Keeping tabs on rental property finances isn’t always straightforward. With income, expenses, and maintenance costs constantly in motion, it’s easy to lose track of your cash flow, especially if you’re still relying on spreadsheets. That’s where cash flow management software can make a real difference. It brings clarity to your finances by helping you monitor income and expenses in real time, so you can make informed decisions with confidence.

This guide will explore what this software is, why it's critical, must-have features, how to choose the best option, and more, helping you master your landlord cash flow.

What is rental property cash flow management software?

Cash flow management software for rental properties is a digital tool specifically built to track, analyze, and report on these financial movements. Unlike general accounting software, it's tailored to the unique needs of landlords and property managers. This software automates tasks like income and expense logging, categorizes transactions, and generates financial reports relevant to rental businesses. It acts as a dedicated cash flow management system for your real estate portfolio.

Many platforms also include tools for collecting security deposits and managing tenant ledgers, making it easier to track balances, outstanding payments, and deposit returns.

Why is effective cash flow management crucial for landlords?

Maintaining positive and predictable property management cash flow is paramount for the long-term success and sustainability of any rental business. Without clear cash flow visibility, you risk falling behind on mortgage payments, maintenance, or other critical expenses. This can lead to significant financial stress and jeopardize your investment.

Effective cash flow property management ensures you have sufficient funds to cover operating costs, planned capital expenditures, and unexpected repairs. It allows you to identify trends, understand which properties are performing best, and make strategic decisions about rent pricing, expense control, and reinvestment. Ultimately, strong cash flow management enables financial stability and supports portfolio growth.

If you’re handling tenant funds, features for putting rent in escrow or tracking your escrow account interest rate are important to ensure compliance and transparency.

How many landlords & property managers use cash flow software?

The adoption of technology, including cash flow management tools, is rising in the property management sector. The global property management software market is projected to reach approximately $26.55 billion in 2025. While specific statistics on the exact percentage of independent landlords using dedicated cash flow software are varied, the overall market growth indicates increasing reliance on digital solutions for efficiency and compliance.

According to the National Apartment Association (NAA), 93% of property managers reported adopting at least one form of technology for property management purposes within the past 18 months. This includes automating tasks that streamline processes and cut down on administrative work.

As a result, even landlords with smaller portfolios are moving away from manual methods in favor of specialized software. This trend underscores a growing recognition that effective small business cash flow management is essential for profitability, regardless of portfolio size.

Benefits of automated cash flow management

Tracking rental income and expenses with spreadsheets might work for a single property, but as your portfolio grows, so do the risks and inefficiencies. Manual data entry is time-consuming, error-prone, and lacks the real-time insights needed for smart decision-making. That’s where a landlord cash flow analyzer comes in—offering automation, accuracy, and clarity.

Here’s how it outperforms traditional methods, aligned with the core rules of cash flow on property management:

- Reduced errors: Spreadsheets have an estimated 88% error rate due to manual input. Automated tools significantly lower that risk.

- Time savings: Automating transaction tracking and reporting can cut six hours of admin per property every month.

- Real-time insights: Instantly view your financial health with dashboards that update as transactions occur.

- Auto-categorization: Transactions are sorted based on IRS guidelines, simplifying tax prep and compliance.

- Bank feed integration: Software connects to your real estate bank account, eliminating the need for manual uploads.

- Professional reports in minutes: Generate lender-ready or tax-ready reports quickly and easily.

Using dedicated cash flow software isn’t just convenient—it’s a smarter way to manage property finances as you scale.

Manual spreadsheets vs. cash flow management software for landlords

Here is a table that compares the functionality of manual spreadsheets and cash flow management software.

Transitioning to software moves you from basic record-keeping to strategic financial management.

Features you should look for in a cash flow management software

When evaluating software, focus on features that directly support cash flow analysis and management. Look for these essentials:

- Automated income and expense tracking: The software should sync directly with your bank accounts, automatically importing transactions. Smart categorization rules help tag income and expenses accurately, minimizing manual data entry.

- Real-time cash flow dashboards and reporting: A clear, visual dashboard showing your current cash position, income vs. expenses, and net cash flow is vital. Look for customizable reports like Profit & Loss (P&L), Cash Flow Statements, and property-specific performance views.

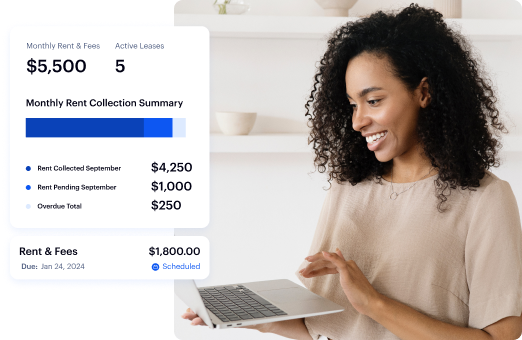

- Automated rent collection and tracking: Integrated online rent collection streamlines payments, automatically records income, tracks payment statuses, and can handle late fees. This ensures timely revenue capture, a cornerstone of healthy cash flow.

- Budgeting and forecasting tools: Effective software allows you to set budgets for different expense categories and forecast future cash flow based on historical data and anticipated changes. This helps in planning major expenses and identifying potential shortfalls.

- Tax preparation features: Look for tools that automatically categorize expenses according to tax codes and generate reports like the Schedule E.

- Tenant ledger management: Maintaining individual ledgers for each tenant, tracking rent payments, determining security deposits, and outstanding balances, provides clarity on income streams.

- Integration capabilities: Beyond bank feeds, consider integrations with other property management tools or general accounting software if needed, though all-in-one platforms often reduce this necessity.

Top Rental Property Cash Flow Software

Choosing the right software depends on your portfolio size, technical comfort, specific needs, and budget. Here are some leading platforms known for strong cash flow management features:

1. Baselane

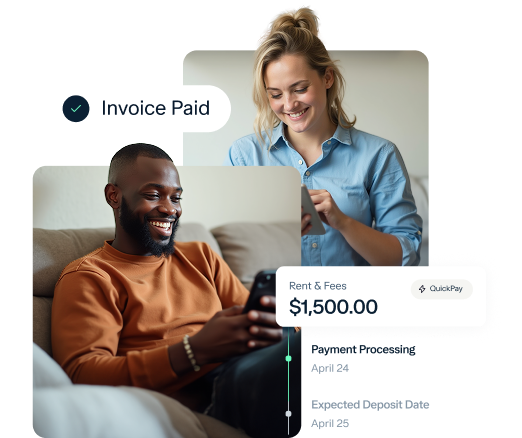

Baselane is a modern, all-in-one financial and cash flow management software platform designed specifically for landlords and real estate investors. It combines banking, bookkeeping, and rent collection for complete cash flow automation and real-time insights into property performance. Instantly see which properties are making or losing money, and quickly adjust to protect your profit margins.

Best for: Automated cash flow management and financial reporting for new and experienced real estate investors.

Key features

- Auto-balance transfers and bill payments

- Shareable virtual debit cards with smart spend controls

- Unlimited checking and high-yield savings accounts with up to [v="apyvalue"] APY²

- Automated expense tracking and Schedule E reporting

- Real-time property and portfolio-level cash flow insights

- Free online rent collection software with automated reminders and late fees

Baselane also provides services for tenant screening, digital leases, rental property loans, and rental insurance directly in the dashboard.

Pros

- Comprehensive cash flow management system

- Real-time reporting to maximize cash flow

- Free to use, with no monthly fees or account minimums

Cons

- No mobile app (coming soon)

- Tenant messaging not available (coming soon)

Pricing

Baselane is free to sign up.

2. Stessa

Stessa is a tool for landlords who want to automate financial tracking without diving into full-scale property management. It syncs with bank accounts for landlords, categorizes expenses, and gives you reports.

Best for: Landlords focused on financial tracking and tax reporting.

Key features

- Income and expense tracking

- Dashboards and visual performance metrics

- Receipt scanning and rent collection tools

Pros

- Great for tracking profitability

- Easy setup and clean interface

- Basic free tier available

Cons

- Limited property management features (e.g., tenant communication, maintenance)

- Premium features require a paid plan

Pricing

Free, or $12–$28/month for premium plans.

3. REI Hub

REI Hub is rental property accounting software for landlords who want more control over their books. However, it’s not a full property management platform.

Best for: Landlords who prioritize accounting.

Key features

- Transaction categorization rules

- Schedule E exports and financial reports

- Basic tenant tracking tools

Pros

- Built specifically for rental property accounting

- Responsive customer support

Cons

- Subscription required after free trial

- Less visually dynamic than dashboard-based tools

Pricing

Starts around $20/month after a free trial.

4. DoorLoop

DoorLoop is a property management software that combines operational tools with basic accounting and reporting features. It's good for landlords looking to streamline tasks in one platform, though its accounting capabilities may be limited compared to more specialized financial software.

Best for: Landlords and property managers with mid to large portfolios.

Key features

- Online rent collection and tenant portal access

- Full accounting suite with bank reconciliation and custom chart of accounts

- Cash flow reports and customizable financial statements

Pros

- Platform for finance and operations

- Scalable for different portfolio sizes

Cons

- Higher cost than simpler platforms

- May include more features than small landlords need

Pricing

It’s $69–$199/month depending on plan.

5. RentRedi

RentRedi is a mobile-first platform designed for landlords who prioritize tenant communication. While it lacks native advanced accounting features, it does offer integrations with REI Hub for financial reporting.

Best for: Landlords who prioritize mobile tools and tenant-facing features.

Key features

- Basic expense tracking via bank sync (Plaid integration)

- Mobile rent collection

- Tenant screening tools

Pros

- Includes a mobile app

- Flat-rate pricing with no per-unit charges

- Good for landlords who want a hands-on tenant management tool

Cons

- Limited accounting features natively

- Rent deposits can take 4–5 business days

Pricing

It’s$12–$42/month depending on plan and billing cycle.

A comparison of the top cash flow software

Here is a table comparing the best landlord software.

Tips for choosing the cash flow management system

The best software for your rental business depends on your unique needs. Use these tips to guide your decision:

- Assess your needs: Identify your biggest pain points—whether it’s accounting, rent collection, banking, or full property management. Define must-have features before comparing tools.

- Match to portfolio size: A single-family rental has different software needs than a 20-unit building. Choose a platform that fits your current scale but can grow with you.

- Prioritize ease of use: A tool is only valuable if it’s easy to use. Look for intuitive navigation, clean design, and a helpful onboarding process.

- Check integrations: Ensure the software integrates with your bank and any tools you already use (like listing platforms or maintenance systems).

- Read user reviews: Explore feedback on sites like G2, Capterra, or landlord forums. Look for insights into reliability, support quality, and how well the platform handles cash flow.

- Evaluate reporting tools: Can it generate essential reports like Cash Flow Statements, Profit & Loss, and Schedule E? Are reports customizable?

- Think about growth: Will the software scale with you? Review unit limits, pricing tiers, and advanced features to ensure it meets your future needs.

Strategies to enhance rental property cash flow using software

Implementing cash flow management software isn't just about tracking; it's a tool that enables proactive strategies to improve your financial performance. By having real-time cash flow management data, you can:

- Optimize rent pricing: Analyze property performance reports to understand if your rent is competitive or if there's room for adjustment based on market data and property profitability.

- Control operating costs: Detailed expense tracking allows you to identify areas where costs are higher than expected. By categorizing rental property expenses accurately, you can spot inefficiencies and negotiate better rates or find cost-saving alternatives.

- Improve budgeting and forecasting: Create more accurate budgets based on historical data from the software. This helps anticipate expenses, plan for capital improvements, and predict future cash flow, reducing financial surprises.

- Streamline rent collection: Using the software's online rent collection features can reduce late payments, ensuring consistent income flow. Explore different rent collection techniques and find the best way to collect rent using digital tools integrated into the platform.

By leveraging the insights provided by your software, you move from simply recording transactions to actively managing and optimizing your property's financial health.

Automate and maximize your cash flow with Baselane

Managing rental property finances effectively is key to improving the average cash flow from each rental property—and it starts with moving beyond spreadsheets. A dedicated cash flow management platform saves time, reduces errors, and gives you real-time insights to make smarter financial decisions.

Baselane is built for real estate investors who want to manage, analyze, and optimize cash flow all in one place. Start with online banking and rent collection to simplify payments and separate property finances. Then enable automated bookkeeping to track income and expenses by property, and view real-time performance analytics of your portfolio’s performance to maximize your cash flow.

Get started with Baselane today and take full control of your rental property finances—freeing up time and maximizing your returns.

FAQs

What is the best free cash flow software for landlords?

Baselane is one of the best free options available. It offers integrated banking, automated bookkeeping, rent collection, and real-time cash flow analytics. It’s everything you need to track and manage rental property cash flow without spreadsheets or extra costs.

Is QuickBooks good enough for rental cash flow?

QuickBooks works for general business accounting, but it’s not built for landlords. It lacks rental-specific features like property-level tracking, Schedule E reporting, and integrated rent collection. Baselane is a better fit for landlords, it’s free and tailored specifically for managing rental finances.

What is the easiest cash flow software for a small landlord?

Baselane is the easiest cash flow software for small landlords. It’s simple to set up, user-friendly, and combines rent collection, expense tracking, and automated cash flow reporting in one free platform.

How often should I review my cash flow reports?

It's recommended to review your cash flow reports at least monthly. This allows you to catch potential issues early, track performance against budget, and make timely adjustments to your strategy.

What is good cash flow for rental property?

A healthy rental property cash flow means your rental income consistently exceeds your expenses—including mortgage, taxes, insurance, and maintenance. While the number varies by market, positive monthly cash flow is key. Tools like Baselane help you monitor this easily and make data-driven decisions.

.jpg)

.jpg)