Many investors fear the sudden $15,000 expense of a new roof, but experienced landlords know that capital expenses for rental property are actually a powerful tool for building wealth. What are capital expenses for rental property? They are the long-term investments—like replacing HVAC systems or renovating kitchens—that increase your property’s value, extend its life, or adapt it to new uses. As we approach 2026, understanding rental property capital expenditure is more critical than ever due to shifting tax regulations.

Successful real estate investors don’t just pay for repairs; they strategically plan for capital expenses in rental property to optimize tax returns and boost ROI. In this guide, we will move beyond the basics of capital expense vs operating expense to explore advanced strategies like cost segregation and the impact of the 2026 bonus depreciation phase-out.

Key takeaways

- Misclassifying rental property capital expenses as repairs can trigger IRS audits, while missing them leads to lost depreciation benefits.

- The bonus depreciation rate drops to 20% in 2026, making cost segregation studies essential for maximizing upfront deductions.

- Allocating 5-15% of rental income into a high-yield savings account ensures you are ready for major capital expenses real estate projects.

- You may be able to deduct up to $2,500 per invoice immediately using the Safe Harbor election, avoiding complex depreciation schedules.

- Strategic CapEx investments should prioritize projects that increase rent potential, reduce vacancies, or improve long-term property value.

What are capital expenses (capEx) for rental property?

Capital expenses for rental property (CapEx) are funds used to acquire, upgrade, or maintain physical assets like buildings, technology, or equipment. Unlike day-to-day operational costs, rental property capital expenses provide benefits that last longer than one year. According to the IRS, these are expenses that add value to your property, prolong its useful life, or adapt it to a new use.

Understanding the distinction between CapEx and operating expenses (OpEx) is foundational for accurate bookkeeping. OpEx includes recurring costs like property management fees, utilities, and minor repairs necessary to keep the property in good working condition. You can dive deeper into rental property operating expenses to ensure you aren't leaving deductions on the table.

Common examples of rental property capEx

To maintain a profitable portfolio, you must recognize what qualifies as a rental property capital expenditure. These are not simple fixes; they are substantial reinvestments in your asset. Identifying these correctly ensures you depreciate them over the correct useful life, typically 27.5 years for residential real estate.

Here is a list of capital expenses for rental property:

- Structural improvements: Replacing a roof, adding a room, or reinforcing the foundation.

- Systems upgrades: Installing a new HVAC system, replacing plumbing pipes, or rewiring electrical systems.

- Restoration: repairing significant damage from a casualty event (like a fire or flood) to restore the property to its pre-loss condition.

- Adaptation: converting a garage into an accessory dwelling unit (ADU) or modifying a unit for commercial use.

Misclassifying these items affects your cash flow and tax liability. For a broader view of all costs, review our guide on rental property expenses.

Capital Improvements vs. Repairs

One of the most common questions investors ask is: What are capital expenses in real estate versus simple repairs? The IRS uses the "BRA" test—Betterment, Restoration, Adaptation—to distinguish between the two. If an expense falls into one of these categories, it is likely a capital improvement that must be depreciated.

A repair keeps your property in its current operating condition, such as painting a room or fixing a leaky faucet. A capital improvement, however, adds value or extends the property's life. For example, patching a few shingles is a repair (OpEx), but replacing the entire roof is a capital expense example (CapEx).

The Risks of misclassification

Getting this wrong can be costly. If you deduct a $15,000 roof replacement as a repair in a single year, the IRS may disallow the deduction, forcing you to pay back taxes and penalties. Conversely, capitalizing on a small repair means you miss out on an immediate tax break. Proper classification is essential for maximizing rental property tax deductions.

For landlords, maintaining clear records is non-negotiable. Baselane’s automated bookkeeping simplifies this by allowing you to tag transactions as "Repairs" or "CapEx" instantly. This ensures that when tax season arrives, your accountant has a clean, accurate ledger to maximize your landlord tax deductions.

CapEx tax strategies: Depreciation, bonus depreciation & cost segregation

Effective tax planning separates average investors from high-growth portfolio owners. Capital expenses for rental properties are generally recovered through depreciation rather than immediate deduction.

Rental property depreciation

When you incur a capital expense on rental property, the IRS requires you to spread the deduction over the asset's useful life. For residential rental property, this period is 27.5 years. This non-cash expense lowers your taxable income without affecting your cash flow, significantly boosting your after-tax returns.

For a detailed breakdown of how this calculation works, read our guide on depreciation on rental property.

Bonus depreciation in 2026

Bonus depreciation allows investors to deduct a large percentage of the cost of eligible assets (like appliances or flooring) in the first year. However, the Tax Cuts and Jobs Act initiated a phase-down of this benefit.

The bonus depreciation schedule is as follows:

- 2023: 80%

- 2024: 60%

- 2025: 40%

- 2026: 20%

- 2027: 0%

This means in 2026, you will only be able to deduct 20% of qualifying capital expenses for rental property upfront, with the remainder depreciated over time. This shift makes claiming capital expenses for rental property more complex and necessitates advanced strategies to preserve cash flow. Learn more about what bonus depreciation is to prepare for these changes.

Cost segregation

With bonus depreciation fading, cost segregation studies are becoming the gold standard for tax optimization. A cost segregation study identifies components of your property that can be depreciated over shorter periods (5, 7, or 15 years) instead of the standard 27.5 years.

This includes items like carpeting, specialty plumbing, and landscaping. By reclassifying these assets, you accelerate depreciation, significantly increasing your deductions in the early years of ownership. This strategy remains powerful even with the 20% bonus rate in 2026. Explore our comprehensive resources on cost segregation and how to commission a cost segregation study.

For investors looking to maximize every dollar, combining cost segregation and bonus depreciation provides a sophisticated shield against tax liability.

De Minimis Safe Harbor election

You don't always have to depreciate every small improvement. The IRS De Minimis Safe Harbor rule allows you to deduct rental property write-offs of capital expenses less than 2500 per invoice or item immediately.

If you have an applicable financial statement (AFS), this limit increases to $5,000. This is a critical tool for claiming capital expenses for rental property efficiently, reducing the administrative burden of tracking small assets over decades. While utilizing these deductions, you should also be aware of the pass-through tax deduction and the qbi deduction for rental property to further optimize your tax position.

Just remember that you must file a specific election statement with your tax return to use this Safe Harbor. Consult your CPA to ensure you meet the requirements for the QBI safe harbor rental property.

Depreciation recapture

It is important to note that depreciation is essentially a tax deferral, not total forgiveness. When you sell the property, the IRS will tax the amount you depreciated (or could have depreciated) at a specific rate, known as depreciation recapture. This applies to all capital expenses for landlords that were depreciated. Understanding the depreciation recapture tax helps you plan your exit strategy effectively.

Strategic capEx planning & budgeting for long-term ROI

Failing to budget for real estate capex is one of the primary reasons rental properties become distressed. Capital expenses tend to increase significantly as properties age, and without a reserve, a sudden furnace failure can wipe out a year’s worth of profit.

Estimating capEx

The industry standard suggests setting aside reserves for capital expenses in rental properties using one of two methods:

- Income-based: Save 5-15% of your gross monthly rent.

- Property-value based: Save 1-2% of the total property value annually.

However, generic percentages can be dangerous. A more accurate method is component-based analysis. List every major system (roof, HVAC, water heater), its remaining lifespan, and replacement cost. According to MIT research, the average CapEx for apartments is roughly 2.4% of property value annually.

If you are wondering how to estimate capital expenses for multifamily property, lean towards the higher end of these ranges. Multifamily units have more systems and higher wear and tear.

Building your capital reserve

Saving for capital expenses in a rental unit requires discipline. Co-mingling your CapEx reserves with your operating funds or personal cash is a recipe for disaster. Best practice is to open a dedicated cash reserve account specifically for long-term improvements.

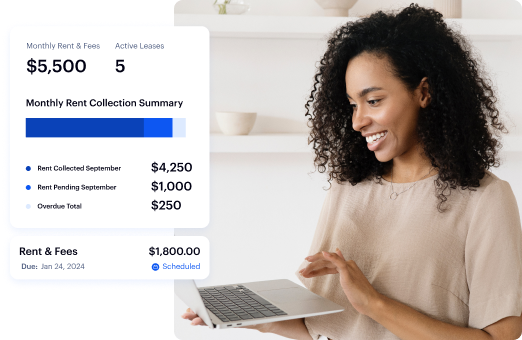

Baselane offers banking solutions tailored for this exact purpose. You can open multiple virtual accounts—one for operations, one for security deposits, and one for your capital reserve. Even better, keeping these funds in a high-yield online savings account ensures your idle cash earns interest, growing your safety net automatically.

Prioritizing capital expenditures

Not all capital expense examples are created equal. Smart landlords prioritize projects based on ROI. Ask yourself: Will this expense allow me to raise the rent?

- High ROI: Kitchen upgrades, adding in-unit laundry, or modernizing flooring often justify rent increases.

- Compliance/Safety: Roof repairs and electrical updates are mandatory to protect the asset, even if they don't immediately boost rent.

- Tenant Retention: HVAC upgrades or smart home features keep good tenants longer, reducing vacancy costs.

CapEx trends & considerations in 2026 and beyond

As we look toward 2026, the landscape of capital expenses on a newly purchased rental property is shifting. Commercial real estate investment is expected to rise, increasing demand for contractors and materials. This could drive up the cost of renovations.

Inflation and interest rates continue to impact borrowing costs for major projects. Smart investors are locking in financing for major renovations now or building larger cash reserves to self-fund. Additionally, green CapEx—investments in energy efficiency—is gaining traction. New tax credits for heat pumps, solar panels, and energy-efficient windows can offset the initial capital expenditure property costs while lowering utility bills for tenants.

Best practices for managing rental property CapEx

Tracking rental deductions, depreciation, and capital expenses manually in a notebook is no longer viable. Digital record-keeping is essential for surviving an audit and making informed decisions.

Digital tracking and spreadsheets

Using a dedicated Rental Property Expenses Spreadsheet allows you to log every invoice and receipt. For prospective purchases, a rental property analysis spreadsheet helps you model different CapEx scenarios to see how they impact your cash-on-cash return.

Automation software

For a more seamless experience, switch to cash flow management software. Baselane integrates banking and bookkeeping, allowing you to categorize a $5,000 payment to a contractor as a capital improvement with a single click. This keeps your operating expenses distinct from your capital assets, simplifying the handover to your CPA at tax time.

Automate capital expense tracking with Baselane

Mastering capital expenses for rental property is about shifting your mindset from "cost" to "investment." By accurately classifying expenses, leveraging cost segregation to combat the 2026 bonus depreciation phase-out, and maintaining robust reserves, you turn major repairs into opportunities for tax savings and value creation.

Whether you are deducting capital expenses after the sale of property or planning a renovation next month, clarity is key. Baselane provides the financial infrastructure—from high-yield banking for your reserves to automated CapEx tagging—to keep your portfolio organized and profitable. Take control of your financial future by planning for 2026 today by signing up for Baselane.

FAQs

What qualifies as a capital expense for rental property?

A capital expense (CapEx) is a cost that improves a property, restores it, or adapts it to a new use. Unlike repairs, which maintain current condition, CapEx adds lasting value or extends the property's life, such as replacing a roof, installing a new HVAC system, or renovating a kitchen.

Can you claim capital expenses on rental properties immediately?

Generally, no. You must depreciate capital expenses over their useful life (usually 27.5 years for residential property). However, under the De Minimis Safe Harbor rule, you may be able to deduct expenses up to $2,500 per invoice immediately if you file the proper election.

Are appliances capital expenses for rental property?

Yes, appliances like refrigerators, stoves, and dishwashers are typically considered capital expenses. However, they usually have a shorter depreciation recovery period (often 5 years) compared to the building structure, making them ideal candidates for bonus depreciation or cost segregation strategies.

How does the 2026 bonus depreciation change affect landlords?

In 2026, bonus depreciation drops to 20%, meaning you can only deduct 20% of the cost of eligible assets (like appliances or flooring) in the first year. The remaining 80% must be depreciated over the asset's useful life, increasing the importance of cost segregation studies.

How do I distinguish between capital allowances rental property and operating expenses?

Use the BRA test (Betterment, Restoration, Adaptation). If the expense fixes a broken part to its original condition, it's a repair (OpEx). If it upgrades the property, restores it after a casualty, or adapts it for a new purpose, it is a capital allowance or expense (CapEx).

.jpg)

.jpg)

.jpg)