In Carolina, there is no limit, as long as you collect the same amount for all of your comparable units.

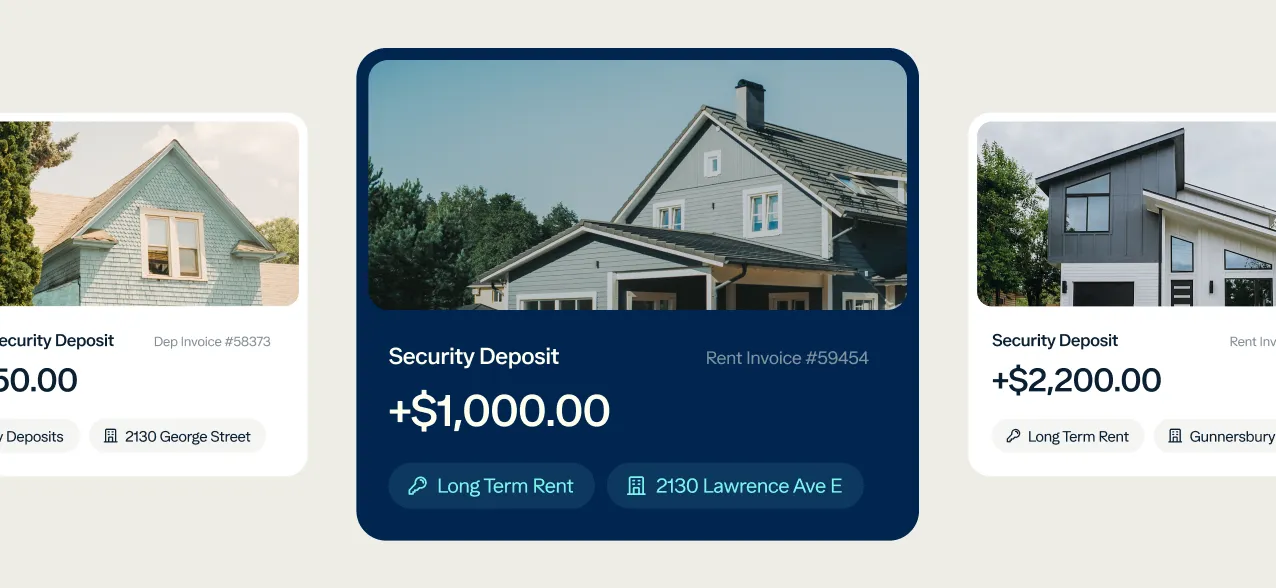

Security deposit rules in {{ state }}

- Limit: No limits, as long as you collect the same amount for all of your comparable units

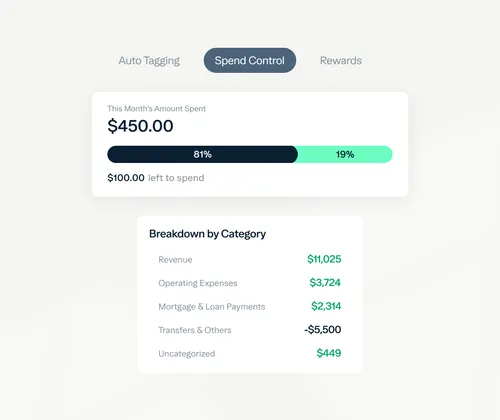

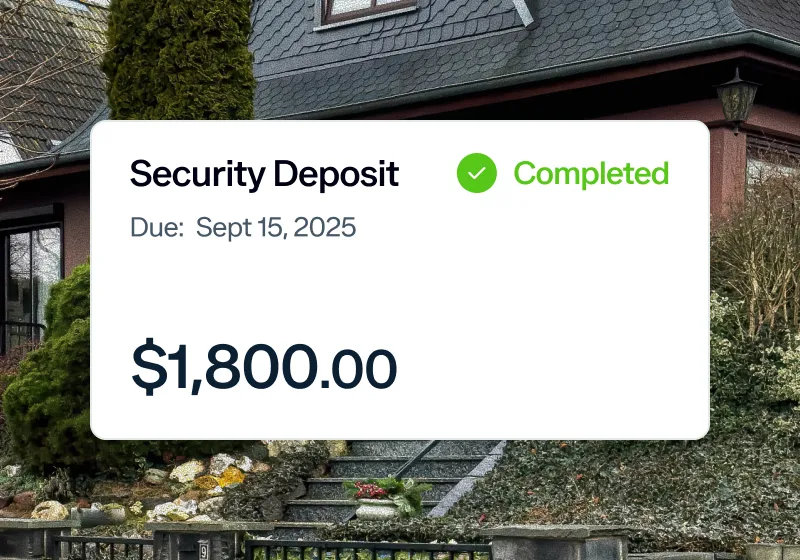

- Return Deadline: The security deposit must be returned within 30 days

- Acceptable Deductions: Unpaid rent, and damage beyond normal wear and tear

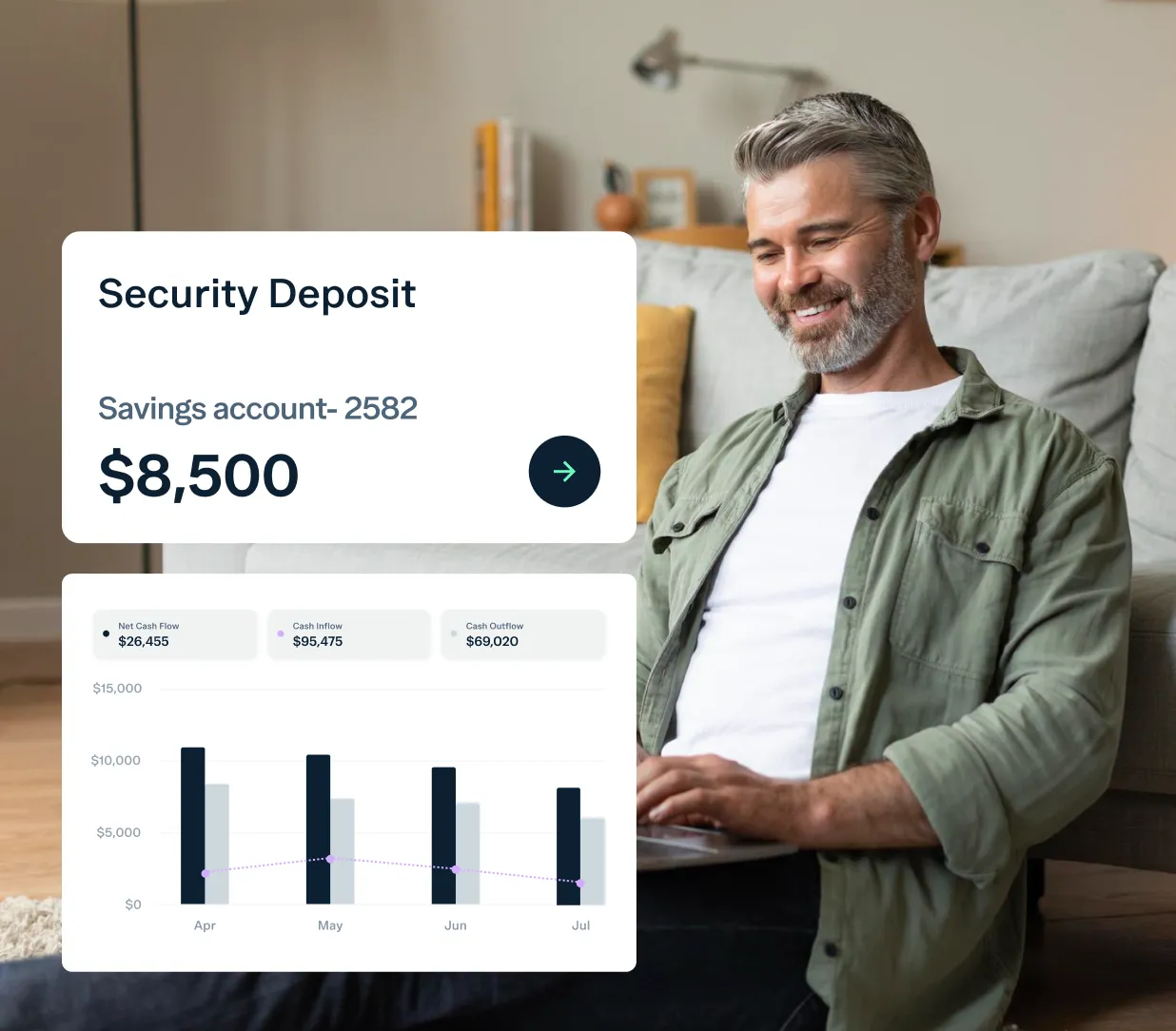

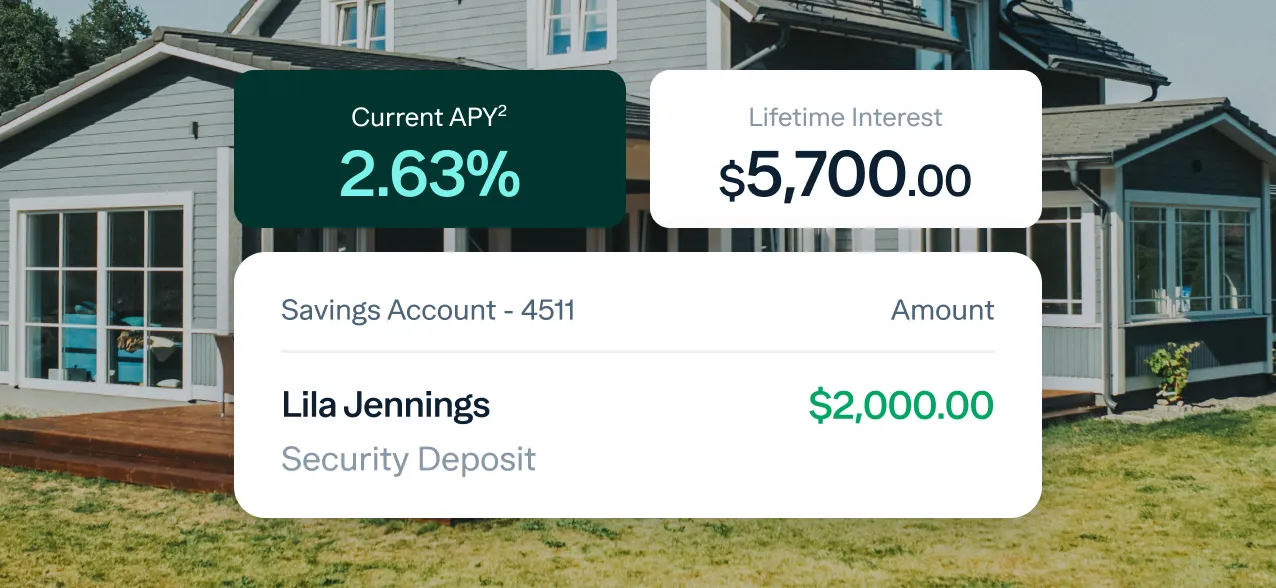

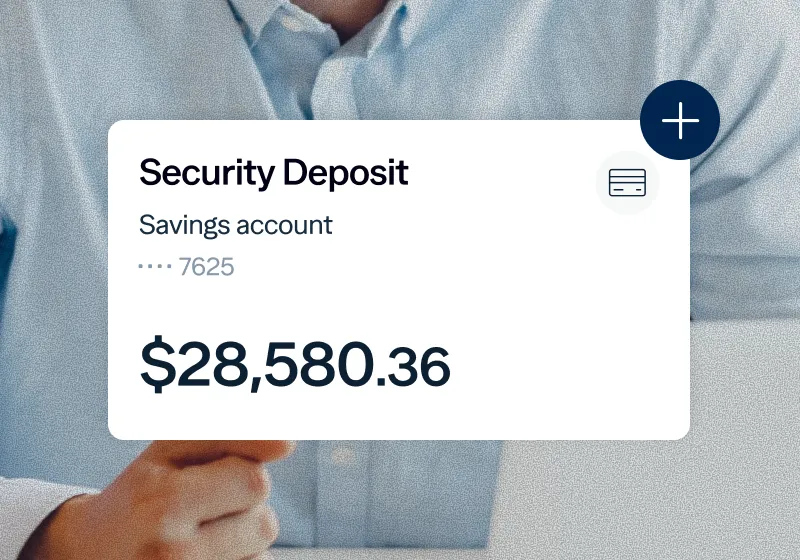

- Where to Deposit: Interest-bearing accounts are not required for security deposits in Carolina.