Owning multiple rental properties comes with big opportunities—and big tax questions. One of the trickiest is depreciation recapture: the tax you pay on the depreciation you’ve already claimed when you sell. Understanding how it works and how it applies across a portfolio can save you thousands and help you plan smarter.

In this guide, we’ll discuss how to calculate, report, and manage depreciation recapture for multiple properties, along with expert tips to minimize the tax amount.

Key takeaways

- Depreciation recapture is real and unavoidable. Every dollar you’ve deducted as depreciation during ownership becomes taxable when you sell the property.

- Separate recapture from capital gains. Profits from property sales are split into two buckets: depreciation recapture (treated differently for tax purposes) and long-term capital gains.

- Calculate per property, then combine. Calculate depreciation recapture for each property and then combine the recapture and remaining gains across your portfolio to see the full tax impact.

- Plan strategically to minimize taxes. Spreading sales, using 1031 exchanges, leveraging losses, or holding properties long-term are all proven ways to reduce or defer recapture, especially when managing multiple properties.

- Keep detailed, organized records. Track purchase prices, improvements, depreciation (split by property type), adjusted basis, and sale proceeds for each property. Accurate records make reporting on Form 4797 and Schedule D much easier and protect you during audits.

What is depreciation recapture?

Depreciation recapture is an important tax concept and is the IRS’s way of “clawing back” the tax benefit you received from deducting depreciation during the years you owned a property. Every time you deduct depreciation on rental properties, you lower your taxable income. That’s great while you’re holding a property, but when you sell, the IRS wants some of that back.

As depreciation deductions are temporary tax benefits, not permanent exclusions, the IRS calculates tax rates based on two things

- Property’s original cost basis, reduced by accumulated depreciation

- Property sale price

Suppose you bought a rental property for $200,000 and claimed $50,000 in depreciation over 10 years. If you sell the property for $250,000, part of that $50,000 in depreciation is taxed separately from your regular capital gains.

Depreciation recapture converts the portion of your gain attributable to depreciation into a taxable event, taxed at a different rate than capital gains.

Depreciation recapture vs capital gains tax

The IRS splits the profit from a rental property sale into two buckets, both of which are taxed differently.

Real estate depreciation recapture tax applies specifically to the portion of the gain that represents the depreciation deductions you claimed (or could have claimed) during ownership.

Capital gains tax applies to any remaining gain above the original purchase price (after depreciation is accounted for). This portion is taxed at long-term capital gains rates if the property was held for more than one year.

For example, if you bought a property for $300,000, took $50,000 in depreciation, and sold it for $400,000, your total gain is $150,000. However, that gain is split into two buckets: $100,000 is true appreciation (capital gain), and $50,000 is depreciation recapture.

Separating these two types of tax early is critical because each is calculated differently, taxed differently, and influenced by different planning strategies. Learn more about landlord tax deductions.

How to calculate depreciation recapture tax rate for multi-property portfolios

You always calculate rental depreciation recapture tax rate property-by-property, then sum across the portfolio in the year of sale, so “multiple properties” mainly affects how many separate recapture calculations you’re doing and how the totals hit your return and rate brackets.

Step 1: Determine adjusted basis

The adjusted basis is your “cost” in the eyes of the IRS after accounting for improvements and depreciation. This helps you calculate the total capital gain on the sale to ensure accurate tax deductions.

Adjusted basis = Original cost (building + eligible improvements, excluding land) + capital improvements − total depreciation taken to date

Tips to get this step right:

- Track each property separately.

- Include all eligible capital improvements.

- Exclude land because it is not depreciable.

- Keep track of rental property deductions for each asset to ensure accurate calculations.

Step 2: Calculate total gain on sale

The total gain is the amount of money you make from selling a property before taxes.

Total gain = Net sale price (after selling costs) − Adjusted basis

Note: Net sale price should account for commissions, legal fees, and other selling costs.

Step 3: Split gain into depreciation recapture and remaining gain

Section 1250 property (Building/structural)

1250 property includes the building and structural components of a rental property. The IRS taxes only the portion of gain that comes from depreciation on these assets—not the full profit from the sale.

The section 1250 depreciation recapture tax rate is 25%. Any profit above the depreciation is taxed separately as a long-term capital gain at the standard rate. By separating these two parts, you can clearly see which portion of your sale is taxed as recapture and which portion is taxed as a regular gain.

Multi-property impact:

- Perform this calculation for each property individually.

- Sum all 1250 recapture amounts to get the total unrecaptured gain.

- Sum all remaining long-term gains across properties to see your net capital gain.

- Large combined recapture can push more income into higher marginal brackets, even though 1250 recapture itself is capped at 25%.

- Losses or low-gain sales on some properties do not offset recapture from others.

Section 1245 property (Personal property/cost segregation)

1245 property includes personal property such as appliances, carpeting, tenant improvements, or other cost-segregated assets.

You pay tax only on the depreciation you claimed for these items, up to the gain you make from them, and it is taxed at your ordinary income rate. Anything above that depreciation is treated under the 1250 rules.

Multi-property impact:

- Calculate 1245 recapture for all qualifying assets per property.

- Sum all 1245 recaptures across properties separately from the 1250 recapture.

- Remaining building gain falls under the 1250 rules as outlined above.

Check the example below to see how depreciation recapture is taxed when you sell multiple properties in the same year.

How to report depreciation recapture on your tax return

The rental property depreciation recapture tax rate is reported on Form 4797 (Sales of Business Property). After you calculate recapture for all your properties, any remaining profit counts as long-term capital gain and goes on Schedule D. Make sure to add all long-term gains to see your total tax impact. Consider using real estate tax software or AI based accounting software to simplify Form 4797 reporting across multiple properties.

Keep clear records for every property

For each property, note:

- Original purchase price

- Capital improvements

- Depreciation claimed (split by 1250 vs 1245)

- Adjusted basis

- Net sale price

- Depreciation recapture and remaining LTCG

Having this information organized adequately by property makes completing Form 4797 and Schedule D much easier and ensures that all recapture calculations are accurate. You can also explore accounting software for real estate management or online rental property accounting software to centralize your data.

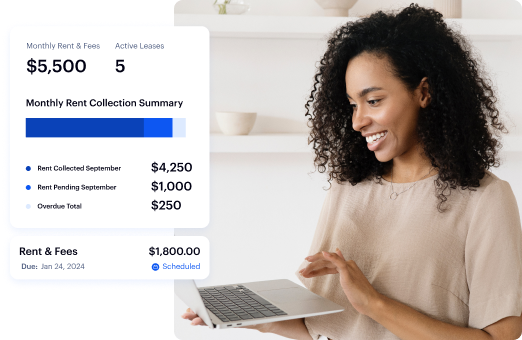

Baselane is the best option as it makes tracking easier by syncing all bank/credit transactions and tagging each line item to a property and category, including integrated Baselane banking if you use it.

When you sell multiple properties in a year, you can pull separate exports for each asset instead of untangling them from one big generic account. Because transactions flow through the same system, you get a downloadable “tax package” (income statements, ledgers, receipts) and send it to your CPA or invite him to Baselane through shared access. That keeps you focused on structuring sales, 1031s, or timing decisions rather than reconstructing years of books.

How to minimize depreciation recapture tax

While you cannot simply ignore tax on depreciation recapture, you can manage when and how you pay it. The IRS provides several legal avenues to defer or even eliminate this tax, allowing you to keep more of your equity working for you.

Stagger property sales over multiple years

Selling several properties in the same year can push your income into higher tax brackets, especially for 1245 recapture taxed at ordinary income rates. By spacing sales out, you can spread the tax liability and avoid large spikes in your overall tax bill.

Defer taxes with a 1031 Exchange

Use a 1031 exchange to roll the proceeds from one property into another similar property. This lets you defer both capital gains and depreciation recapture taxes. Take a good look at your portfolio and decide which properties to exchange, focusing on those with the highest 1250 or 1245 recapture to maximize deferral. See our guide on how does a 1031 exchange work to plan your property swaps effectively

Offset gains by using losses from other properties

If some of your properties sell at a loss, you can use those losses to offset gains on other properties with high depreciation recapture. Keeping detailed, property-by-property records ensures you know exactly where the offsets apply and how much you can reduce your overall tax.

Eliminate recapture by holding property until death

Holding property until you pass away allows your heirs to inherit it with a “stepped-up” basis at fair market value. This effectively wipes out accumulated depreciation recapture and capital gains tax, letting your heirs sell the property with little to no tax impact.

Reduce capital gains by converting to a primary residence

If you convert a rental property into your main home and live there for at least two of the five years before selling, you may qualify for the Section 121 exclusion ($250,000 for singles, $500,000 for couples). Note: this applies to capital gains, but the depreciation portion is still subject to recapture taxes.

Sell other investments at a loss to manage your tax bracket

You can strategically sell other investments that have lost value to offset gains from property sales. While this primarily affects capital gains, it can help reduce your overall taxable income and indirectly manage the impact of depreciation recapture.

Invest gains in qualified opportunity funds (QOFs)

Placing capital gains into a Qualified Opportunity Fund can defer taxes on the gains until the end of 2026 or until the fund interest is sold. This mainly applies to capital gains, not depreciation recapture, but it gives you liquidity and time to plan, while deferring some taxes on your portfolio gains.

Combine these strategies with rental property accounting tips for overall portfolio efficiency.

Common depreciation recapture myths debunked

Depreciation can be confusing, and getting it wrong can be costly. Let’s clear up the most common myths:

- Myth: "If I don't claim depreciation, I don’t have to pay recapture." The IRS taxes depreciation that was allowed or allowable, even if you didn’t claim it. If you missed it, you might need to file Form 3115 to catch up before selling.

- Myth: "Recapture depreciation tax rate is always 25%." 25% tax rate on recaptured depreciation only applies to 1250 properties. Your actual rate can be lower if your ordinary income bracket is lower. For 1245 property, recapture is taxed at your ordinary income rate, which can go up to 37%.

- Myth: "Depreciation hurts my property's value." Depreciation is just a paper loss for taxes—it doesn’t affect market value. Real estate usually appreciates over time, so the loss on your taxes is purely accounting, not a reflection of the property itself.

Take control of depreciation recapture across your portfolio

Depreciation recapture can get complicated with a growing portfolio. The key is to calculate it property by property, track your assets carefully, and time your sales strategically. By using Baselane to organize property records across your portfolio to pull individual reports on time and think ahead, you can turn depreciation recapture from a complicated tax obligation into a manageable part of your real estate strategy. Get started with Baselane today!

FAQs

Is depreciation recapture subject to the net investment income tax?

Yes, for higher-income earners, the gain from the sale of a rental property, including depreciation recapture, is generally considered investment income. It may be subject to the 3.8% Net Investment Income Tax (NIIT) if your modified adjusted gross income exceeds the statutory thresholds ($200k for single, $250k for married filing jointly).

Is depreciation recapture subject to self-employment tax?

Generally, no. Rental income and the gain from the sale of rental property are considered passive income and are typically not subject to self-employment tax. For short-term rentals, check the vacation rental tax rules to understand recapture implications.

How do I avoid depreciation recapture tax on rental property?

The most effective way to defer depreciation recapture tax is through a 1031 exchange, which allows you to reinvest proceeds into a like-kind property. Alternatively, holding the property until death provides a "step-up in basis" for heirs, effectively eliminating the recapture liability.

Can I just not claim depreciation to avoid the tax?

No, this is not a valid strategy. The IRS requires you to pay recapture tax on the depreciation that was "allowed or allowable." This means you owe the tax based on what you should have claimed, even if you never deducted it on your tax returns.

Does depreciation recapture apply if I lost money overall?

Yes, even if you sell property at a net loss overall, depreciation recapture still applies to the portion of gain attributable to depreciation on individual assets, because RS taxes the depreciation you’ve claimed regardless of the overall profit or loss. To reduce the impact, you can combine losses from other properties, deduct mortgage interest, and apply other strategies for how to pay no taxes on rental income.

Does depreciation recapture apply to inherited property?

No. When property is inherited, the cost basis is “stepped up” to the fair market value at the date of death. This effectively wipes out any depreciation recapture liability for the heirs. However, any deductions such as mortgage interest on rental property claimed before the inheritance may still influence ongoing rental reporting if the heirs keep the property as a rental.

.jpg)

.jpg)