Managing property finances means collecting rent, paying vendors promptly, and complying with trust rules—all while maintaining smooth operations and client confidence.

The problem is that many bank accounts aren’t built to handle money the way property management companies work. Incorrectly structured accounts cause issues: reconciliation headaches, compliance risk, delayed owner payouts, and constant cleanup work..

In this guide, we break down how property management banking needs to work in practice. You’ll learn which property management bank accounts matter, how to structure them, and how to choose a banking platform that supports your operations.

Key takeaways

- Property management banking requires separate account structures and tighter controls than standard business banking.

- Dedicated property management bank accounts reduce compliance risk and simplify owner reporting.

- The best banks for property management companies support trust accounting, automation, and software integrations.

- Choosing the right platform depends on portfolio size, transaction volume, and regulatory requirements.

How property management banking differs from standard business banking

As a property manager, most of the money you touch isn’t yours. You’re responsible for holding, moving, and reporting on funds that belong to owners and tenants. That changes everything—from how accounts are structured to how transactions are tracked.

With property management banking, you’re dealing with:

- Fiduciary responsibility: You’re legally responsible for protecting owner and tenant funds

- High transaction volume: Rent collections, vendor payments, owner distributions—every month

- Strict separation of funds: Company money cannot mix with trust or tenant money

- Audit and licensing exposure: Your banking records may be reviewed by regulators or owners

A standard small business account can’t handle any of this, as it treats every dollar the same. A property manager bank account, on the other hand, supports clean separation, transparency, and control—without slowing you down. Explore the best multifamily property management software to manage operations across your portfolio.

Benefits of property management banking

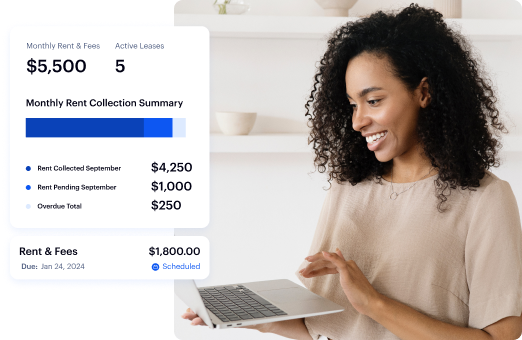

When your banking setup matches how property management actually works, everything else gets easier. Here are some other benefits of maintaining dedicated property management accounts using a digital banking solution:

- Separate property management bank accounts reduce commingling and help you meet trust account requirements.

- Automate payments and reduce late fees when collecting rent.

- Easily pay vendors and contractors and organize transactions with property management spreadsheets.

- Stay compliant with state laws using separate escrow or trust accounts (if your state requires them).

- Meet legal fiduciary responsibilities and use the best property tax management software for compliance and efficiency.

- Simplify accounting for rental properties with clean records and automation.

- A solid banking foundation makes it easier to add properties, owners, and staff without chaos.

Bank accounts every property management company needs

Here are the most common types of accounts you can use to create a working property management bank account structure:

- Operating account: Used for daily business expenses, property repairs, staff salaries, and operating costs. Helps track income and expenses related to property management.

- Trust account: This account holds rent you collect on behalf of property owners and is often a state requirement. Trust accounts protect owners, support audits, and create clear money trails.

- Security deposit account: Ensure deposits are never spent or confused with rent. This makes move-outs, refunds, and disputes much easier to manage.

- Reserve account: This holds emergency funds for unexpected expenses like major property repairs or property upgrades. Helps in financial planning for long-term maintenance costs.

- Property-level or portfolio accounts: Individual accounts per property or per owner portfolio to simplify financial reporting.

Key features to look for in a property management banking platform

When choosing a bank account, look for the following features tailored to your company’s operations.

- Low or no fees to keep management costs low.

- Online and mobile banking for easy access to transactions, mobile check deposits, and digital payments.

- Security and fraud protection through multi-factor authentication, fraud monitoring, and secure transactions.

- High-volume ACH and check payments for vendors and owners.

- Virtual accounts and cards for budgeting and expense control management.

- Expense management to automatically categorize and track transactions and sync with your accounting system.

- Bank integrations with property management software for smoother reconciliation.

- Clear user roles and permissions for staff and accounting teams.

Best banking platforms for property management companies

Choosing the right bank is crucial for property managers. The best banks offer specialized services, low fees, and integrations with property management software. Here are our top picks for the best banking solutions for real estate investors:

Baselane

Best for: PMs handling mid-range portfolio (dozens to low hundreds of units) and need an integrated banking platform.

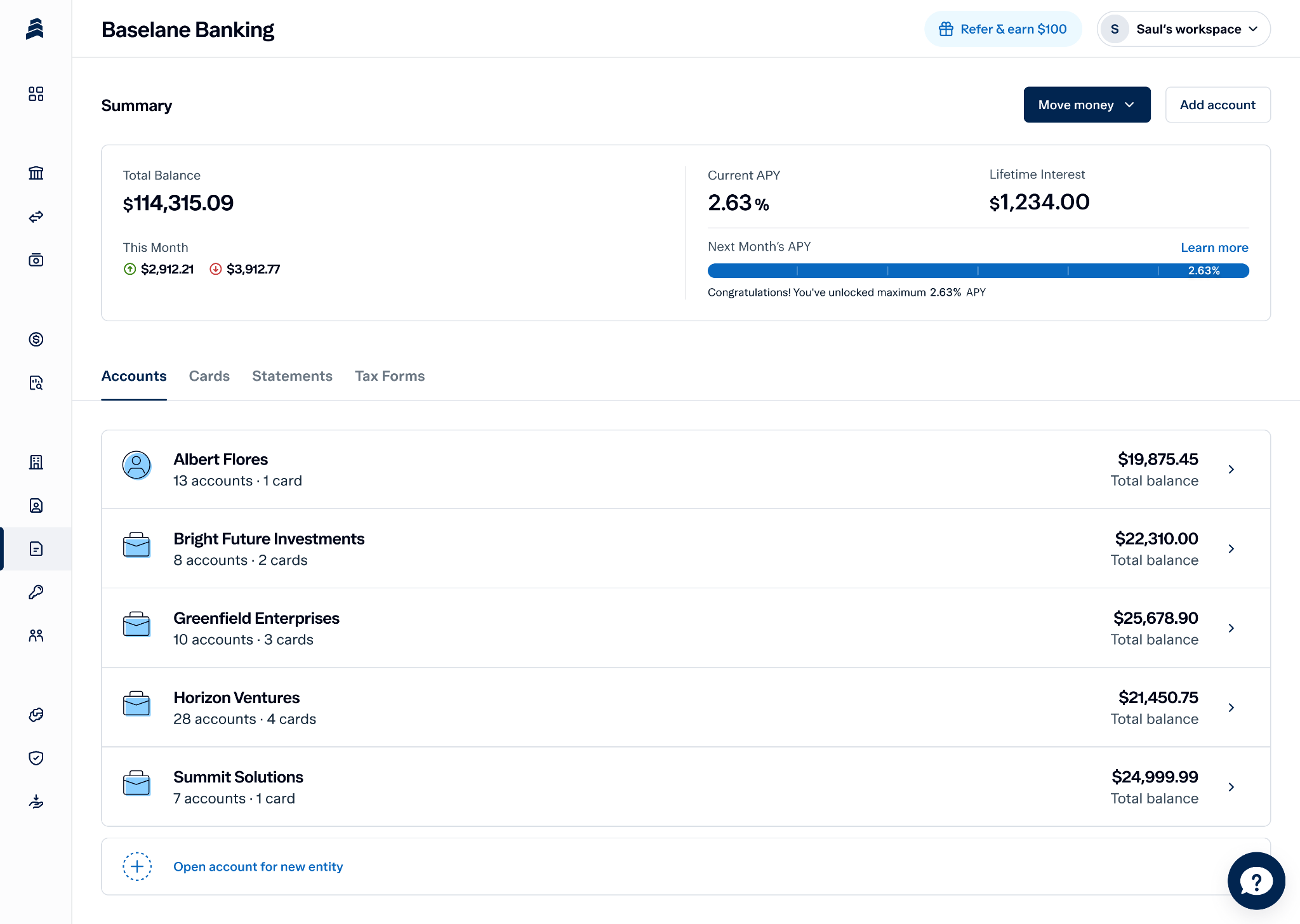

Baselane is a modern banking and bookkeeping platform that helps you manage property and owner-level accounts, automate transaction tagging, and get real-time visibility into each portfolio’s performance.

Account types & structure

- Unlimited checking and savings accounts with no monthly balance requirement for LLCs or sole proprietors.

- Create multiple sub‑accounts per property or owner to separate operating funds, security deposits, CapEx reserves, etc.

- Designed specifically to support trust‑style separation (owner funds vs management company funds) via multiple accounts rather than manual workarounds.

Key features

- Handles a large volume of transactions and supports ACH, wire, checks, and card payments.

- Built-in bookkeeping that auto-tags every transaction to the right property and the correct Schedule E tax category.

- Auto-transfer rules to automate transfers to/from internal or external accounts.

- Debit cards with spend control cards and custom spend limits to share with your staff or team of contractors.

- Real-time financial reports to monitor cash flow and profitability.

Chase Bank

Best for: PM firms that want nationwide branches, strong online banking, and robust small‑business services, and are willing to pay some fees in exchange for scale, reliability, and brand strength.

Chase is one of the largest U.S. banks with extensive small‑business banking, merchant services, and credit/lending products. It serves many real‑estate and property businesses, though not in a landlord‑specific way.

Account types & structure

- Multiple business checking account tiers (e.g., Complete Business Checking, Performance Business Checking).

- Business savings, money market, CDs.

- Manage multiple business entities and accounts under a single login structure.

- State‑specific trust/escrow accounts in many jurisdictions.

Chase Bank key features

Bank of America

Best for: PMs that want a large, stable bank with solid commercial features, decent digital tools, and existing relationships.

Bank of America is one of the largest banks in the U.S., operating a network of over 3,900 branches, making it a viable option for in-person banking. It provides accounts for nearly every personal or business need, including commercial real estate (CRE) loans.

Account types & structure

- Multiple small business checking products (e.g., Business Advantage Fundamentals, Business Advantage Relationship).

- Savings, money market, CDs.

- Create trust/escrow and client funds as per the state law.

- Multi‑entity log‑in structure suitable for PMs with several management and owner entities.

Bank of America key feature

Wells Fargo

Best for: Established PM firms with high payment volume, multiple trust accounts, and the need for relationship managers.

Wells Fargo is a major U.S. bank with extensive branch coverage and commercial services. It has a large presence in real estate and mortgage banking and offers numerous tools for businesses handling huge payment volumes.

Account types & structure

- Online business checking accounts in multiple tiers targeted at small to mid‑sized businesses.

- Business savings/money market, CDs.

- Dedicated escrow/trust accounts for client funds and security deposits.

- Maintain many entities and accounts under one corporate banking relationship.

Wells Fargo key feature

U.S. Bank

Best for: Mid‑sized PMs who prefer in‑person relationship banking, trust accounts, and regulatory compliance.

U.S. Bank is a large national bank with a strong footprint in many states and a full suite of business banking products. It is not landlord‑specific but is experienced with real estate, commercial clients, and trust/escrow accounts.

Account types & structure

- Business checking tiers (Basic, Gold, Platinum) for different transaction volumes.

- Business savings, money market, CDs.

- IOLTA / trust/escrow accounts in many states.

U.S Bank key feature

Axos Bank

Best for: PMs who want low‑fee online banking with high APY and flexibility, and have a more mature tech stack, and simply need a cheap, scalable, digital bank.

Axos is a U.S. online bank with robust business checking and savings products, plus commercial real estate lending. It does not focus exclusively on property management, but it actively markets to small businesses and real estate investors.

Account types & structure

- Basic Business Checking with no monthly maintenance fee, a higher opening deposit, and a monthly free transaction limit.

- Business Interest Checking that comes with a modest monthly fee

- Business savings, CDs, and money market accounts.

Axos Bank key features

Best property management banking platforms comparison

Choosing the right tools can make a significant difference in how efficiently you manage your portfolio — compare the best accounting software for rental properties or explore the 10 best free property management software platforms to find the right fit.

How to choose the best bank account for your property management company

There’s no single answer to what the best bank is for property management businesses. The right choice depends on how you operate. As you evaluate property management banking options, ask yourself:

- How many properties and owners do we manage today?

- How many transactions move through our accounts each month?

- Do we need strict trust account controls?

- How important is automation versus branch access?

- Are we planning to grow or stay steady?

Choose a bank that scales with your portfolio, integrates with your systems, and supports fund separation. Otherwise, your bank will eventually slow down your property management workflow.

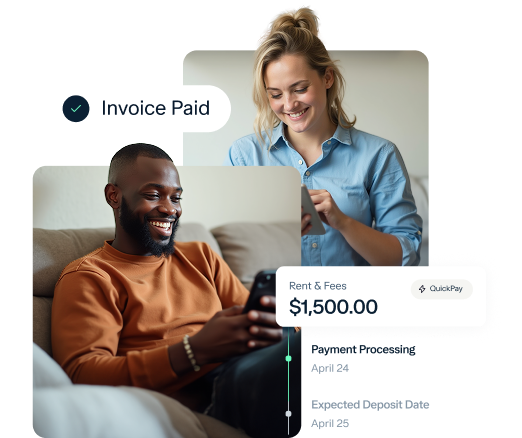

Automate your property management finances with Baselane

Managing different property types across multiple owners requires a banking platform that adapts to your portfolio.

Baselane is built for this reality, combining banking, rent collection, and bookkeeping in one simple system. Because Baselane organizes finances by property and unit, you spend less time stitching tools together and more time seeing what’s actually happening across your portfolio.

Whether you manage a single property or a large portfolio, Baselane replaces outdated workflows with modern tools designed for property management. Get clear, real-time visibility into your finances and operate with confidence. Sign up for Baselane today!

FAQs

Do property management companies need a trust account?

State landlord-tenant laws dictate this. Many states legally require property managers and landlords to collect security deposits in a separate trust or escrow account to prevent commingling funds. Even in states without a mandatory requirement, a dedicated bank account for rental properties helps you stay compliant.

Can I use a personal account for property management?

Yes, you can, but it isn't recommended. By using a personal account, you risk mixing personal and business funds, creating legal liabilities, tax complications, and audit risks. Some states require you to clearly separate tenant deposits and operating expenses.

How do I open a property management banking account?

You’ll typically need business formation documents, licenses, EIN, and trust account paperwork. Some banks require additional compliance review for property management companies.

How many bank accounts should a property manager have?

At a minimum, an operating account and a trust account. Larger firms often need additional accounts for deposits, reserves, or properties.

What is Positive Pay, and do property managers need it?

Positive Pay helps prevent check fraud by verifying payments before they clear. It’s especially useful for firms with high vendor payment volume.

What is ECR, and how does it reduce fees?

ECR allows account balances to offset banking fees. It’s valuable for property managers processing frequent transactions.

Which property management software supports bank integration?

Most modern property management platforms offer bank feeds, but integration depth varies. Look for real-time syncing and property-level mapping.

.jpg)