When it comes to collecting rent, you can accept cash, checks, direct deposits, or use online rent collection tools. While each method has pros and cons, 81% of renters prefer to pay rent online. A property management payment portal allows tenants to submit their payments in minutes using a credit, debit, or ACH transfer. As a result, you get paid faster and on time.

Here are seven tips for collecting rent online with property management software to help prevent late payments and fees.

1. Find The Right Tenant

The first step to consistent cash flow is finding quality tenants. Rental applications should at least cover the basics for screening tenants to verify contact information, employment status, and landlord references. You can also request authorization for credit and background checks (if allowed in your state) to assess personal income, credit history, criminal activity, late payments, and eviction records.

Five attributes of a quality tenant:

- Ability to afford rent

- Stable employment

- Rent paid on time

- Clean criminal record

- No prior evictions

A general rule of thumb when you screen potential tenants is to check if their income is at least three times the monthly rent price. This ensures the tenant has enough money to cover rent. If a unit rents for $2,000 a month, then the tenant’s monthly income should be $6,000 (3 x $2,000).

2. Establish Clear Lease Terms

Landlords are more likely to get paid on time if tenants understand the rent collection policy. Make sure you clearly outline the terms and conditions for monthly rent payments in the lease agreement. You can specify an online rent payment service as your preferred rent collection method. However, most states require landlords to accept other forms of payment.

Rent collection details for lease agreements:

- Rent payment amount

- When rent is due

- Who and where to pay rent

- Payment options

- Late payment fees and grace periods

- Rent increase policy

- Security deposit amount

Consider using property management tools that let you edit lease agreements. Although you cannot edit an active lease, you can always add a rental addendum. These support the original lease agreement and must be signed by the tenant and landlord. Common addendums include adding a new tenant to an existing lease or upcoming rental unit renovations.

3. Offer Flexible Payment Options

Most tenants choose to pay rent with bank transfers, but since rent is one of the biggest expenses, some tenants prefer to use a credit card to maximize their rewards. Choosing a property management platform with flexible online payments will make it easier for tenants to pay rent and switch between payment methods depending on their expenses.

Online rent payment methods:

- ACH bank transfer

- Debit cards

- Credit cards

Make sure the rent payment tool lets you collect security deposits and one-time or recurring fees (e.g., prorated rent or move-in fees). You should also check the fine print for processing fees, which can cost up to 3.5% for each transaction. Keep more money in your pocket by using a rent collection app that offers ACH transfers and less than 3% on debit and credit card payments.

4. Set up Auto-Late Fees

Dealing with late rent payments can be stressful, especially when you need the money to cover expenses like a mortgage or property taxes. Using online rent collection features to automatically charge late fees will help keep tenants motivated to pay rent on time.

You can set late fees as a percentage of the rent price, but some states require grace periods and limits on how much you can charge. For example, New York has a 5-day grace period and late fees are limited to 5% of the monthly rent or $50 (whichever is less). Florida has no restrictions on late fees beyond charging “a reasonable amount”.

5. Schedule Rent Reminders

Use an online rent collection tool that sends out automatic reminders so you don’t have to worry about chasing down overdue rent payments. Some platforms even allow you to schedule reminders for upcoming rental payments. For example, if you want tenants to pay rent on July 1st, you can create a reminder that goes out on June 30th.

Rent reminders typically aren’t available on money transfer apps like Venmo and Zelle. You can find these advanced features on property management platforms designed specifically for landlords. These rent collect apps should also include rent receipts and real-time notifications when payments are received or overdue.

6. Encourage Auto-Pay Enrollment

When collecting rent online, choose rental management software that lets tenants set up automatic payments. This option automatically withdraws funds on the same day every month to help prevent missed payments and late fees. On-time payments can also help tenants boost their credit score.

Landlords who offer automatic rent payments are five times more likely to get paid on time. This helps lower the cost of constantly chasing and processing late payments. Plus, your cash flow will be more consistent to cover bills, repairs, or buy new rental properties.

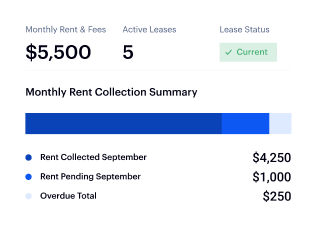

7. Get Built-In Bookkeeping

Any time you collect rent from tenants, you should be recording the payments for taxes. Property management tools with built-in bookkeeping can help you track expenses and rental income all in one place. This integration will give you a complete record of every transaction, who paid, the tax category, and which property it’s for.

Choose accounting software that includes features for:

- Integration with existing bank accounts for property management companies

- Automated income and expense tracking

- Transaction tags for Schedule E reporting

- Income statements and cash flow analytics

- Flexibility to add, hide, or split transactions

Some property management platforms will also offer online banking for landlords, like Baselane. You can open unlimited accounts for each property, rental unit, and security deposits. This makes it easy to separate personal expenses from rental property finances to know exactly how much money you’re making.

What Is The Best Tool For Online Rent Payments?

Any tool that helps streamline the rent collection process will save you time and money. That said, the basic features of an online rent payment system should include flexible payment options, fast payouts, and live customer support. The best online rent collection tools offer additional features like reminders, late fees, automatic payments, and expense tracking.

FAQs

Online payments offer a more convenient and secure way to collect rent compared to cash or checks. Tenants can pay by ACH transfer, credit card, or debit card. ACH transfers are take around three banking days to process.

Landlords must first get a court judgment to collect unpaid rent from a tenant after eviction. The steps to get paid can involve taking the tenant to small claims court, filing a civil suit, garnishing wages, or putting a lien on the tenant's property. Some states also allow landlords to use security deposits to cover unpaid rent.

Most states require landlords to keep security deposits in a separate bank account. Online rent payment services make it easy to collect and record security deposits as a separate payment, transfer the deposit to another account, and issue receipts.