As a sole proprietor, landlord or real estate investor, managing your property finances can feel overwhelming. You need efficient tools to track income, expenses, and tenant payments to ensure compliance and maximize your returns. Finding the right accounting software for sole proprietor landlords is crucial for simplifying these complex financial tasks.

This guide explores the best sole proprietorship accounting software options available for 2025, specifically tailored to your unique needs.

Key takeaways

- Specialized accounting software is vital for sole proprietors to manage rental income and expenses efficiently.

- Top software options offer features like bank integration, property-level tracking, and Schedule E reports.

- Baselane provides an integrated banking and bookkeeping platform, offering a free core service for landlords.

- Dedicated business bank accounts are essential for streamlining accounting and maintaining financial clarity.

- Many solutions offer free or low-cost plans, making professional bookkeeping accessible for sole proprietor businesses.

Why sole proprietors need dedicated accounting software

Managing rental properties as a sole proprietor means you are often responsible for every aspect of your business. This includes everything from finding tenants to handling all financial bookkeeping. Without proper tools, financial tracking can quickly become a manual, time-consuming effort.

A dedicated accounting software for sole proprietor businesses helps automate these tasks. It ensures accuracy, saves valuable time, and provides clear financial insights. This focus on efficiency allows you to concentrate on growing your real estate portfolio.

Specialized sole proprietor bookkeeping software can transform how you manage your finances. It moves you away from spreadsheets and towards a streamlined, organized system. This makes a significant difference for tax preparation and overall financial health.

Key features to look for in an accounting software for a real estate sole proprietorship

Your choice should align with your specific investment strategy and portfolio size.

Think about your current portfolio size and growth expectations. If you manage just a few units, a free accounting software might be sufficient. For larger or growing portfolios, scalability becomes critical, making paid options with advanced features more suitable. Consider how easily the software can adapt as you acquire more properties.

Then, evaluate accounting software based on the following must-have features.

- Automation: The software should integrate with your sole proprietor business bank account to import transactions. This reduces manual data entry and helps you record all financial activities.

- Receipt scanning and document management: Allows you to easily upload and store digital copies of receipts and important documents. This feature is invaluable for expense tracking and audit readiness.

- Tax support and Schedule E reporting: Generates comprehensive reports specifically designed for tax season, including the crucial Schedule E. This simplifies filing and ensures you capture all eligible deductions.

- Income and expense tracking by property: Enables you to track financial performance for each individual property. This granular data helps assess profitability and make informed decisions.

- Security deposit management: Provides clear tracking of tenant security deposits, ensuring compliance with state and local regulations. It separates these funds from operational income for better financial clarity.

- Mobile access: Offers convenient management of your finances on the go, allowing you to record expenses or check payment statuses from anywhere. This flexibility supports busy landlords and investors.

Our best picks: 6 accounting software for sole proprietor landlords

The market offers several strong contenders for the best sole proprietor accounting software in 2025. Each platform provides unique benefits, catering to different needs and portfolio sizes.

Baselane

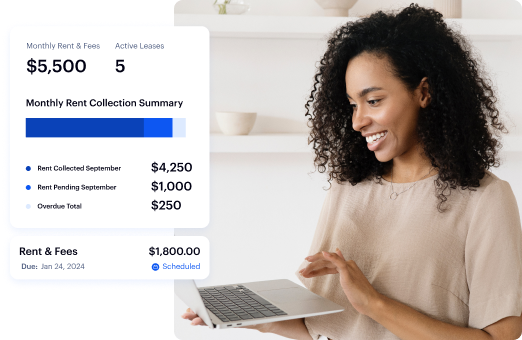

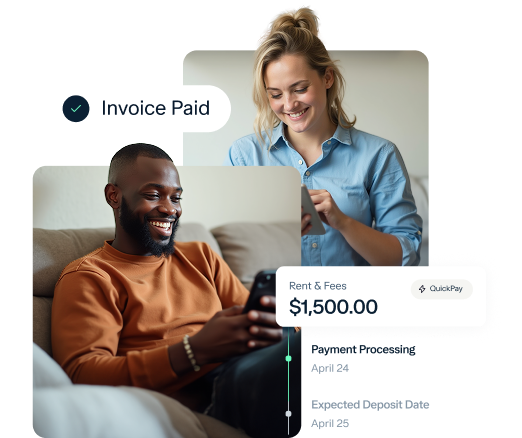

Baselane offers a full-fledged banking solution for real estate investors and landlords. It means you can not only organize your rental property books but also open a bank account and keep track of cash flow across all your properties.

Key features

- Automated Schedule E Reporting: Auto-tags all transactions by property and the IRS's Schedule E category.

- Unlimited Virtual Accounts: Allows organization of funds by property, unit, or security deposit without needing multiple separate banks.

- Consolidated Ledger: Automatically syncs all transactions (from both Baselane and external accounts) into one ledger for real-time cash flow analysis.

Pricing

Baselane is free to use, but we do offer a $20 Baselane Smart plan. This plan offers faster payment processing, automation rules, and AI categorization.

Stessa

Stessa offers a powerful free core plan, specifically focused on real estate investors, allowing landlords to manage an unlimited number of properties without cost. It is a leading free online accounting software option well-suited for DIY and small to mid-sized portfolios.

Key features

- Automated Income/Expense Tracking: Automates income and expense tracking by linking bank and mortgage accounts.

- Tax-Ready Reports: Generates necessary reports for tax filing, including Schedule E and depreciation reports.

- Portfolio Performance Metrics: Provides real-time dashboards to visualize critical metrics like cash flow and net operating income (NOI) across the portfolio.

Pricing

Offers a robust free core plan; upgrades are available for more advanced features.

Landlord Studio

Landlord Studio is highly regarded for its mobile-first design and straightforward financial tracking, making it an excellent choice for landlords who manage properties on the go. Its platform simplifies daily tasks and keeps your financial data organized.

Key features

- Receipt and Expense Digitization: Uses SmartScan to capture receipts instantly via mobile app, auto-fills details, and links them to expenses for audit-proof records.

- Tax-Compliant Reports: Instantly generates over $15+$ reports, including profit and loss (P&L) summaries and a purpose-built Schedule E report.

- Mileage Tracking: Includes a GPS-based tracker to log real estate-related mileage, auto-calculate distance, and generate IRS-compliant reports for tax deductions.

Pricing

Free for up to three units; paid plans start at approximately $12 per month for more advanced features or units.

QuickBooks Online

QuickBooks Online is a widely recognized accounting software with extensive capabilities, best suited for accounting-savvy sole proprietors who require flexibility or work closely with an accountant.

Key features

- Automated Transaction Import: Connects with banks to securely import and automatically organize income and expenses, eliminating manual data entry.

- Detailed Expense Structuring: Allows for a customizable Chart of Accounts, including specific categories for real estate (e.g., mortgage interest, different repair types).

- Vendor and 1099 Management: Facilitates managing suppliers, tracking bills, and setting up payments for contractors, with tools to prepare and file 1099s.

Pricing

Pricing starts at approximately $30 per month.

Buildium

Buildium is a comprehensive property management platform that is affordable and accessible for early-stage landlords since it has no minimum unit requirement.

Key features

- Automatic Bank Reconciliation: Streamlines and automates the process of reconciling bank statements with the financial ledger.

- Accounts Payable Management: Built-in calculators show amounts owed to the company, property owners, and vendors, allowing conversion of work orders into bills.

- Compliance Reporting: Provides tools for precise bookkeeping and real-time financial data, simplifying end-of-year reporting, including 1099 e-filing.

Pricing

Pricing starts at approximately $58 per month.

AppFolio

AppFolio is an advanced platform typically geared toward mid-to-large portfolios, offering deeper automation and financial reporting tools suitable for scaling operations.

Key features

- Automated Bank Reconciliation: Securely links bank accounts to automate transaction matching using AI-powered features.

- Budgeting and Forecasting: Allows creation of accurate budgets, tracks expenses against them, and forecasts future financial performance for strategic decision-making.

- Advanced Reporting Suite: Generates comprehensive financial statements, including general ledger, owner statements, income statements, and cash flow statements, with real-time, flexible reports.

Pricing

Custom pricing with a significantly higher minimum monthly spend, often requiring a 50-unit minimum.

Here is how different accounting software stacks up against each other.

Bottom line

The right accounting software helps you gain real-time insights into your sole proprietor real estate business. It also help you get a detailed view of your funds and ensures you stay away from any personal liability claims.

Baselane is the right choice as it combines banking, bookkeeping, and rent collection, and is designed specifically for real estate landlords and investors. Create a free account today to experience streamlined financial management and make smarter decisions for your portfolio.

FAQs

What is the best bookkeeping software for a sole proprietor landlord?

The best bookkeeping software for a sole proprietor landlord depends on your portfolio size and needs. Options like Baselane and Stessa offer robust free plans ideal for many investors, while Landlord Studio is great for mobile-first management. For more complex portfolios, Buildium or AppFolio provides comprehensive features.

How does accounting software help with Schedule E reporting?

Specialized accounting software for sole proprietor landlords automates the categorization of income and expenses. It then generates detailed reports that align with Schedule E requirements. This significantly simplifies tax preparation, ensuring accuracy and helping you capture all eligible deductions.

Can I use free accounting software for my sole proprietorship business?

Yes, several excellent free accounting software for sole proprietor options are available. Platforms like Baselane and Stessa offer robust free plans with core features like property-level tracking and tax reporting. These are ideal for new landlords or those with smaller portfolios looking for efficient management.

Why is a dedicated bank account important for sole proprietor accounting?

A dedicated bank account helps maintain a clear separation between personal and business finances. This separation simplifies expense tracking, reconciliation, and tax preparation, making it easier for accounting software to function effectively. It ensures accuracy and provides a clear financial picture of your real estate business.

.jpg)

.jpg)

.jpg)

.jpg)