Rental income management isn’t truly passive if you’re stuck chasing payments and sorting through transactions to see who’s late. Whether you’re managing one unit or a hundred, having a solid rent tracking system will help you save time and stay compliant.

In this guide, we’ll cover top tools, tips, and templates to track income, manage rental property expenses, and streamline your income statement. We’ll also explore software options, spreadsheets, and how pairing them with the best bank for real estate investors can help you stay ahead.

Key takeaways

- Tracking rental income is essential for maintaining profitability, staying tax-compliant, and growing your portfolio, whether you’re managing one unit or many.

- A clear system helps you stay organized, maximize deductions, and simplify year-end reporting. It also supports tax strategies like how to pay no taxes on rental income.

- Yet, many landlords struggle with visibility. In a recent poll on BiggerPockets, 72% of investors said they don’t know their return on investment, and 57% said they aren’t sure about their property’s profitability. These gaps are often due to inconsistent or manual tracking.

- Using purpose-built rental income tracking software, like Baselane, can help you automate financial tasks, minimize errors, and confidently scale your real estate business.

- Want to grow your portfolio? Proper financial tracking is key to unlocking better financing and identifying the best places to invest in Florida and beyond.

Why tracking rental income is important

Tracking rental income isn’t just good practice; it’s essential for running a profitable rental business. With accurate rental tracking, you can stay on top of cash flow, prepare for tax season, and make smarter investment decisions.

Tax compliance and reporting

The IRS requires detailed rental property income statements and charges a hefty 20% fee for underreported income. Tools like a rental property Excel spreadsheet or software-based rent tracker make it easy to log income, track deductions, and generate tax-ready reports.

This is especially helpful when claiming rental property mortgage interest deductions or managing Airbnb accounting. Want to learn how to pay minimal taxes on rental income? It starts with clean, accurate records.

Records to keep for rental income:

The IRS recommends keeping rental records for at least three years, or up to seven years if claiming depreciation or complex deductions.

- Lease agreements: Document the terms of rent, deposits, and responsibilities.

- Rent payment logs: Keep a record of when rent was due and when it was paid.

- Security deposits: Document amounts received, dates, and how they were handled (held in trust, returned, or used).

- Other income: Include laundry fees, pet fees, late fees, and other tenant charges.

- Bank statements and receipts: Monthly statements and rent receipts for payments received, such as rent checks deposited into your account or online payment records.

Improved cash flow management

A Baselane survey on BiggerPockets found that 72% of real estate investors don’t know their return on investment, while 57% are unsure of their rental property’s profitability. These gaps often stem from inconsistent tracking or reliance on manual rental property excel spreadsheets. Using rental income tracking software helps you spot cash flow gaps, plan for repairs, and make data-driven financial decisions.

Better financial organization

Tracking rental income helps improve financial organization by giving you a clear view of your property’s cash flow and expenses. However, to fully separate personal and rental finances and avoid accounting issues, it’s best practice to open a dedicated bank account for your rental properties.

How to keep track of rental income

There are several ways you can organize rental income, depending on the size of your portfolio and how automated they want the process to be.

Here are the most common methods:

- Spreadsheets (Excel or Google Sheets): Great for beginners or single-unit landlords, but one ine five small and medium landlords still use manual ledgers or Excel, which can become messy and error-prone over time.

- QuickBooks: A general accounting tool that supports income and expense tracking, invoicing, and financial reporting. However, it’s not built for rentals, so you’ll need to customize accounts, tag transactions manually, and use workarounds for Schedule E reporting. It also doesn’t include features like automated rent collection or tenant tracking.

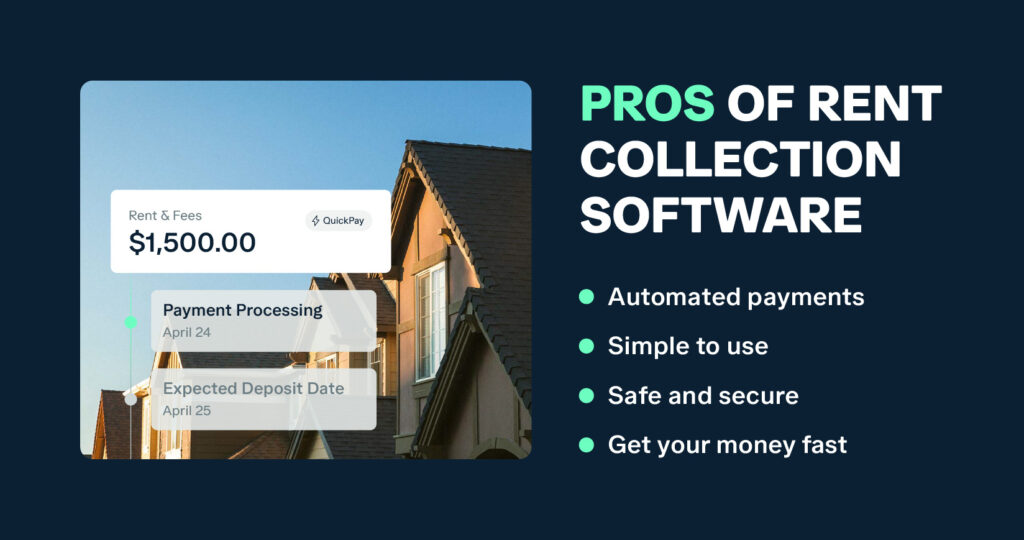

- Rent collection apps: Apps like Baselane allow tenants to pay rent online, with payment records automatically generated. Some apps offer limited tracking and don’t fully categorize income or integrate expenses, requiring separate bookkeeping tools.

- Rental income tracking software: Platforms like Baselane provide more robust automation. These tools track rent payments, automatically categorize income by property, and generate cash flow reports. They also simplify tax preparation by organizing all transactions in one place, making it easier to file taxes and maximize deductions.

Here is a table summarizing ways to track rental cash flow.

| Method | Pros | Cons | Best For |

|---|---|---|---|

| Spreadsheets | Free, flexible, easy to customize | Manual updates, error-prone, doesn’t scale well | New landlords or small portfolios |

| Payment Apps | Simple for receiving rent | No income categorization, no expense tracking, no reporting | Casual landlords collecting rent |

| Quickbooks | Robust accounting features, integrates with banks | Not rental-specific, manual setup, lacks rent collection and property tagging | Landlords with accounting experience |

| Property Management Software | Built for landlords, automates rent collection, expense tracking, and reporting | Some platforms have feature limits or fees | Landlords looking to automate and scale |

How to track income for multiple rental properties

Managing multiple rental properties requires a more structured approach. Here’s how to track multiple rental units efficiently:

- Use rental earnings tracking software

- Create a rental income log template

- Label and categorize expenses by property

- Maintain digital and physical records

- Regularly reconcile bank statements

Tip: Look for rental income tracking software that offers banking integration, automatic payment tracking, and financial reporting for each property.

Best rental income tracking software

Traditional banks let you manage your rental property finances, but often come with high fees, minimum balance requirements, and limited flexibility. No-fee banking offers a smarter alternative for landlords, delivering the same core features without the overhead.

The best banks for real estate investors offer no-fee checking accounts, no minimum balance requirements, and built-in property management tools to save even more by not paying for third-party apps.

1. Baselane

When it comes to the best rental records tracking software, Baselane stands out as an all-in-one solution for landlords and real estate investors. It combines banking, rent collection, bookkeeping, and financial management tools into one easy-to-use platform. Which helps you streamline your entire operation without juggling multiple apps.

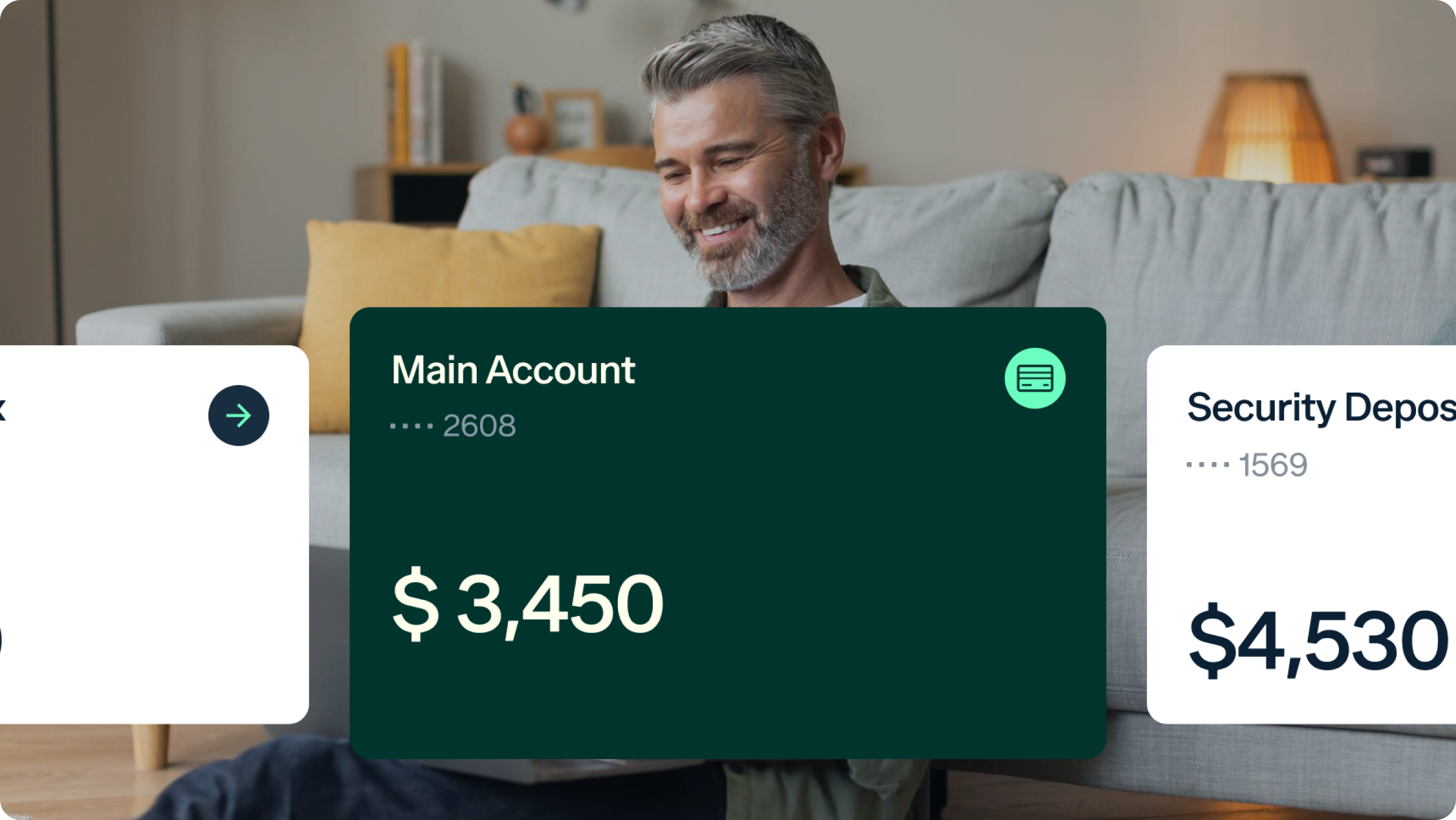

With Baselane, you can automate rent collection, auto-tag transactions by property and Schedule E category, and generate tax-ready reports effortlessly. You also get access to high-yield landlord banking, earning up to 3.35% APY² with no monthly fees or minimums. Plus, Baselane offers tenant screening, digital lease signing, renters’ insurance, and rental property loans, giving you everything you need to manage the full rental lifecycle in one place.

Key features

- Free, automated rent collection with late fee management

- Integrated banking with high-yield savings and virtual accounts

- Built-in bookkeeping with auto-tagged transactions by property and Schedule E category

- Unlimited property tracking and separate financial reporting for each property

- Tenant screening, digital lease signing, landlord and renters’ insurance, and rental property loans are available

2. Stessa

Stessa offers basic rental income tracking and ACH rent collection, but has notable limitations. While Stessa offers a free plan and a $28/month Pro upgrade, it lacks debit or credit card payment options and has ACH limits as low as $6,000, which may cause cash flow issues for larger portfolios.

Key benefits:

- Automated rental income reporting

- Generates financial reports for tax filing

- Tracks multiple properties

3. Rentec Direct

Rentec Direct’s rental revenue management tools are best for landlords and property managers with mid-sized to large portfolios. The platform includes features like rent tracking, tax reporting, lease management, and tenant screening. Pricing starts at $45/month for the Pro plan, with additional costs for certain integrations. Some advanced tools may require third-party add-ons, which can increase overall expenses.

Key benefits:

- Tracks rental payments and expenses

- Tenant screening and online rent collection

4. Buildium

Buildium is a property management platform that supports enterprise-level rental income tracking. Starting at $58/month, Buildium offers tools for accounting, tenant screening, maintenance management, and automated rent collection. Some downsides include high unit-based pricing, additional fees for certain features and onboarding, and a learning curve for using the platform that may not be worth it for managing a few properties.

Key benefits:

- Cloud-based rental earnings tracking

- Automated bookkeeping features

- Integration with QuickBooks

5. AppFolio

AppFolio provides rental income tracking primarily for mid to large-sized portfolios. Pricing starts at $1.49–$5 per unit (minimum $298/month) and includes rent collection, leasing, maintenance, marketing, and financial reporting tools. It’s important to note that some advanced tools are only available on higher-tier plans, and the platform can take time to fully master.

Key benefits:

- Supports landlords managing multiple properties

- Automated tenant payment tracking

- Includes expense and maintenance tracking

Compare the best rent trackers for landlords

If you own a few properties, Bluevine or Novo offer simple setups but lack property-specific tools and require separate logins for each EIN. For landlord-friendly banking, consider platforms like Baselane that support multiple accounts and entities with built-in rental property management tools.

| Feature | Baselane | Stessa | QuickBooks | Buildium | Rentec Direct | AppFolio |

|---|---|---|---|---|---|---|

| Cost | $0/month | $0-$28/month | $17.50-$117.50/month | $58–$375/month | $45+/month (Pro plan) | $1.49–$5/unit, $280+ min |

| Rental collection | ACH payments, late fee automation, tenant reminders | ACH only, limited payment types | Not included | Online payments with reminders | Online payments, ACH, credit card options | Full rent collection with automation |

| Automated Income & Expense Tracking | Fully automated with property-level tagging and Schedule E categories | Partial automation, limited tagging | Manual data entry and setup | Automated but designed for property managers | Yes – basic automation with categorization | Automated, geared toward enterprise |

| Property-Specific Financial Reporting | Yes – customizable per property with real-time insights | Basic property reports | Limited without add-ons or manual sorting | Yes – strong reporting suite | Yes – per-property reports included | Yes – built-in property reports |

| Integrated Banking & Transactions | Built-in banking with high-yield interest | Includes cash-back debit card but limited banking automation | No banking features | No built-in banking | Not included | Includes bank integrations, not built-in banking |

| Integrated Banking & Transactions | Built-in banking with high-yield interest | Includes cash-back debit card but limited banking automation | No banking features | No built-in banking | Not included | Includes bank integrations, not built-in banking |

| Scalability (From 1 to 50+ Properties) | Scales effortlessly from 1 to 100+ properties | Better suited for small portfolios | Ideal for small businesses, not rentals | Best for 10–100 properties | Supports mid to large portfolios | Designed for large portfolios (50+ units) |

| Tax Preparation & Reporting | Export a full tax package with CSV reports (Net Operating Cash Flow & Ledger) and Schedule E tagging | Yes – tax summaries included | Yes – requires manual setup | Yes – supports 1099s and tax prep | Tax reporting included | Yes – with full reporting suite |

| Ease of Use | Very Easy | Easy | Moderate | Moderate | Moderate – learning curve with setup | Moderate |

5 common mistakes landlords make when tracking rental property income

Even with the right tools, tracking rental income can get messy if you’re not careful. From mixing personal and property finances to overlooking deductible expenses, small mistakes can lead to bigger headaches at tax time.

Avoiding these slip-ups is key to maximizing real estate passive income and claiming benefits like the rental property mortgage interest deduction. Here are five common mistakes landlords should watch out for:

5 tips for choosing a no-fee bank account

Not all no-fee bank accounts online are created equal. While many banks advertise “fee-free” checking, the fine print often tells a different story. When choosing a bank, look for one that truly eliminates fees, simplifies your finances, and integrates seamlessly with your property management tools.

Here’s what to look for when looking for the best no-fee business checking accounts:

1. Mixing personal and rental finances

The mistake: Using the same bank account for personal and rental transactions

Why it matters: It makes it difficult to track income and expenses, complicates tax prep, and increases audit risk

How to fix it:

- Open a dedicated bank account for your rental income and expenses

- Use a separate debit or business credit card for property-related purchases

- Avoid commingling funds to simplify bookkeeping and maintain legal protection

Baselane offers high-yield landlord banking with virtual accounts and built-in bookkeeping tools.

Open unlimited accounts for properties and security deposits with no monthly fees.

2. Not using a rental income tracker

The mistake: Relying on memory, paper notes, or scattered files to manage rent payments

Why it matters: This leads to missed payments, inaccurate records, and unnecessary stress during tax season

How to fix it:

- Use a rental income tracker spreadsheet for small portfolios (1–2 units)

- Include key columns: date, unit, charge description, amount due, amount paid, balance owed, and notes

- For larger portfolios, switch to rental income tracking software to automate and scale

3. Failing to track expenses

The mistake: Manually collecting rent or relying on peer-to-peer apps like Zelle or Venmo

Why it matters: Limited lease income tracking, no late fee automation, and no centralized reporting

How to fix it:

- Use a platform like Baselane to automate ACH rent collection, apply late fees, and send tenant reminders

- Avoid managing payments across multiple apps—Baselane centralizes everything in one dashboard

According to Baselane’s survey, 49% of landlords still use P2P apps, but only 27% use property management platforms. As automation becomes essential, platforms like Baselane offer an affordable, landlord-specific solution.

4. Not reconciling rental payments with bank deposits

The mistake: Waiting until tax season to sort through receipts and categorize spending

Why it matters: Increases your risk of missing deductions, misreporting finances, and scrambling under deadlines

How to fix it:

- Avoid manual systems like receipt photos or spreadsheets—they don’t scale

- QuickBooks is an option, but it requires rental-specific customization and lacks property-level tracking

- Use a landlord-focused platform like Baselane, which auto-tags expenses by property and Schedule E category through integrated banking

5. Ignoring rental property financial reports

The mistake: Not reviewing your rental property cash flow or real estate income statements regularly

Why it matters: You miss opportunities to spot performance issues, forecast repairs, or make smarter investment decisions

How to fix it:

- Set a recurring time monthly to review income, expenses, and cash flow

- Compare actual income to expectations and monitor trends over time

- Use a tool that offers real-time dashboards and downloadable reports

We’ve created a free rental income spreadsheet template to help you get started. But if you’re managing multiple properties, manual tracking like this can quickly become overwhelming.

Landlord rental income tracking examples

Traditional banks come with a laundry list of account fees, balance requirements, and transaction limits. These charges might seem small at first, but over time, they eat into your cash flow and ROI.

With Baselane, you can connect all your external bank accounts and open unlimited free sub-accounts for multiple entities without monthly fees or minimum balance requirements. Plus, rent collection and bookkeeping are all built in and fully automated, so you can manage your finances without logging into multiple platforms.

Ready for a banking platform that can save you 150 hours and $5,000 per year? Get started for free today.

1. Beginner landlord (single rental property)

Scenario:

Sarah just bought her first rental property, a single-family home. She’s new to real estate investing and wants an easy way to track rental income, monitor expenses, and handle tax reporting without much hassle.

Tracking needs:

- Basic income and expense tracking

- Simple cash flow overview

- Year-end tax reporting

Best way to track rental income:

Baselane – Offers free automated income and expense tracking, real-time cash flow insights, and built-in tax reporting, making it perfect for a beginner who needs an easy-to-use system.

Other options:

Excel/Google Sheets – Works but requires manual input and lacks automation.

QuickBooks – Good for general bookkeeping but may be too complex and expensive for a single property.

2. Intermediate landlord (multiple units)

Scenario:

Jason owns a mix of five single-family rentals and duplexes. He’s comfortable managing his properties but needs a more efficient way to track rental income across multiple units while keeping an eye on property performance.

Tracking needs:

- Automated income and expense tracking per property

- Cash flow reports and property performance analysis

- Banking integration for streamlined transactions

Best way to track rental income:

Baselane – Offers automatic transaction categorization, property-specific financial tracking, reporting rental income, and landlord banking features. This makes it the most efficient option for managing multiple properties.

Other options:

Stessa – Good for property tracking but lacks banking and automation features.

Buildium – Works fine but is more expensive and complex for a mid-sized portfolio.

3. Advanced landlord (large portfolio)

Scenario:

Michael owns 30+ rental units across different cities. He manages a mix of short-term and long-term rentals and needs a highly efficient system for tracking rental income, expenses, and financial performance across multiple properties.

Tracking needs:

- Portfolio-wide financial tracking with detailed reporting

- Integrated banking with automation for expense tracking

- Advanced analytics for performance optimization

Best way to track rental income:

Baselane – Provides landlord banking, automated financial management, and advanced property-level reporting, making it the best all-in-one solution for a larger portfolio.

Other options:

AppFolio – Offers robust features but requires a minimum of 50 units and has a higher cost.

Yardi Breeze – Works for large portfolios but is pricier and geared toward commercial properties.

Automatically collect and track rental income with Baselane

Finding the best way to track rental income depends on your portfolio size and how much automation you need. You can use spreadsheets, payment apps, or rent collection software, but as your portfolio grows, juggling multiple tools can get messy fast. A clear system ensures accuracy, maximizes deductions, and keeps your rental business on track.

That’s where Baselane stands out. It’s a complete banking and financial platform that automates rent collection, tracks income and expenses by property, and generates tax-ready reports—all in one place. No more switching between apps or manually updating spreadsheets.

Ready to simplify how you manage rental income? Open a free Baselane account today.

FAQs

You can track rental income using a spreadsheet, general accounting software, or a dedicated all-in-one platform. While spreadsheets and basic tools can work for small portfolios, an all-in-one solution like Baselane is the best option for staying organized, simplifying taxes, and supporting long-term real estate passive income growth.

Baselane is one of the best platforms for tracking rental income. It automates rent collection, tags transactions by property and category, and provides real-time cash flow insights, all with no monthly fees. You can manage your entire portfolio from one dashboard, making it easy to stay organized, save time, and keep your finances tax-ready.

The best rental income tracking software depends on your portfolio size, the level of automation you want, and whether you need integrated banking and bookkeeping. Baselane offers a complete rental income tracking solution tailored to landlords and real estate investors. You can track income and expenses automatically, generate financial reports, and even separate finances by property with unlimited virtual accounts. Everything from rent collection to tax prep is built in. It’s a smart, hassle-free way to manage your rental business.

Yes, you can use QuickBooks or Excel to track rental income, but it requires more manual effort and customization. Baselane simplifies things by doing the heavy lifting, auto-tagging expenses, collecting rent, and generating reports for you.

The best way to manage rental income across multiple properties depends on how many units you have and how much automation and reporting you need. Baselane makes it easy to manage multiple properties by letting you open unlimited virtual accounts, one for each property.

This keeps your income and expenses organized and makes it simple to run reports by unit. You’ll always know how each property is performing. Plus, it’s one of the best bank accounts for rental property owners thanks to its no-fee structure and high-yield interest.

Yes, but security deposits should be tracked separately from regular rental income. While they’re not taxed upfront, it’s important to document when they’re collected, where they’re held, and how they’re returned or used. Proper tracking ensures compliance with state laws and simplifies bookkeeping.