The QBI deduction allows you to deduct up to 20% of net rental income from your taxes, which is even more beneficial when you own multiple rental units. With 2026’s new rules—including higher income limits and a minimum deduction—you can reduce what you owe to the IRS and keep more of your own rental revenue.

In this guide, we explain how the LLC QBI deduction works for LLCs with multiple properties and how to plan your tax strategy with confidence.

Key takeaways

- The One Big Beautiful Bill Act (OBBBA) has made the QBI deduction permanent.

- Starting in 2026, phase-in ranges increase to $150,000 for joint filers and $75,000 for other taxpayers.

- The 2026 rule allows a $400 minimum deduction if an active qualified trade or business generates at least $1,000 in QBI.

- Rental enterprises need to meet IRS Safe Harbor requirements to qualify for QBi deductions—maintain separate books, complete 250 hours of service, and maintain real-time records.

- Proper LLC structuring and aggregation can help maximize deductions for high-income earners subject to wage and property basis limits.

What is the QBI deduction for LLC?

QBI deduction allows you to deduct up to 20% of your qualified business income from your taxable income. Your LLC structure—whether you're a single-member or a multi-member —doesn't change the fundamental LLC qualified business income deduction benefit. The deduction flows through to your personal tax return, reducing what you owe the IRS.

If you own five rental properties that generated a combined $150,000 in net rental income after expenses, and you qualify for the QBI deduction, you can deduct $30,000 from your taxable income. You subtract this $30,000 before calculating your final tax bill, which means the money goes into your pocket rather than to the IRS.

The deduction is taken "below the line," which means it reduces your taxable income but doesn't affect your adjusted gross income (AGI). This distinction matters because certain tax benefits and thresholds are tied to AGI, while others depend on taxable income.

How to qualify for QBI deductions: Safe Harbor rules

To remove confusion among real estate investors about what qualifies as a trade or business, the IRS issued Revenue Procedure 2019-38, which established a safe harbor specifically for rental real estate.

The safe harbor requires you to meet three requirements to claim deductions.

Separate books and records for each rental enterprise

Maintain separate books and records for your rental activity. You have more flexibility in organizing your finances.

You can have separate books for each property individually, or you can group similar properties into a single "rental real estate enterprise" and maintain one set of books for that enterprise.

For example, if your LLC holds three long-term single-family rentals in the same market, you could maintain one set of books covering all three as a single enterprise.

If you have multiple members within the LLC, the separate books requirement extends to proper tracking of each member's capital account, income allocation, and distribution. Make sure to clearly show how income and expenses are attributed to each member.

Complete 250 hours of qualifying rental services annually

Perform at least 250 hours of qualifying rental services each year. Qualifying activities include activities that directly relate to managing and operating your rental properties

- Advertising vacancies

- Screening prospective tenants

- Negotiating lease terms

- Collecting rent

- Responding to maintenance requests

- Coordinating repairs

- Supervising contractors

- Conducting property inspections

- Managing tenant communications

For short-term rentals or Airbnbs, you can include time spent on guest communications, coordinating cleaning services, restocking supplies, managing reservations, and handling check-ins and check-outs. This is where self-managing LLC landlords have a substantial advantage. Every hour you spend on legitimate rental services counts toward this threshold.

If you hire contractors or employees to perform these services, those hours count too. So if you hire a cleaning service for your Airbnb that spends 100 hours cleaning throughout the year, those hours contribute to your 250-hour requirement.

If you aggregate your properties into a single rental real estate enterprise, all the hours you spend across those properties combine toward one 250-hour threshold, helping you reach the limit quickly.

What doesn't count?

Investor-level activities that don't directly relate to day-to-day operations.

- Time spent arranging financing for your LLC

- Reviewing financial statements

- Researching markets for potential acquisitions

- Traveling to investigate new investment opportunities

Also read: Vacation home tax rules

Maintain contemporaneous time records

Record and maintain the hours of services performed as they happen, rather than reconstructing everything from memory when tax season arrives.

Your records need to show three things: the date services were performed, the number of hours spent, and a description of what you did.

If different members and contractors are performing services, also track the name and occupation of the person providing the service, such as a plumber, electrician, painter, etc. This becomes important if the IRS ever questions your qualification, and it helps ensure you're properly documenting each member's contribution to the LLC's operations.

You can use different methods to track the services.

- A free time tracker sheet: It’s the easiest way to add activities or services as they happen. Create entries like "3/15/2026 - 2 hours - showed property to prospective tenants, answered maintenance questions from current tenant" or "3/20/2026 - 1.5 hours - coordinated plumber for leak repair at Oak Street property, updated listing ads."

- Time-tracking apps: Give you a better estimate of the time you actually spent.

- Property management software: Makes it easy to tag activities to a specific property or unit.

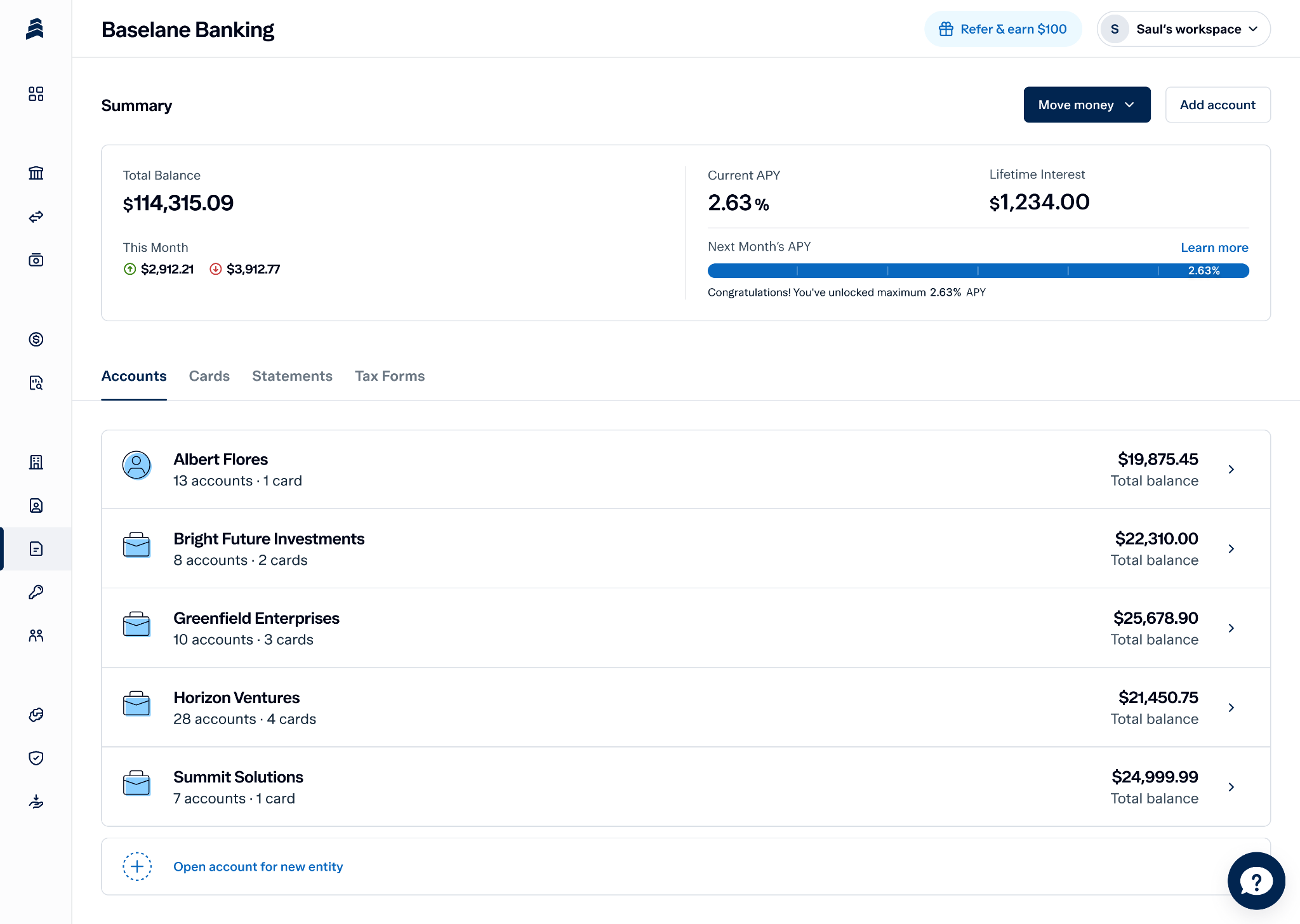

Why integrated banking and bookkeeping matter for LLCs

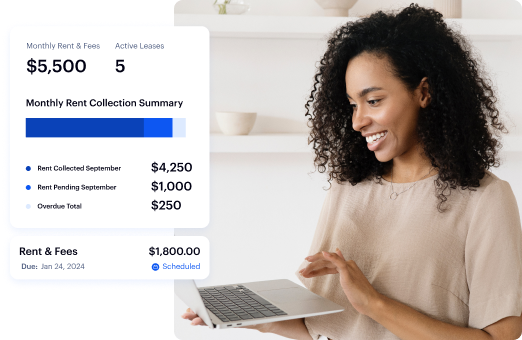

Managing documentation for multiple rental properties can be complicated, especially when you need to track income, expenses, and hours to qualify for QBI. Baselane’s integrated banking and bookkeeping platform helps automate this process. Here’s how:

- Maintain separate accounts for each property or rental enterprise.

- Categorize income and expenses by property, so your books are ready for QBI calculations.

- Generate reports showing net rental income, expenses, and time-tracking summaries that support IRS safe harbor requirements.

- Track aggregated numbers if you combine properties into a single rental enterprise, ensuring your QBI calculations are accurate.

Because everything is organized and accessible in one place, you can calculate your QBI deduction and maintain the documentation the IRS requires—without spending extra time managing spreadsheets or hunting down receipts.

How to calculate LLC QBI deduction in 2026

The QBI deduction for LLC is straightforward: you take the lesser of 20% of your LLC's qualified business income or 20% of your taxable income (minus net capital gains).

Your LLC's QBI is your net rental income after expenses. If your LLC generates $80,000 in rental income and has $30,000 in deductible expenses (mortgage interest, property taxes, insurance, repairs, property management costs, depreciation), your QBI is $50,000.

You calculate 20% of $50,000 = $10,000. You also calculate 20% of your taxable income. If your total taxable income is $70,000, then 20% is $14,000. You take the lesser amount—in this case, the $10,000 from your LLC's QBI.

This calculation assumes you're below the income phase-in thresholds. Once you exceed those thresholds, additional limitations kick in based on W-2 wages and UBIA.

The new 2026 minimum deduction for LLCs

The 2026 tax year introduces two major updates under the OBBBA.

The $400 minimum deduction

If your LLC generates at least $1,000 in qualified business income from an active qualified trade or business, you're guaranteed a minimum deduction of $400.

This helps LLC landlords just starting out, those with a single rental that doesn't generate massive income, or anyone going through a year with lower profits due to vacancies or major repairs. Even if your calculated deduction would be less than $400, you get the full $400 minimum as long as you meet the $1,000 QBI threshold.

Increased income thresholds

The phase-in range starts at $150,000 for joint filers and $75,000 for other taxpayers (single filers, heads of household, married filing separately).

Below these thresholds, you get the full calculated deduction—20% of your LLC's QBI.

Once taxable income exceeds the upper threshold, the QBI deduction for LLC owners becomes subject to limitations. The deduction is capped at the greater of:

- 50% of W-2 wages paid by the business, or

- 25% of W-2 wages plus 2.5% of the Unadjusted Basis Immediately After Acquisition (UBIA) of qualified property

This rule is especially important for rental LLCs that do not pay W-2 wages. In these cases, the UBIA calculation allows owners to use the building's original cost basis (excluding land) to determine the deduction limit.

For example, if you own a rental property with a building value (UBIA) of $1 million and pay no wages, your limitation would be 2.5% of $1 million, which is $25,000. If 20% of your QBI is less than $25,000, you get the full 20%; if it is more, you are capped at $25,000.

QBI deduction impact table (2026 projections)

How to reduce taxable income to maximize QBI benefit

For LLC landlords approaching or exceeding the income phase-in thresholds, reducing your taxable income becomes strategically valuable. Lower taxable income means either avoiding the limitations entirely or facing less severe caps on your deduction.

Maximize deductible expenses for your LLC

Look for overlooked deductions: a landlord home office tax deduction if you have a dedicated space for managing your LLC's properties, rental property repair tax deduction, vehicle mileage for property visits and management tasks, mortgage interest on rental property, professional development costs for landlord education, technology, and software subscriptions for property management.

Strategically time your expenditures

If you're close to an income threshold, timing your expenditures can matter. Repairs completed in December versus January, property improvements that might be accelerated or delayed, and even the timing of property acquisitions can affect which tax year claims certain deductions.

This doesn't mean deferring necessary maintenance or making poor business decisions. But if you have discretion over timing, being aware of how it affects your QBI deduction calculation helps you optimize.

Understand the interplay between deductions

Some deductions reduce your taxable income but don't reduce your QBI. For example, the standard deduction or itemized deductions reduce taxable income without touching your LLC's net rental income.

Other deductions, like rental property expenses, reduce both. Mortgage interest on your LLC's rental properties is a deductible expense that lowers your net rental income (and thus your QBI) while also lowering taxable income.

For high-income earners, there's a balancing act. Maximizing rental expenses lowers your QBI (which could reduce your QBI deduction), but it also lowers your overall taxable income (which could help you avoid or reduce the W-2 wage and UBIA limitations). The right balance depends on your specific numbers and where you fall relative to the thresholds.

How to report and claim QBI for your LLC

LLC owners must report QBI correctly on their individual tax returns:

- Use Form 8995 (Qualified Business Income Deduction Simplified Computation) when taxable income is below the threshold

- Use Form 8995-A is required for higher-income taxpayers or those aggregating properties

Making the safe harbor election

To claim safe harbor treatment, you attach a statement to your tax return. This statement should include:

- A description of the rental real estate enterprise

- Confirmation that separate books and records are maintained

- A statement that 250 or more hours of rental services were performed

- A description of the rental services performed and hours spent

The safe harbor election is made annually, and you need to qualify each year to claim it.

Get your books and time logs in order

You can qualify for a QBI deduction and save on taxes by being diligent and consistent with your rental activities and financial tracking.

With Baselane’s integrated banking and bookkeeping platform, you can automatically separate property income and expenses, track hours across all units, and maintain IRS-ready records—so claiming your QBI deduction becomes simple, accurate, and stress-free. Open your account today!

FAQs

Does single member llc qualify for QBI deduction?

Yes, a single-member LLC can take the 20% QBI deduction if the rental activity qualifies as a "trade or business" under Section 162 or meets the IRS Safe Harbor requirements. The deduction is claimed on the owner's personal Form 1040.

What is QBI deduction for single single-member LLC?

Qualified Business Income (QBI) for a single-member LLC is the net amount of qualified items of income, gain, deduction, and loss from the business. It generally excludes capital gains, interest income, dividends, and W-2 wages paid to the owner.

Does a rental LLC qualify for QBI if it pays no wages?

Yes, a rental LLC can qualify even if it pays no wages. High-income earners can use the unadjusted basis immediately after acquisition (UBIA) of their property to calculate the deduction limit, which is 2.5% of the property's unadjusted basis.

How to calculate QBI for an LLC with multiple properties?

You can calculate QBI separately for each property or elect to aggregate them into a single enterprise if they meet specific criteria. Aggregation allows you to combine W-2 wages and UBIA from all properties to potentially increase your deduction limit.

What is the QBI LLC minimum deduction for 2026?

If a taxpayer has at least $1,000 in total QBI from an active qualified trade or business, they may claim a minimum deduction of $400.

.jpg)

.jpg)

.jpg)

.jpg)