Although not mandatory in all states, creating a separate bank account for rental property transactions can simplify your finances and make tax time much easier.

This article will explain the benefits of maintaining separate bank accounts for your rental properties and offer step-by-step guidance on setting one up. If you’re unsure how to choose a bank that meets the needs of real estate investors, we’ll walk you through what to look for to simplify your finances and maximize returns.

Key takeaways

- A separate bank account for rental property simplifies financial organization by separating your business and personal finances.

- A business bank account for rental property finances demonstrates professionalism and enhances credibility with investors, lenders, and tenants.

- The number of separate accounts depends on factors like legal structure, number of properties, and state requirements.

- Baselane banking includes unlimited accounts per property, automated expense tracking and preparing financial reports, online rent collection, plus other key features for real estate investors and landlords all without any monthly fees or minimum balance requirements.

Compare the best banks for real estate investing.

Compare the top 10 best banks for real estate investing.

Benefits of Having a Separate Bank Account for Your Rental Property

Using a rental property business checking account to keep personal and business finances separate can help you stay organized and improve operational efficiency. Understanding the differences between a business vs personal bank account is crucial, as a business account for real estate offers features tailored to managing rental income, expenses, and financial reporting.

Prevents commingling funds

Commingling occurs when personal and business funds are mixed. For example, if you deposit rent payments into your personal account and use that same account for personal expenses, it becomes hard to tell which funds are for business and which are for personal use. Learning how to separate money in bank account setups is essential for accurate income and expense tracking, proper tax reporting, and avoiding potential legal issues during an audit.

A separate business checking account prevents comingling and ensures a clear separation between your personal finances and rental income and expenses. When combined with proper property management escrow practices, it also simplifies bookkeeping and tax preparation.

In certain states, mixing business and personal funds can result in a fine. When dealing with tenant rental security deposits, most states require landlords to have a separate bank account to hold deposits (sometimes called an escrow account). Learn more about how to open an escrow account for security deposits.

Protects personal assets

If you’re involved in a legal dispute with your tenant or any other individual (i.e., lawsuit), having a separate company (e.g., LLC) and business bank accounts for real estate business finances can help shield your personal assets from liability.

Let’s say your tenant files a lawsuit for an injury that occurred on your property. If you have a commingled bank account, then your personal funds could be used to pay a judgment. A separate business bank account for landlords funds establishes a clear distinction to safeguard your savings, investments, and other personal property from legal issues related to your rental business.

A separate bank account for your rental property can also be helpful during financial difficulties. It prevents issues like insufficient rental income or unexpected repair costs from affecting your personal finances, which is especially important if you have debts tied to the property. This separation helps protect your personal credit and financial standing.

Simplifies rental property accounting

A dedicated account for your rental property makes tracking income and expenses much easier. Instead of sorting through transactions in a single account for expenses and rent payments, all the transactions in the separate business bank account belong to the property, so you can easily track your cash flow and generate reports.

Reduces tax preparation time

A separate bank account for landlords provides a clear and organized record of your rental income and expenses. This simplifies the process of identifying landlord tax deductions that you may otherwise miss in a commingled account, such as:

- Repair and maintenance costs

- Property management fees

- Mortgage interest

- Property taxes

- Insurance payments

When it’s time to file your taxes, you’ll have all the necessary information readily available to prepare financial statements.

Supports scalability and financing

As your real estate portfolio grows, separate bank accounts become even more critical for maintaining organized finances and efficiently managing multiple properties. A separate account for each property can help you track the performance of each investment individually and make informed decisions about your overall portfolio.

When it’s time to apply for financing, lenders typically want to see clear and organized financials showing your rental property’s performance. A dedicated account provides straightforward documentation. You can quickly gather bank statements and transaction histories that demonstrate your cash flow for lenders to assess your financial stability.

Streamlines employee payroll and vendor payments

If your business entity has employees, such as property managers or maintenance staff, a dedicated online business checking account can help you manage payroll. You can set up direct deposit for employees, track payroll expenses, and generate reports for tax purposes.

Additionally, if you regularly pay for services related to your rental property, like landscaping, plumbing, or electrical work, a separate business checking account simplifies vendor payments. You can issue checks or electronic payments, maintain a record of all vendor transactions, and reconcile expenses for accounting.

Enhances credibility

Maintaining separate bank accounts demonstrates professionalism and financial responsibility to potential real estate investors, lenders, and tenants. It shows investors that you’re serious about your business and follow sound financial practices.

Similarly, lenders may view landlords with separate accounts as lower risk borrowers, potentially leading to more favorable loan terms and interest rates. It also builds trust with tenants by assuring them that their security deposits are handled securely and separately.

Offers potential rewards and extra features

A business account for rental property owners often comes with added perks like cashback or discounts at home improvement stores. Look for a landlord-friendly bank that offers multiple accounts per property, virtual cards for rent tracking, and strong savings options. As you explore how to open a high yield savings account, prioritize banks that offer competitive interest rates with little to no fees for maintenance, minimum balances, or opening new accounts.

Understanding how to avoid bank fees is a key part of selecting the right banking partner, especially as you grow your rental business.

Check out our guide to compare features and pricing of the best banks for real estate investors.

Open unlimited accounts for properties and security deposits with no monthly fees.

How many separate bank accounts for rental property should you have?

Depending on how your business is structured, you can open one business no-fee checking account or many.

Factors to consider:

- Entity legal structure: Sole proprietor, LLC, Corporation.

- Number of entities: Single entity vs. multiple entities.

- Number of properties: One rental property vs. many rental properties.

- Geography: Are your rentals in one state or multiple?

- Security deposit: Are you required to open a separate non-operational bank account?

Generally speaking, for landlords with one rental property, having one business bank account for income and expense tracking makes sense. Multiple accounts can work for larger portfolios, so long as you structure them up properly.

The best bank account for rental property finances will allow you to open one main account and several virtual accounts for each property, like Baselane.

Examples of sub-accounts could be:

- Operating expenses: Used to pay property management fees, property taxes, utilities, mortgage and insurance payments, and other rental property operating expenses.

- Maintenance reserve account: Used to set aside funds for routine maintenance, emergency repairs, and capital improvements.

- Security deposits: Used to hold security deposits separately for each tenant or property, depending on state regulations.

Baselane lets you open unlimited accounts per property to easily organize, manage, and track your cash flow at a property and portfolio level.

How to open a Baselane banking account for rental property finances?

Opening a Baselane banking account for landlords only takes a few minutes. If you’re learning how to structure rental property bank account setups, follow these steps to set up a business bank account for your rental property.

Step 1

Start by signing up for a free Baselane account.

Step 2

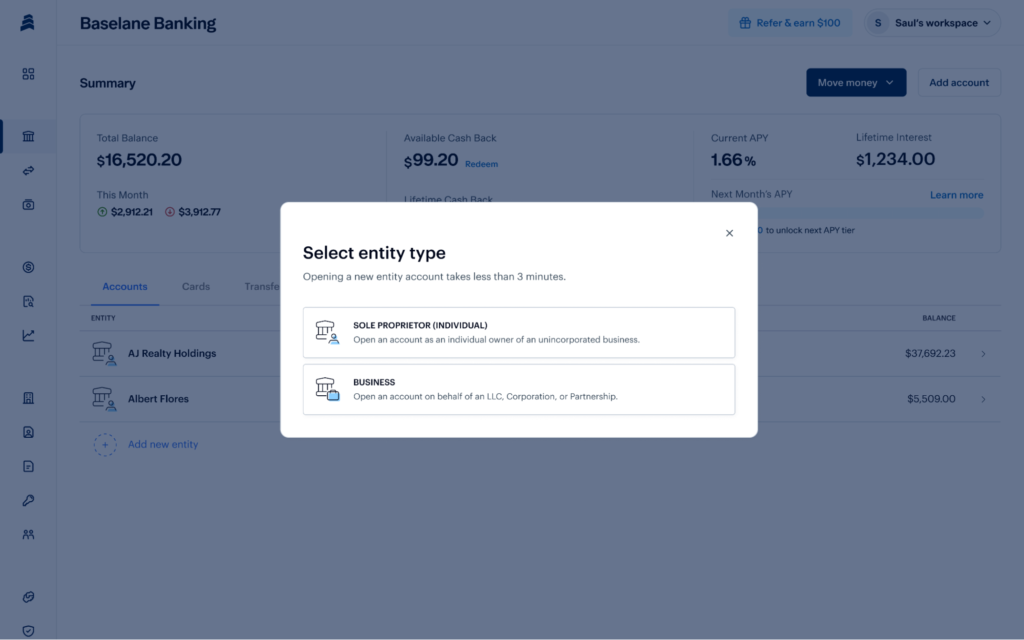

Once logged in, click ‘Add Account’ as an individual (sole proprietor) or as a business (LLC, corporation, or partnership). You’ll be asked to provide documents for identity verification. For a business account for real estate, you must be registered in the U.S. and provide your EIN.

Step 3

Set up a virtual checking or savings account. Checking accounts are made for collecting rent and managing day-to-day finances. High-yield online savings accounts are ideal for earning interest on security deposits or cash reserves.

Bottom line

Opening a separate business checking account for your property is an easy way to stay on top of rental finances, but watch out for bank fees. You’ll likely need to pay extra for each account and maintain a minimum balance.

With Baselane, you can open unlimited accounts per property for all your entities without any monthly fees or minimum balance requirements while earning cash back and a high yield on savings deposits. All your transactions are auto-tagged to a specific property or unit for effortless tax reporting. Plus, you can collect rent online, e-sign leases, screen tenants, and more, all in one place.

Ready for banking that manages real estate finances for you? Get started for free today.

Banking built for real estate

- Multiple accounts per property

- No monthly fees or minimum balances

- Earn up to 3.35% APY2

Don't miss these

How to Calculate & Track Rental Property Operating Expenses

Calculating your rental property operating expenses starts with understanding these costs. While it may seem like every cost associated with your rental is...

1 June 2023

10 Tax Deductions You Can Claim as a Landlord

Having to pay tax on your rental property income is one of the frustrations of being a landlord. Fortunately, you can deduct most of your expenses from you...

4 February 2022

12 Best Accounting Software for Rental Properties

Owning rental properties requires careful attention to finances. From tracking income and expenses to generating tax reports, efficient financial managemen...

18 December 2024