Dealing with real estate financials can feel like managing a business entirely different from real estate.

When you manage 10 or more rental units, your financial operations are complex enough that relying on basic bookkeeping software is a risk you can't afford. You need a specialized financial system designed not just for tax filing, but for actively optimizing your portfolio's performance.

The solution isn't to add more human resources but to invest in a good real estate management accounting software that automates the manual work of tracking, classifying, and reporting on your property-level finances.

In this guide, we define management accounting vs. basic financial accounting and list the top 5 management accounting options to consider.

Key takeaways

- Financial accounting looks backward for compliance, but management accounting is a forward-looking process that uses operational data to drive strategic decisions and improve profitability.

- Traditional software lacks native features like unlimited property-specific accounts and built-in accounting, necessary for real estate compliance and clarity.

- The right platform must provide real-time financial dashboards, automated Schedule E categorization, and granular, property-level reporting to accurately assess unit performance.

- Baselane solves fragmentation by integrating dedicated banking and bookkeeping, ensuring all financial data is immediately accurate and categorized for analysis.

Management accounting vs. financial accounting

Most traditional accounting tools focus on financial accounting, which looks backward. It meticulously records past transactions for external use by investors, creditors, and the IRS, ensuring compliance with standards like Generally Accepted Accounting Principles (GAAP).

Real estate management accounting is different. It's an internal, forward-looking process focused on the day-to-day operations and strategic decision-making that drive profitability.

In short, Financial accounting answers "How did I do last year?" Management accounting answers "How can I do better next month, and what's the best next step for my portfolio?"

This management focus is critical for any landlord who wants to move beyond simply running a business to actually growing one.

Key features of a real estate management accounting software

The best software solutions go beyond a simple general ledger (GL) and offer property-specific tools designed to give you clarity and control over your operations.

Multi-property chart of accounts and reporting

To truly manage your portfolio, you need a system that can track income and expenses not just for your entire business, but for each property or even each unit.

- Property-level performance: Real estate is a game of units. You need clear reporting—like Income Statements and Net Cash Flow statements—for each property to easily see which ones are the most profitable.

- Entity-level reporting: If you own multiple limited liability companies (LLCs) or other entities, the software must be able to manage rental property finances and consolidate them while keeping everything cleanly separated.

Trust and escrow accounting workflows

Handling security deposits and prepaid rents is one of the most regulated areas of being a landlord. An effective system simplifies escrow accounting to ensure you stay compliant and avoid legal trouble.

- Dedicated accounts: The software should allow you to automatically separate security deposit funds into a dedicated, non-operational account right upon collection. This prevents commingling funds, which can have legal consequences.

- Compliance tracking: You need to easily track and report any accrued interest to tenants, especially in states where it's required.

Real-time financial dashboards and auto-reconciliation

If your financial data is days or weeks old, you're making decisions based on old information. Management accounting requires instant visibility.

- Real-time data: The platform must sync instantly with your bank transactions to provide an up-to-the-minute view of cash flow.

- Automated bookkeeping: A system should automatically categorize every transaction and assign it to the correct property and the proper Internal Revenue Service (IRS) Schedule E category. This is the only way to significantly take back time from manual data entry.

Top real estate management accounting software

We've evaluated the top platforms specifically through the lens of real estate management accounting to help you find the best tool to manage and grow your real estate investment.

Baselane

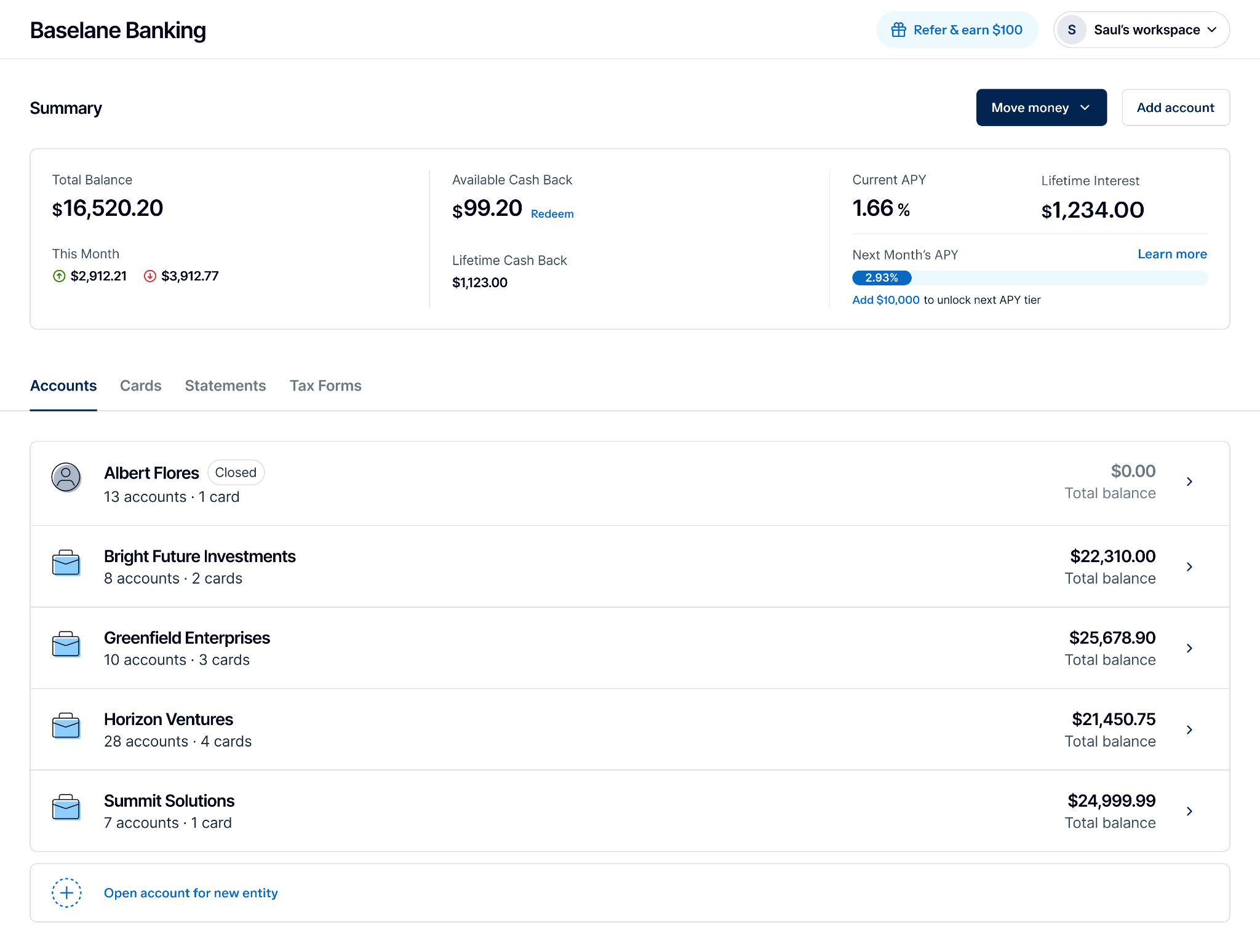

Baselane is the all-in-one financial management platform built specifically to support your real estate management accounting lifecycle. We unify specialized banking, automated bookkeeping, and integrated rent collection, ensuring your data is clean, accurate, and ready for analysis the moment a transaction occurs.

Here's how Baselane offers superior value for your management accounting needs compared to other software, allowing you to take back time and gain clarity & control:

Maintain clean books with property-specific accounts

With Baselane landlord banking, you can open an unlimited number of checking or high-yield savings accounts, segregated by property, unit, entity (like your limited liability company - LLC), or purpose (e.g., capital expenditure - CapEx reserves or security deposits), all under a single login.

Such property-level account organization gives you crystal-clear visibility into each property’s cash flow and simplifies complex trust and escrow accounting workflows.

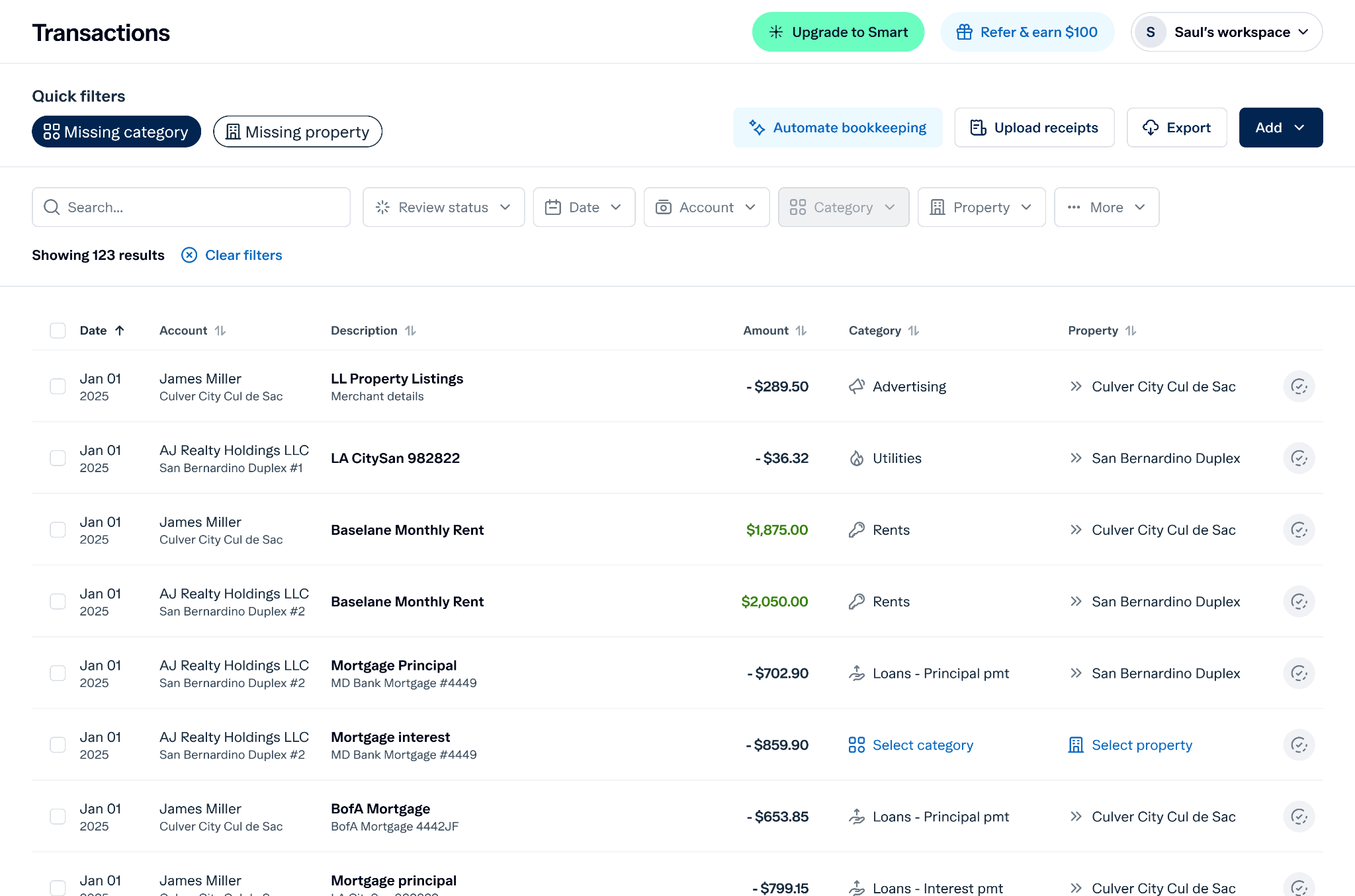

Automate portfolio accounting and tax preparation

With our built-in bookkeeping, all your financial activity (from Baselane and external accounts) is automatically categorized and tagged to the right property/unit and over 120 Schedule E categories.

You can also create custom categories and automate the tagging process by setting up specific rules like ‘If the transaction description contains 'Home Depot', automatically tag it as 'Repairs & Maintenance'.

Such automated bookkeeping saves you manual reconciliation time and reduces the risk of misclassification, ensuring you capture legitimate rental property tax deductions, directly impacting your bottom line.

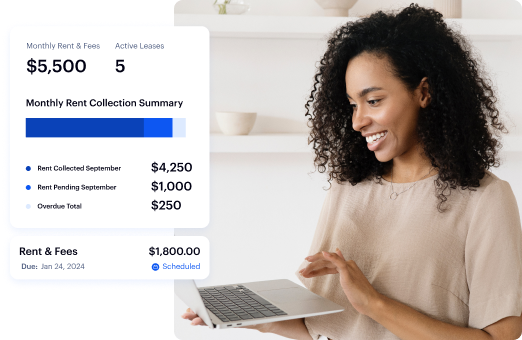

Access real-time financial reporting for data-driven decisions

Management accounting is forward-looking. Because data from Baselane banking and bookkeeping feeds into the reporting dashboard, you get ready-to-analyze reports to evaluate your property and cash flow performance instantly.

Here is a rundown of reports you can toggle between and assess various aspects of your real estate property management.

- Net Operating Income (NOI): Gives you a Profit & Loss (P&L) view of property performance.

- Net Operating Cashflow: Tracks your actual cash in and out—including loan payments.

- Total Inflows & Outflows: Provides a complete record of all money flowing into and out of your accounts.

- Schedule E: Organizes your income and expenses in the Internal Revenue Service (IRS) Schedule E format—essential during tax season.

- Tenant Ledger: A detailed history of tenant charges, payments, and balances.

- Rent Roll: Summarizes active leases and key unit-level details.

Pricing

- Baselane Core: Free with no monthly fees and no minimum balance requirements.

- Baselane Smart: $20/month, offering expedited 2-day rent deposits, shared access for partners/CPAs, enhanced auto-tag assistance, custom categories, and advanced bookkeeping rules.

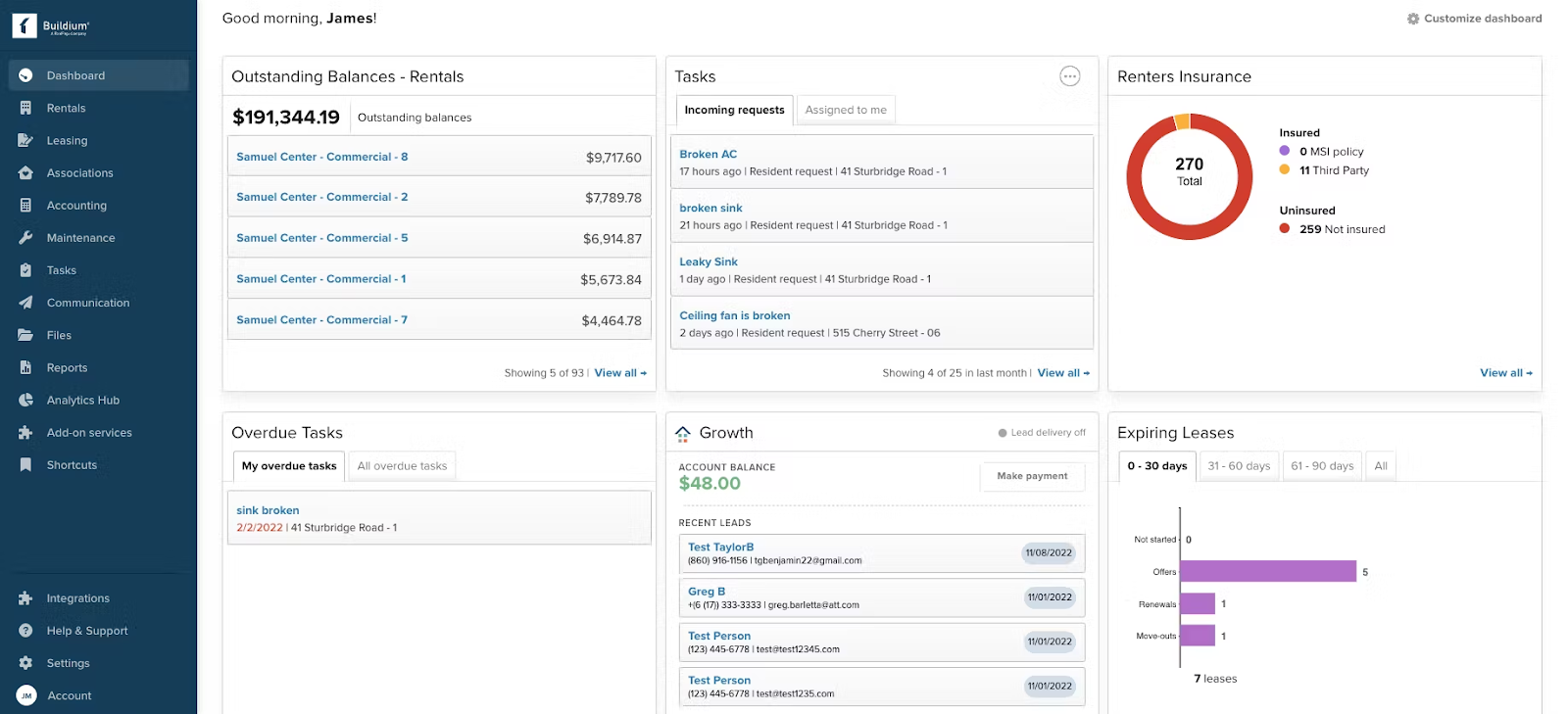

Buildium

Buildium is a property management solution that anchors its offering around property accounting. It is primarily designed for property managers with large portfolios, offering modules for leasing, maintenance, and accounting. Its strength lies in its full suite of reports and features designed to handle complex trust accounting and management needs.

Key features

- Full property accounting with customizable Chart of Accounts and GL.

- Maintenance tracking and work order management.

- Resident and owner portals.

- Open application programming interface (API) for custom integrations.

Pricing

Buildium doesn’t offer a free plan. Pricing starts from $62/mo, which offers only basic accounting features. Advanced features are locked behind premium tiers, which go up to $400+ per month.

AppFolio

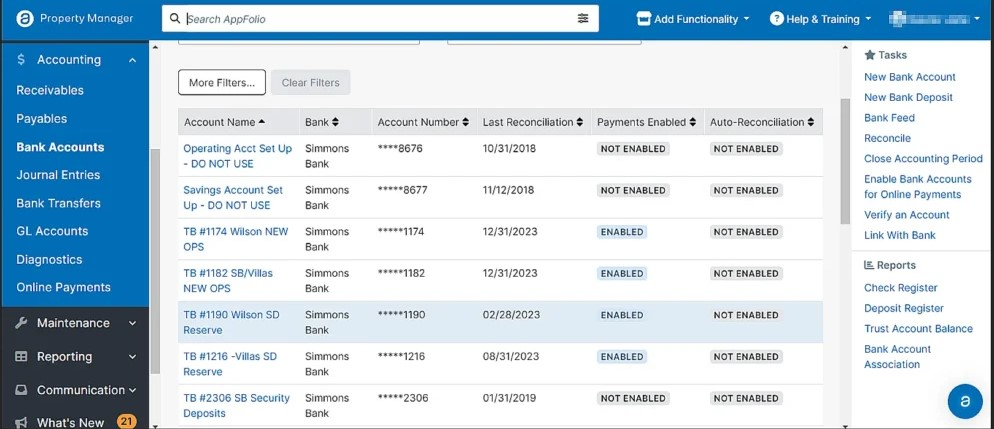

AppFolio is a cloud-based property management software platform known for its automation and AI-driven features. It provides a unified platform for accounting, leasing, and marketing. AppFolio's accounting module is built on a single data architecture, aiming to give users a holistic financial view with automated processes like bill approval and bank reconciliation.

Key features

- AI-powered smart accounting and bill entry

- Owner statements and cash flow reporting

- Online payments (send and receive)

- Advanced budgeting and data analysis (on higher tiers).

Pricing

AppFolio offers a monthly subscription model divided into three tiers for residential properties—Core, Plus, and Max. Pricing for each is available only through a demo.

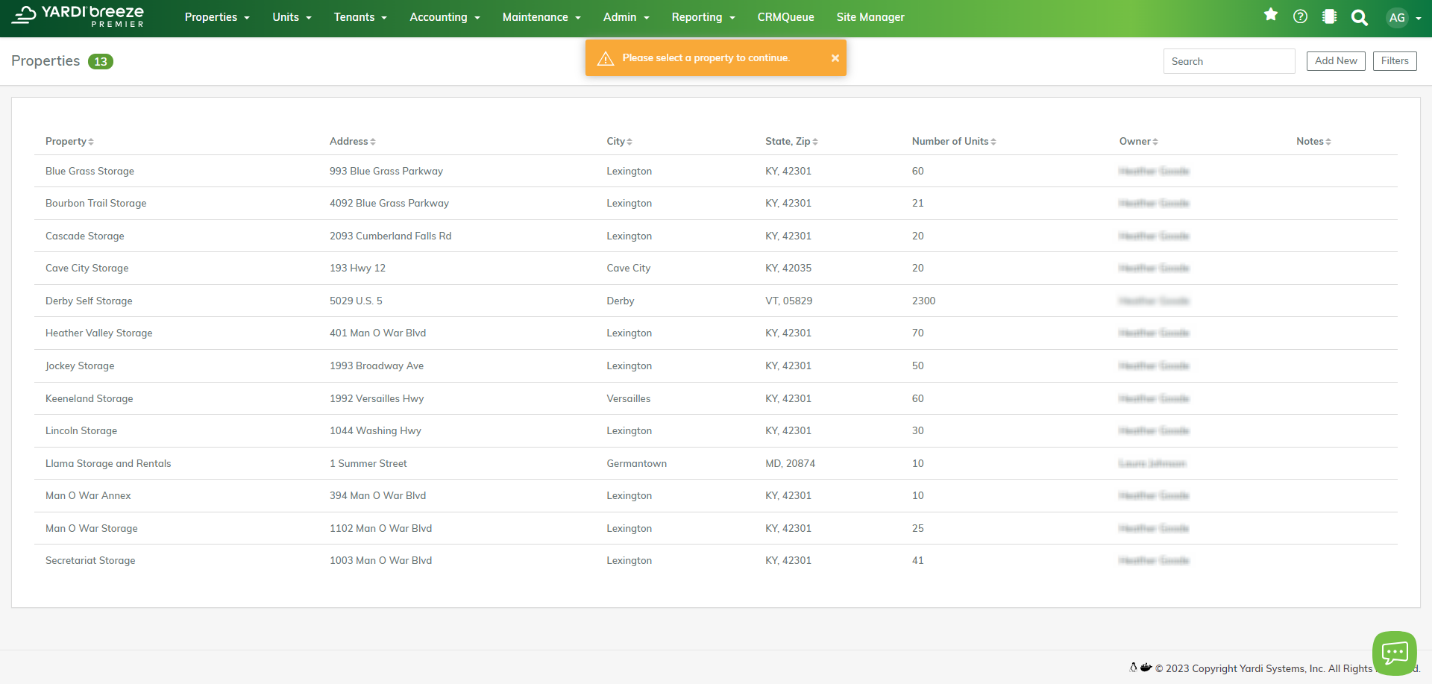

Yardi Breeze

Yardi is a global leader in real estate technology, primarily serving large-scale real estate operators and institutional investors. Yardi Breeze is their streamlined solution aimed at smaller businesses, while Yardi Voyager is the complete system for complex enterprise needs. Their accounting features are robust, including tools for commercial-specific needs like Automated Common Area Maintenance (CAM) reconciliation and percentage rents.

Key features

- Integrated general ledger with Accounts Receivable (AR) and Accounts Payable (AP).

- Automated CAM reconciliation (for commercial properties).

- Configurable role-based dashboards.

- Investment management and corporate accounting features.

Pricing

Yardi Breeze offers flexible pricing, including both unit-based and flat-rate options, which vary depending on the type of rental property. For residential properties, pricing begins at a minimum of $100 per month or $1 per unit.

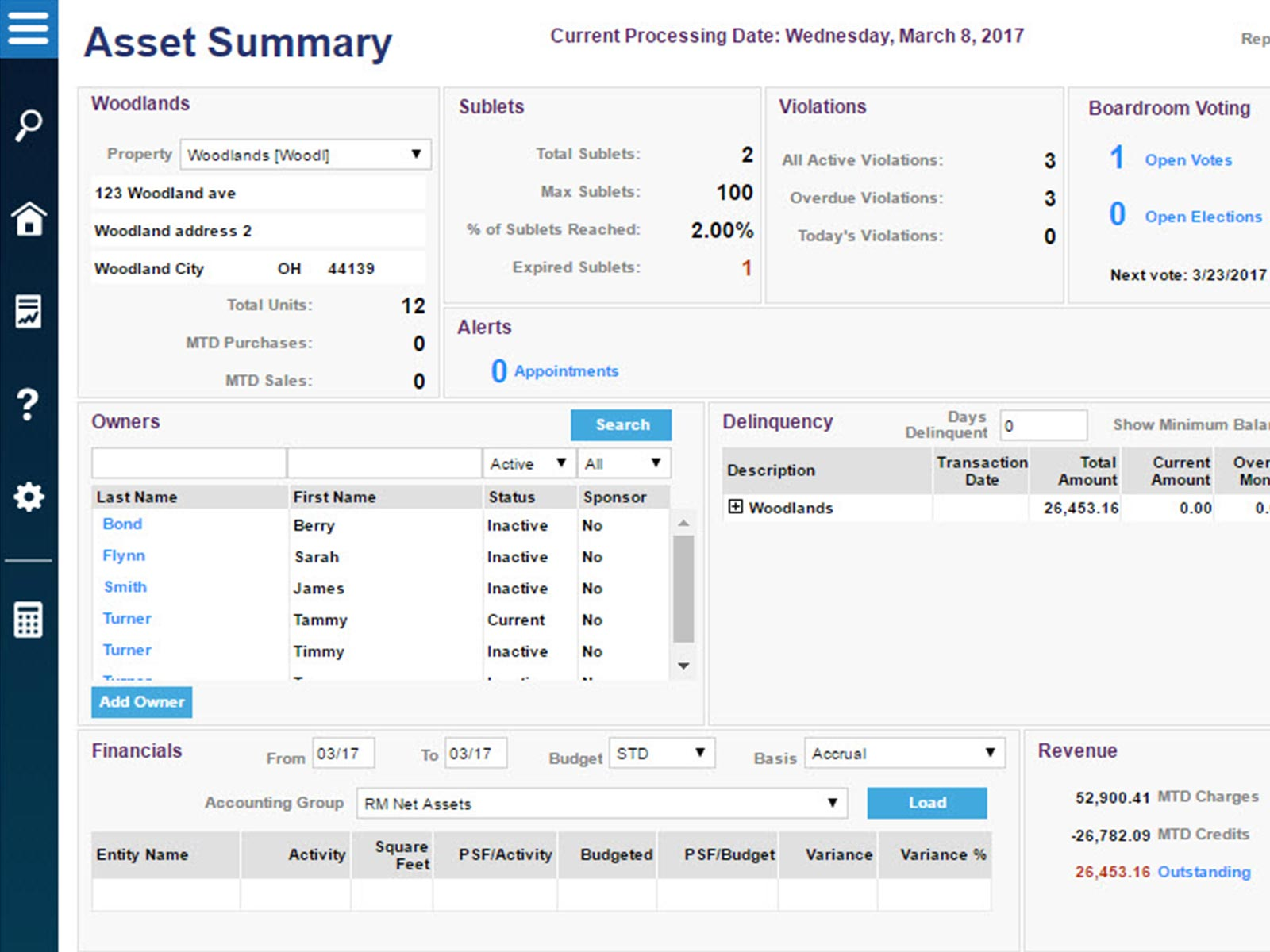

MRI Software

MRI Software is an enterprise-level, comprehensive solution tailored for real estate management across all asset classes—commercial, residential, multifamily, and more. It's known for its flexibility and ability to integrate with third-party solutions through its open and connected nature. The platform offers advanced features like AI lease management and energy management, positioning it as a tool for long-term asset value optimization.

Key features

- Integrated accounting (AR, AP, GL, P&L, balance sheets).

- Asset and facilities management tools.

- AI-powered lease management.

- Mobile apps for residents and tenants.

Pricing

Custom quote-based (high cost, steep learning curve).

Expert tips to pick the right real estate management accounting platform

Here are the best practices and expert, non-cliché tips to ensure you select the platform that makes accounting for rental properties easy.

Audit your financial workflow first

Before you even look at software, look inward—at your existing accounting workflow.

- Map your current process: Document exactly how an invoice arrives, how you currently process a maintenance payment, where rent deposits land, and how you handle trust funds (like security deposits). If you're currently using spreadsheets, paper files, and different bank accounts, map that entire journey.

- Identify the "Who": Determine who handles the accounting tasks now and assess their experience level. A non-tech-savvy user will fail with enterprise software that has a steep learning curve.

- Define your non-negotiables: For management accounting, a platform must support property-level reporting, automated bank feeds, tenant ledgers, and secure trust/escrow accounting. Everything else (like advanced analytics or an open API) is a "nice-to-have" until your portfolio warrants it.

Prioritize integration over features

Many property accounting platforms are feature-rich but disconnected, forcing you to manually push data between tools (e.g., from rent collection to your general ledger). This is where errors creep in.

Look for a platform that is built on a single database, seamlessly linking your banking and bookkeeping. If your books are instantly updated the moment a tenant pays rent or a bill is paid, you achieve true automation.

When testing a platform, verify that its automated bookkeeping can instantly assign transactions to the correct property and the proper Schedule E tax category—without you having to create complex workarounds.

Vet the compliance and control features

Management accounting is about preventing risk and ensuring compliance, especially when dealing with other people's money.

Trust and escrow accounting processes must be flawless. Choose a platform that natively supports holding security deposits in separate accounts and automatically tracking interest accrual as required by state law.

For compliance and clear reporting, you need the ability to separate funds beyond just "Business" and "Personal". Look for the ability to create multiple virtual accounts for CapEx reserves, different properties, or security deposits, while all remaining accessible under one login. This is the financial equivalent of creating a separate ledger for every investment without the hassle of opening a new bank account every time.

The software must also make it impossible or very difficult to commingle security deposits with operating expenses for rental property, protecting your personal assets from liability.

Set up real estate management accounting with Baselane

The best software for real estate investors to run management accounting is not just to pass an audit, but to simplify the chaos, empower smarter decisions, and directly contribute to growing your passive income.

While platforms like Yardi and MRI are built for institutional complexity and AppFolio/Buildium for property managers, Baselane is purpose-built for the independent real estate investor.

We align directly with your management accounting goals:

- Instead of manual setup and costly fees per account, Baselane offers unlimited, free virtual accounts under a single login for all your properties, entities, and security deposits.

- Our integrated AI bookkeeping automatically categorizes every transaction by property and the right Schedule E code. This eliminates the need for manual data crunching or expensive third-party accounting software.

- You earn high yield on all your funds, including security deposits, turning every account balance into a passive income stream.

Ready to stop doing financial busywork and start making strategic, data-driven decisions that grow your portfolio? Sign up for Baseelane today!

FAQs

What is the difference between property management and rental property accounting software?

Property management software is typically an all-encompassing suite that includes leasing, maintenance requests, and tenant communication alongside financial tools. Rental property accounting software, on the other hand, focuses specifically on the financial aspects, offering deeper features for bookkeeping, property-level reporting, and tax preparation.

How is AI changing real estate accounting software?

AI bookkeeping software automates many manual tasks in real estate accounting, such as categorizing expenses, reconciling bank statements, and flagging unusual transactions. This saves landlords significant time, reduces human error, and provides more accurate, real-time financial data for better decision-making.

Is QuickBooks good for property management?

While QuickBooks is a powerful general accounting tool, it is not specifically designed for real estate. It lacks essential features like property-level reporting, trust accounting, and tenant ledgers out of the box, requiring complex and often inefficient workarounds to manage a rental portfolio effectively. QuickBooks alternatives like digital banking solutions offer tailored solutions to help you manage property accounts with ease.

Can I claim the cost of accounting software on my taxes?

Yes, the cost of accounting software for real estate used to manage your rental properties is generally considered a business expense. As such, you can typically deduct the subscription fees on your taxes, which helps to offset the investment in the tool.

.jpg)