You know the feeling: the mounting stress as tax season approaches, juggling multiple bank accounts, and painstakingly sifting through spreadsheets to categorize every expense.

You want to focus on growing your portfolio, but the financial busywork keeps pulling you back into the weeds.

The truth is, generic accounting tools or infamous spreadsheets weren't built for rental properties. They lack the real estate specific categories, reporting, and integration you need to maximize deductions and truly take in your cash flow.

A landlord accounting and bookkeeping software is the key to turning financial chaos into crystal clear profitability. It’s the difference between guessing your property’s true performance and knowing exactly "how much money am I making per door?".

This definitive guide compares the top platforms, highlighting essential features to help you choose the right software to save time and increase passive income.

Key takeaways

- Common accounting software like QuickBooks or Xero requires manual customization for rental categories, costing you time and increasing the risk of missing valuable Schedule E deductions.

- The best solutions offer automated transaction tagging by property and Internal Revenue Service (IRS) Schedule E category, turning hours of monthly bookkeeping into a few clicks.

- A platform that seamlessly links banking, rent collection, and bookkeeping into one consolidated ledger eliminates manual data entry, disconnected accounts, and data lag, providing a single source of truth for your finances.

- The ideal software for independent landlords and investors offers an all-in-one solution with unlimited accounts, automated bookkeeping, and zero hidden fees, designed to simplify your financial life and maximize your returns.

Benefits of using a dedicated accounting and bookkeeping software

As your portfolio grows, managing finances across multiple units and entities becomes a significant time sink. A specialized accounting and bookkeeping software immediately addresses your primary pain points, delivering three core benefits:

- Dedicated software automates transaction synchronization, tagging, and receipt capture, drastically reducing the time you spend on administrative tasks and freeing you up to focus on sourcing new deals.

- Property-focused tools generate real estate-specific financial reports, like Net Cash Flow statements and detailed property performance insights. This granular level of detail ensures you know the exact performance of every door, empowering you to make smarter financial decisions.

- Rental bookkeeping software uses real estate-specific categories based on Schedule E, ensuring accurate categorization and generating a tax-ready package with a single click. This simplification saves time for both you and your accountant.

General accounting software vs. landlord focused bookkeeping software

The most significant difference between general accounting software and landlord-focused platforms is a fundamental alignment with the real estate industry's unique financial structure.

While you can use (and a lot of first-time investors do) general solutions like QuickBooks or Xero, they are designed to cover a broad spectrum of small businesses, not specifically rental properties.

- QuickBooks is the preferred software for many accountants. However, as a landlord, you will need to spend significant time manually setting up the correct rental income and expense categories (over 120 of them) for Schedule E compliance. Furthermore, it often requires manual data imports or constant re-syncing of external accounts, which is a significant administrative burden.

- Xero offers robust general accounting features but lacks the specialized, integrated functions landlords need. It does not natively support multi-property segregation or automatically categorize transactions to rental-specific tax lines, forcing you back into the frustrating world of manual data entry and complex setups.

In short, using QuickBooks or Xero means you become the bookkeeper and the integrator, whereas real estate focused accounting software does that heavy lifting for you.

Key features to look for in an accounting and bookkeeping software

When evaluating your options for 2026, focus on software that directly addresses your core need: simplifying real estate finance to maximize your returns.

- Automated transaction categorization: Look for platforms that offer automated income and expenses tagging to a specific property and its corresponding Schedule E category. This eliminates the need for manual categorization and reduces the risk of errors.

- Real estate-specific reporting: The software should offer comprehensive reports beyond a basic profit and loss statement. Essential reports include:

- Income and Expense statements

- Net Cash Flow statements

- Property Performance reports

- Schedule E tax reports (automatically generated)

- Consolidated financial ledger: Choose a platform that automatically syncs and tracks transactions from all your banking sources—both internal (if they offer banking) and external bank accounts and cards. This prevents lost transactions and disconnected data feeds.

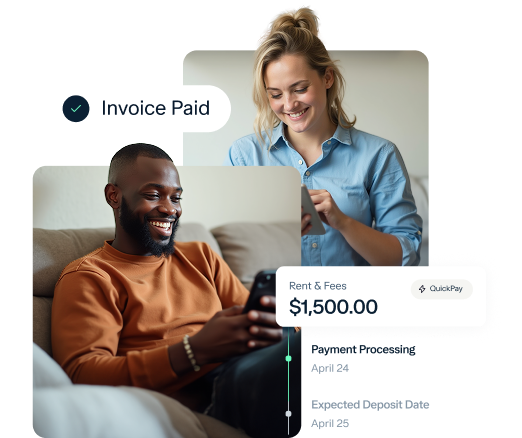

- Integrated rent collection: Check if the software offer both rent collection and accounting. When a tenant pays rent, the transaction should be instantly categorized as rental income, tagged to the correct property, and deposited into your account without any manual reconciliation.

- Support for multiple accounts & properties: Check if the platform helps you create separate bank accounts for your rental property, operating expenses, security deposits, and maintenance reserves for each property or unit. Look for unlimited, free sub-accounts or virtual accounts.

7 best picks for accounting and bookkeeping software

Here is a comparison of the top choices for landlord accounting and bookkeeping software in 2026.

Baselane

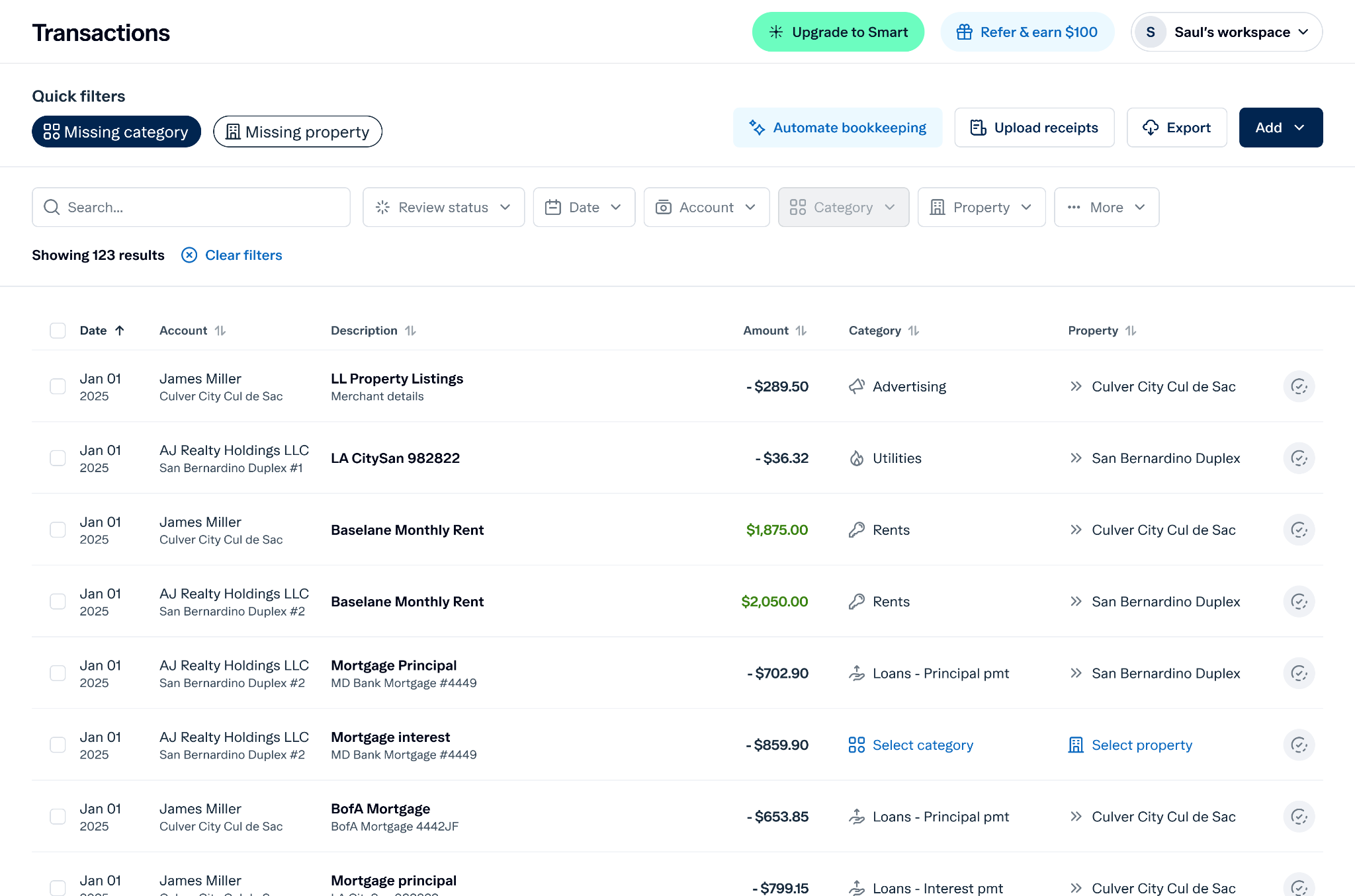

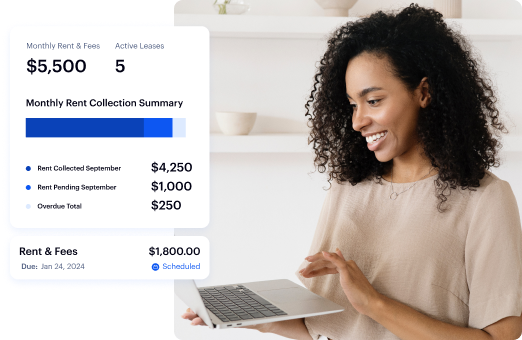

Baselane is an all-in-one integrated banking and bookeeping platform for real estate investors and landlords growing or scaling their rental portfolio of 10+ units. We offer income and expense tracking, auto-tagging to Schedule E categories, and generate tax packages and cash flow statements. All the features help you automate the bookkeeping side of your business so that you can focus on growing your rental business.

Key features

- Auto-tagging: All transactions are instantly categorized to the correct property and its specific Schedule E line.

- Automated bookkeeping: Create custom rules to tag incoming or outgoing transactions to a category or property.

- Integrated banking: Open as many checking and savings virtual accounts as you need—one for each property, unit, and security deposit.

- Shared access: Collaborate with property managers, bookkeepers, and CPAs securely.

- Online rent collection: Collect rent via ACH or card ($2 ACH fee only when not depositing directly to Baselane), set up auto-pay for tenants, and receive direct deposits within 2-5 business days.

- Schedule E tax package: Generate and export customizable tax package that includes an income statement, transaction ledger, and captured receipts to hand directly to your Certified Public Accountant (CPA).

Baselane has been great for me. I was struggling to find a platform and approach for accounting and bookkeeping. I either had to pay someone or figure out all the advanced features of other software. Baselane helped bring together all of my activities in one (bookkeeping for short-term rental, long-term rental, rent collection, and banking) and has significantly improved things for me! ~ Dante Myers

Pros and cons

Pricing

Baselane has two pricing plans. You can get access to core accounting features by using our free plan at no monthly fees or minimum balance. To unlock advanced transaction auto-tagging, 2-day rent deposits, shared access, and auto-recent receipts, we oiffer Baselane Smart at $20/mo.

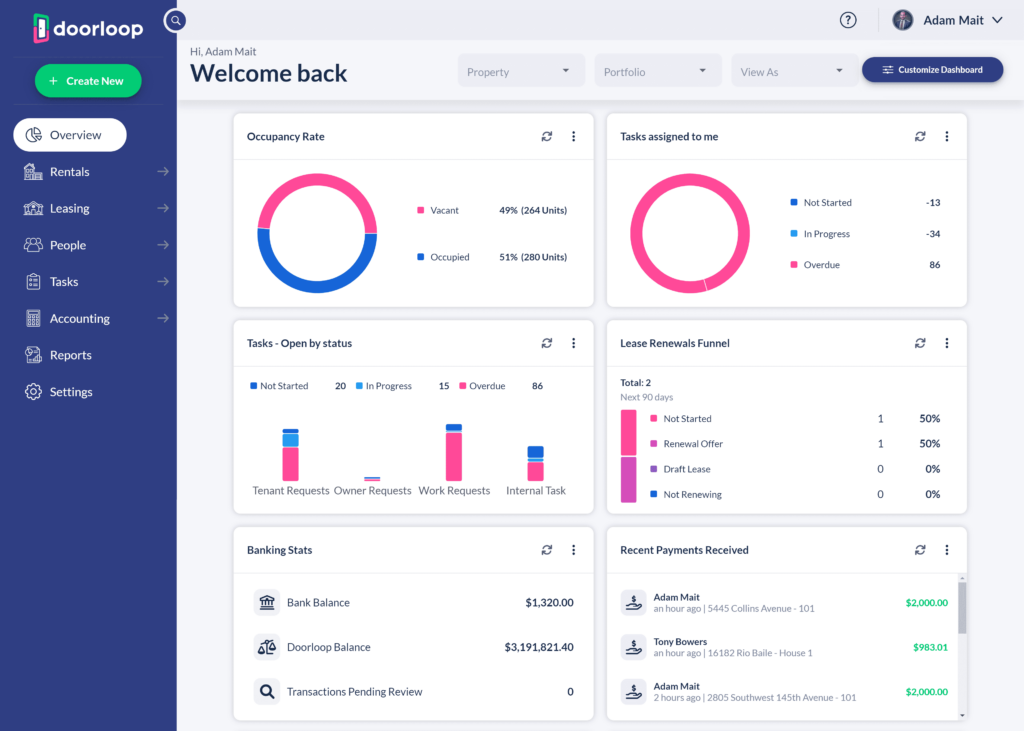

DoorLoop

DoorLoop is a property management software with comprehensive accounting features, making it a strong option for landlords and managers who need full accounts payable and receivable functionality. It’s built to centralize maintenance management, leasing, and financial reporting.

Key features

- Accounting and reporting: Includes features for managing accounts payable/receivable across multiple portfolios and entities.

- Bank connect and reconciliation: Sync bank accounts for secure reconciliation and matching of bank transactions with internal records.

- QuickBooks online sync: One-way sync to send income and expense transactions to QuickBooks Online.

Pros and cons

Pricing

Starts at $69/month for 1 unit. There’s no free plan or trial offered.

Buildium

Buildium offers property management, accounting, and tenant communication tools. Its rental property bookkeeping software includes bill payments, real estate balance sheets, and expense categorization. It’s one of the more expensive options on this list, making it less suitable for smaller or budget-conscious landlords.

Key features

- Built-in accounting: Offers templates and drop-down menus to simplify entering revenue and expenses for different property types, including community associations.

- Vendor and owner payment management: Collect rent and pay vendors/owners in one place, creating a clear record of each transaction.

- Rent collection: Automates rent collection, helping to reduce manual tasks and improve cash flow.

Pros and cons

Pricing

Starts at $62/month with a 14-day free trial.

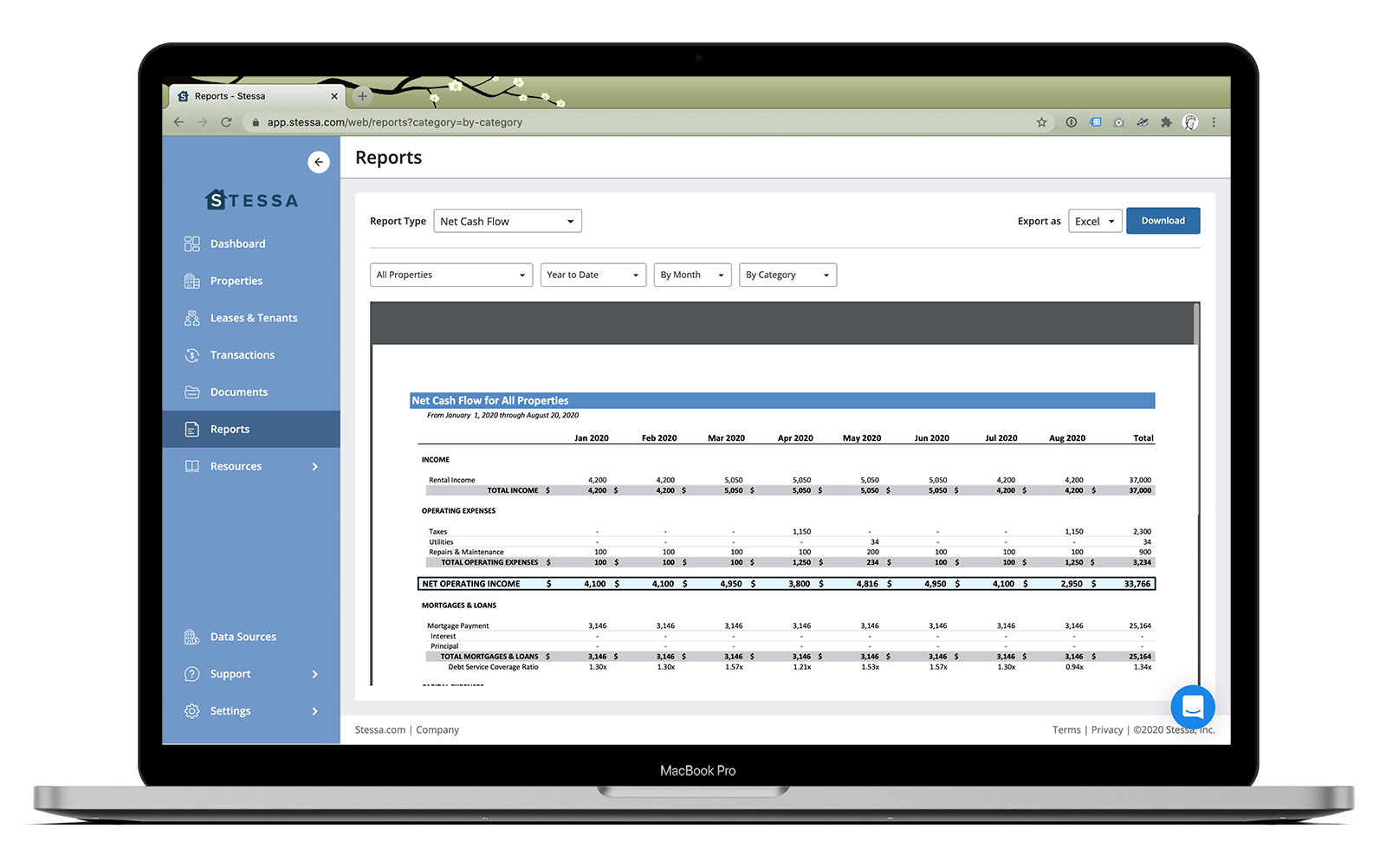

Stessa

Stessa includes essential accounting features for expense tracking, tax preparation, and single-entry bookkeeping. It helps you manage your accounts without manual hassle. But, you’ll have to pay for the Pro plan to get reports for budgeting and pro-froma analysis, expense tracking, and capital expenditure reports as well as the tax package.

Key features

- Automated bank data feeds: Automatically imports and organizes transactions from unlimited bank accounts and cards, simplifying financial data collection.

- Reporting: Delivers a proper Income Statement, Net Cash Flow report, and Schedule of Real Estate Owned, moving beyond generic P&L statements.

- Accountant tax package: Provides a basic tax package on the free plan, with Schedule E reports included in the paid plans.

Pros and cons

Pricing

Stessa offers a free plan for tracking up to 10 properties. Paid plans start at $12/mo.

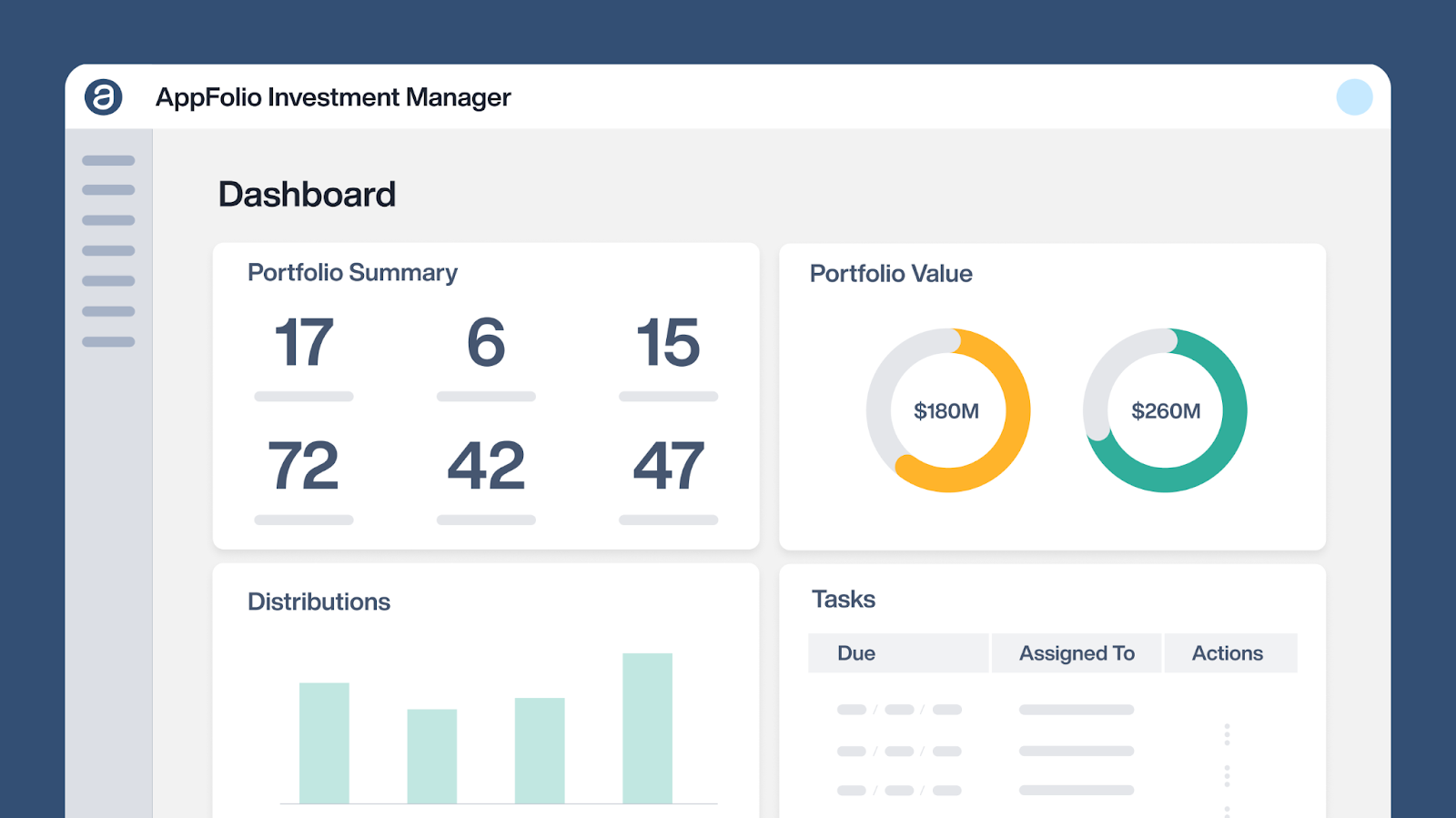

AppFolio

Appfolio is a property management platform with built-in tools for accounting, tenant management, and data analysis. You get customizable financial reports, automated invoices, and escrow accounts to manage security deposits. Since its pricing structure caters to larger portfolios, the platform is significantly more expensive than other options.

Key features

- Property accounting and reports: Advanced budgeting and configurable options for commercial assets in higher tiers.

- End-to-end marketing and leasing: Listing management, online applications, and tenant screening.

- Integrated communication: Text and email communications and mobile apps for residents, vendors, and owners.

Pros and cons

Pricing

Custom pricing and required minimum 50 units to get access to the starting plan.

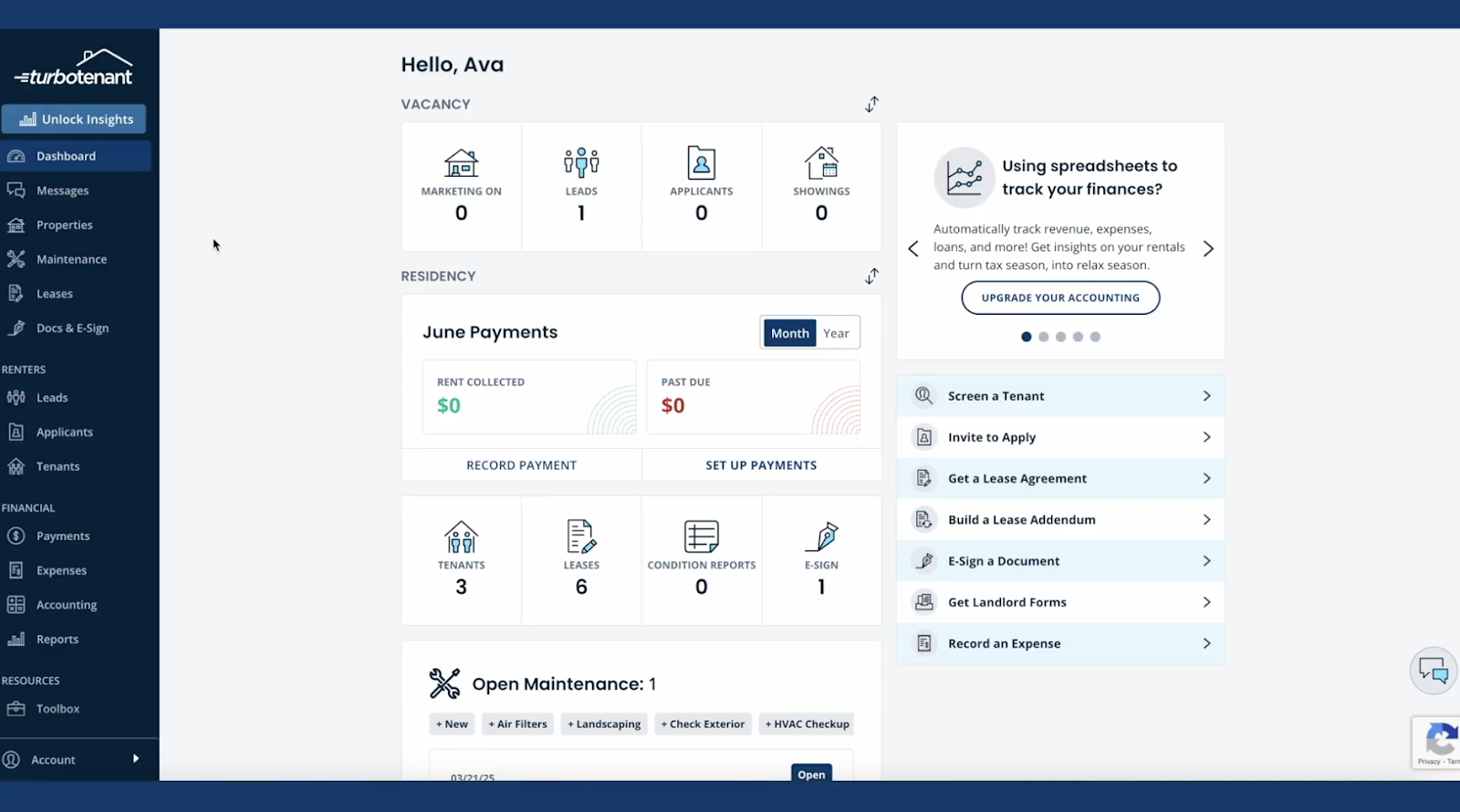

TurboTenant

TurboTenant is a property management platform that includes accounting features for financial report generation, bank account syncing, and automated rent payments.

Key features

- Owner portal: Gives owners access to track financial performance and reports.

- Accountant collaboration: Provides tools to share information with your accountant.

- Tax prep tools: Offers basic tools to help gather necessary tax-related information.

Pros and cons

Pricing

TurboTenant offers a free plan with basic accounting tools. Paid plan starts at $9.92/mo with a 14-day free trial.

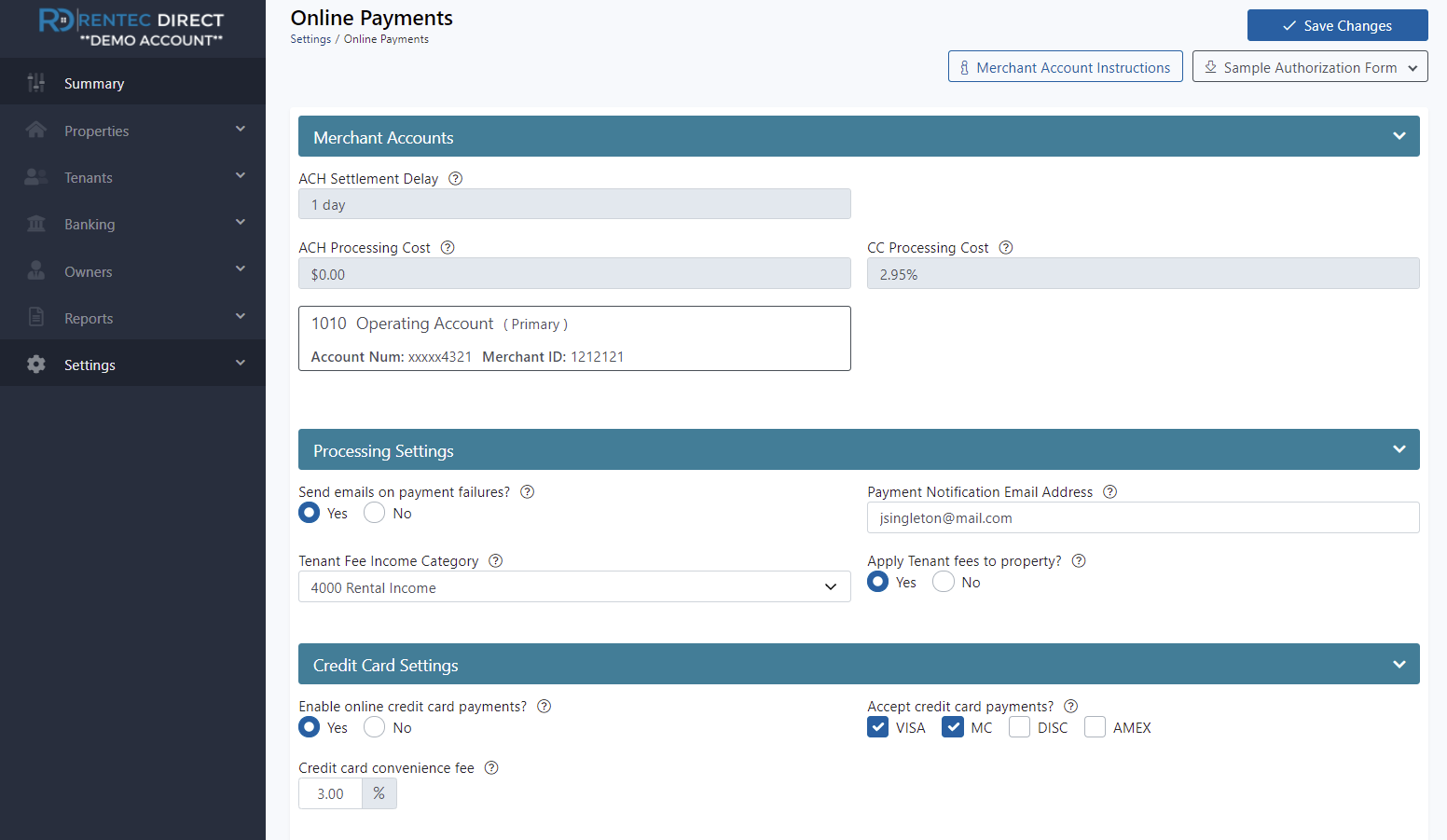

Rentec Direct

Rentec Direct is a property management platform that offers general bookkeeping software for rental property accounting. Those seeking more advanced features, like in-depth financial reporting or real-time data analysis, should use another tool.

Key features

- Online rent payments: Supports free Automated Clearing House (ACH) payments for tenants, with options for credit/debit cards and electronic cash payments.

- 1099 e-file and Schedule E tax reports: Includes key features for tax preparation, simplifying the process for landlords.

- Tenant portal and mobile app: Offers modern tools for residents to pay rent online and submit maintenance requests.

Pros and cons

Pricing

Starts at $45/month for 1 unit. Offers a 14-day free trial, no free plan.

Which is the right solution based on your portfolio size

The best accounting software for rental properties depends entirely on your current portfolio size, future growth goals, and desire for operational simplicity.

- For the 1–4 unit scaling investor: Baselane or Stessa are ideal. They offer free plans, auto-categorization to save you time, and the ability to cleanly separate your personal and rental finances, positioning you perfectly for growth.

- For the 5–25 unit established investor: Baselane is the top choice for centralized banking, unlimited organization, and integrated bookkeeping to efficiently manage your cash flow and retire early. DoorLoop is a good alternative if you need more advanced, manager-focused accounts payable features.

- For 25+ units, or specialized property managers: Buildium, AppFolio, or Rent Manager are your primary considerations. Be prepared for high setup fees, monthly minimums, and tiered pricing.

Manage your property accounts with Baselane

Manual bookkeeping and complex, disconnected financial tools are relics of the past.

Baselane is purpose-built to empower you to reduce the mental burden of managing finances manually by integrating all your financial workflows—banking, rent collection, and automated bookkeeping—into one platform.

Stop drowning in manual data entry. Get a financial partner that makes managing your rental property business easier, not harder. Open your account today with Baselane!

FAQs

What is landlord accounting software?

Landlord accounting software is a specialized tool designed to help real estate investors track rental income, categorize expenses, and manage the financial health of their properties. It automates bookkeeping tasks and generates reports specifically for tax purposes, such as the IRS Schedule E.

How is this different from regular accounting software?

Unlike general tools like QuickBooks, landlord-specific software is pre-configured for real estate. It includes features like property-level reporting, rent ledgers, and automated Schedule E tax package generation, which simplifies the unique financial management needs of rental property owners.

Can I use free landlord bookkeeping software?

Yes, several platforms offer powerful free bookkeeping software for landlords. These free tiers often include essential features like automated bank feeds, income and expense tracking, and basic financial reporting, providing a significant upgrade over manual spreadsheets.

.jpg)

.jpg)

.jpg)

.jpg)