As a landlord, you might get a request to fill out or send a verification of rent (VOR) form. You might be asked to provide this information to another landlord, a lender, or a housing authority.

In this guide, we’ll break down what a VOR form is, why it’s used, and how you can complete or send one. We’ve also included a free rent verification form PDF template to help get you started.

Key takeaways:

- Rent verification forms are essential for confirming a tenant’s rental and payment history.

- Rental verification is commonly used for tenant screening, mortgage applications, or settling legal disputes.

- Get written consent before collecting or sharing rental history to protect privacy and avoid legal issues.

- Use rent verification alongside credit and background checks for a more comprehensive tenant assessment.

- Keep tenant records for at least 3–7 years for future verification requests or legal needs.

What is the rent verification form?

A rent verification form is a document used to confirm a tenant’s rental history and rent payments for a current or previous lease. This form is commonly requested when a tenant is applying for a rental unit or mortgage. It helps the requesting party evaluate how reliable and financially responsible an applicant is.

When is a verification of rent required?

Rent verification isn’t limited to landlords—it can be requested by lenders, leasing agencies, or even legal professionals. Below are common scenarios where rent verification is used.

Rent verification for mortgage applications

Lenders often require a verification of rent form for mortgage applications to confirm payment history. Consistent on-time payments show that someone is likely to keep making their mortgage payments reliably in the future. Conversely, missed or late rent payments can raise concerns about financial stability.

For example, a lender might request a rent verification letter for a mortgage application to purchase a home with a monthly payment of $1,800. An applicant who has consistently paid $1,500 in rent for two years without late payments suggests they can handle the slightly higher mortgage payment, assuming they meet other qualification criteria (credit, debt-to-income ratio, etc.).

Rent verification for tenant screening

With over 8 million U.S. adults behind on rent payments, new tenants need to show they’re financially responsible. Landlords frequently request rent verification when screening to avoid dealing with bad tenants and late payments or evictions.

While a credit and rental background check reveals an applicant’s financial habits and criminal history, rental verification gives you details on what they’re like as a tenant. Ask for a proof of residency rent verification letter from a landlord, proof of rent payments, and contact details for past addresses.

Previous landlords are a great resource for verifying rental history. They can answer questions about whether the tenant paid rent on time, how they treated the property, and if they followed or violated lease terms.

Rent verification for legal or financial record-keeping

Legal or financial professionals may need a rent verification letter from the landlord to settle disputes or maintain accurate records. For example, rental payment history might be used to establish financial responsibility during a divorce or legal separation.

What should a rent verification form include?

It’s important to ask the right questions to get a clear picture of a tenant’s rental history. Here’s what to include:

- Tenant’s name and rental property address

- Lease start and end dates

- Monthly or annual rent amount and payment frequency

- History of on-time payments or late payments

- Any notices given (e.g., late payments or lease violations)

- Condition of the property at move-out

- Landlord’s contact information for follow-up questions or further verification

If the tenant agreed to a lease renewal with the rent increase, this should be noted in the verification form to reflect their payment history.

How to conduct a rent verification process (step-by-step)

Here’s a simple step-by-step process to verify a tenant’s rental history.

Step 1: Start with a rental application

Have the tenant fill out a rental application. This should include their personal details, rental history, employer information, and references. Make sure they give you written permission to contact their previous landlords.

Step 2: Send the form and follow up

Mail the rent verification letter to the previous landlord or request rent verification online via email. If you mail it, include a pre-addressed return envelope with postage paid to improve your chances of getting a response.

Step 3: Review the response and follow up

When you get the completed rental verification letter from the landlord, check for red flags like late payments, property damage, or lease violations. Follow up to ask questions and make sure the information matches what’s on the rental application.

Compare these details with their credit, background, and eviction history (Baselane’s tenant screening report also includes income, employment, and ID verification). If something doesn’t add up, you might want to talk to the tenant for clarification.

What to do if the tenant has no rental history

Legally, you can deny an applicant with no rental history, but that doesn’t mean you should. Many tenants without a rental history, like young adults or first-time renters, can still be great tenants. Here are some ways to work around limited rental history:

- Ask for a cosigner or guarantor: Require a lease co-signer with a strong financial background.

- Verify employment and income: Check their job stability and income to make sure they can afford the rent. Ask for recent pay stubs, tax returns, or bank statements.

- Check credit history: A good credit score can show they can pay bills on time and manage other financial obligations. A minimum credit score of 650 is generally acceptable.

- Ask for personal references: Contact personal or professional references, like managers or teachers, to understand their character and reliability.

- Request a larger security deposit: If legally allowed in your area, ask for a higher security deposit to cover potential risks.

- Offer a shorter lease: Start with a shorter lease term, like six months. It’s good to test how well they do as a tenant before committing to a longer lease.

Consider investing in rent guarantee insurance for added security. This will protect you from loss of income if the tenant fails to pay rent.

Best practices for completing a verification of rent form

If your tenant is moving out, you’ll likely get a request to verify their rental history for the new landlord or a lender if they’re buying a home (58% of renters considered buying in 2024).

Follow these best practices when completing a verification of rent form:

Respond promptly

Under the Fair Credit Reporting Act (FCRA), landlords are required to respond to rent verification requests in a timely manner. Landlords should aim to complete requests within a reasonable time frame, typically 5–7 business days.

Stick to the facts

Stick to factual information about the tenant’s rental history. Avoid adding personal opinions or subjective judgments about their character. For example, report that a tenant made three late payments during their lease rather than labeling them as “unreliable.”

Respect privacy laws

Respect the tenant’s privacy by only sharing details they’ve authorized. Ensure you have their written consent before providing any rental history. Keep a copy of the completed form for your records as proof of what was reported in case of future disputes.

Bottom line

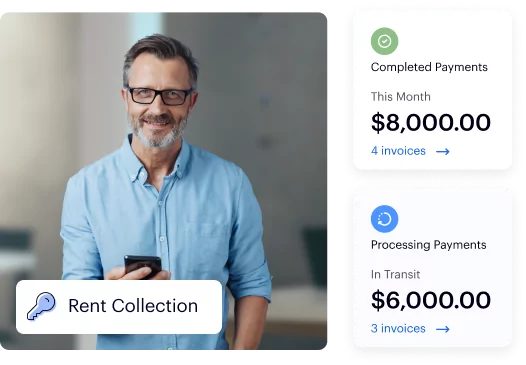

Being a landlord is already a lot of work, and trying to find lease and payment details for rent verification forms can make it even harder.

Baselane’s online rent collection automates invoices, deposits, and bookkeeping to give you complete financial records without any admin work. Easily view leases and payment history (including late fees and deposits), look up maintenance and repair expenses for a specific property or unit, and check receipts for any security deposit deductions.

With Baselane, everything you need to know about a tenant, property, or entire portfolio is at your fingertips. Get started for free today!

Put Rent Collection on Autopilot

Get paid on time with automated rent payments, reminders, and late fees.

FAQs

No, you are not legally obligated to complete a verification of rent form unless there is a court order or a legal mandate.

If you don't have records or clear recollection, be honest about it. Avoid guessing or providing vague information.

A fillable rent ledger can help you keep track of a tenant's monthly payments. The best rent collection apps will do this for you. Baselane automates rent collection, reminders, late fees, and tracking for a complete payment history of each tenant.

If the tenant has an outstanding balance, include this information on the rent verification form along with any relevant payment agreements or notices. Here's a guide on how to collect unpaid rent from tenants.

Best practices suggest keeping records for at least three to seven years, depending on local laws. These records provide sufficient information in case of any disputes or inquiries related to a rental application, such as employment history, rental payments, and any prior rental issues.

When reviewing applications, you can download our free verification of rent form sample to send to previous landlords. If your tenant is moving, their new landlords will send you a verification form to fill out.

Stress-free rent collection

- Easy setup for landlords and tenants

- Fast payments

- Automated reminders and late fees

Don't miss these

How to Perform Tenant Background and Rental History Checks?

The average cost of an eviction is $3,500 up to $10,000, and it takes at least 3-4 weeks for the process to run its course. Even tenant turnover can cost u...

27 March 2022

Move-in/Move-Out Checklist for Landlords [Free Template]

Checking the condition of your rentals before tenants move in and after they leave is the best way to avoid any miscommunication over property damages. In ...

29 November 2024

Free Rent Receipt Template For Landlords

When tenants pay rent by check, cash, or online, they may ask for a rent receipt. As a landlord, rent receipts are good business practice and may even be r...

7 October 2024