When introducing new tenants to your rental property, the last thing you want is to get stuck with late rent payments and eviction costs. While most landlords and tenants are familiar with credit reports and background checks, rental history reports are there to help you bridge the gap between financial activity and how the tenant will be as a renter. In this article, we will explain what a rental history report is, why this type of report is important, and how to check rental history reports for red flags to find the ideal tenant.

1. What is a Rental History Report?

A rental history report contains information about a potential tenant’s previous rentals. Third-party companies provide this type of report for a fee ranging from $1.99 to $55. The American Apartment Owners Association offers one, and the Landlord Credit Bureau has an online database landlords can access. You can also use a tenant screening service. These companies consolidate information from multiple sources, including background and credit checks, for a comprehensive report to vet prospective tenants.

In general, rental history reports include:

- Past rental addresses

- Contact information of former landlords or property managers

- How long the tenant lived at each location

- How much the tenant paid in rent

- Missed payments or prior evictions

This information gives you an idea of what each applicant is like as a renter. Even though landlord insurance covers the loss of rental income, property damage, and liability costs, a rental history report can protect you from a risky tenant before they even step foot in the building.

2. Why is Tenant Rental History Important?

With 84% of landlords stating nonpayment and possible evictions as their top concerns (TransUnion), you want to make sure you are renting to reliable tenants. Verifying income and employment lets you know if they have the money to pay the bills, but a tenant rental history report gives you insight into how likely they are to break a lease or skip rent payments. Considering the average cost to evict a tenant is $3,500 to $10,000, checking their rental history upfront will save you the headache of tracking down a problem tenant and suffering the financial damage of evicting them.

It might be worth listing a rental check as an application requirement in the rental property advertisement. That way, you can weed out any applicants who don’t want to disclose their rental history information. Those willing to provide this information upfront will help improve your chances of finding a qualified tenant for your rental property.

3. How to Check Rental History Reports

Checking a rental history report is relatively straightforward, but you must read it thoroughly. If you just skim the information, you might miss some important details that could influence your decision to move forward with the applicant.

You will want to examine a rental history report for:

- Dates of Residency: If a tenant moves frequently or before the end of a lease, the odds are you will only have rental income for one year before turning the property over for a new tenant.

- Rent Amount: Seeing what a tenant has previously paid in rent will let you know if they can afford your unit or not.

- Payment History: Missing one or two payments can be a mistake, but a pattern of overdue rent indicates a financial risk that will impact your cash flow.

- Prior Evictions: If the applicant has any previous evictions, this generally implies a major breach of a lease agreement. For example, evictions in New York are only reported if the tenant is found at fault in a legal eviction case.

After reviewing the rental history report, call the potential tenant’s current and previous landlords to verify the information. Ask additional questions about how the tenant treated the property and whether the landlord would rent to them again.

4. Tenant Screening Checklist

Often, landlords will use an online screening tool that pairs a rental history report with additional information to identify quality tenants. A thorough screening includes:

- Income Insights: Compare a tenant’s income with monthly debt payments to determine if they can pay rent, utilities, and living expenses.

- Employment History: Review previous jobs and contact references to confirm if the tenant has a stable job and steady income.

- Credit Report: Check for red flags such as late payments, outstanding debt, high credit usage, collections, and bankruptcies.

- Background Check: Verify a tenant’s identity and if they have a criminal history, pending cases, or outstanding warrants.

- Rental History: Evaluate a tenant’s past rental payments, lease terms, and landlord references to decide if they will be a reliable source of rental income.

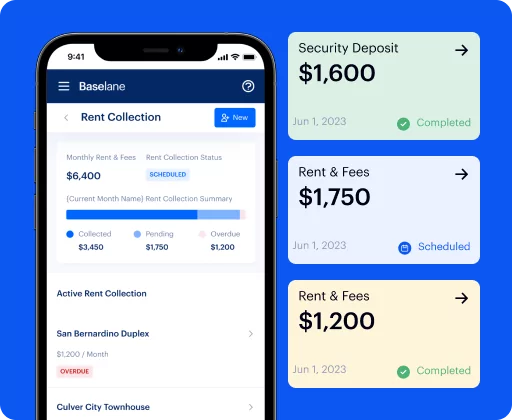

Not all screening services are created equal. The Fair Credit Reporting Act (FCRA) allows tenants to sue landlords for rejecting applications with incorrect information. It’s best to invest in a reliable service that sources accurate data. You can get FCRA-compliant rental history reports in minutes with Baselane tenant screening services for independent landlords.

FAQs

The prospective renter must sign a release form before running a rental check report. Once you receive the report, compare it to the application and look for inconsistencies. Then, ask the tenant to explain the discrepancies before speaking with their former landlords to verify the information and ask about any issues with payments, neighbors, or damages.

Rental history reports will give you hard data about a potential tenant, but you still need to verify that the information is accurate. If you skip the report and rely on references, they may give false information to get rid of a bad tenant that you can't cross-check with data. Pairing a rental check with references is the best way to thoroughly screen potential tenants.

A rental check provides information about a tenant's previous rental addresses, landlord contact information, and occupancy dates. A credit check is used to assess a tenant's financial behavior based on their credit score, payment history, credit usage, credit history, and delinquent accounts.