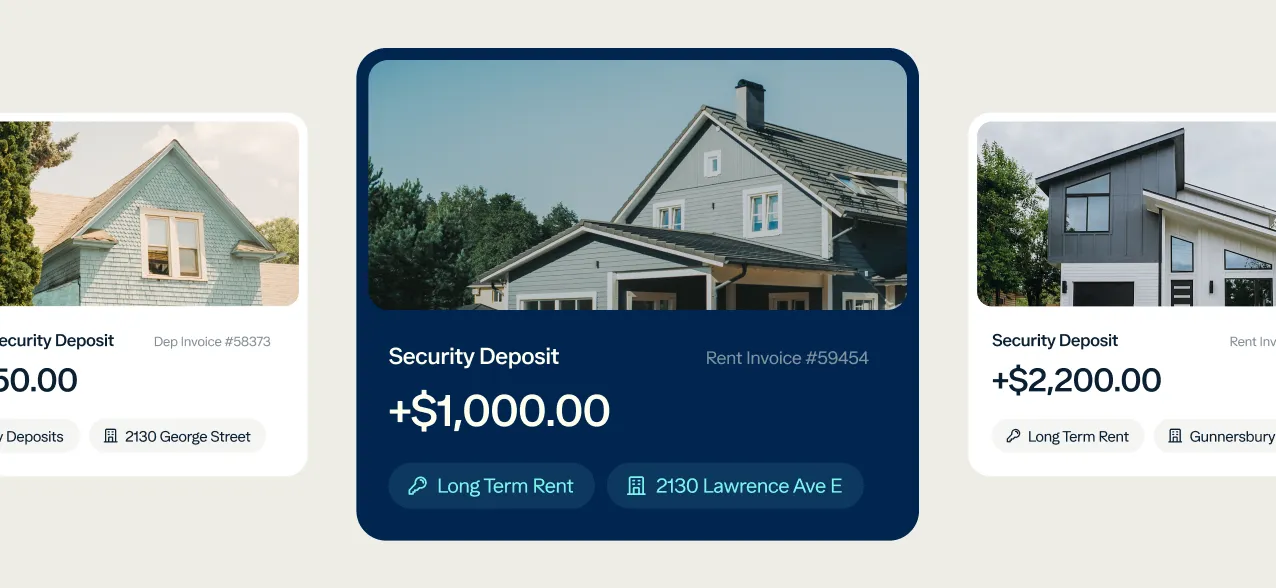

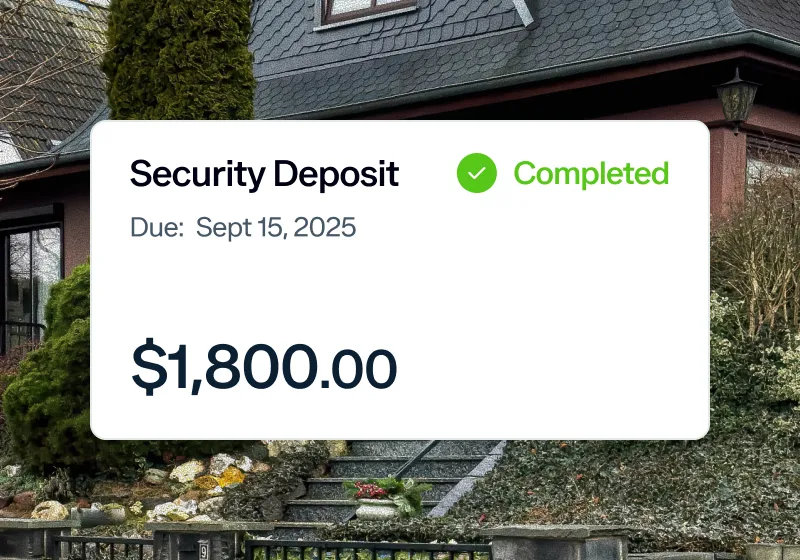

South Carolina does not set a legal maximum for the tenant security deposit. Most landlords charge around one month’s rent, but higher deposits are allowed if clearly outlined in the lease. The landlord must return the deposit within 30 days after move-out, along with an itemized list of deductions.

Security deposit rules in {{ state }}

Limit: In South Carolina, there is no statutory limit on the amount a landlord can charge for a tenant security deposit. Most landlords typically charge an amount equal to one month’s rent, but the tenant deposit can vary depending on factors such as rental history, credit, and property type. The amount must always be clearly stated in the written lease agreement before move-in.

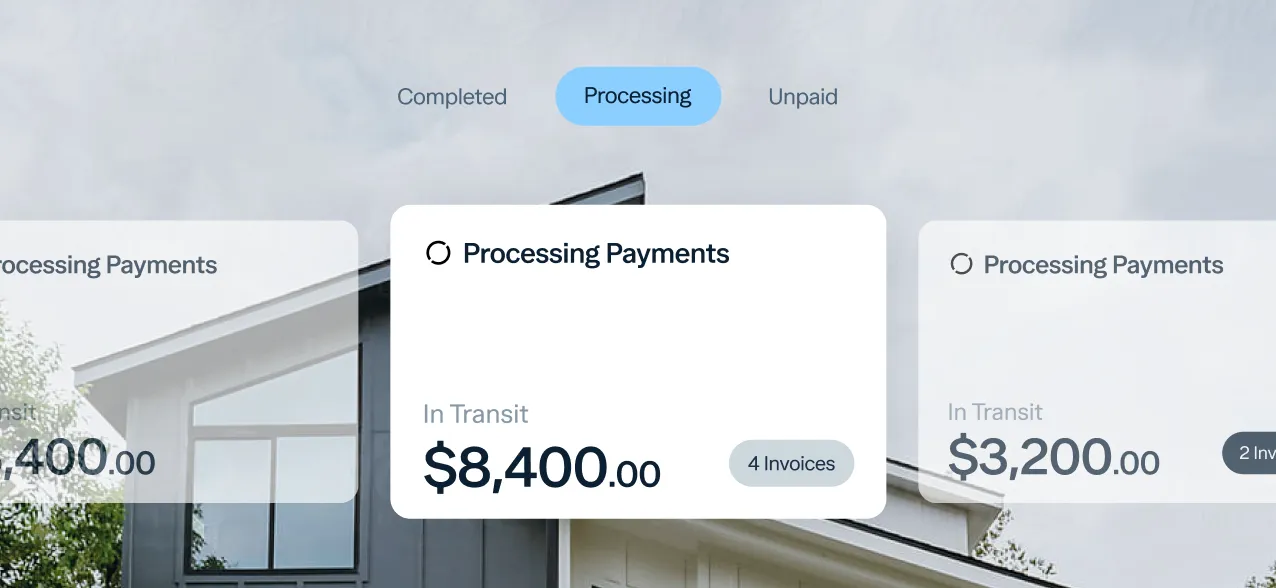

Return Deadline: The landlord must return the tenant deposit, along with an itemized list of deductions, within 30 days after the tenant vacates the rental property and provides a forwarding address. Failure to return the tenant security deposit or provide the itemized statement within this period may result in the landlord being liable for up to three times the amount wrongfully withheld, plus attorney’s fees.

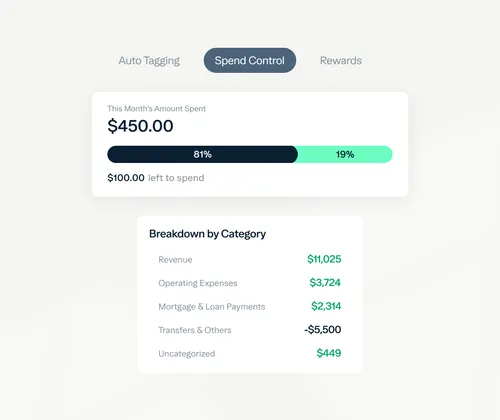

Acceptable Deductions: Unpaid rent, late fees, damage beyond normal wear and tear, and reasonable cleaning or repair costs needed to restore the property to its original condition. The landlord must provide an itemized written statement of deductions from the tenant security deposit and any supporting documentation.

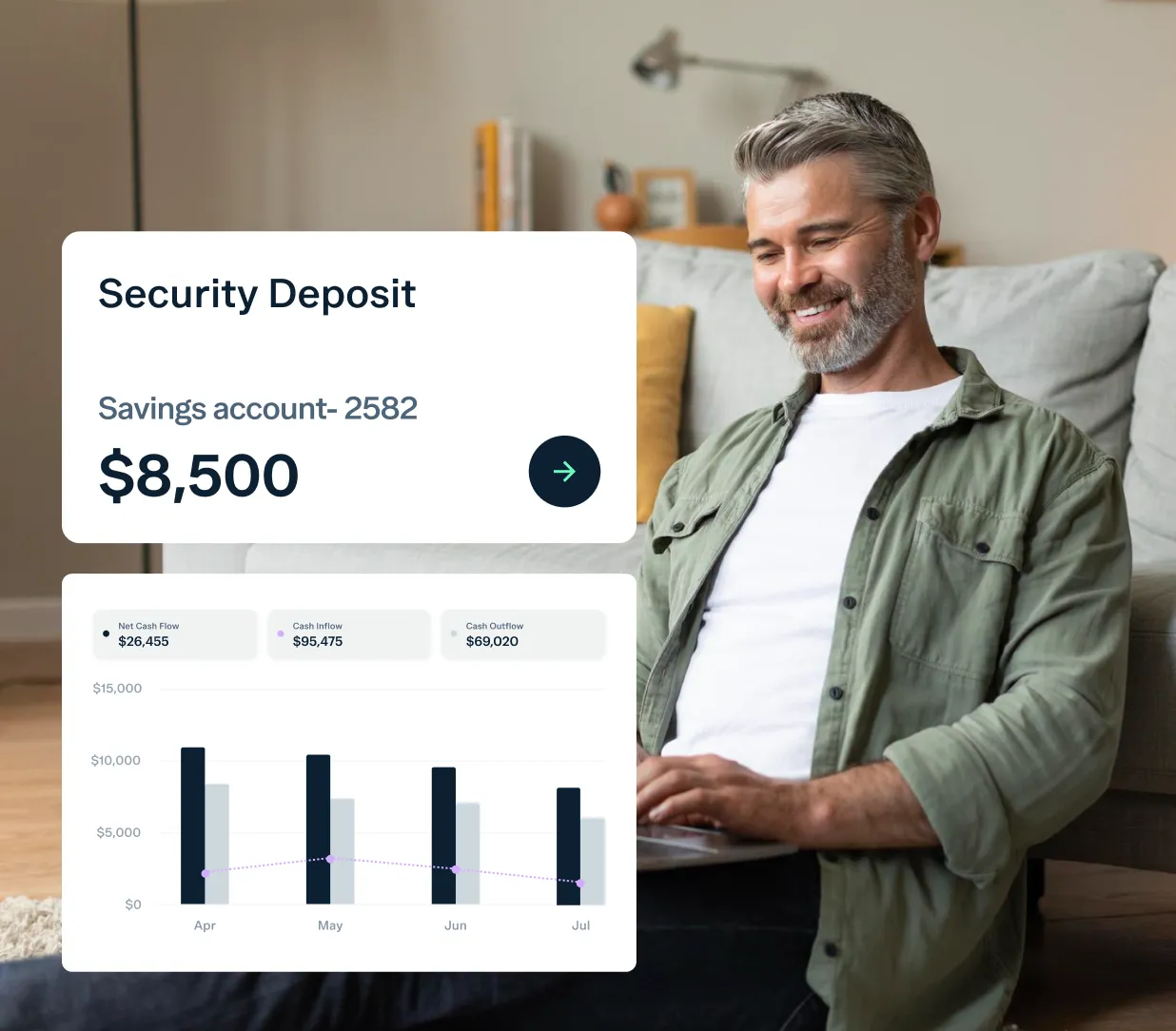

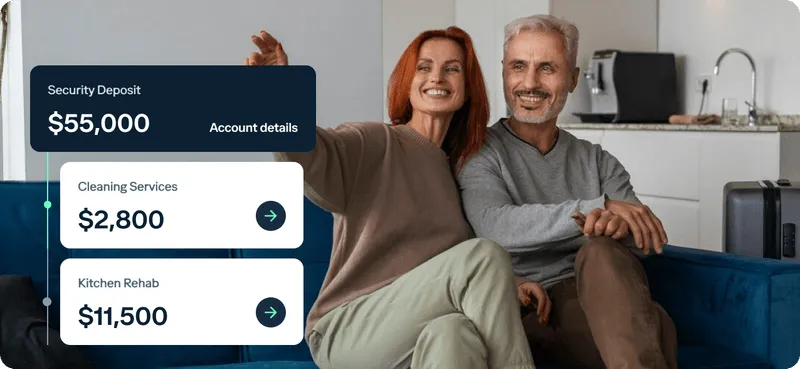

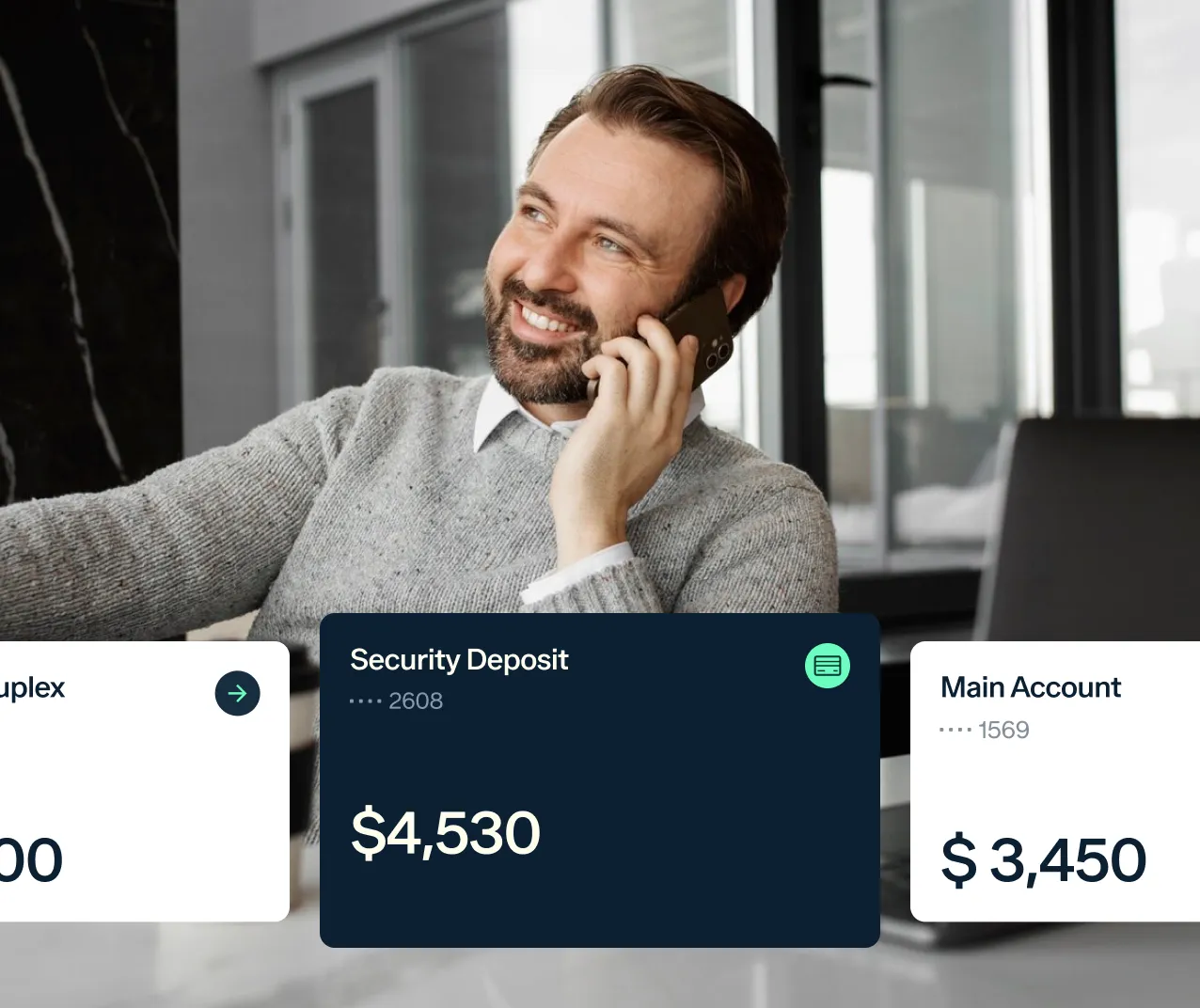

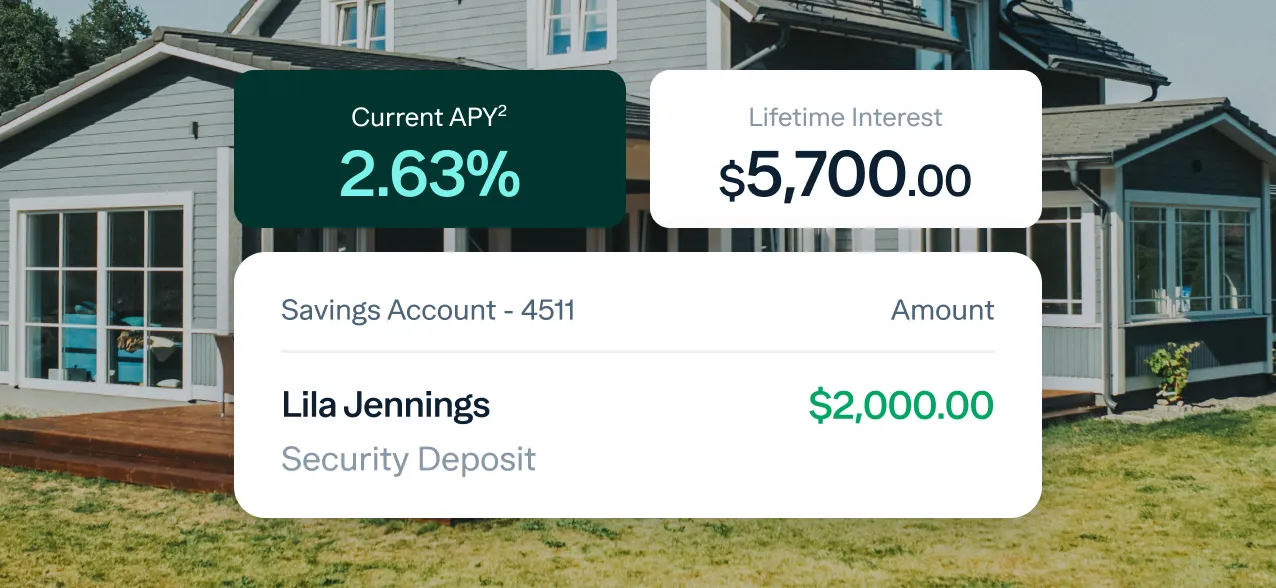

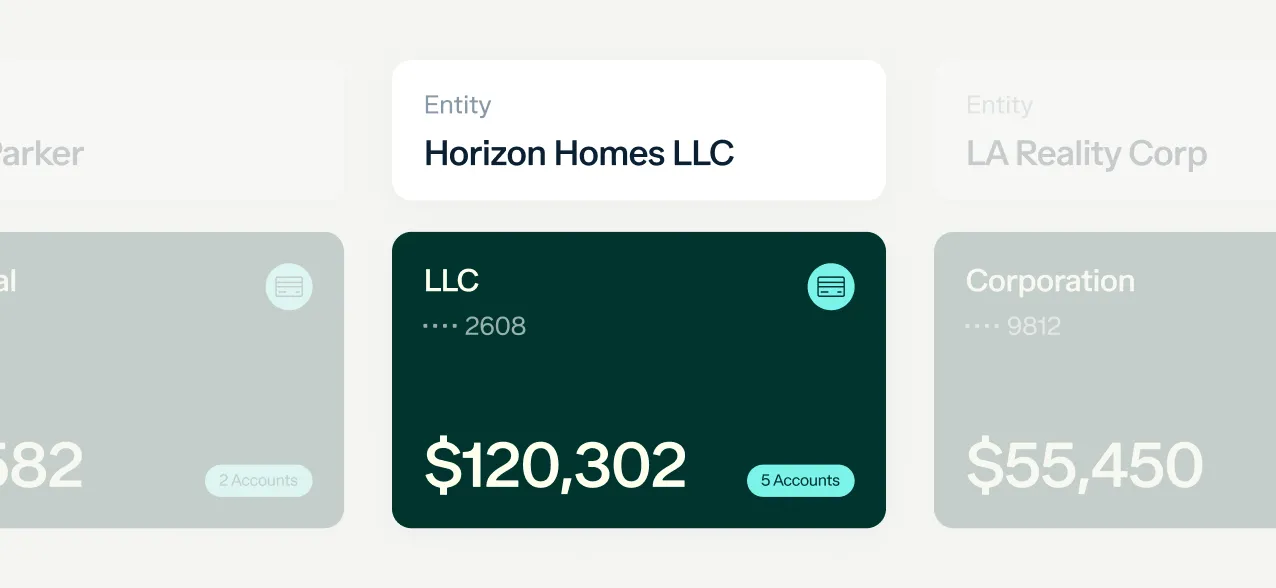

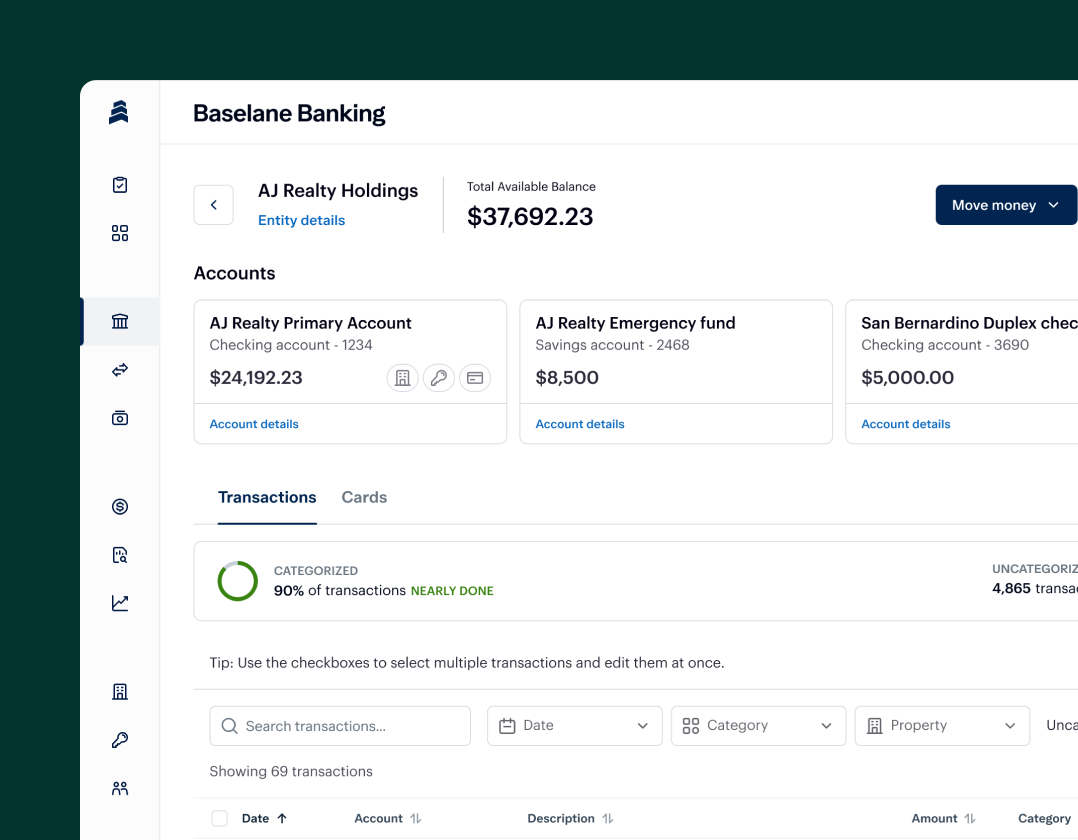

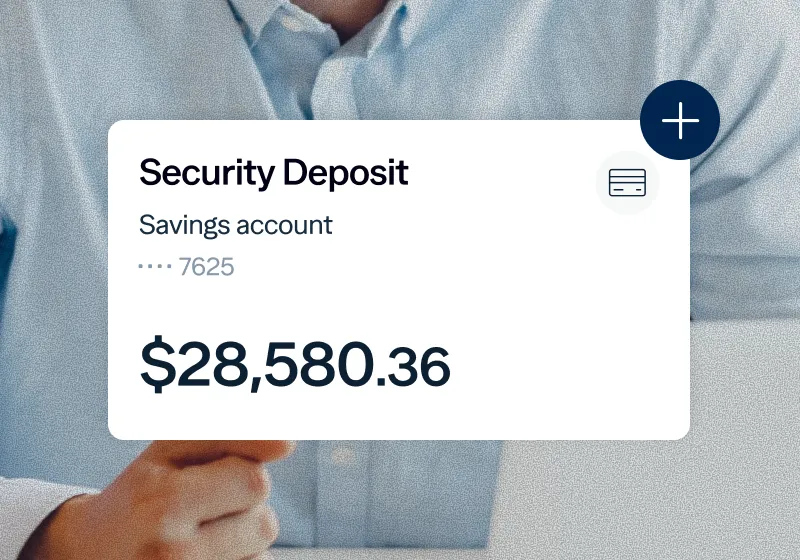

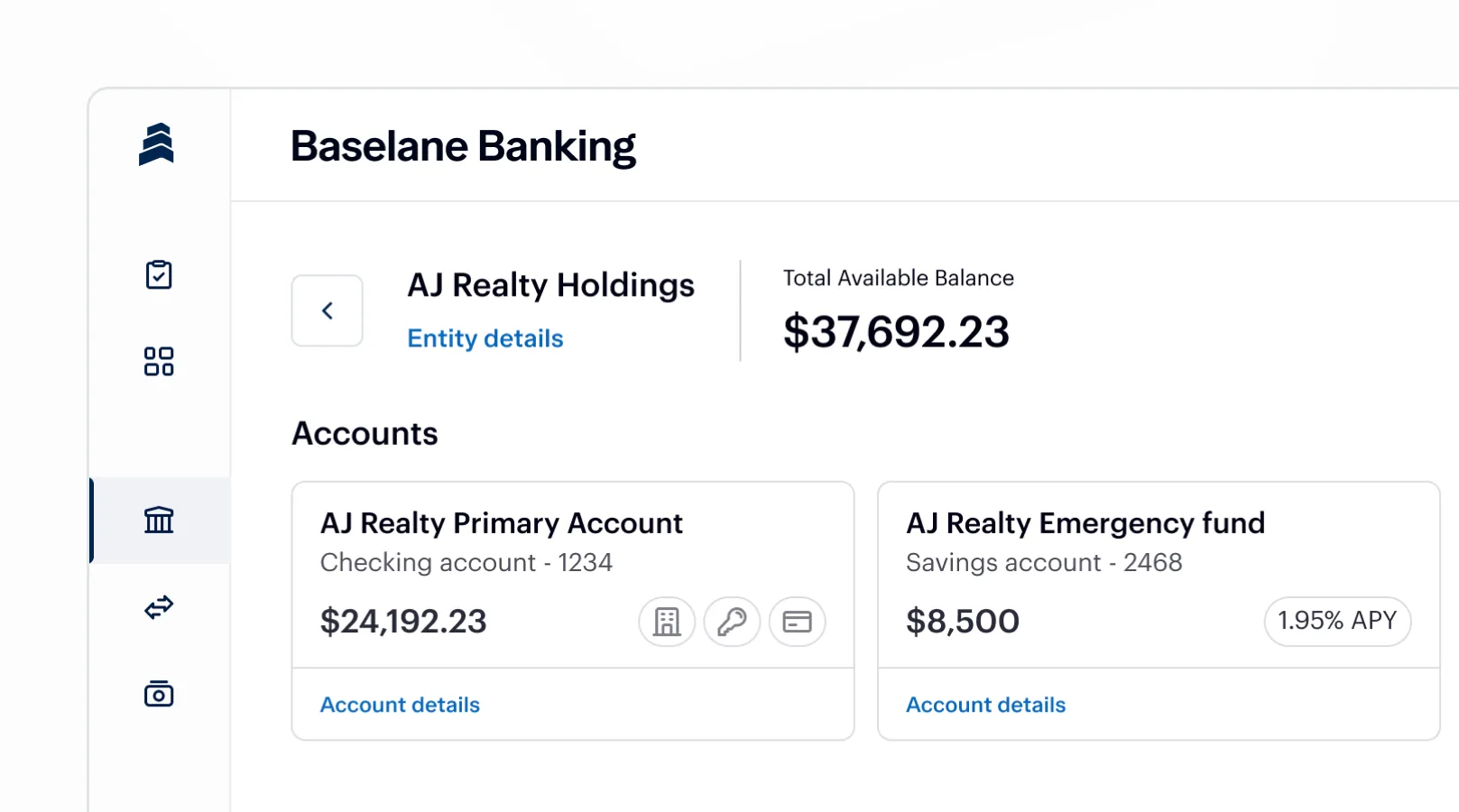

Where to Deposit: Landlords in South Carolina must hold tenant deposits in a separate escrow account at a financial institution located in the state. The funds must not be commingled with the landlord’s personal or business accounts. Landlords must also notify tenants in writing of the name and address of the bank where the tenant deposit is held.