Managing rental properties demands efficient financial operations, especially when it comes to rent collection and expense management. Traditional payment methods often introduce delays and administrative burdens for landlords and real estate investors. Utilizing an eCheck bank account offers a modern solution, streamlining transactions and enhancing financial clarity.

This guide explores the significant advantages eChecks provide for property owners, from cost savings to increased security.

Key takeaways

- eChecks offer a secure, cost-effective, and fast alternative to traditional paper checks for rent collection.

- Landlords can benefit from reduced processing fees and faster cash flow compared to other payment methods.

- Integration with property management payment software automates bookkeeping and improves record-keeping.

- Dedicated landlord bank accounts with eCheck capabilities offer features like sub-accounts and high Annual Percentage Yield (APY) savings.

- Addressing tenant concerns through clear communication helps ensure smooth adoption of eCheck payments.

What is an eCheck?

An eCheck, or electronic check, is a digital payment method processed through the Automated Clearing House (ACH) network. It enables funds to be transferred directly from a tenant's bank account to a landlord's bank account. This process eliminates the need for physical paper checks, making payments faster and more secure.

For landlords and investors, an eCheck bank account facilitates these electronic transactions seamlessly. These specialized accounts are designed to handle recurring rental income and property-related expenses efficiently. You can explore how ACH bank account options specifically cater to real estate needs.

How eChecks work for landlords and tenants

The eCheck process begins with the tenant providing their bank account and routing numbers to the landlord or property management system. This information allows for a direct debit from the tenant's account. The transaction then goes through a series of steps within the ACH network.

First, the payment is authorized by the tenant, often electronically through a secure portal. The landlord's bank submits the payment request to the ACH network. The ACH network then communicates with the tenant's bank to verify funds and process the transfer.

Once verified, the funds are electronically transferred, typically clearing within 1-3 business days. Landlords receive a notification once the payment is successfully processed. This entire digital flow makes rent collection predictable and automated.

Benefits of using eCheck accounts for rental properties

eCheck bank accounts offer numerous advantages for landlords, optimizing various aspects of rental property management. These benefits extend from financial savings to enhanced operational security.

Cost savings compared to paper checks and other payment methods

One of the most compelling benefits of using an eCheck bank account is the significant cost reduction. Paper check processing can incur substantial annual expenses for businesses. SeamlessChex indicates these costs can reach up to $24,540 annually.

eChecks, however, typically involve minimal fees, often lower than those associated with credit card processing or wire transfers. This cost-efficiency directly impacts a landlord's net operating income. By reducing transaction fees, more of your rental income remains available for property investments or other operational needs.

Faster payment processing and cash flow improvement

Speed is another critical advantage of eCheck payments. Unlike paper checks that can take several days to mail and clear, eChecks usually clear within 1 to 3 business days. This faster processing time ensures quicker access to funds for landlords.

Improved cash flow allows for more agile financial management, enabling timely payment of property expenses or reinvestment. The predictability of eCheck clearing times helps landlords forecast their finances more accurately. This efficiency prevents delays that can arise from traditional payment methods.

Enhanced convenience and record-keeping automation

eCheck payments provide unparalleled convenience for both landlords and tenants. Tenants can submit payments anytime, anywhere, eliminating trips to the bank or post office. Landlords benefit from automated receipt and tracking of payments.

Many eCheck-enabled bank accounts and property management systems offer built-in bookkeeping features. These systems automatically categorize transactions and generate financial reports. Such automation simplifies tax preparation and provides real-time cash flow insights.

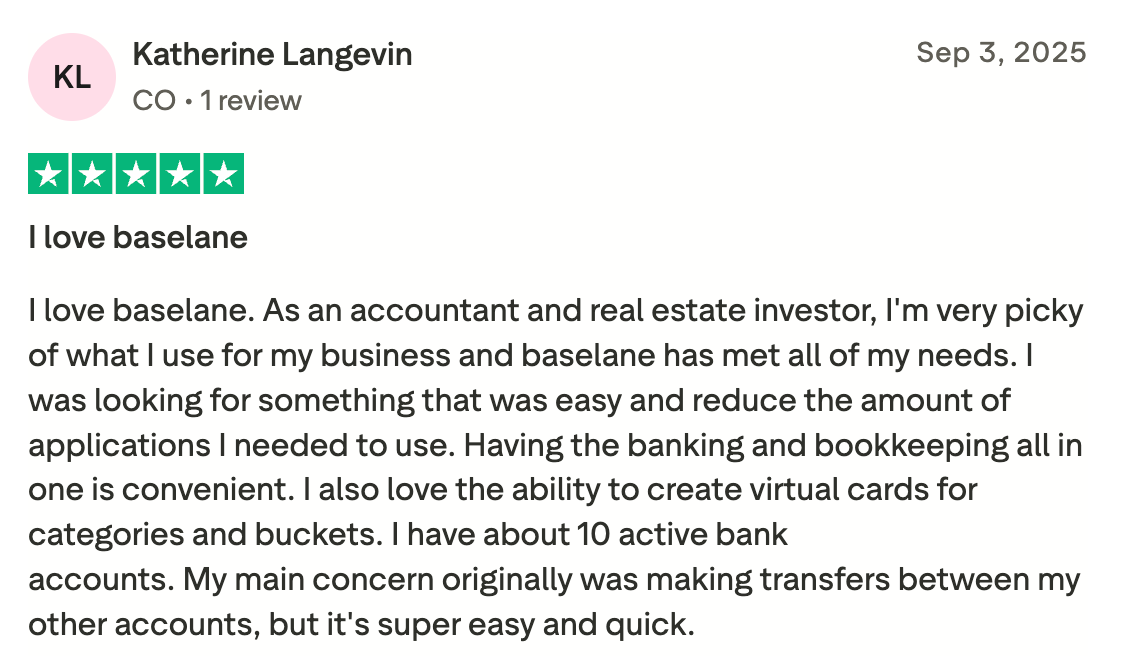

Baselane, for instance, offers automated rent collection and bookkeeping tools that integrate seamlessly. This helps landlords gain clarity and control over their finances, reducing the time spent on manual administrative tasks.

Increased security and fraud prevention

Security is a primary concern for any financial transaction, and eChecks offer robust protections. They utilize encryption technology to secure sensitive bank account information during transmission. Payments are processed through the secure ACH network, which employs various fraud prevention measures.

This security infrastructure significantly reduces the risk of fraud compared to paper checks, which can be lost or stolen. Bank account verification protocols are also in place to prevent unauthorized transactions. These layers of protection give landlords peace of mind regarding their financial assets. eChecks reduce fraud and unauthorized transactions.

eChecks vs. other payment options

Each option has distinct advantages and disadvantages regarding speed, cost, and convenience. Let's examine the common payment methods used in rental property management.

Paper checks

Paper checks are a traditional payment method, but they come with several drawbacks. They are slow, requiring mail time and manual deposit. They are also prone to loss or theft, and reconciliation can be time-consuming for landlords. Furthermore, the processing costs associated with paper checks can accumulate significantly.

ACH transfers

eChecks are a type of ACH transfer, meaning they leverage the same secure and efficient network. The primary difference is often in the user interface and how the payment is initiated. ACH transfers are widely adopted, with network volume increasing by 6.2% annually in 2024, indicating growing acceptance for digital rent payments.

Credit card payments

Credit card payments offer instant gratification for tenants and can provide rewards points. However, they typically involve higher processing fees for landlords, often 2-3% of the transaction amount. These fees can significantly erode profit margins over time, making them a less cost-effective option for recurring rent payments. While convenient, the cost often outweighs the benefits for landlords.

Key features to look for in a bank account that supports eChecks

Choosing the right bank account is crucial for maximizing the benefits of eChecks for your rental properties. Landlords and investors need more than just a basic checking account; they require features tailored to their unique financial needs. A dedicated account simplifies operations and enhances financial management.

Business entity support and sub-accounts

A robust landlord bank account should support your chosen business structure, whether an LLC or sole proprietorship. Many landlords find it beneficial to organize their bank accounts by property. This clear separation of funds for each rental property helps maintain organized financial records.

Look for a banking solution that offers the ability to create multiple sub-accounts. This feature allows you to segregate income and expenses by property, making bookkeeping much simpler. This can also be beneficial if you manage an HOA bank account for a property.

Competitive APY and no minimum balance requirements

Earning a competitive APY on your savings can significantly boost your returns. Many specialized landlord bank accounts offer high-yield savings options. This allows your rental income and reserves to grow passively.

Understanding what APY is on a savings account and how APY works is key. Look for accounts that have no minimum balance requirements, ensuring flexibility for your operating capital.

Comparing an APY savings account with a checking account can optimize your financial strategy.

For more details on yield, refer to resources on the best APY savings account and savings account vs checking account.

Integration with property management tools

Seamless integration with property management payment software is essential for modern landlords. This allows for automated rent collection, expense tracking, and financial reporting. Choose a bank account that can link directly with your preferred management platform.

This integration simplifies your workflow, reducing manual data entry and potential errors. It provides a comprehensive view of your property's financial performance. A strong property management financial software should work in harmony with your banking solution.

Virtual debit cards and AI-assisted banking

Modern banking solutions for landlords often include virtual debit cards. These cards provide enhanced security for online purchases and offer granular control over spending. You can issue separate virtual cards for different properties or expense categories. Check out banks with virtual debit cards for more information.

The integration of artificial intelligence (AI) in banking further automates tasks like transaction categorization. AI-powered tools learn your spending patterns and automatically tag expenses for tax purposes. This saves considerable time during tax season.

For more information, explore AI in banking for real estate. Consider an online bank account with an instant virtual debit card to streamline your finances.

Top banking platforms to open an eCheck bank account with

When you are ready to use eChecks in your rental property business, choosing the right banking and financial partner is critical to your success. The best platform will offer low fees, integrated rent collection, and features specifically designed for the complexities of real estate investing.

Here is a look at several popular options for US landlords and real estate investors:

Baselane

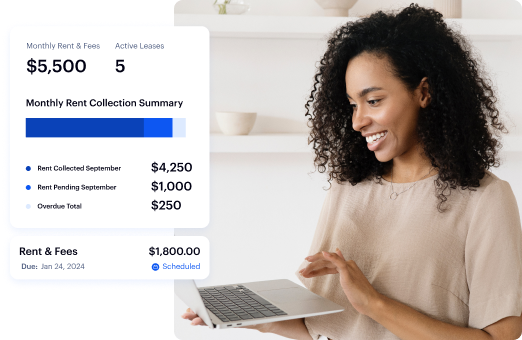

Baselane is an all-in-one banking and financial platform purpose-built for real estate investors and landlords. We empower you to open unlimited virtual bank accounts (checking or high-yield online savings per property without monthly fees or minimum balance requirements.

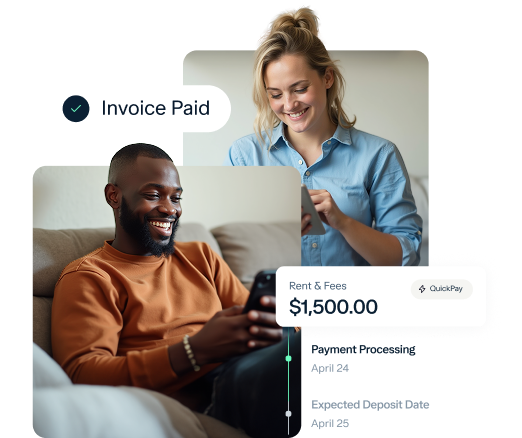

Our platform integrates eCheck (ACH) rent collection, automated bookkeeping, and tax reporting tools all in one place. Tenants can pay rent via ACH for free when the landlord uses Baselane banking, and the rent payments are processed quickly, often within two to five business days with QuickPay.

Baselane is the all-in-one banking and financial platform purpose-built for real estate investors and landlords. We know that, as a landlord, getting paid reliably and affordably is paramount. Our platform is designed to make receiving electronic checks (eChecks) as efficient as possible.

When you use Baselane's integrated rent collection, you can automatically collect eCheck (ACH) payments from tenants directly into your account for free, with funds typically deposited in as little as 2 to 5 business days with QuickPay. This direct integration eliminates the hassle and costs often associated with traditional ACH processing and third-party systems.

To keep your eCheck income perfectly organized for tax time and growth, you can open unlimited virtual accounts per property, unit, or even for security deposits, all without monthly fees or minimum balance requirements. This structure, combined with automated bookkeeping, ensures all your eCheck transactions are correctly categorized, helping you gain clarity and control over your cash flow and letting you focus on scaling your portfolio.

Stessa

Stessa, a Roofstock subsidiary, provides online banking and a platform that simplifies online rent payments, largely focusing on ACH transfers. Stessa offers a no-fee ACH payment option for landlords and tenants when rent is deposited into a Stessa Cash Management account. For deposits into an external bank account, residents may pay up to a $2 fee per ACH transaction.

ACH payment deposit times can take up to five business days. For better interest rates and accounting features, landlords may need to upgrade to a paid Pro plan, which starts at $28 per month.

Bluevine

Bluevine is an online bank for small businesses that offers accounts with low fees and no monthly or overdraft fees for its standard plan. Standard ACH transfers, a key component of eChecks, are free for both incoming and outgoing payments on the standard plan.

Bluevine’s offerings include a high APY on checking deposits and up to 20 sub-accounts on its Premier plan, though it lacks built-in real estate-specific property management features. Premium plans are available for a monthly fee but may be waived if minimum daily balance and spend requirements are met.

Chase Bank

Chase Bank is a traditional, large, brick-and-mortar bank with a wide network of branches and a robust suite of lending products. You can send and receive money using several methods, including ACH or eChecks.

For landlords, Chase offers ACH Collections that allow you to electronically withdraw money from your customers' accounts (like tenants) with their permission. Chase typically charges monthly maintenance fees unless you meet a required minimum daily balance. Fees apply for faster payment options like Same-day ACH and Real-time payments. For ACH Collections, the fee is $25 for the first 25 collections per month, and then $0.25 for each subsequent collection.

Capital One

Capital One offers a suite of business services, including business checking and savings accounts. Its business checking accounts include no-fee digital transactions, which cover ACH payments. This means setting up eChecks to pay vendors or receive rent is free for digital transactions.

However, Capital One business checking accounts typically charge a monthly service fee unless a minimum daily balance is maintained. For example, the Basic Checking account has a $15 monthly fee, which is waived with a $2,000 minimum balance. Capital One does integrate personal and business banking with a single login, which can be convenient for hands-on investors.

eCheck banking platform comparison for landlords

Open your eCheck bank account with Baselane

Choosing the right platform for eCheck (ACH) payments is more than just selecting a bank. It's also about selecting a partner that makes banning easier for you.

If you're looking to eliminate the complexity and stress of juggling multiple apps, Baselane’s integrated banking approach is for you. With ACH processing and the flexibility to open multiple virtual accounts, we help you move beyond manual busywork and manage your income and expenses effectively.

Open your Baselane account today and start collecting rent and gaining financial clarity.

FAQs

What is an eCheck bank account?

An eCheck bank account facilitates electronic payments directly from one bank account to another via the ACH network. It acts as a digital version of a paper check, offering faster and more secure transactions for landlords and tenants. This system is ideal for recurring payments like rent.

How does an eCheck bank payment work for landlords?

For landlords, an eCheck payment begins when a tenant authorizes a direct debit from their bank account. The landlord's bank submits this request through the ACH network. Funds are then electronically transferred, typically clearing within 1-3 business days.

What banks accept eChecks from tenants for rent?

Most modern banks and specialized landlord banking platforms support eChecks, which are processed through the ACH network. Platforms like Baselane are designed specifically to handle eCheck rent payments efficiently, providing seamless integration with landlord accounts.

Are there bank charges for eCheck transactions?

eCheck transactions typically have lower fees compared to credit card payments or wire transfers. Many landlord-focused banking platforms, like Baselane, offer these services with no monthly fees, minimizing your operational costs. Fees can vary, so it's always wise to check with your provider.