BANKING

BUILT FOR REAL ESTATE BUSINESSES

Easily organize your money, manage expenses, and pay bills – in one integrated platform that saves you time and puts you in control of your finances.

Baselane is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. FDIC insurance available for funds on deposit through Thread Bank, Member FDIC. Pass-through insurance coverage is subject to conditions.1

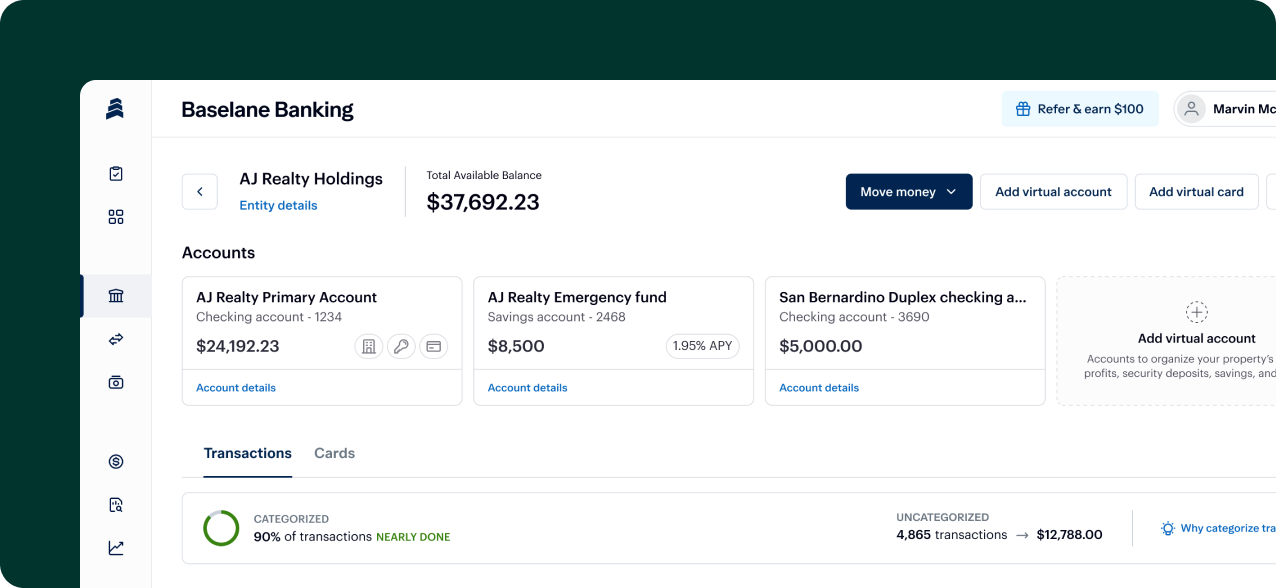

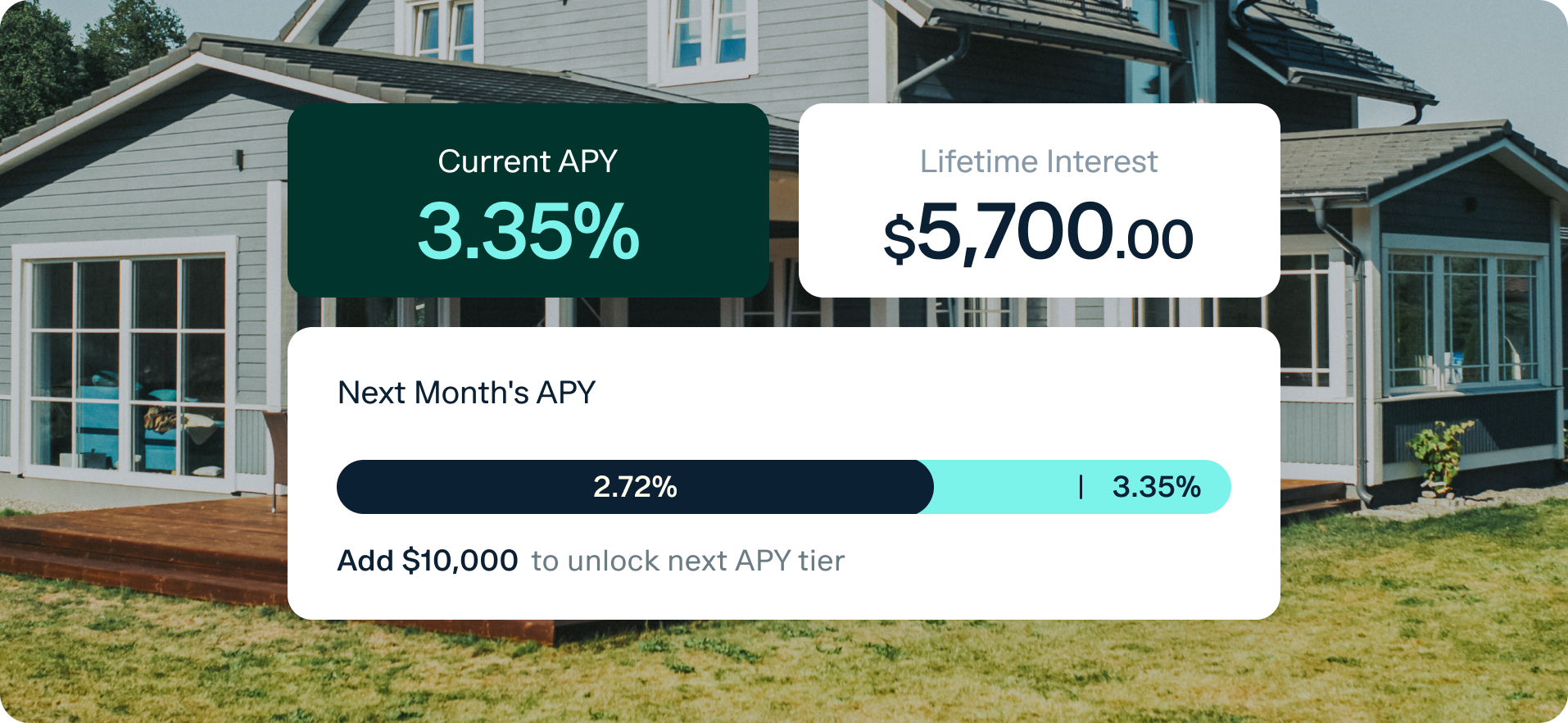

Organize & grow your money

Open unlimited checking accounts to organize your property’s finances and savings accounts to grow your money with up to 3.35% APY2 . FDIC insurance up to $3M1 on funds deposited via Thread Bank; Member FDIC.

Checking accounts built for real estate

Keep your property operating expenses, profits, security deposits, and projects organized with unlimited accounts for each entity.

Savings accounts

Have your money work for you by earning up to 3.35% APY2. That is 60x the national average.

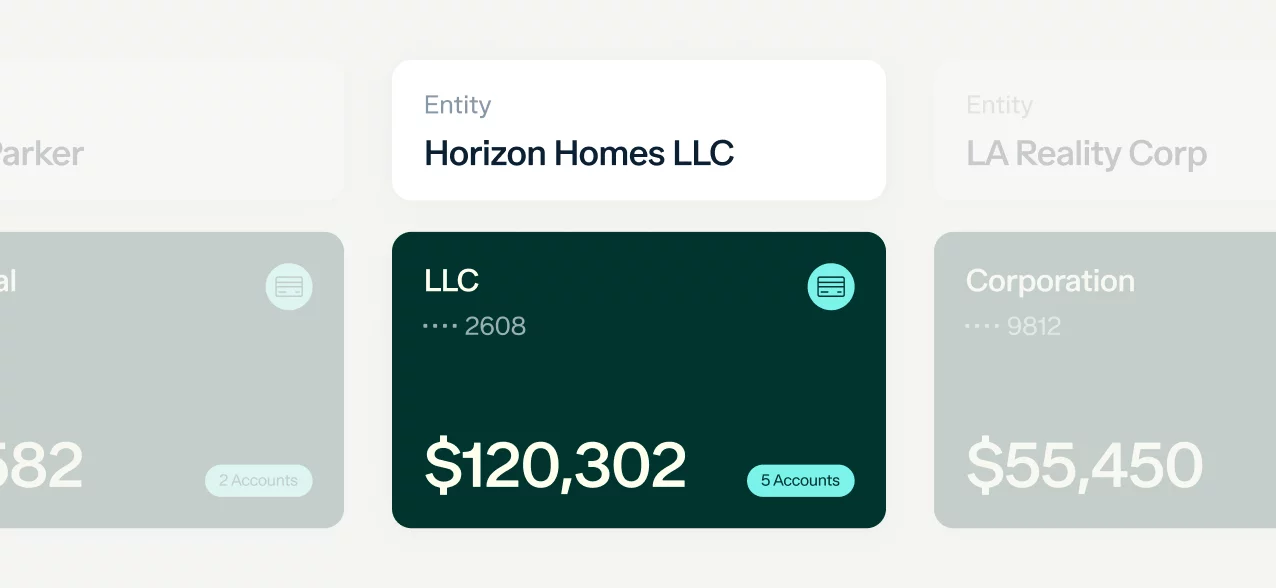

Unlimited accounts, for all entity types

Manage all your entities under one roof — from LLCs to Corporations, Partnerships, and individuals.

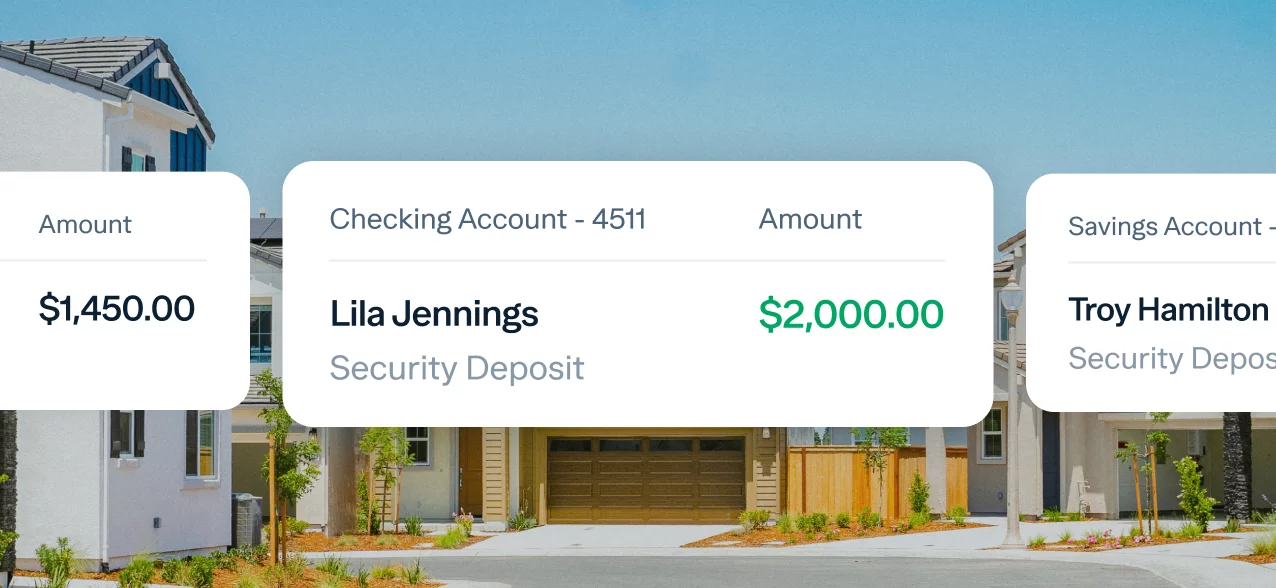

Separate security deposits

Use separate interest or non-interest accounts to hold each security deposit compliantly, and easily return them.

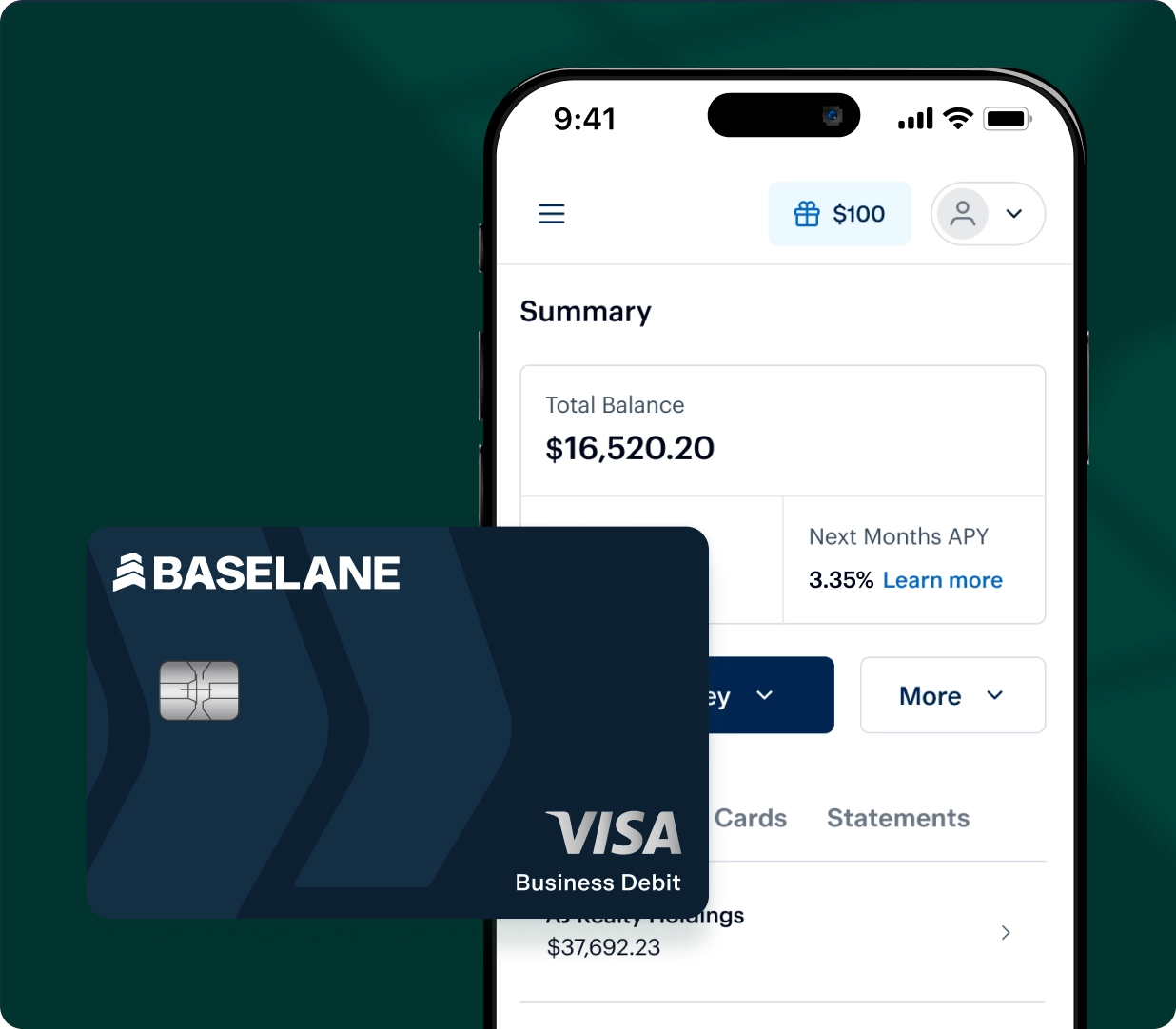

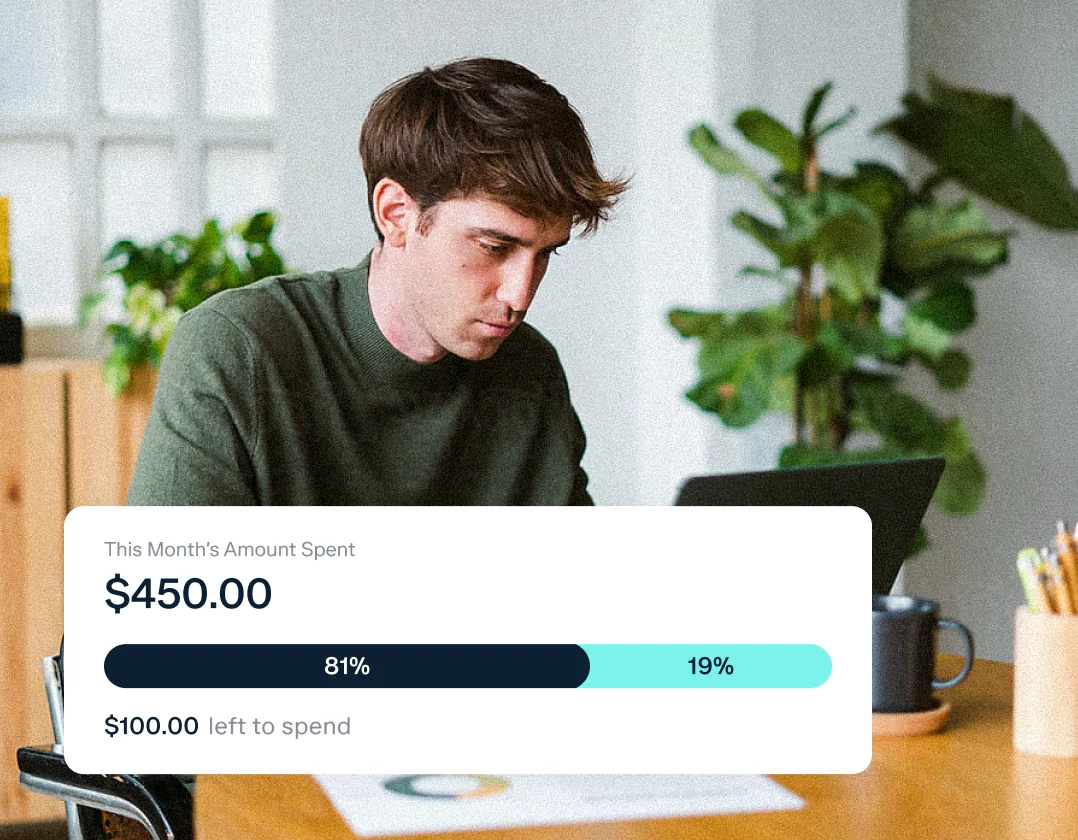

Manage & control spend

Get full visibility and control of your spend using physical and virtual debit cards with smart limits

Smart spend control

Set weekly or monthly spending limits, and easily lock cards for safety.

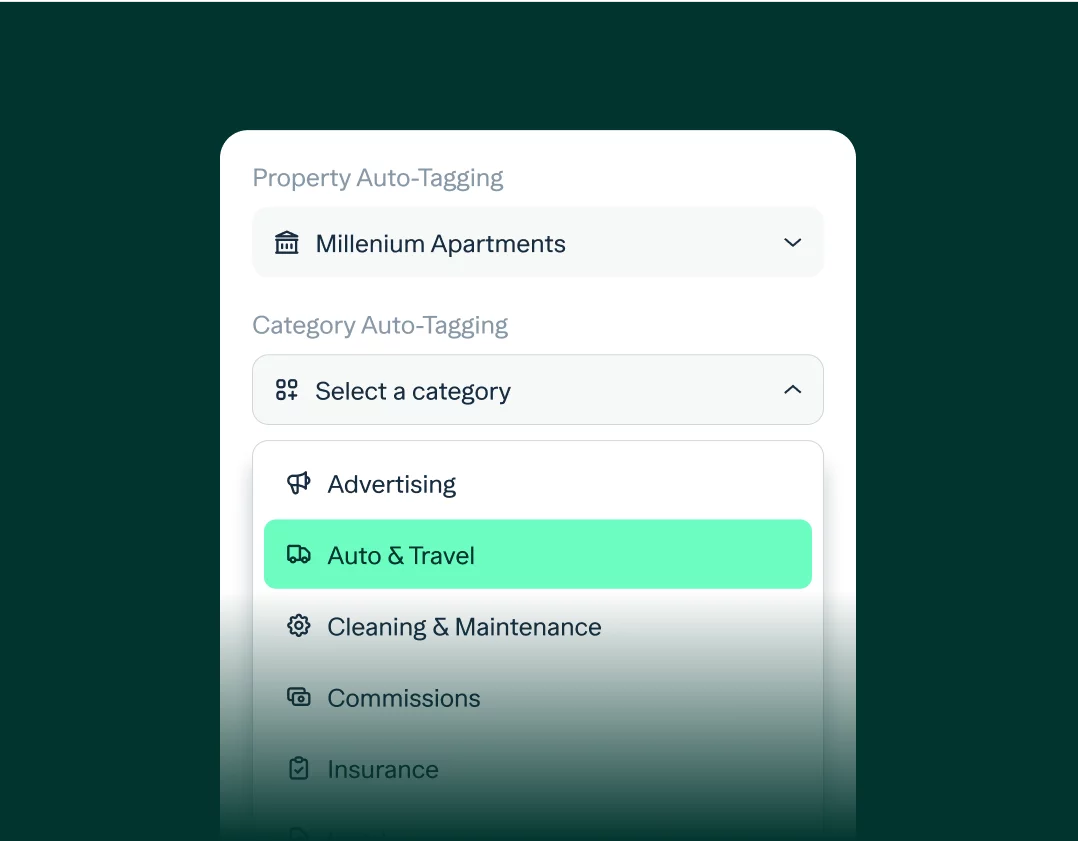

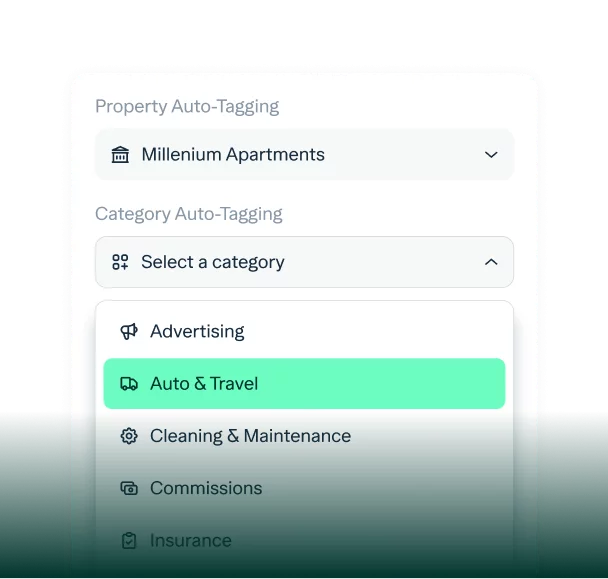

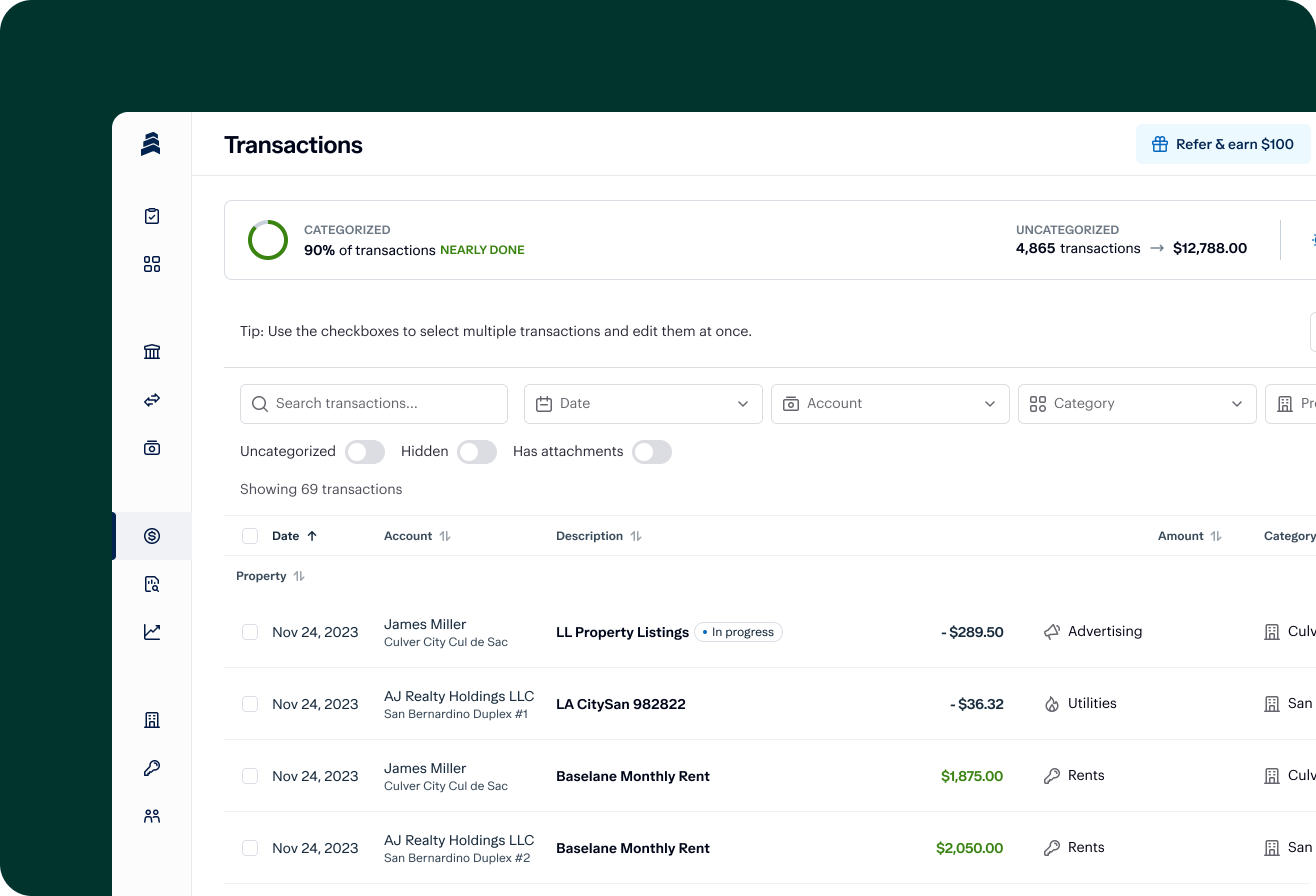

Automated transaction tagging

Set property and expense category tagging rules by card so bookkeeping is done for you.

Manage security deposits

Easily open separate interest or non-interest accounts to hold each security deposit compliantly. When the lease is up, return security deposits at the click of a button.

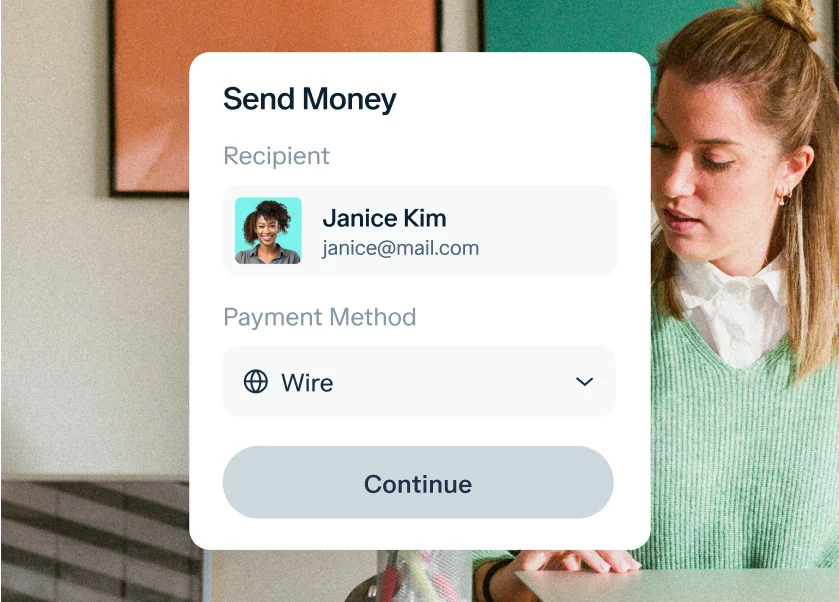

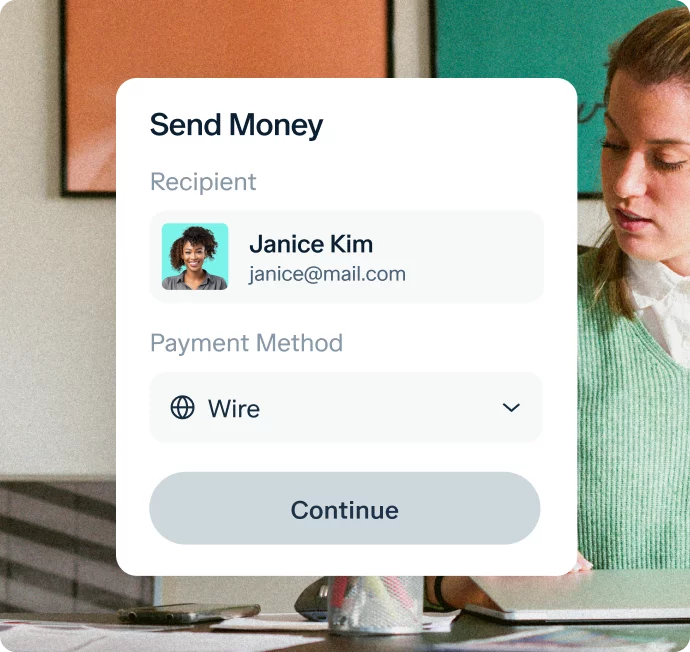

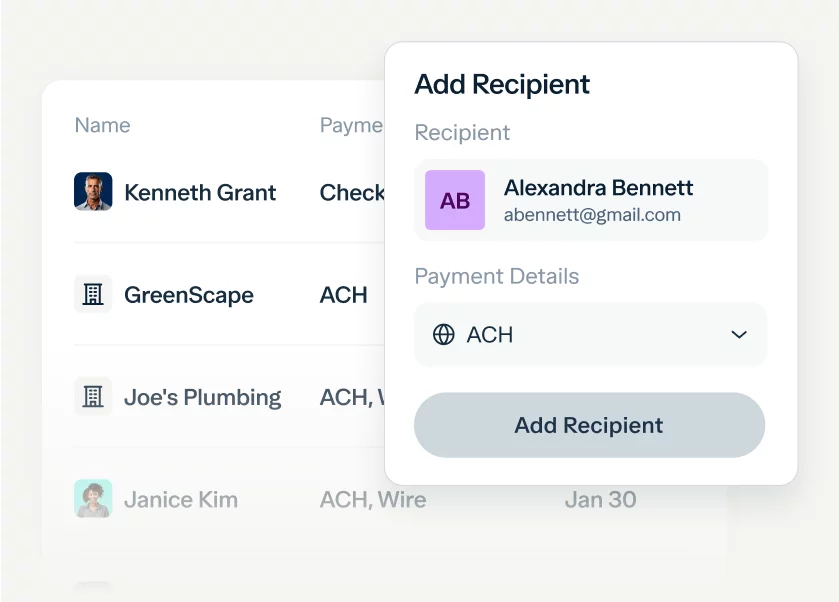

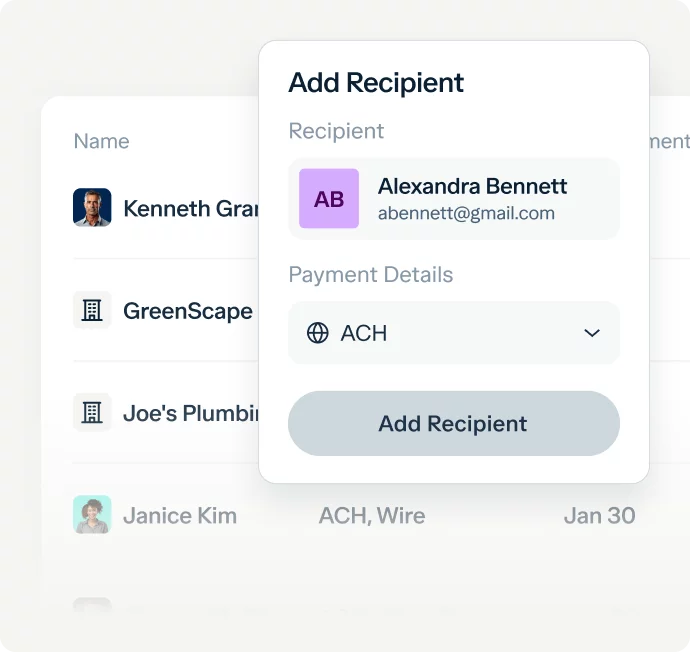

Automate bills & payments

Easily pay bills and make disbursements via ACH, wire, or mailed check with our automated payment platform built to save you time.

Make any kind of payment

Send one-time or recurring payments via ACH, wire, or check (printed & mailed for you).

Manage recipients

Organize and save all your payees and vendors on one platform so you can easily send money with a click of a button.

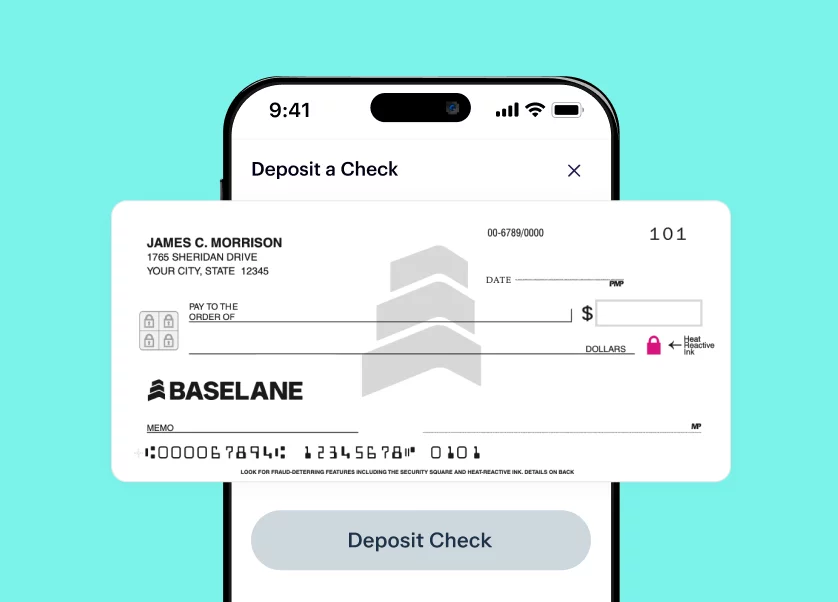

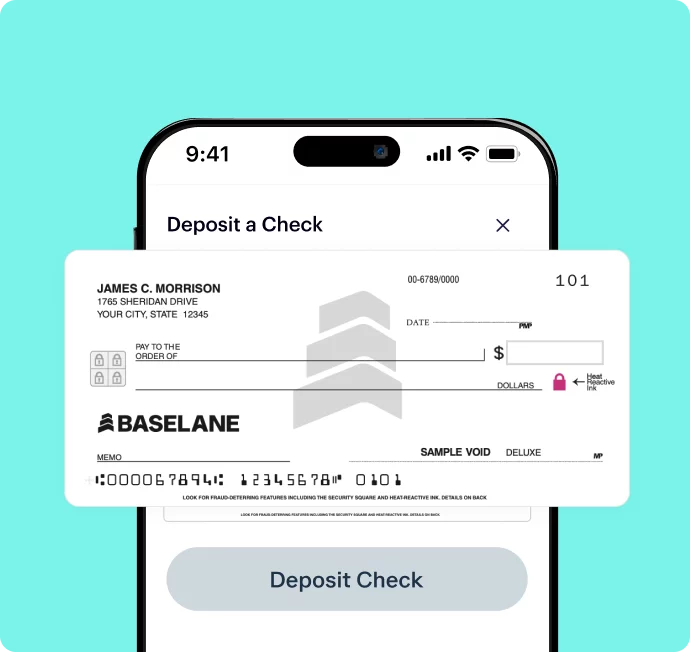

Deposit and write paper checks

Snap a picture to deposit checks on your mobile or order a Baselane checkbook to write them.

Free from hidden fees

Unlike traditional banking accounts, Baselane banking has no hidden, monthly, or minimum balance fees.

Built-in rent collection & bookkeeping

Easily manage your rent collection, bookkeeping, and tenants — all seamlessly integrated with Baselane banking.

Keeping your money protected

Thousands of real estate investors bank on Baselane

“As a real estate investor managing my own properties, Baselane has been an invaluable tool. You can instantly open business checking and savings accounts with unlimited virtual accounts and cards. Getting cash back is a nice bonus for a debit card.”

“Baselane has very useful tools for banking and running a real estate investment business, including setting up accounts and sending wires, managing bookkeeping, and creating virtual accounts for contractors and maintenance crews.”

“Baselane is very user-friendly—tenants love it, my accountant loves it, and it's great for organizing finances. It’s a one-stop solution for rental banking.”

SEE HOW WE STACK UP

Here’s why real estate investors choose banking built for them over traditional business banking.

| Traditional Business Banking | ||

|---|---|---|

| Built for Real Estate Investors | ||

| APY Interest | Up to 3.35% APY2 | 0.07% APY |

| FDIC Insurance | $3M via Thread Bank1 | $250K |

| Unlimited Entities | ||

| Unlimited Accounts Per Entity | ||

| Virtual Cards & Spend Control | ||

| Integrated Rent Collection | ||

| Integrated Bookkeeping | ||

| Integrated Tenant Management | ||

| Minimum Deposit | $0 | Up to $1,500 |

| Monthly Fees | $0 | $15 or more |

Real support from real humans

Schedule a call, send an email, or chat live with our customer support experts who speak real estate.

Get dedicated support anytime, anywhere. Our customer support experts speak real estate.