Powered by

Landlord Insurance that is right for you

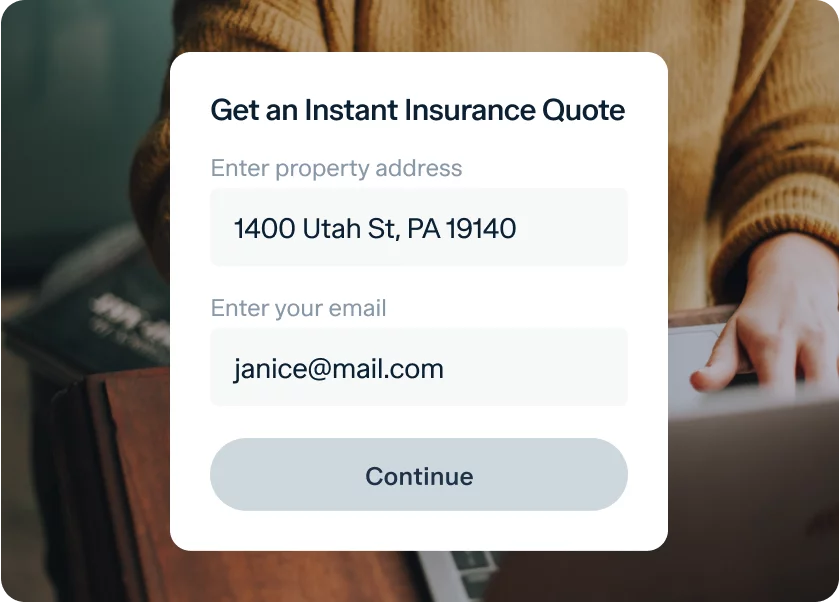

Get the right protection for your rental property without breaking the bank. Receive a personalized quote instantly.

Rental property insurance landlords love and trust

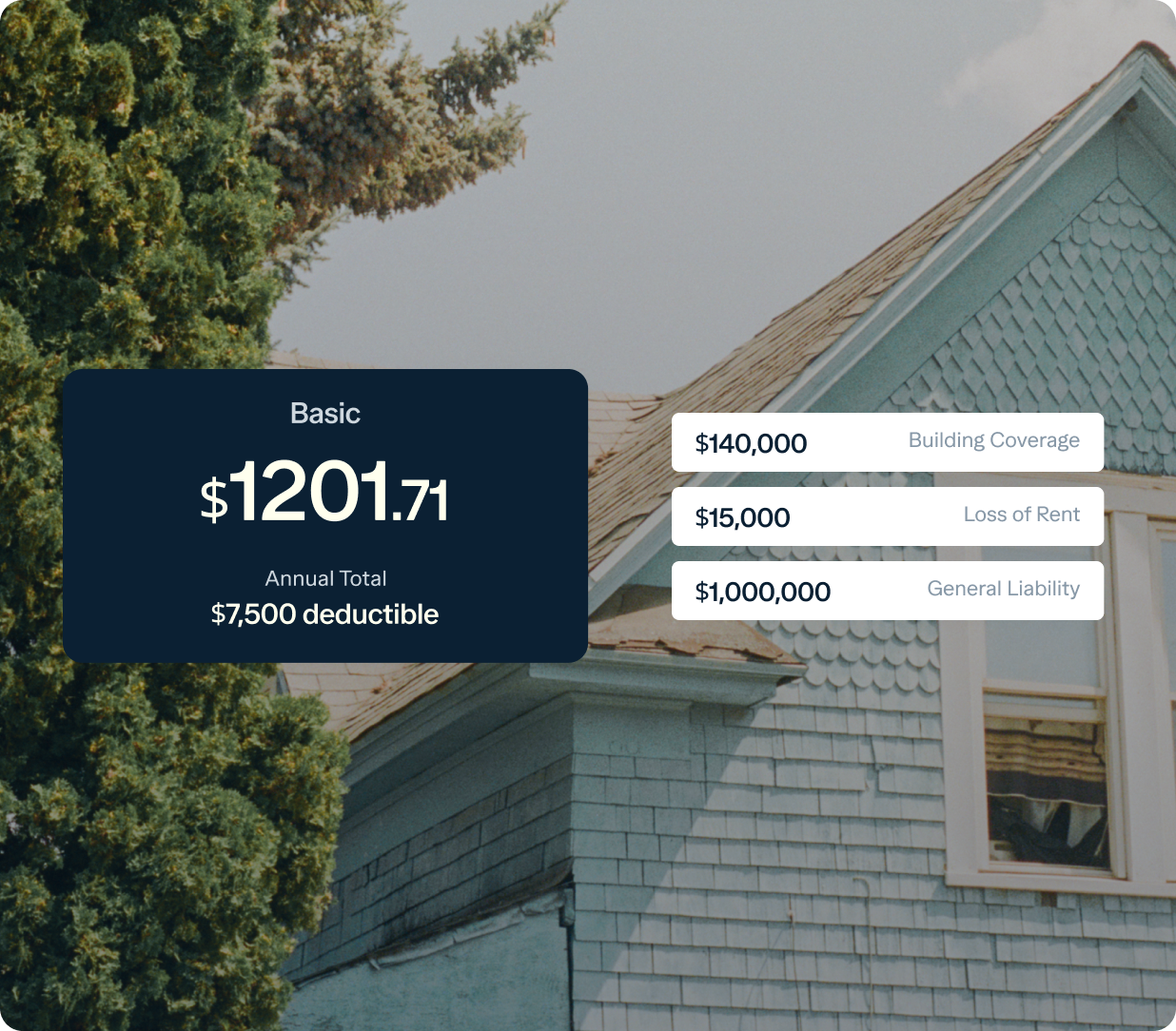

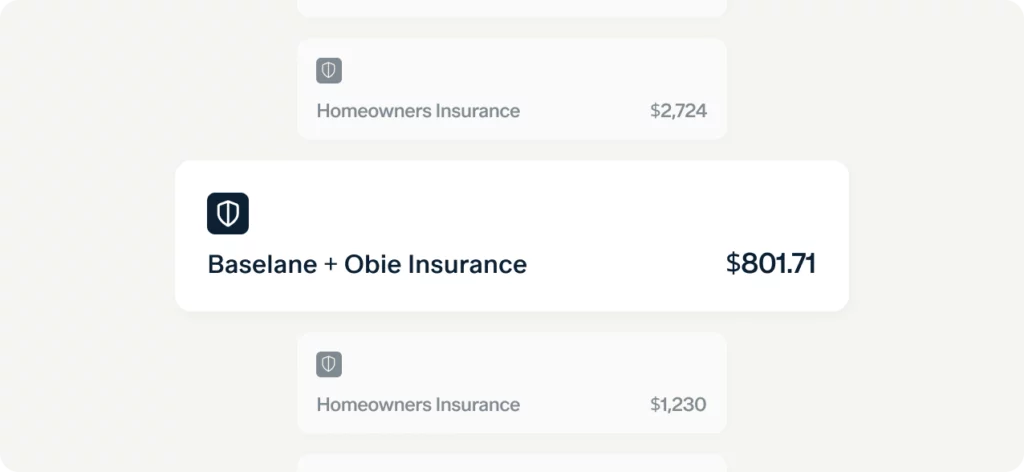

Affordable rates

Save $100s on your existing properties. We offer industry-best rates for the coverage that is right for you as a landlord.

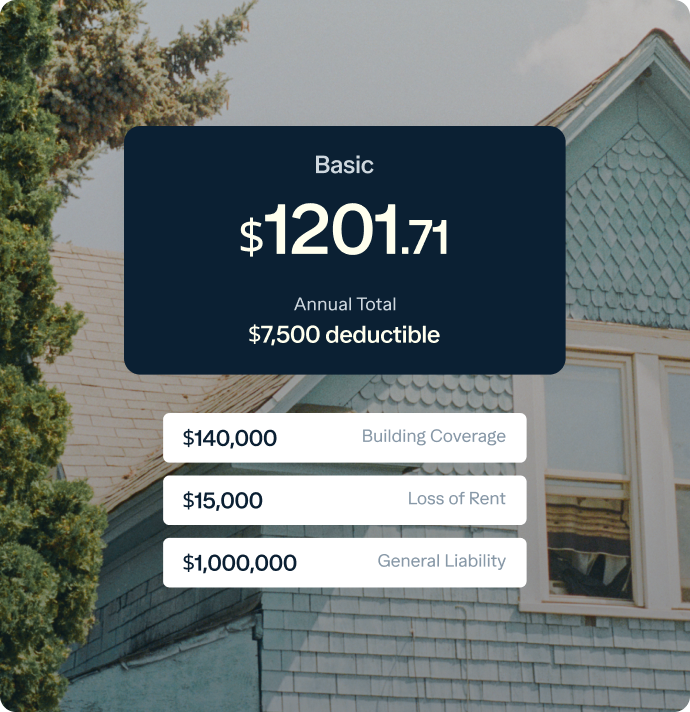

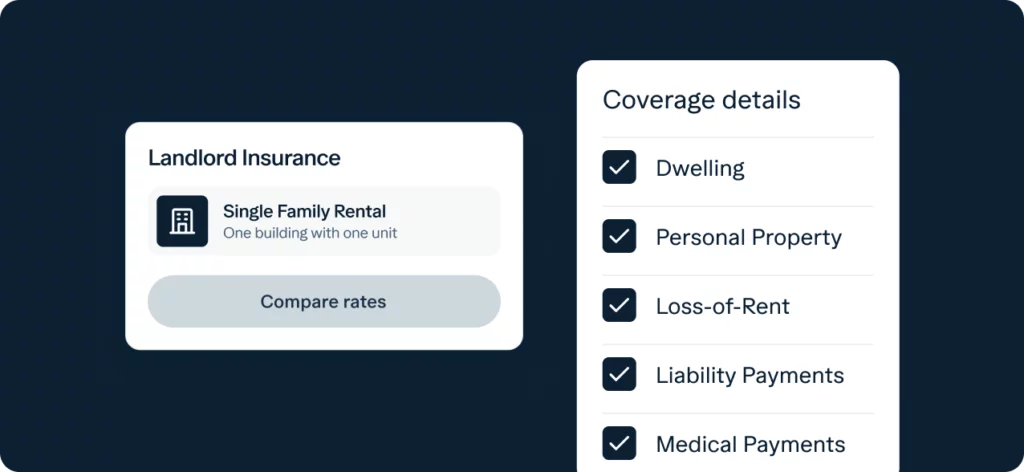

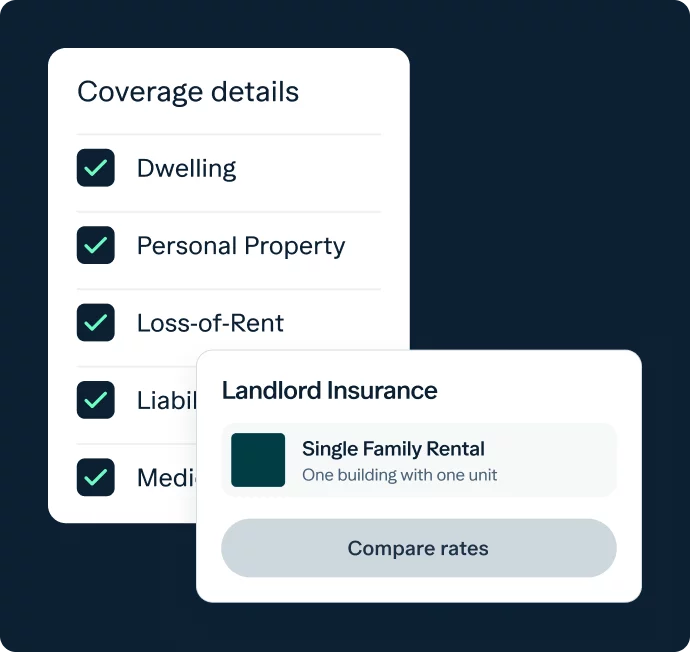

The right coverage

Reduce your risk and relax knowing that your landlord insurance will offer you protection against the unexpected.

Simple and transparent

Receive a rate comparison online in less than a minute with zero commitment or phone call required.

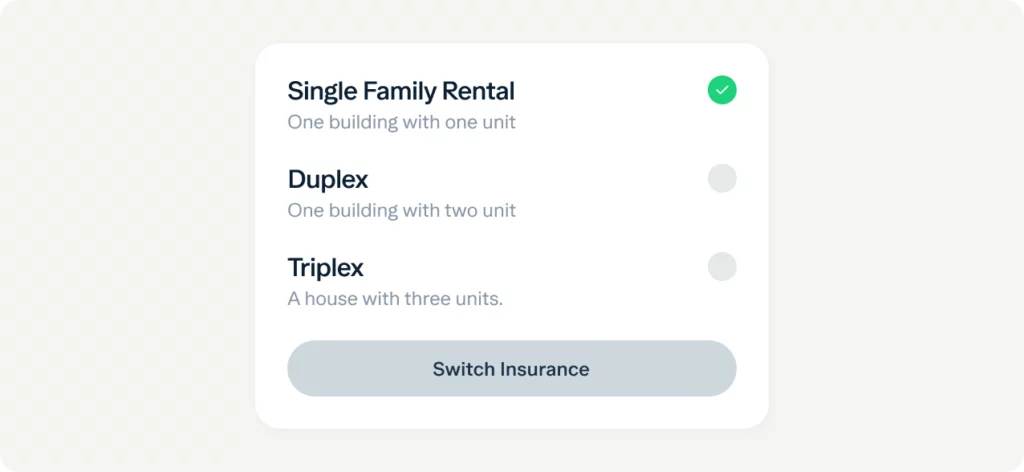

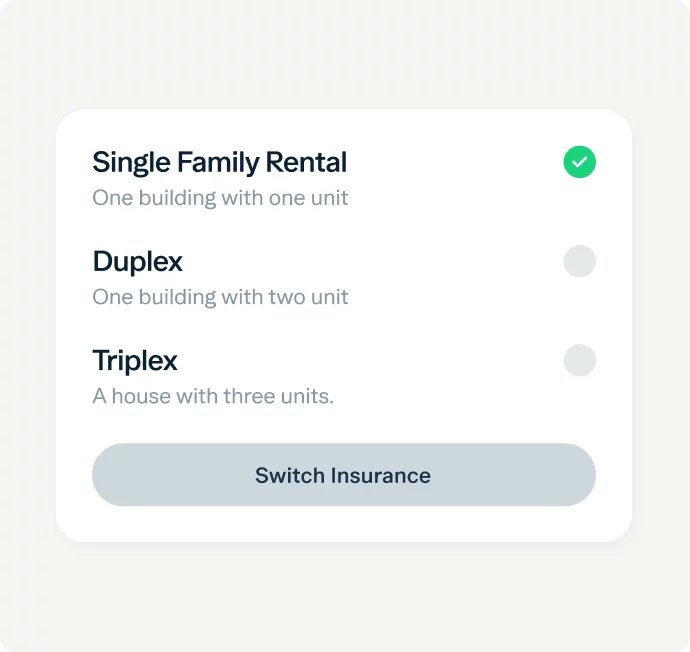

We make it easy to switch

Already insuranced? We make it easy to switch. On average, people save 25%.

How Baselane’s landlord insurance works

Simple, affordable, and transparent.

Save time

Simply provide your email and answer a few property questions to get started. Forget about confusing paper applications or having to speak to someone on the phone.

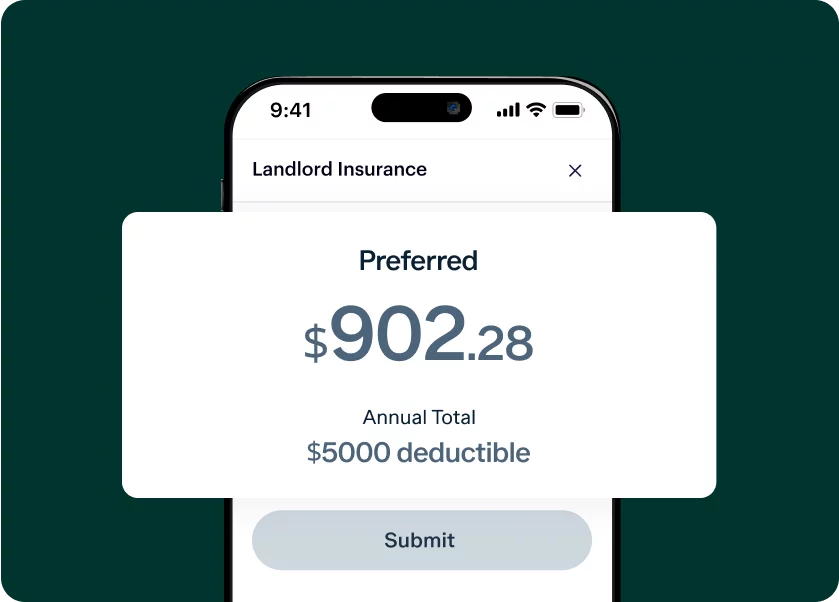

Save money

Our simple quote request process will match you with the right insurance for your rental. Saving you up to 25% on your existing claim.

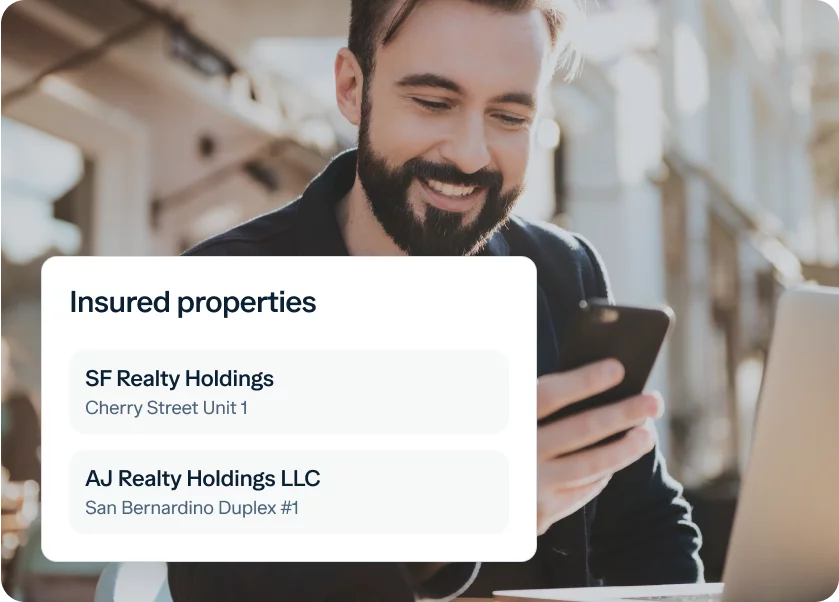

Gain peace of mind

Reduce your risk and increase financial security knowing you have the right coverage for your property!

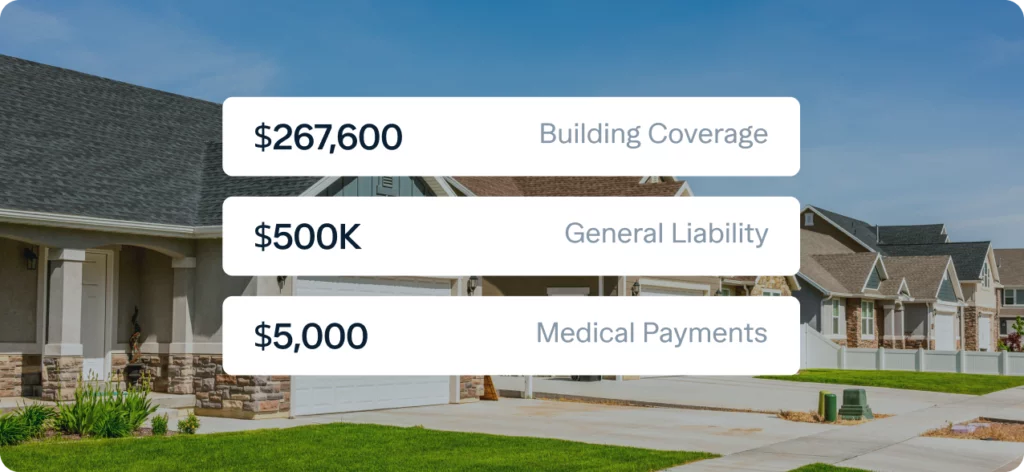

A Better Option

| Landlord Insurance | Homeowners Insurance | |

|---|---|---|

| Dwelling | ||

| Personal Property | Optional | |

| Loss-of-Use | ||

| Loss-of-Rent | ||

| Liability Payments | ||

| Medical Payments |

*Medical payments: Covers guests’ medical bills if they are injured on the property.

Trusted by 40,000+ real estate investors

“No phone calls or lengthy application needed. I submitted my quote online and and had better coverage for a fraction on the cost in a matter of minutes.”

“As a new landlord just starting out, I was recommended Baselane and Obie for my property insurance needs. They made the process incredibly easy, and now I have peace of mind that my property is covered.”

“This is easily the best quote I have received. I get everything I need and want covered at an extremely attractive rate. The best part…it only took me 5 minutes!”

Ready for an instant quote?

Join thousands of customers who received landlord insurance from us