How to Calculate Rental Property ROI?

Not sure whether a prospective rental property is a good investment? Baselane’s rental property ROI calculator helps you evaluate a real estate investment and determine the property’s ROI, annual cash flow, cash-on-cash return, and more. When you’re ready, use Baselane to collect rent online, track the performance of your rental properties, and maximize your profit.

Why Use a Rental Property Calculator?

When planning to buy a real estate investment property, it can be easy to focus on big numbers like the property purchase price and your potential rental income. While these numbers are essential, they are only a few pieces of the puzzle to being a real estate investor. Buying a rental property is a considerable investment, and it’s critical to factor in all variables before deciding.

Some costs might seem insignificant but can tip the scales and shrink your return on investment to the point where buying the property isn’t worth it – or you could even lose your money. Here are some metrics that many rental property owners and real estate investors fail to consider when attempting to calculate rental property ROI:

- What Rent to charge?

- Loan costs

- Unexpected repairs

- Property tax bills

- Legal fees

- Vacancy rates

Our rental property calculator can help you identify how different costs will impact your bottom line and decide if a rental property is worthwhile.

Note: Lower-end real estate investment properties tend to score better on rental income calculators than mid and higher-end properties, but don’t be fooled. Lower-end properties come with the risk of higher vacancy rates and repair costs. Turnover could be more frequent, which means chasing down delinquent tenants and repairing expenses like painting, new carpets, and fixing damage caused by tenants.

How To Calculate Rental Property Returns?

Our free rental property calculator takes a massive number of variables into account and works well alongside cash flow management software to help you evaluate your real estate investments. Here’s how the rental property calculator works.

There are two ways to use this calculator.

- Quick analysis – You can enter basic information about a potential rental property, like the purchase price and monthly rental property income, to determine a basic return on investment based on your monthly cash flow.

- Advanced analysis – For a more in-depth analysis of a property’s profitability, input the purchase price, total rental income, loan details, renovation costs, and monthly expenses. These extra details can help you accurately estimate cash flow, cash-on-cash return, and capitalization rate.

Using this information, the rental property ROI calculator will produce several key metrics that you can use to determine whether this income property is a decent investment.

What is Return on Investment (ROI) for a Rental Property?

Your property’s return on investment (ROI) is a measure of the profitability of a real estate investment. ROI attempts to measure the return on an investment relative to the cost. The simple formula for calculating ROI is:

Return on Investment (ROI) = net annual rental income / cost of investment

For example, if a property costs $100,000 to acquire and generates $6,000 per year after all expenses, including the mortgage payments, property taxes, insurance, and maintenance costs, the ROI of this property is 6%. An ROI between 5% and 10% is considered acceptable. An ROI of over 10% is an excellent real estate investment.

What is Annual Cash Flow for a Rental Property?

Annual cash flow is the most basic metric that you can use to quickly determine whether your property is a worthwhile investment. Your yearly cash flow is determined by calculating the gross income for your property and deducting all expenses related to the property, like maintenance, insurance, property tax bills, utilities, and mortgage payments. The difference between these two is the property’s annual cash flow.

Annual cash flow = gross income – all expenses

At a minimum, your property should have a positive annual cash flow. Otherwise, it is not a sound investment.

What is Net Operating Income for a Rental Property?

Net operating income, or NOI, differs slightly from annual cash flow. To calculate NOI, you’ll need to take the property’s revenue and deduct operating expenses, excluding interest payments on loans and capital costs like renovations. What is left is the total cash available after operating expenses.

Net Operating Income (NOI) = annual income – annual operating expenses

(not including mortgage and renovations)

If your property has a negative NOI, it is not an ideal investment.

What is Cash on Cash Return for Rental Property?

Our rental property ROI calculator also estimates your cash-on-cash return, which is a metric that measures the cash income earned relative to the money that you invested in the property. This annual pre-tax metric can be used to set a target for projected earnings and expenses.

The formula to calculate cash-on-cash return is:

Cash on Cash Return (COC) = annual cash flow (net) / total cash invested

Example: If you want to earn $300/month for a rental property, how much cash-on-cash return should you target? According to the rental property calculator, you should target at least ~10% COC return.

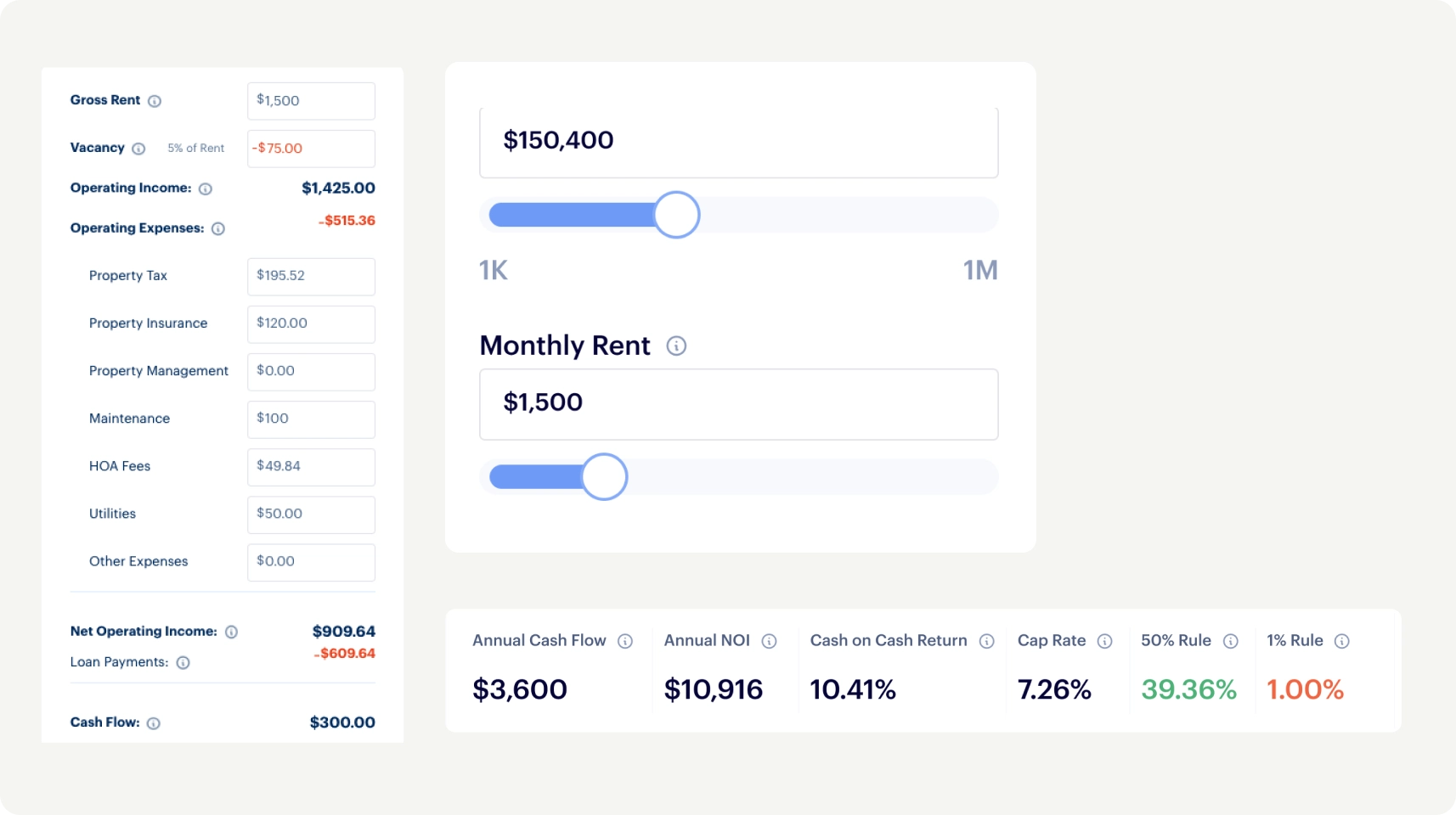

If you buy a property for $150,000 and can earn $1,500 of rental income per month, assuming you put down 20% and borrowed 80% to acquire the property, based on the rental property calculator, you should target at least ~10% COC return.

To calculate the Cash on Cash return, you can do the following:

- Calculate annual cash flow (net): $300 * 12 months = $3,600 annually.

- Calculate the total cash invested: $150,000*20% = $30,000 + some closing costs =$34,592

- Divide the annual cash flow by the cash invested: $3,600/$34,592 = 10.41%

This means you inherently seek at least a 10% return on your invested cash. You may want to keep hunting for better rental property investing deals if you don’t get this result using a rental income calculator.

See the screenshots below for setting up the rental property calculator to get this result. Try out different scenarios to set your Cash on a Cash return goal.

What is the CAP Rate for a Rental Property?

The capitalization rate, or cap rate, is another metric for determining the expected return rate on rental property investment. The cap rate is the net operating income (NOI) ratio to the property’s current market value. You can calculate the capitalization rate with this formula:

Cap rate = net operating income / current home value

For example, if your property has an NOI of $8,000, and a current market value of $200,000, the cap rate is 4%.

The cap rate is valuable for quickly comparing real estate investment properties. You can also use past capitalization rates to evaluate the performance of an investment property, which helps you determine how the property will perform in the future. There are a few rules to keep in mind when evaluating a property’s cap rate:

- The higher the cap rate, the higher the return

- The higher the return, the bigger the risk

So while a high capitalization rate means your return is higher, these rental properties are also riskier. On the other hand:

- The lower the cap rate, the lower the return

- Lower returns are less risky

For example, a 6% cap rate property may be in good repair with well-off tenants. This property is lower risk but also has a lower return. Buying real estate with a higher capitalization rate may need costly repairs because maintenance has been deferred, making it a more significant risk.

You can use capitalization rate to determine a fair purchase price for a rental property using the following formula:

Maximum purchase price = net operating income / cap rate

For example, if a property’s cap rate is 10%, and the NOI is $10,000 per year, your maximum purchase price should be $100,000. If the cap rate increases to 8%, your maximum purchase price will increase to $125,000.

What is the 50% Rule?

Another standard method to quickly analyze a potential real estate investment property is the 50% rule. The 50% rule indicates that the property’s operating expenses (not including the mortgage payment) should be 50% or less of its gross income. That doesn’t mean you’ll get a 50% profit, as the remaining 50% will be used for mortgage or loan payments. Here is the formula:

Operation expenses < Gross Rental Income x 50%

For example, if you have a property with $35,000 in gross income annually, and the operating costs are $15,000 per year, this property passes the 50% rule. If you evaluate real estate as a potential deal, this rule can help you quickly determine if the property could be profitable. Use the 50% rule to filter out good investments, but make sure to use our rental property ROI calculator to perform a deeper analysis before buying real estate.

What is the 1% Rule?

The 1% rule is another metric you can use to determine whether a real estate investment property is a good buy for a real estate investor. This rule suggests the property’s gross monthly rental income should be 1% or more of the purchase price. Here is the formula:

Gross Monthly Rental Income > 1% x Purchase Price

For example, if you were to purchase a property for $200,000, your gross monthly rental income should be at least $2,000 per month. Remember that gross monthly income includes the property’s anticipated vacancy rate. Use the 1% rule to filter out good investments, but make sure to use our rental income calculator to perform a deeper analysis of potential real estate investments before making your final decision.

How to Evaluate a Rental Property ROI?

Entering your property’s information into our rental property calculator is one thing, but knowing how to assess the data correctly is another. Understanding rental property income and return on investment is integral to performing the financial analysis and deciding which property is suitable for your real estate portfolio, so here is a primer on evaluating the calculations above.

Below is an example of target ROI metrics you can set for your property.

Disclaimer: This is not considered real estate investing advice in any way, shape, or form.

How to Calculate ROI for Rental Property Investments?

ROI = Net Annual Returns / Cost of Investment

For example, if an investment generates annual returns of $6,000 and the cost of the investment is $100,000, the ROI would be 6%:

ROI = $6,000 / $100,000 = 6%

What is a Good ROI for Rental Properties in 2023?

There is no one correct answer to this question, but we’ll provide a solution based on our experience with rental property investment. In most cases, a rental ROI of under 5% is not worth pursuing (unless there are other reasons to buy it besides ROI).

Returns between 5% and 10% are reasonable for rental properties if you’ve included conservative cushions for annual repairs, vacancy rate, etc. An ROI of over 10% is generally a good deal. Check how other real estate properties are performing in your area to get an idea of the expected return.

A good rule of thumb is to aim for at least $100-300 per unit in monthly cash flow. Otherwise, the time commitment of managing vacancies, tenant maintenance calls, and evictions will outweigh the returns.

How Can I Increase My Rental Property ROI?

If you’ve found that your real estate investment property violates any of these critical metrics, this may be a red flag that you should not proceed with your purchase. You can change some metrics and rerun the calculations to improve your property’s ROI. For example:

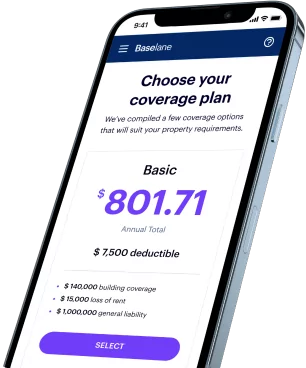

- Insurance: If you are conservatively estimating your property’s insurance costs, get a no-commitment quote to reduce your monthly insurance costs.

- Property management fees: If you’re using a property management company, consider reducing their service or nixing the service altogether to improve your profitability.

- Maintenance: Older properties tend to have more maintenance needs, but a detailed inspection can help you forecast your maintenance costs more accurately and implement preventative maintenance.

- Renovations: If you plan to renovate your property, consider reducing the scope to save costs or, conversely, increasing the scope so you can raise your monthly rent.

- Purchase price: Offering a lower purchase price will give you a better ROI.

- Mortgage: Use a mortgage calculator to determine whether you can reduce your monthly debt costs by refinancing, and be sure to negotiate so you can reduce the closing costs.

- Monthly rent: Perform a market analysis and revisit your estimated monthly rent to determine whether you can increase it to improve your ROI.

- Vacancy rate: A standard vacancy rate is 5% to 7%. Lowering this rate will increase your operating income and gross rent.

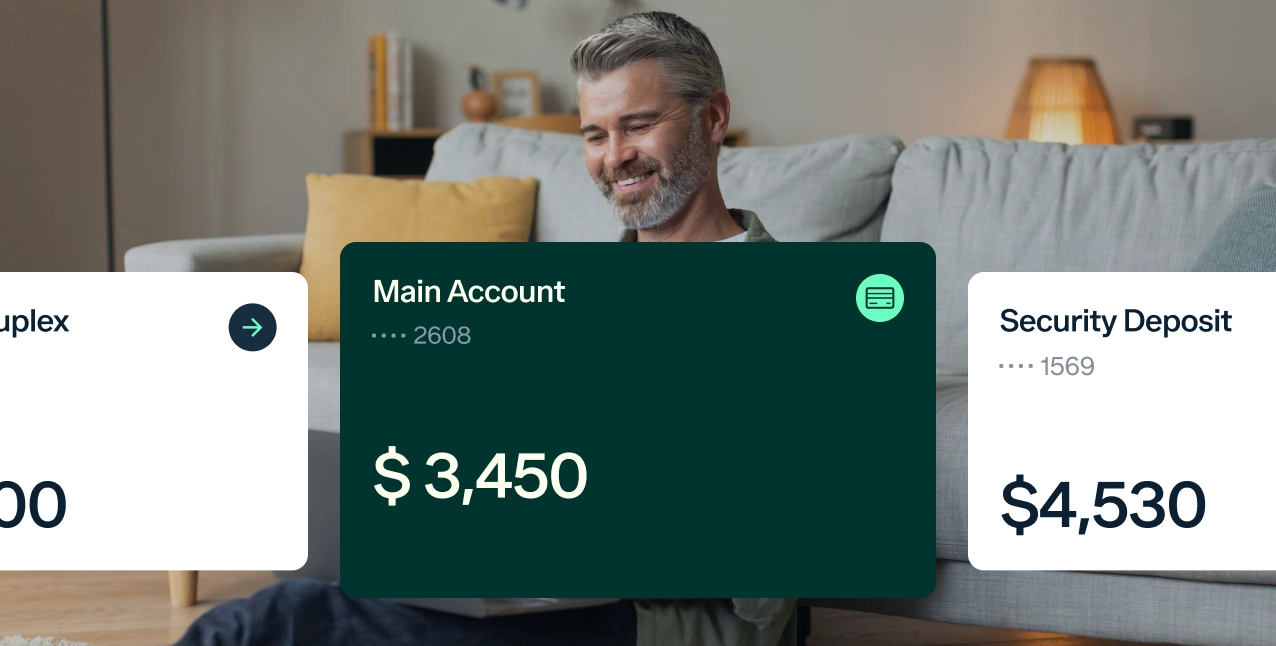

- Bookkeeping: Collect your rent through Baselane to monitor your property’s financials and increase your monthly income.