Banking Built for Landlords

Baselane is a powerful banking platform that puts you in complete control of your real estate finances.

To qualify for the $50 cash bonus, deposit and maintain a balance of $500 in your Baselane Banking account for 30 days.

Baselane is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. FDIC insurance available for funds on deposit through Thread Bank, Member FDIC. Pass-through insurance coverage is subject to conditions.1

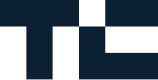

Banking Accounts and Features for Landlords and Real Estate Businesses

Unlock more rewards

Put your cash to work. Earn up to 3.35% APY interest2 (60x national average)

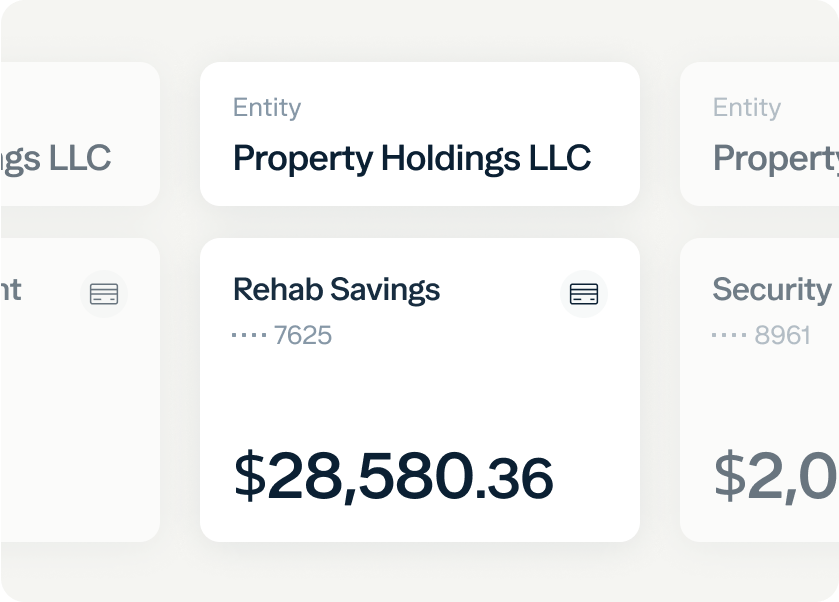

Streamline your finances

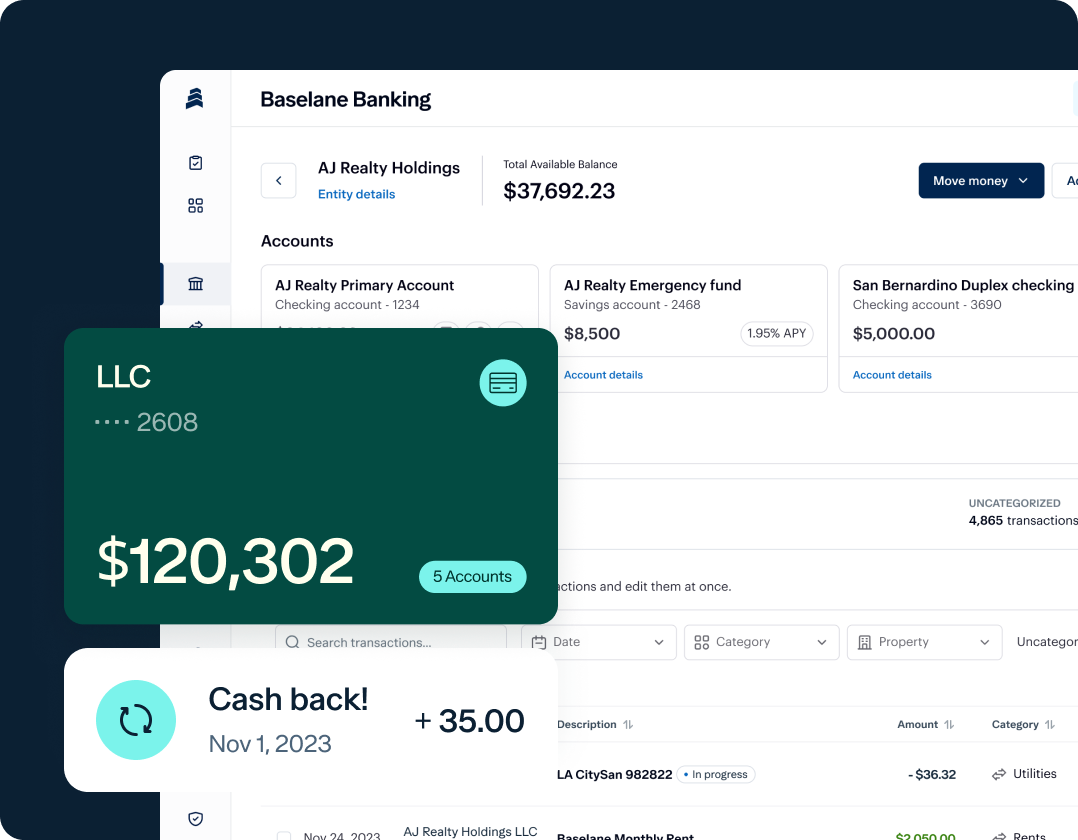

Create unlimited virtual accounts and cards. Easily open an operating account for each property or unit, and create separate accounts for security deposits.

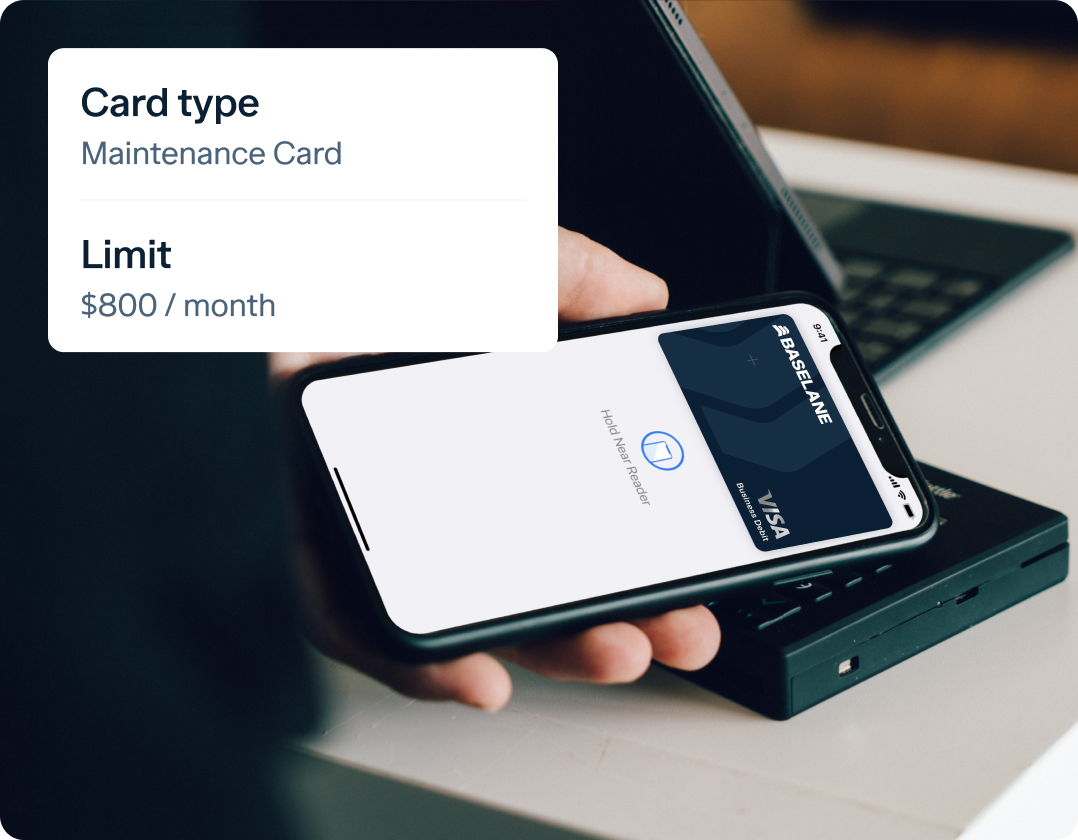

Take control of your spend

Physical & virtual debit cards with custom spend controls and automated transaction tagging by Schedule E.

Simplify payments

Easily pay expenses with ACH and wires. Send payments, pay invoices, make transfers, and deposit checks from any device.

Automate rent & accounting

Baselane banking is seamlessly integrated with Baselane’s rent collection, accounting and reporting tools. Manage everything in one place.

Security Deposits

Use Baselane to manage your security deposits. Easily open a separate account for each security deposit. Like all Baselane savings accounts, security deposits earn up to 3.35% APY2.

Keep Your Rental Property Finances in Check

Baselane’s powerful financial tools put you in complete control of your rental property cash flow.

Banking

Automate your banking. Up to 3.35% APY2, organized accounts, and powerful spend management.

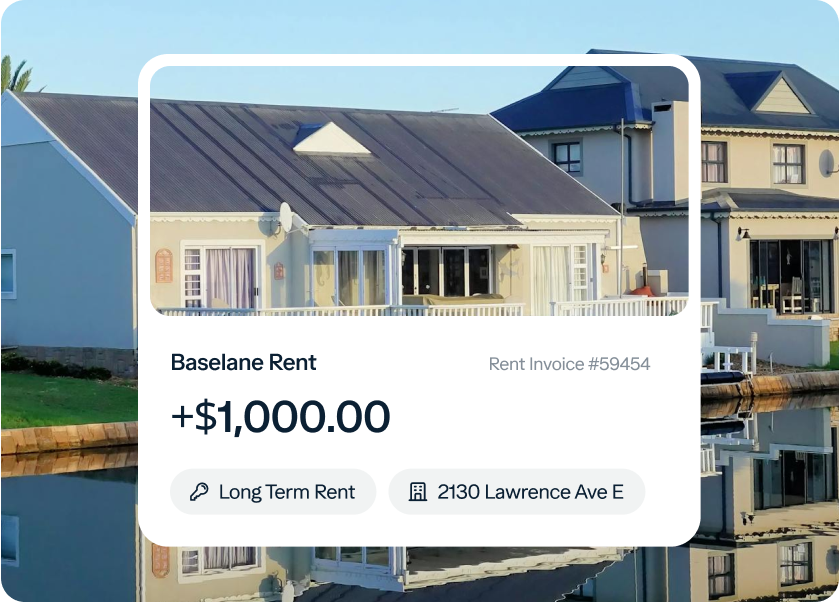

Rent Collection

Never chase down checks or late rent again. Fast payments, simple to set up, easy for tenants.

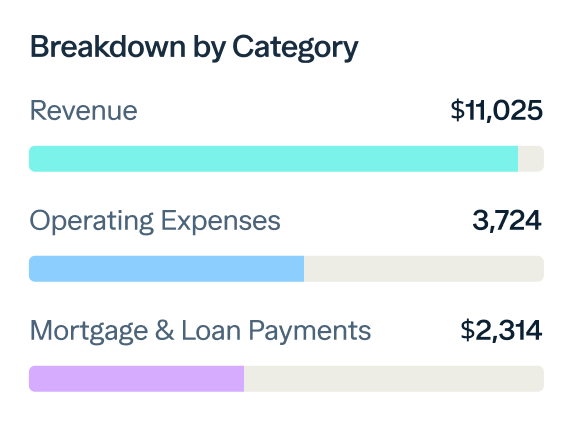

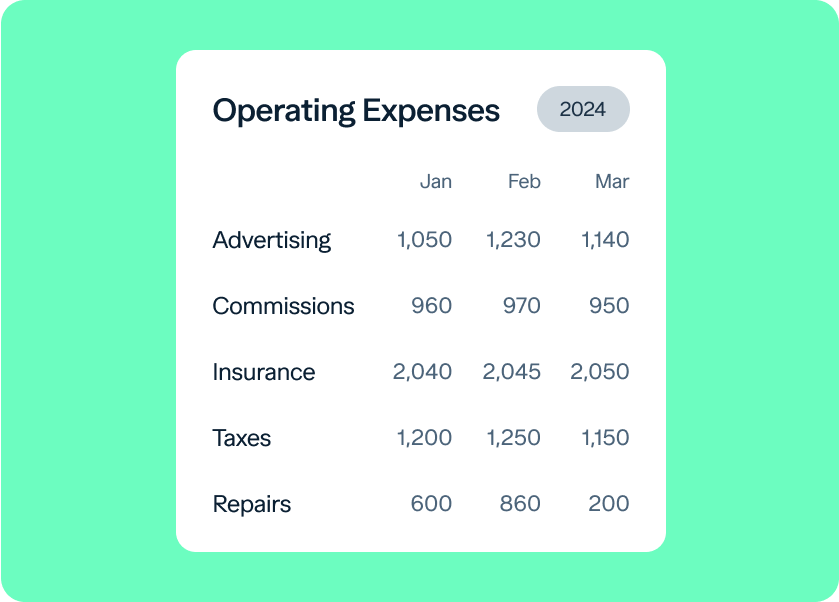

Accounting & Reporting

See your cash flow clear as day. Maximize returns and make tax time a breeze.

Landlord Banking Built for All Investors

Landlords and Investors of All Sizes

Whether you have 1 unit or 100, Baselane is built for you.

Multiple Property Types

Baselane supports multiple property types including residential, commercial, and long- and short-term rentals.

Keeping your money protected

Switching to Baselane was an immediate success. I stopped manually managing my property finances last month for the first time. I saved over 5 hours and $200 on accountant fees. Everything is now automated and in one place.

60k+

60x

$3M1

Why Landlords Choose Baselane

| Typical Business Checking Account | ||

|---|---|---|

| Built for Landlords | ||

| Interest | Up to 3.35% APY2 | 0.07% APY |

| Unlimited Accounts, Partitioned by Unit | ||

| Virtual Cards & Spend Control | ||

| Integrated Rent Collection, Bookkeeping, & Reporting | ||

| Minimum Deposit | $0 | Up to $1,500 |

| Monthly Fees | $0 | $15+ monthly fees + additional fees for wires, ACH, and overdraft |

CONNECT TO THE TOOLS YOU USE EVERY DAY

Whether it’s Airbnb, Quickbooks or Venmo, easily connect to the tools that power your rentals.

Real support from real humans

Schedule a call, send an email, or chat live with our customer support experts who speak real estate.

Get dedicated support anytime, anywhere. Our customer support experts speak real estate.

Create a free Baselane account

Upgrade your banking experience with Baselane Banking.