges on accurate record-keeping and easy reconciliation of transactions. ACH payments generate a clear, electronic audit trail for every transaction. This eliminates the guesswork often associated with paper-based systems.

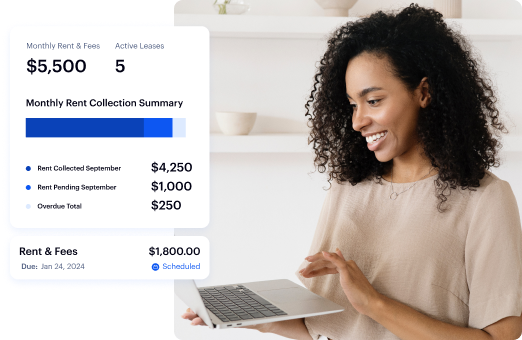

When integrated with a robust banking or bookkeeping platform like Baselane, ACH transactions are automatically categorized and tagged to specific properties. This automation drastically simplifies the reconciliation process, reducing the time and effort needed to prepare financial statements and tax documents.

For managing payments to vendors and suppliers, understanding ACH for accounts payable can further streamline your operations.

You can also use the same system to pay cleaners, maintenance pros, and contractors. The benefits of ACH payments for vendors include faster payments, fewer paper trails, and less back-and-forth.

Baselane’s tools, for example, consolidate all your transactions into a single ledger and offer auto-categorization features, making tax season significantly less stressful. This provides greater clarity and control over your finances. Moreover, you can learn how to send an ACH billing to streamline outgoing payments.

Environmental friendliness

Adopting ACH payments is also a step towards more sustainable business practices by significantly reducing paper waste. Moving away from paper checks means less printing, fewer envelopes, and less postage. This not only benefits the environment but also reduces your operational costs.

Embracing a paperless payment system aligns with modern environmental consciousness. Many tenants appreciate contributing to eco-friendly practices, adding another positive aspect to your property management. By choosing ACH, you contribute to a greener planet while simultaneously streamlining your financial operations.

How to set up ACH payments for your rental business

To provide you with the most straightforward, most actionable steps to start receiving ACH payments for your rental business, here is the process using a landlord-focused platform:

- Choose your platform: Select a digital banking solution built specifically for landlords, like Baselane, which is the most efficient method compared to dealing directly with a traditional bank. Look for a solution offering low transaction costs, as ACH fees are typically 50–70% cheaper than credit card fees.

- Create landlord account: Sign up for your account within the chosen platform and provide the necessary business or individual details.

- Link rental bank account: Securely connect the bank account where you want to receive rent money. We highly recommend linking a separate business bank account for your rental properties to prevent commingling funds and simplify your accounting.

- Configure rental terms: Input the specific details for each unit, including the exact monthly rent amount, the due date, any applicable grace period, and the amount of any late fees.

- Send tenant invitation: Use the platform to send a secure electronic invitation to your tenant, prompting them to enroll in the digital payment system.

- Tenant enters details: Your tenant must create their account and securely enter their own bank account and routing numbers.

- Tenant authorizes debit: The tenant must formally authorize the platform to automatically debit their bank account for the recurring monthly rent amount, satisfying the ACH network's requirement. They can set this up as an automatic, recurring payment.

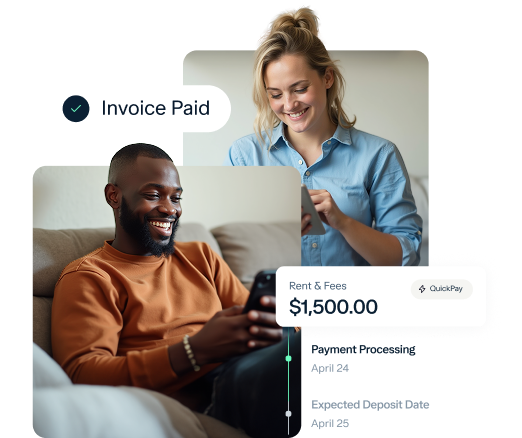

- Payment processing: The system will automatically initiate the transfer on the due date. ACH transfers typically take one to three business days to settle and deposit the funds into your account. When depositing into a Baselane bank account, payments can be processed in as little as two business days.

- Automate management: Once active, the platform provides automated features like sending reminders, applying late fees, and automatically recording and categorizing every rent payment, which streamlines your bookkeeping and reduces manual effort.

ACH vs. other payment methods: A detailed comparison

When considering the best way to collect rent, you have several options beyond traditional paper checks. Each method has its own set of advantages and disadvantages.

Understanding these differences can help you make an informed decision that best suits your rental business.

For a detailed look at electronic fund transfers, check out our guide on EFT for rent payments.

Embrace the future of rent collection

The benefits of ACH payments for landlords and rental managers are clear and compelling. From significant cost savings and enhanced security to improved efficiency and consistent cash flow, ACH offers a modern, reliable solution—and the ACH payment advantages really stack up when you're managing multiple tenants.

By embracing this technology, you can streamline your operations, reduce administrative burden, and ultimately maximize your profits and investment strategies.

As you look to optimize your real estate business, consider how a comprehensive platform like Baselane can integrate ACH payments seamlessly into your financial workflow. Baselane helps you take back time, gain clarity and control over your finances, and grow your passive income. It also simplifies the process of setting up multiple bank accounts for real estate, so you can assign transactions to specific properties automatically.

Create an account today to experience the power of integrated banking, bookkeeping, and rent collection, designed specifically for real estate investors.

FAQs

What are the benefits of ACH payments for landlords?

The main ACH payments benefits include significant cost savings compared to credit cards, enhanced security and reduced fraud risk, improved operational efficiency, and more consistent cash flow.

How secure are ACH payments for rent collection?

ACH payments are highly secure, governed by Nacha operating rules that include data encryption and robust fraud detection mechanisms. This framework provides a secure electronic audit trail, significantly reducing the risks associated with paper checks.

Can ACH payments help landlords save money?

Yes, ACH payments are very cost-effective, often costing only pennies per transaction. This is significantly cheaper than credit card processing fees, which can range from 1.5% to 3.5% of the transaction value, leading to substantial savings for landlords.